If you're looking for Dylan Jovine's stock recommendations, then you're in the right place.

Below, I've put together a list of what stock picks we've been able to expose here.

If you're not familiar, here at GreenBullResearch.com, we spend our time digging into the hints/clues that are given in the investment teasers, such as those by Jovine himself, and figure out what stocks he's teasing… which we then let you know about for free.

If there are any stock picks of his that you'd like to jump to right away you can use the nifty table of contents here…

Table of Contents

- Picks from 2025

- 2024 Picks

- Jovine's 2023 Picks

- 2022 Picks

- Picks From 2021

- 2020 Picks

- Who Is Dylan Jovine?

- Conclusion & Should You Buy Jovine's Recommendations?

*Got a recommendation that's not on the list? Let us know in the comment section below this post*

Picks from 2025

Elon's Backdoor AI Stock

- Title of Teaser Presentation: “Elon's Final Move”

- Special Report: “How You Could Profit From ‘ELON’S #1 AI STOCK’”

- Promoted Under: Behind the Markets

Dylan Jovine is back at it, promising to unveil “Elon's #1 AI Stock”—a company he claims offers a backdoor entry to Elon Musk's private AI startup, xAI. Jovine pitches this opportunity as potentially creating 10 times more millionaires than Tesla, primarily because Elon’s AI has moved beyond online chatbots into real-world applications like Tesla's self-driving vehicles and Optimus robots.

Clues provided in Jovine’s teaser pointed squarely at a company making GPU chips, crucial for AI training and inference, amid the ongoing shortage driven by Nvidia’s dominance. He highlighted several hints, noting the company’s chips are reportedly 2.5 times more powerful than Nvidia’s latest GPUs, it counts tech giants like Apple, Microsoft, Google, and Meta as clients, and importantly, is about 15 times smaller than Nvidia—leaving plenty of room for growth.

All signs quickly pointed to Advanced Micro Devices (Nasdaq: AMD). AMD fits the clues perfectly: its latest AI-focused GPU chip, the M1325x, outperforms Nvidia’s offerings in certain tasks; it's a well-known supplier to major tech companies; and at about one-eighteenth the size of Nvidia, the upside potential checks out. Moreover, AMD and Nvidia are both investors in Elon’s xAI, cementing AMD’s position as Jovine’s touted “backdoor” into Musk’s private AI venture.

However, while AMD’s prospects appear solid, Jovine's claim of “making 13x your money” deserves some healthy skepticism. AMD trades at a valuation close to Nvidia’s—29x forward earnings compared to Nvidia’s 33x—suggesting caution in chasing the hype at current levels.

As we've seen from past AI pitches like Louis Navellier’s “AI Master Key”, riding the AI wave can be lucrative, but timing and valuation matter.

For more detail and to see if this play matches your risk profile.

>> Read the full write-up here.

“The Last Retirement Stock You'll Ever Need”

- Title of Teaser Presentation: “The Last Retirement Stock You'll Ever Need”

- Special Report: “The Last Retirement Stock: AI Income For Life”

- Promoted Under: Behind the Markets

Dylan Jovine is back with another bold pitch, promising that a single “last retirement stock” could pay us lifetime income by exploiting the $85 trillion global equity turnover, all running through a tiny county just outside Washington D.C. It's a familiar playbook we've seen before—highlighting an emerging trend and promising massive returns—but Jovine insists this one taps into an overlooked side of the AI boom: energy demand.

The teaser hones in on Loudoun County, Virginia, the “Data Center Alley,” which handles a staggering 70% of global internet traffic. Jovine argues that as AI adoption skyrockets, the enormous electricity consumption of data centers will follow suit—an issue we've seen underscored in other pitches tying energy to tech booms.

Jovine’s clues indicate clearly he’s talking about an energy play rather than an AI software company: it's a “toll booth” operation, not a driller, distributing 90% of its profits back to shareholders. He mentions the company manages pipelines controlling millions of barrels per day—a hint which matched up with Enterprise Products Partners L.P. (NYSE: EPD), the largest publicly traded pipeline partnership in the U.S., transporting 7.4 million barrels daily.

While Jovine’s prediction of a 2,000% return—making EPD a trillion-dollar company—is obviously hyperbolic, the underlying logic is sensible. Pipelines are critical energy infrastructure, and as AI demands surge electricity needs, fossil fuel use won't vanish overnight. Enterprise Products' position as an infrastructure backbone, paired with its 7% dividend yield and 98% revenue from stable contracts, makes it an appealing retirement pick, even if not exactly the explosive growth promised.

We've seen Jovine use similarly grandiose language before, as with his “rare earth metals” teaser. Skepticism aside, there's genuine value beneath the exaggeration, making EPD worth a closer look.

>> Read the full write-up here

2024 Picks

No picks were covered in 2024.

Jovine's 2023 Picks

The “Little-Known” Laser Stock to Profit from the Taiwan Invasion

- Title of Teaser Presentation: “China Will Attack Taiwan as Soon as March 16, 2023”

- Special Report: “China vs. Taiwan: 3 Steps You Must Take to Prepare for War”

- Promoted Under: Behind the Markets

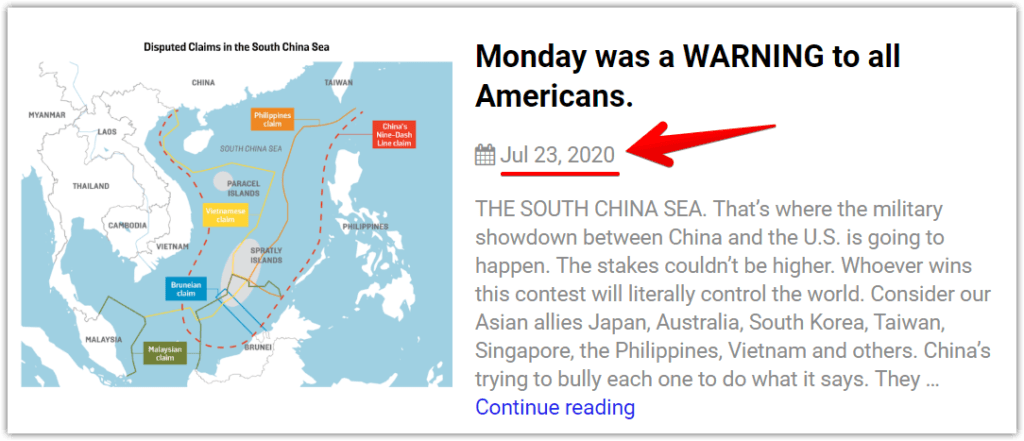

Here we have Jovine with another war teaser, this time telling us that China's going to be attacking Taiwan as soon as March 16th, 2023.

He predicts the stock market will crash by at least 35% after this happens, but also tells us he's found a stock so that we can profit from it all, and profit by a lot.

In fact, he tells us that this stock “could soar 2,476% in nine months.”

That's a bold claim, but if you're at all familiar with Jovine's teasers then you know darn well that he's always making wild claims and hyping up blue sky scenario sensationalist figures, such as that 35,960% figure we saw him stating in his “War Games” teaser.

I don't think a stock has ever lived up to his hype, but regardless people want to know what he's teasing and this is what we're here to do at GBR.

As you know, this teaser is all about the possible Chinese-Taiwan invasion.

There has been talk about this for years now. Back in 2021, Xi Jingpin stated that he would work towards a “reunification” with Taiwan, many believing that this is simply a more politically correct way to state that he's planning an invasion and takeover, which looks more and more probable with the increased Chinese military exercises near the area.

We are told that we should 1) limit our exposure to Taiwanese and Chinese stocks, 2) increase exposure to metals and mining stocks, and… very vaguely… 3) be opportunistic.

The “be opportunistic” part of it all is what is most relevant to this teaser. He talks about how when wars break out there are often quick and large shifts of money into a few important asset classes. In this case, there is supposedly money going into laser defense technology, which we are told the Army, Navy, Marines, and Allies are all trying to get their hands on.

He mentions that this laser tech is already being used by the Navy on their ships. With this clue it sounds like he's teasing the same opportunity from his “War Games” pitch I've already covered below… and this is because he is… or at least this is the conclusion we've come to based on the scant clues he's given us.

We know that Lockheed Martin Corp is the lead contractor for the layered laser defense weapon systems that he talks about in the teaser. But, we also know that Lockheed is a large company and doesn't fit the “tiny” description. Looking further we've found that Aerojet Rocketdyne Holdings Inc. (NYSE: AJRD) worked with Lockheed as a subcontractor on this project.

We think that Aerojet Rocketdyne Holdings Inc. (NYSE: AJRD) is Jovine's stock here – yes, it's a repeat.

>> Full review of this laser stock here

That “Rare Metals” Stock

- Title of Teaser Presentation: “Why the Pentagon is Securing $1 Billion Worth of ‘Rare Metals' Inside these Unmarked Trucks”

- Name of “Special” Report: “Unfair Advantage: This Rare Earth Stock Just Got Hired by The Pentagon”

- Promoted Under: Breakthrough Wealth

In this one, Dylan teases us with possible “short term gains up to 786%” from a “tiny $5 small-cap”.

It all has to do with the Pentagon securing “rare metals”, which we've heard about before from teasers like where Ian King was teasing his Neodymium company.

You've probably heard how China dominates the rare earth metals market. In fact, according to Politico, they account for 63% of the mining, 85% of the processing, and a whopping 92% of rare earth magnet production.

As some rare earth metals are needed for weapons for our national defense, this has been a big concern for years, and increasingly so as geopolitical tensions have escalated.

Not to fear, however, Jovine tells us that this is the biggest opportunity he's seen in 75 years and it all has to do with a company that the Pentagon has given $150 million to build a processing facility in good old Texas.

The pick he's teasing here is focused on the EV market, but nonetheless has the ability to produce large amounts of rare earth metals for other purposes as well.

Some of the clues given in this teaser include:

- They've signed a $150 million contract with the Pentagon

- It's one of just two rare earth plants in the US

- They have a processing facility in Texas

- He tells us it will be shipping thousands of truckloads of rare earths to be processed here

- It's trading for around $6 per share

There are quite a few good clues to go off of here and we are confident that his pick is Lynas Rare Earths Limited (OTC: LYSCF), which was awarded a $120 million contract with the DOD (not $150 million, but close enough), has its Hondo, Texas-based processing plant where it will be shipping rare earths to from its Australian mine… and it's trading around $6.

Yes, it's an Australian company, but has operations in Texas.

>> Full review of his “Rare Metals” stock here

The “War Games” Weapon Stock

- Title of Teaser Presentation: “War Games”

- Name of “Special” Report: “21st Century Battlefield: 4 Companies Changing Warfare”

- Promoted Under: Behind the Markets

In this “War Games” teaser, Jovine tells us that the US military is sick and tired of losing to China and that after losing 18 war games to them they are now ramping up the funding for a “living missile” made by a small defense contractor company.

The idea is that if we buy the stock of this small defense contractor we all get rich, right?

Well, according to the man of the hour, “investors stand to reap 35,960% on shares” of this small company.

We are told of a top-secret plan by the US gov called “Project Overmatch” that is working on advancing weapons, including this “living missile” thing.

This project was fully approved in March 2022 and because of this, it will receive additional funding.

More recently, the Navy stated that it will begin deploying this “Project Overmatch” tech aboard one of its carrier strike groups.

The specific tech that Jovine is getting so excited about in his pitch is that of the hypersonic missile, which I've already covered in his “5G Arrow” and “5G Weapon” teasers listed below.

In short, this is a new type of missile that is almost “impossible to defend against” because of the fact that it can change direction in mid-flight and travels about 25 times faster than the speed of sound.

The company that has to do with this technology is one that:

- announced recently a contract with the army and the Navy to build these weapons

- has had DARPA working closely with them in the development of this weapon tech

- has beaten large companies like Raytheon and Boeing to win contracts with the military for this weapon

We think this pick is Aerojet Rocketdyne Holdings Inc. (NYSE: AJRD), which has been involved in DARPA's HAWC program and matches up with some of the other clues too.

>> More on this “War Games” stock here

2022 Picks

His 5G “Arrow” Company to “Replace Nuclear Missiles”

- Title of Teaser Presentation: “New 5G ‘Arrow' to Replace Nuclear Missiles”

- Name of “Special” Report: “World War 5G – The Small Company at the Forefront of the Military Revolution”

- Promoted Under: Behind the Markets

With another national defense-type investment teaser, here we have Dylan Jovine teasing us with a possible 35,960% investment opportunity.

He claims there is some “New 5G ‘Arrow' to Replace Nuclear Missiles”…

Sounds interesting enough.

He tells us that the small company making this tech just inked a contract with the US Army and that the US Gov has budgeted a large sum of money towards the weapon tech development.

We are told that this “5G Arrow” has the ability to change its trajectory mid-flight, something that nuclear missiles are not capable of. Furthermore, with this ability to change directions, the target of these missiles is something that enemies won't be able to figure out.

Once again, as was teased previously in his “World War 5G” teaser that we've already covered below, he's talking about hypersonic glide missile technology – about 2x faster than nuclear missiles and with that ability to change directions as mentioned.

The US military continues to advance this hypersonic glide missile tech by pumping money into it, in what seems to be a race against Russia and China.

Jumping to the point now – what is the company he's teasing?

The clues given include that:

- DARPA has worked closely with this small company to create this new tech

- There are 38 scientists working at the Sandio National Laboratories to develop this tech

- It's a small company

And no need to go any further. This pick was an easy one because we've already covered it. It's Dynetics Technical Solutions that he's teasing again, which remember is owned by Leidos (LDOS) so this is your investment opportunity.

You'd have to invest in this Fortune 500 giant to get a piece of the pie… meaning you're unlikely to see such optimistic gains such as those teased by Jovine.

>> Full review of this 5G “Arrow” stock here

Picks From 2021

A pick of his from 2021…

His “The End of Alzheimer's” Company

- Title of Teaser Presentation: “The End of Alzheimer's”

- Name of “Special” Report: “Past the Blood-Brain-Barrier: The Small Company Revolutionizing Alzheimer’s Disease”

- Promoted Under: Behind The Markets

In this “End of Alzheimer's” presentation, Jovine tells us that this new drug, he thinks, “could be the biggest drug ever.”

Could you imagine investing in a company coming out with “the biggest drug ever”?

This would certainly be the investment opportunity of a lifetime, which is why he's teasing us with the possibility to make up to 113,584% gains on this one.

But of course, he can't predict the future and we've seen time and time again that you often have to take these numbers with a giant grain of rock salt.

We are told that this medical breakthrough could save the US $20 trillion over the next twenty years.

This breakthrough all has to do with 3 words: the “blood-brain barrier”, which is a barrier that is apparently incredibly difficult for drugs to get across. Supposedly, this new drug is like a “trojan horse” and can pass this barrier to treat Alzheimer's.

Jovine tells us that the company he's targeting already has a distribution partner, which is the 3rd ingredient for what he considers to be an amazing biotech investment, following 1) it being led by a breakthrough scientist and 2) there being a massive market for this treatment.

What is the company?

The clues given include:

- Fidelity Biosciences and Jeff Bezos are among its founding investors

- Last year a big pharma company purchased 11.2% of its stock

- It's won the FDA's “fast-track” status in the last few months for one of their drugs

- Some of its shareholders include Goldman Sachs, BlackRock, State Street Capital, Credit Suisse, Schwab

This all said, the company teased here looks to be Denali Therapeutics (Nasdaq: DNLI), of which Fidelity Biosciences is a founding investor and of which recently the big pharma company Biogen acquired an 11.2% equity stake.

>> Full review of his Alzheimer's stock here

2020 Picks

Some of his picks from 2020 that we've covered…

The “Living Software” (CRISPR) Stock

- Title of Teaser Presentation: “‘Cut & Paste' Disease From Your Body”

- Name of “Special” Report: N/A

- Promoted Under: Behind The Markets

With this promo, Mr. Jovine is teasing even bigger gains than the last one. This time, it's the possibility to turn $1k into $1.57 million or more…? Wow.

The title is intruiging. The ability to “Cut & Paste” disease from the body…

Here we have another medical miracle teaser. Ones like this are sure to get you excited. They're all about saving the planet and making tons of money. Doesn't that sound good?

It reminds me of that Miracle Antibiotic company that Jeff Brown was pitching to no-end.

Anyway, Jovine is very bullish on this new treatment and claims that some of the big pharma companies are already investing large sums, such as:

- “Juno Pharma just invested $700 million, Glaxo SmithKline invested $350 million, Johnson & Johnson invested $292 million…”

He hints at some type of “living software” and later we find out that what this all has to do with is CRISPR technology, which is the tech that's being used to edit genes. Yes, edit genes… and potentially just edit out diseases.

This new tech seems very promising and he claims the company he's narrowed in on has a strong patent, a strategic partner, and has survived the “patent challenge”, making it an excellent choice in the CRISPR space.

Some clues include:

- “in the last few months, they’ve announced positive results from a partnership with Allergan Pharmaceuticals and Celgene, two of the largest biotech companies in the world.”

- “this company is literally at the center of this revolution” and “CRISPR has the opportunity to radically change how we treat diseases.”

Again, not much to go off of here. That said, it looks to be Editas Medicine (NASDAQ: EDIT), that kind of “won” the patent fight over CRISPR technology that was hinted at in Jovine's presentation.

Editas has made way with trial approval and could be worth a look, but something else that should be known is that Jovine has been teasing this company for over a year now… and the gains he was teasing back then are far from being realized.

>> Read complete report on this “Living Software” company here

His “5G Weapon” Company

- Title of Teaser Presentation: “World War 5G”

- Name of “Special” Report: N/A

- Promoted Under: Behind The Markets

In this teaser, we have Jovine teasing what he thinks is the chance to turn every $1,000 investment into $461,800 – his words not mine.

It all has to do with what he's calling “World War 5G”.

As I'm sure you are well aware, 5G is a very promising technological sector that is predicted to see large growth in the near future. It's all the rage these days.

As is normal with Jovine's teaser, this has to do with national defense.

We are told that the Pentagon is rushing to push out this new technology, and we're also told that “it’s the fastest weapon on Earth”.

What he's talking about here is a Hypersonic Glide Missile that uses, as you can guess, 5G technology for guidance – a 5G tech that is a bit more complex than the stuff we use for our cell phones.

As per usual, Jovine supposedly has found the perfect company to get in on this opportunity.

We are told that:

- “at the center of this massive market is a small company. It’s only a fraction of the size of the biggest defense contractors like Lockheed Martin, Boeing, and Raytheon.”

- the Pentagon wants these weapons for all four branches of the military

- “in the last year alone, the top defense firms in the world have all invested hundreds of millions in this technology as well: Lockheed Martin, Raytheon, Boeing, Aerojet Rocketdyne, and Spirit Aerosystems.”

Not a lot given here, but it sure does sound like he's teasing Dynetics, which was more recently bought out by Leidos (NYSE: LDOS), which is a big-time contractor.

Because of this, investing in this opportunity would more than likely not bring in the gains teased as if you were investing in some small-timer.

>> Read our full write-up of this “5G weapon” stock here

Who Is Dylan Jovine?

Who the heck is this guy anyway?

Well, Dylan Jovine isn't just some guy off the street. He has quite a bit of experience in the investment world, having started out on Wall Street in 1991.

There are no fancy college diplomas to brag about here. Jovine has stated that he “grew up poor, and went to city college”, and that because of this none of the big firms on Wall Street would consider hiring him. However, he claims to have gotten lucky when the Wall Street investment banker Peter Jacquith decided to give him a chance. He worked here for 3 years and was able to grow his reputation with some solid investments for the firm.

After this, he went on to launch his own registered broker-dealer and market maker at the age of 24, of which I don't know much about.

According to his LinkedIn profile, he's the CEO & Founder of Lexington Capital Partners, a manager “of secondary private equity and co-investment funds”, which he started in 1995. From there, in 2004 he founded Tycoon Publishing which was later sold to the Agora, then in 2011 founding the Institute for Individual Investors, also under the Agora.

Currently, he's the CEO of Jupiter Publishing as well as the CEO & Founder of Behind the Markets, which is the publisher that's behind all of the crazy investment teasers we've gone over above. Jupiter Publishing seems to be a large company that Behind the Markets is under the roof of.

But much of this isn't so important. What's important is that he started off working on Wall Street in some capacity and now runs these investment advisory services.

On his DylanJovine.com website, he claims to have been “writing about stock market & life since 2003”, which would be a year before he founded Tycoon Publishing in 2004 (which sold to the Agora), but it seems that his website isn't a priority for him lately judging by the fact that his last post was from 2020…

*As of Oct 2025, this is still his latest post.

I haven't taken the time to really dig deep into his background, but haven't found anything that would make me think he's not to be trusted, other than, of course, the over-the-top investment teasers that are hyped up to no end.

If you want to know more about the guy you can also visit his Facebook page, but this is more of a business-focused FB page where his profile is that of an expert stock investor rather than a personal page.

Conclusion & Should You Buy Jovine's Recommendations?

Here at GreenBullResearch.com we uncover recommendations by Dylan Jovine and others for our readers for free. But, this certainly doesn't mean we recommend buying them.

This is the only stock-picking service we actually recommend and it isn't run by Mr. Jovine.

Many of Jovine's known picks haven't fared as expected, or rather, as you would have expected from the hyped-up teasers that he puts out there. That said, this doesn't mean you should or shouldn't buy into them.

As always, do your own due diligence and just be sure to take what he says with a giant grain of rock salt.

Let us know what you think of Jovine's picks below. And if you have any additional information on picks we haven't covered, please let us know!

Check … New Legal Birthright for American Investors