I started GreenBullResearch.com back in 2020 and have reviewed hundreds and hundreds of investment teasers over the years.

Here, I want to cover some commonalities that I've noticed that are red flags for me – meaning that they serve as warning signs to proceed with caution or you might end up joining an investment newsletter that turns out to be a big disappointment.

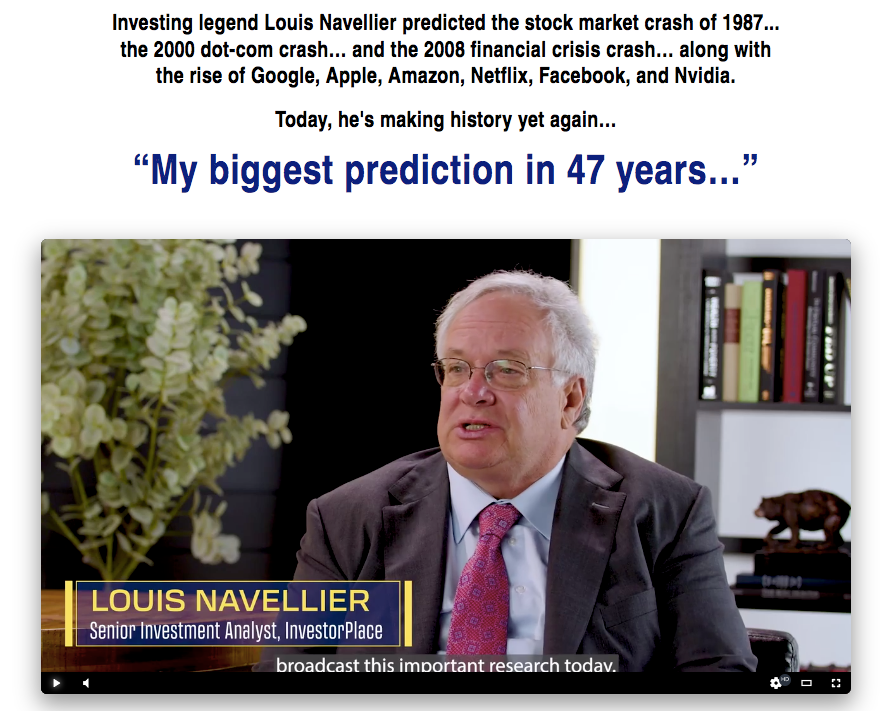

Red Flag #1: Sensational Teasers

We've all seen the investment teasers where they hype up some new investment opportunity to no end and get you all excited to invest in the stock(s) being teased, but, of course, you have to whip out your credit card and join their service before you get any real information.

There's nothing wrong with a paid service, but if the opportunity sounds too good to be true… well, you know what they say.

For example, is this really his “biggest prediction in 47 years…”? Probably not.

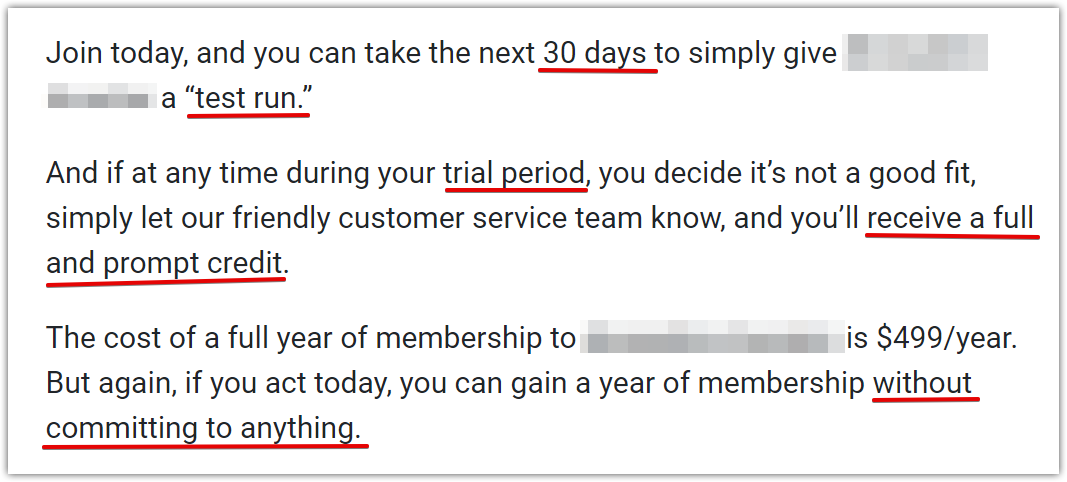

Red Flag #2: Refund Credits

A word of warning: Always check the refund policy before joining any of these investment newsletter services.

And make sure you understand it before purchasing.

Sometimes they can be a bit tricky.

For example, here's a screenshot of a refund policy that says you get 30 days to give the service a “test run”. They call this a “trial period” and say that you can get this “without committing to anything.”

However, you can see that this refund policy is for a “full and prompt credit” refund.

What this means is that you simply get your account credited with the money to put towards another one of their investment newsletter services.

You DON'T actually get a money-back refund where you receive the money back in your bank account.

This is a very sleezy trick. Not too common, but I still see it sometimes.

Red Flag #3: Unclear Track-Record

It's always nice to see a clear track-record of the service you're looking into before buying in. Unfortunately, most are very unclear and often are promoted with cherry-picked past results.

I don't have a problem with there being cherry-picked winners shown in the teasers. After all, who wouldn't want to talk about their best stock investments?

The issue comes when these cherry-picked results are the ONLY results they show.

Makes you wonder… what are they hiding? A poor track-record maybe?

Red Flag #4: Renewed Subscription Price Hike

I can't stress it enough. You always have to read that fine print that's usually located somewhere around the bottom of the checkout page.

It's a pretty common practice in the industry that these investment newsletter services will be promoted at a discount, but when it comes time for the subscription to renew the retail price will be charged.

So, maybe you join for $99 for the first year, but then for the second year and onward you will be automatically charged $499/yr.

Red Flag #5: Hidden Subscriptions

This is an extremely sleezy practice that I've seen, albiet on very rare occasions.

You'll be buying into XYZ Investment Newsletter and in the fine print at the bottom it will tell you that they're going to include a ‘free' subscription to some ABC Investment Newsletter too.

Sounds fine and all, but that ‘free' additional subscription that you didn't want in the first place is going to cost you when it renews.

Sometimes these ‘free' bonus subscriptions will be mentioned in the main text of the sales presentation or at checkout (rather than in the fine print), but either way I don't like this practice… and often there is no way to decline the offer.

But again, this is a rarely used practice.

Red Flag #6: Massive Discounts

You might think to yourself, if the original price is, for example, $197/yr and there's a discount for just $5 for the first year, how good can this service possibly be and what kind of trickery is going on behind the scenes here?

The discount above is a real example I came across.

Discounts can be fine, but sometimes they make you wonder..

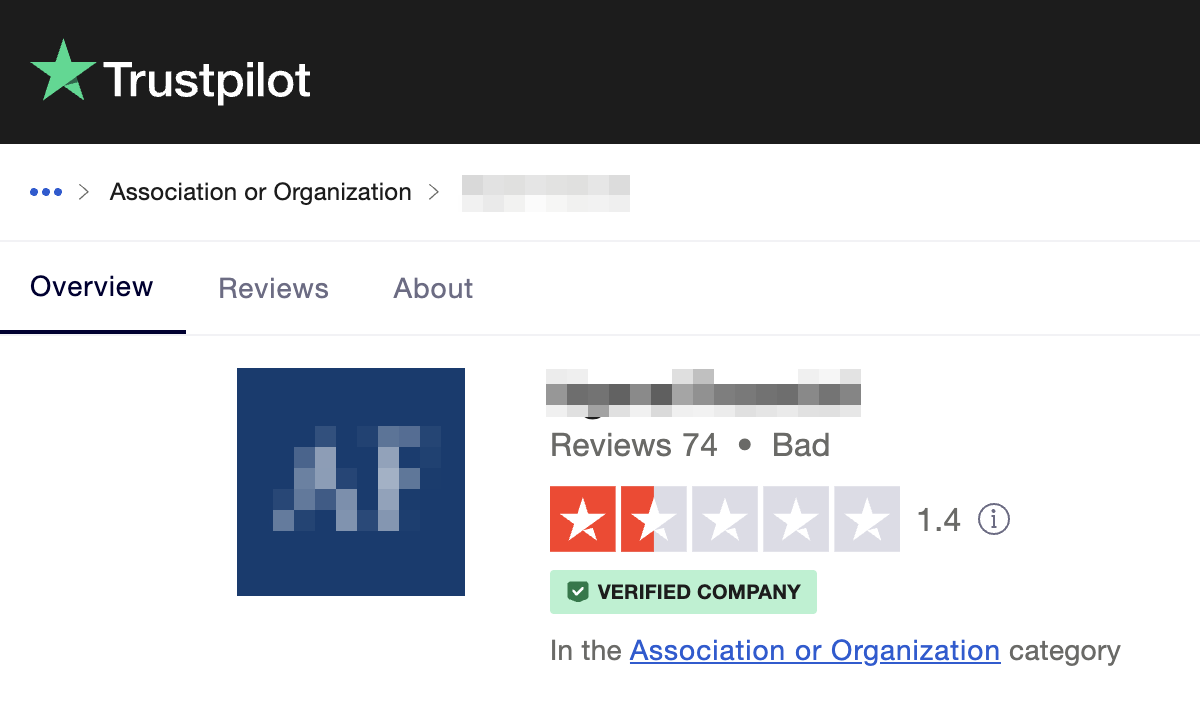

Red Flag #7: Low Customer Ratings

Last but certainly not least, it's always a good idea to see if you can find any customer reviews/ratings of the service you're looking into.

Trustpilot.com is a great website to check as it seems to get a lot of activity for investment newsletter services.

If a low rating, it's probably a good idea to read some reviews and see why.

Here's a screenshot from a certain investment newsletter service that doesn't exactly have the best reputation.

A bad rating could mean that other subscribers are losing money on the lousey recommendations made, or, something that I find pretty common is that the investment newsletters aren't necessarily all that bad, but since they are over-hyped and promoted as ways to strike it rich, naturally they lead to disappointed subscribers.

The Bottom Line

Most of these red-flags are exactly that, red-flags… but just because you see one or two doesn't mean you should necessarily avoid buying into a particular investment newsletter service. It just means that you should be cautious.

There are a lot of bad services out there, but the good ones still exist.

If you want a personal recommendation, check out my top-rated investment newsletter service here. It has a