Since the speculator, editor, and author is a prominent figure, it would be fair to ask if Paul Mampilly is indeed legit.

There are many scams surrounding the investment research industry. Naturally, regular investors want to know which among the editors are trustworthy. Many are curious as to who can really deliver on their promises.

The editor is no stranger to our website. We have previously exposed his teaser on an EV stock, one on 3D Printing, and his space investments.

Green Bull Research has also written about his Secret Portfolio and Rapid Profit Summits. In fact, we even wrote a whole article about his supposed political leanings. That is how curious people are about the guy.

So to give you a comprehensive take on Mampilly, we wrote this article. Here, we expose the brutal facts and the honest truth.

Background

To clearly assess the editor and his record, we do a deep dive of his background. This is crucial as it gives us a peek into his career, including his roots and motivations.

We can also see from his career progression if Mampilly is indeed a respected member of the industry. With these editors, there are usually claims that are hard to believe. Some are even outright outrageous.

So these kinds of profiles help readers determine if they can indeed trust an investor.

As for Paul Mampilly, his usual bio indicates that he is a Wall Street hero and one of the world's finest investors. As a result, CNBC, Fox Business News, and Bloomberg TV, among others, feature him and his insights.

According to Banyan Hill, the man is primarily an investor and a former hedge fund manager. It also credits him as the founder of the supposedly in-demand newsletter, Profits Unlimited.

According to the editor, he combines his abilities, skill set, and expertise as a former Wall Street insider to steer subscribers into stocks that are ready to soar.

The claim is that he has more than 130,000 readers already.

Climbing the ladder

Mampilly, born in India, immigrated to the United States when he was young. Eventually, his career advanced on Wall Street.

He began his career in the investment industry nearly 30 years ago as a Bankers Trust research assistant.

Soon, he got promoted to various positions in He quickly rose through the ranks of ING, Deutsche Bank, and other financial institutions. Eventually, he managed one of the hedge funds of an asset management firm that hired him.

Through Mampilly, the hedge fund grew to $5.8 billion from $1.3 billion. As a result, he brought the firm's total assets to $25 billion. Because of this, Barron's named it one of the “world's best” hedge funds.

In addition, the manager competed in a highly esteemed investment tournament. He and his team managed to generate a 76 percent return on a $50 million investment in a single year.

They grew it to $88 million. That would be notable in and of itself. But they did so without shorting stocks during the 2008 and 2009 global recession.

Personal success

He says that winning the competition thrust him into the spotlight. However, even when he was at the center of attention, most people were unaware of his personal gains or his strategy to secure wealth.

For example, Mampilly cites that he discovered Sarepta Therapeutics when it was in the early stages. Then, the firm was just in the process of starting research on a drug to treat muscular dystrophy.

He invested in the company and made a 2,539 percent profit in less than a year.In 2008, Mampilly says that even experts were skeptical of Netflix, but he knew better. Since he was aware of the future of tech, he knew that online streaming was the future of television.

He also invested and gained 329 percent in less than two years.

The editor also boasts that he saw a huge opportunity when Universal Display developed organic LED technology. Mampilly profited by 293 percent in two and a half years.

Not quite a retirement

After accumulating wealth, he retired when he was just 42 and relocated to a country home in North Carolina.

The editor narrated that he grew tired of the fast pace on Wall Street after a string of impressive investment returns. He does not, however, consider himself to be “retired.”

He merely shifted his focus from making money for the ultra-rich to helping Main Street Americans grow their personal finances.

To achieve that, he launched Profits Unlimited in 2016. He had one objective: to find stocks that would rise in value and make ordinary people wealthy.

Moreover, Mampilly claims that countless people have already made thousands and even millions of dollars because of his recommendations.

As a result, he claims they have retired comfortably, paid off debts, and put their children through school.

Humble beginnings

Why is he a success? According to him, his father was his inspiration.

He says that his dad was born in 1933 in a small village in India. The country was in chaos then, with people dying of hunger daily.

His mom passed away when Mampilly was just three years old, and his father died when he was twenty.

When his dad was still alive, he managed to pay his way through college. Even after getting a job in Mumbai, India's largest city, his dad was still broke and needed to support his family.

His father's next step was to apply for a job in Dubai, a relatively unknown location at the time. His siblings reportedly told him not to go when his dad got the job.

However, India's prospects were bleak, and Dubai had recently discovered oil. His dad knew that betting on Dubai was a smart move; it was a calculated risk. Going to Dubai was an obviously better choice, in retrospect. Mampilly says his dad made 100,000 times more money than if he'd stayed in India.

Dubai also grew spectacularly. He was able to send his children to school. His father also saved enough money that Mampilly's mother did not need to work or worry about money ever again.

His father took a calculated risk by going to Dubai, and it paid off handsomely.

Philosophy and strategy

Mampilly proudly says that he is his father's son.

His philosophy in trading and investing is calculated risk-taking. While working on Wall Street, that is how he made money for his clients. It's also how he invests his personal money.

Mampilly believes that calculated risk means taking chances when the stakes are in your favor in the financial markets.

As a result, you have a better chance of making money when you invest. Of course, there is no such thing as a guarantee, but when he sees good odds, he places a bet.

According to Mampilly, it has worked well for him in the thirty years that he has been in the business.

What can you say about the investor, so far? Do you find his narrative compelling and his credentials impressive? If you have further information on him, we would welcome your comments below.

We also invite you to share us your thoughts on Mampilly.

Services

It would be safe to say that Mampilly is among the most prolific editors today. He is the editor or co-editor of ten newsletters under Banyan Hill.

These cover a whole range of topics and interests. The truth is, he could set up a publishing firm, and he would still be able to cater to many people's needs.

So to give credit where credit is due, he deserves commendation for the range and number of his services. Some might say that most editors have copywriters, so it's not worth highlighting.

Be that as it may, if many have access to ghostwriters, why do the others not have as many newsletters? So we think this is a fair point.

Aside from the ten, Mampilly also figures prominently in Crypto Flash Trader. Although Ian Dyer is the editor, he credits Mampilly as his mentor.

In our Crypto Flash Trader review, we said this:

Paul Mampilly is the natural go-to person to introduce Ian Dyer, the service's editor. Mampilly is a Banyan Hill editor who has lots and lots of positive reviews on various legit review websites.So the publisher is hoping that he can lend his credibility to the new advisory. Since it is new, there really is not much evidence as to how good it is.

We recommend that you read our past article to know more about it and Mampilly's role in the service.

In the end, we know that what matters is not the number or types of newsletters. The most important thing is if they deliver what they promise. They should be worth the subscription fee.

So what are his services? We will give you a comprehensive list here to serve as your one-stop-shop for everything Mampilly.

As you read about them below, try to gather your thoughts. Let us see if we have the same impression on his services.

Newsletter services

According to Banyan Hill, Mampilly's premier newsletter is Profits Unlimited. In it, the editor seeks out innovative companies in various industries that he deems are ripe for growth.

These have diverse backgrounds, but they all share one feature. They have the potential to provide readers with enormous benefits.

He claims that he has been investing in firms like these for nearly thirty years. As a result, he has already established a keen eye for recognizing the most notable and lucrative market trends.

For him, joining Profits Unlimited will be the smartest investment decision you will ever make. Of course, as readers, we take this with a grain of salt. Every editor makes such claims.

But he does cite some examples of success, including a 148 percent increase on Eaton in one year.

In two years, he claims that his moves on PayPal gave him gains of 125 percent. Additionally, he has seen gains of up to 244 percent on Lululemon.

Depending on the package you select, the newsletter costs $47, $79, or $129. Based on the cost, you could see that this is the investor's gateway for his other newsletters.

Meanwhile, Extreme Fortunes prioritizes small and innovative businesses that have the potential to grow by 1,000 percent in a year.

The key for the editor is to find “the golden thread” or “the DNA” of these amazing opportunities.

To do this, he says he diligently went through “13,000 hours of real-time market data.” He was intently looking for a common characteristic in highly stable and poised to rally stocks.

The process of looking for this common DNA enabled him to develop a “three-phase strategy.” With Extreme Fortunes, Mampilly says you will get his tried-and-true trading framework.

Already, he claims to have identified extraordinary stocks such as Plug Power and Carvana for his subscribers. As a result, they made 1,142 percent in three and a half years and 1,111 percent in 17 months, respectively.

The annual subscription fee for this is $2,995.

Rapid Profit Trader, Mampilly's other service, provides options suggestions based on stock momentum.

After more than three decades, he says he has already learned that identifying a good “buy” is difficult. That's why he determined to create a system that would remove the emotional component of investing.

With this, he has eliminated all of the guesswork in determining whether, and when, a stock will make a massive breakout.

Instead, he employs a tried-and-true “three-step strategy” that tells him which investments have the most dynamism.

This system determines precisely when to enter and when to exit a position to maximize profits. The yearly fee for this is $2,995.

Meanwhile, he has a strategy for True Momentum that has enabled him to pull various triple-digit winners from the market for his subscribers.

He claims that Roku has increased by 393 percent in less than a year. In one year, Enphase Energy made gains of 638 percent, while SolarEdge Technologies increased by 451 percent.

According to the speculator, his primary goal is to find companies that are in the “sweet spot” or the “Goldilocks zone.”

These are trendsetters, industry leaders, and enterprises that have identified their brand and are now rapidly growing.

For this reason, he is confident in his ability to help you take your portfolio to the “next level.” The promise is for you to achieve gains of 300 percent or more in the next three to five years.

He believes there are loads of opportunities to profit by 100 percent or more from simple stock plays. You can do this regardless of the company's size, segment, or stock price.

When you subscribe, you will have access to this method. It will also give you the opportunity to make profits that many Main Street investors can only dream about.

Additionally, it focuses on firms listed with a capitalization of $3-5 billion or more that are entering their first growth phase. The annual subscription fee is $1,995.Meanwhile, Secret Portfolio exposes almost unknown investment opportunities in the market. Examples of these are special purpose acquisition companies (SPACs).

You can profit from these “diamonds in the rough” by seizing opportunities in areas where Wall Street is not paying attention.

Mampilly says that finding these well-kept secrets is no easy task.

However, he and his team are well-versed in locating assets with massive profit potential. So naturally, this means you need him. Surprise, surprise.

They use his strategy to identify emerging industry trends that most speculators are unaware of. You will then be able to generate income that you will not get if you engage with the mainstream channels.

Moreover, he claims to open your eyes and invest like a genuine Wall Street speculator. He promises to demonstrate how to go after the major game so you can make strategic decisions.This service has a one-time fee of $4,995.

Also, Mampilly has IPO Speculator for those who are interested in this specific type of service.

His three-point IPO rating system is crucial here.

He claims that he and his analysts spent countless hours researching, looking at thousands of data points, and spending an insane amount of money on Wall Street's IPO-centric research group.

The claim is that they've discovered the secret key to the most profitable IPO opportunities. The exclusive information is available for $2,995 per year.

Meanwhile, if you're interested in stock trading but aren't sure how to approach it, Inner Circle Stock Pro has plenty of ideas to suit every trading strategy.

Banyan Hill says that it is an exclusive service for its most discerning readers. It provides unfettered access to “five of his best, hand-picked stock research services” to assist you in building a solid investment portfolio.

You will have access to the suggestions, weekly notifications, special reports, monthly issues, and advisories that he discloses in these five newsletters:

- Profits Unlimited

- True Momentum

- Extreme Fortunes

- Paul’s Secret Portfolio

- IPO Speculator

Inner Circle Stock Pro is available for a one-time payment of $15,000 for lifetime access.

In addition, the 100X Club is another Mampilly service. It supposedly concentrates on tiny microcaps with a potential gain of 10,000%.

The editor claims that these 100X stocks have the highest opportunity to soar 100-fold. He says they will put you in territory that Wall Street's multi-millionaire investors cannot access.

Mampilly claims that he has identified 20 core elements of such companies. You can get in on this for a one-time membership fee of $10,000.

Inner Circle is another top-tier service. It includes access to seven services for each trading style at every level. Here are the newsletters:

- Profits Unlimited

- True Momentum

- Extreme Fortunes

- Rapid Profit Trader

- Paul’s Secret Portfolio

- Rebound Profit Trader

- IPO Speculator

Unfortunately, the price is not on the website. If you want to know how much it is, you can call Banyan Hill.Another service from the editor is Rebound Profit Trader. It seeks to profit by purchasing options on equities that have fallen due to excessive panic.

He claims to have a game-changing strategy for capitalizing on rebound momentum.

Apparently, the service can bring you quick cash on investments that will skyrocket above their momentary volatility. Mampilly uses options to collect these quick upswings.

Furthermore, this framework shows you exactly when to buy and sell to capitalize on a stock's rebound. It claims to consistently provide you with the opportunity to see triple-digit gains quickly.The annual fee for it is $2,995.

Book project

Aside from these services, Mampilly has also written a book. He released Profits Unlimited: A Wall Street Insider Reveals the Secret to Life-Changing Wealth in 2019.

It currently has a 4.6/5 rating on Amazon as of this writing.

The book promises to reveal his “investment secrets” to achieving financial freedom.

Mampilly also discusses his transition into investing. He also shares positive and negative discoveries and techniques for Main Street Americans.

With his help, he claims that people can pay off debts, enjoy retirement, tour the globe, and more. They just need to learn his basic and easy-to-understand investment tactics.

So what have you observed about his services?

One of ours is on the pricing. It would be safe to say that the majority of his newsletters are expensive. Even his book costs a lot for the regular investor.

Another observation is that the descriptions for some are almost the same. Maybe they follow a template. It could also be that some services are inspired by his other newsletters.

But after reading them from a list, it can sometimes be difficult to recall which is which. The processes or descriptions seem to overlap.

What helps readers distinguish one from the other is the different focus of each service.

Feedback

Trustpilot

Mampilly's publisher has 4.1/5 stars from Trustpilot as of this writing. Currently, Banyan Hill has received primarily positive reviews from subscribers.

By the time of publishing, there were 860 reviews overall. 71% of these gave the firm an Excellent rating, while 10% said it was Great.

Meanwhile, 7%, 5%, and 7% gave Banyan Hill Average, Poor, and Bad ratings, respectively.

Although these are specifically not for Mampilly, they are still significant. After all, he is among the company's main headliners. Aside from that, many subscribers constantly mention him in their reviews.

Here is an example:

The review above encapsulates a lot of why subscribers love Mampilly's services.

First, subscriber “LYVIA” has been reading the editor for quite a while already. So they know what the speculator is capable of. This is not like other reviewers who have just signed up and were dissatisfied.

Second, we can also see that the user has experienced more than one newsletter under Mampilly.

This means that they have a broader perspective of the editor's capabilities. If they were not satisfied even with one, they would have said so. This is helpful for those who want to see someone's range and skills.

Third, the subscriber also mentions “integrity and great knowledge of stocks.”

What this connotes are trust and rapport. Through the newsletters, it seems like Mampilly was able to develop a relationship with this subscriber.

If this is indeed a genuine subscriber, this is a remarkable endorsement of the investor. The review seems to touch on the qualities one looks for in an investment research editor.

Even a newly-retired couple, “David and Julie,” says they feel blessed because of Mampilly.

My wife and I joined Profits Unlimited and Extreme Fortunes a little over three years ago. Between the two services, we invested about $50,000.00.

As of this testimonial, we are up $156,864.00, an amazing 313%. We are so thankful to have found you, Paul.

My wife and I believe you are a maverick of your time. You are also a wonderful human being to be willing to share with everyday folks like us what you gave to the wealthy on Wall Street.

That is a top-notch testimonial right there. Any editor would also feel “blessed” to have such feedback.

Here are some more examples of positive statements on Mampilly's services from various people on Trustpilot:

Doug Meyer: Followed the rules of the game, and as of 5/1/2021 my portfolio is up a little over 93%.

Harry: My initial experience with Extreme Fortunes could only be viewed as “Phenomenal. “The return in one year on $6,404 invested was 258% for a total of $16,543.

Terrence: As of January of 2021, I have more than tripled my money since Joining Paul's services in May of 2017.

We are showing these not to promote the service. Our goal is to provide you with various testimonials so you can assess the man further.

In fact, we want to show you the big picture. For this reason, we will also show you subscribers' negative experiences. User “Smart Boy” uses strong words in his review.

According to the subscriber, Mampilly does not seem to be in the know of current market behavior. In fact, he strongly advises retirees to steer clear of the editor and his services.

He is not alone. “Calum Taylor” says that he experienced “over 87% losses on Rebound Profit Trader and Rapid Profit Trader Options services.”

“Brad Shields,” meanwhile, is not impressed with Profits Unlimited. According to him, “seven out of the last eight trades have been in the red immediately.”

Another subscriber, “DS,” also asserts that Profits Unlimited is a “scam.”

After several weeks, he “has only received one buy recommendation for a grossly overpriced stock.” Unfortunately, he gets too many emails promoting other services that have “wildly optimistic allegations.”

In addition, we want to highlight another comment as this may concern the actual newsletter focus. “Sue Guy” highly regrets ever subscribing to Mampilly's 100X Club.

She spent a whopping $10,000 for the service, and despite being dissatisfied, it is non-refundable. Read her argument below.

What can you say about her comment? Do you agree with her? Did she make a compelling case as to why you should stay away from the specific newsletter?

In fairness to Banyan Hill, it did reply to her comment:

Now, what's your opinion on the publisher's reply? With whom are you siding on this debate? We encourage you to share with us your thoughts in the comments section below. It would be great to hear your opinions.

Meanwhile, the comment below uses a tactic most publishers employ. “Rich Waldorf” discusses his experience.

According to him, the editor does not seem to care about his subscribers. The reader availed the newsletter, but Mampilly did not keep his end of the bargain.

Instead of learning about the stock right away, Banyan Hill wanted him to get an upgrade first. For him, such a practice is unfair, and we agree. If a service promises information, the editor has to deliver on it.

We believe the review below is also worth highlighting.

There have been a few comments with the same sentiment. Even if they were in the red, they were still hopeful. According to them, they trust Mampilly.

We are intrigued by such optimism. Honestly, we do not see such comments from other editors. Most of the time, when recommendations turn south, subscribers immediately give negative feedback.

In the case of this speculator-editor, it seems like his subscribers are more patient. Obviously, he must be doing something right to build such trust from his subscribers.

Pissed Consumer

Meanwhile, Banyan Hill only got one star out of five from four reviewers at Pissed Consumer. According to a subscriber, they were not able to maximize the service.

It seems like if you are not a premium subscriber, you won't receive top-notch information. This appears to be the message, according to the subscriber.

Such an impression is unfortunate. Any subscription tier should provide quality service. We understand that some information may not be available to everyone. This is how a free market system works.

But a newsletter, even if it is affordable, must still offer value to subscribers.

What seems like a small amount may already be substantial for some people. So they would expect to get valuable and actionable information.

Stock Gumshoe

We were able to find three newsletter review sites on Stock Gumshoe for Mampilly's services. However, one of the three is no longer operational. This service is the $10 Million Portfolio.

The newsletter has a rating of 2.8 out of 5 from 168 votes as of this writing. One of the comments on the page says that after one year of subscribing, the subscriber was not impressed.

They switched to Mampilly's True Momentum and had better results with it. The reviewer also commended the customer service he got from Banyan Hill.

Profits Unlimited was able to get 4/5 stars from around 1050 Stock Gumshoe reviewers.

Some comments showed how much they trusted the editor and his performance.

We believe the comment above provides us with a fair assessment. The reviewer gives readers the pros and cons of Mampilly and the service.

Some other praises for Profits Unlimited include:

Paul is by far the best growth stock picker that I have encountered.

Been a member for about 2 1/2 years. This is a solid service with good returns.

Best I’ve ever done. Portfolio is up 35%.

I have been making money with the newsletter. I am a satisfied customer.

Of course, we will also present to you the negative comments. These will help you decide as well.

Many subscribers share the sentiment above. Although the publisher says the newsletter is the flagship service, many feel that they need to upgrade first to get substantial information.

The other negative comments that you will see on the page are the ones below:

I am in several levels of the Paul Mampilly stock dream, but it has been more of a nightmare than a dream.

I’ve been a member of P/U for about 18 months & I won’t renew. I bought this as an entry-level service expecting to see lower-priced stocks in my price range but lately, almost all picks are priced triple digits.

Mampilly is a hyped up BS artist. PU newsletters aren't based in reality but Banyan Publisher's reality. My personal advice is not to buy this crap.

There you have it — strong words on either side of the coin.

Meanwhile, his Extreme Fortunes got a lower score from the website. As of this writing, 365 reviewers had an average rating of 2.7 out of 5 stars.

We saw one alarming comment that we believe you should also see.

This is a serious allegation. Travis Johnson himself said that one of the reasons he launched Stock Gumshoe was to warn readers about pump and dump campaigns.

If you want to know more about the scheme and what Johnson thinks about it, read our Stock Gumshoe Review.

If true, you really need to watch out about the newsletter and its publisher.

To be fair, there are some who defend the editor. But based on what we have seen, more people are criticizing him. We suggest you read the comments to see for yourself how lively the discussion is.

Book reviews

Mampilly's also has a book. Its title is Profits Unlimited: A Wall Street Insider Reveals the Secret to Life-Changing Wealth. As of this writing, it has an average of 4.6/5 stars from 207 ratings on Amazon.

Reviewer “Gladys Pérez Espino” says she is grateful for the book. Since she does not have time, knowledge, and experience to analyze stocks, she is glad Mampilly does it for her.

The book has great information for anyone who is or would like to participate in the stock market.

Meanwhile, “Queen Mother” has this to say about the $47.44 book:

I trust Paul Mampilly's advice. The only part I dislike is the price. Very expensive for a thin paperback book, but on the other hand, his advice is worth it.

Of the over 200 reviews, 76% gave his book 5 stars and 14% gave it 4 stars. Meanwhile, 3%, 3%, and 4% gave it 3, 2, and 1 star, respectively.

One of the few negative reviews stated this:

This book has almost zero value.

He doesn’t reveal much. Even more, he doesn’t teach anything. Just propaganda for his paid services. It does not explain the fundamental analysis nor does it explain much on the technical aspect.

So what is our takeaway from all these?

Well, people have varied experiences. Some have made tremendous gains, so good for them. However, many have also said that they lost money on Mampilly.

We suggest that you assess which among the comments resonates with you more. Try to see which ones are more relevant to you as an investor, then decide for yourself.

Controversies

As you know, we want to provide you with the most in-depth research possible. This is why aside from our go-to review sites above, we also checked some others.

We believe you should also be aware of these since they are not easily accessible online.

When you search for “Paul Mampilly,” most of what you will see are positive or generic reviews. Some are even promotional ads disguised as objective feedback.

Dirtyscam.com dedicated a page to the editor. You may see for yourself the kind of words the reviewer used. But we can say that the writer did not mince words at all.

The particular write-up is about the speculator's “internet of things” hype. According to the article, his claims are “nothing more than a marketing stunt and a gimmick.”

The writer says you cannot trust Mampilly's claims because they are mostly overstated. Even if there is potential to the investment, the editor does not emphasize the risks, which is problematic.

The writer further asserts that the editor merely forwards gimmicks and marketing stunts. Naturally, regular investors would not benefit from these.

However, the speculator seems to get away not only with fooling people who do not have much market knowledge. According to the article, Mampilly also has a knack for “fooling experienced investors.”

The strength here seems to be on marketing rather than investing. For the reviewer, the speculator “does not have morals.” Why? Well, according to the article, Mampilly:

fails to justify the marketing limits. He goes too far into lying that he underestimates the ethics that every industry abides with.

As of this writing, there are 52 comments on the thread. We could say that the section has affirmative statements, while many also disagree with the article.

However, both sides seem to be passionately fighting for their own position on the matter.

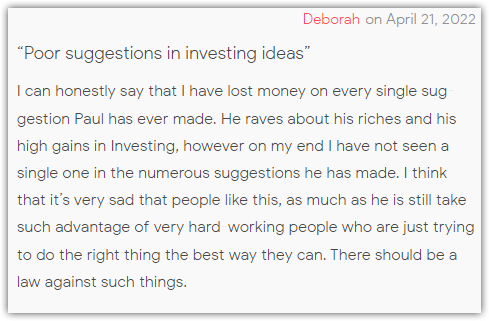

For “Deborah,” it is unfortunate that someone like him seems to take advantage of regular people.

Those against Mampilly also have these things to say:

It is all a SCAM! Paul Mampilly is a phony blowhard and NOT interested in helping the common folk.

He is scammer who claims to want to help people. Gives bad advice. My portfolio, based on his recommendations, have a negative gain. You will receive many emails trying to upsell for other information.

I subscribed to this course. Waste of money! Reason: Paul spends all (as in ALL) of his time with your subscription to keep trying to upsell you!

Do you see how forceful the statements are? People are frustrated because the editor did not meet their expectations. Worse, they feel like they were taken for a ride.

However, Mampilly's supporters in the comments section also defend him ferociously. One even said that the real scam is the review itself.

Some others attest to the editor's credibility.

It’s sad when we read dumbass reviews about a person that really can help us make money in the stock market. All you haters should stay away from investing; leave that to the experts.

I’m a small investor and am currently a subscriber to Paul’s Profit’s Unlimited. I've been in for nine months and am up about 12%.

These negative comments I'm reading remind me of that. They sound like anger & hateful comments. Could they be from the industry itself? Wouldn’t be surprised. Thanks Paul.

Aside from the site above, we also saw one Reddit thread specifically for Mampilly.

We find this intriguing, so we want to show you. Set up in August 2021, there are 36 comments by the time we publish this article.

Apparently, the thread encourages people to report the editor to the Securities and Exchange Commission. The commenters feel that it is their “duty” to report him because of his activities.

What is the issue? See for yourself the explanation from the thread:

Based on the limited knowledge we have from the thread, they are reporting him for stock manipulation. Obviously, this is a serious offense, but we are not aware of developments in the case as of now.

Would you guys know any updates about this issue? If you have updates, let us know in the comments section.

On 25 October 2016, San Diego Consumers Action Network published an article:

SCAM ALERT: Paul Mampilly's $7 Tech Stock Gamble And Other Risky Businesses

It would be fair to say that it was a strongly-worded article. It tackled not only the teased stock but even his past issue with Yahoo! stock and association with Agora.

On 17 February 2017, Courthouse News Service publishes an article with this headline:

Publisher Claims It Was Defamed By Blogger

Apparently, Paul Mampilly and his publisher Sovereign Offshore (now renamed Banyan Hill) sued the blog and its creator, Michael Shames. We were able to get a copy of the complaint.

We will quote extensively from the legal documents so you can have a better appreciation of the facts. Naturally, we do not want to misrepresent anything as this is a sensitive issue.

The suit is because of the “damaging words” in the article. They allege that Shames is:

liable for publishing to third parties false and defamatory statements that have caused and will continue to cause harm to Plaintiffs’ professional reputations within the investing community.

The suit takes issue with specific statements on the website, which include the following:

First, about Mr. Mampilly: He’s a known investment scammer

Mampilly previously worked on letters for Palm Beach, Stansberry, and Agora Financial over the past four years. These are all online investment scammers who we’ve critiqued in other blogs.

And there is also Paul Mampilly’s dubious $7 Tech Stockgamble.

They are all highly disreputable and share a bias towardsheavy internet marketing, abusive email practices, and preyingupon seniors looking for higher returns on their investments.

So, how did the court resolve the matter?

Well, according to the decision of District Court Judge Donald Middlebrooks, the Florida court does not have jurisdiction over the matter. As a result, he dismissed the complaint.

The thing is, Shames and his blog is based in San Diego, California. Furthermore, the decision said that “Florida is not the focal point of the posts.”

Was there any pertinent discussion on the merits of the case? Not really. Unfortunately, it seems like those are the information we have so far.

Conclusion – Should You Take Mampilly's Advice?

If you have been reading our site for a while, you know that we have featured his works extensively. As mentioned, he is among the most prolific editors today.

But quantity does not automatically mean quality. So we have gone through each one of Mampilly's services. Our article gave you brief but meaty descriptions of them.

The goal is for you to see all of the offers without having to click on numerous links, which is always the case with the publisher's websites.

The section also listed how much they are. Aside from the entry-level newsletter, it will cost you thousands if you want to subscribe. But is the price worth it?

Supporters are very enthusiastic about him, while critics give strongly-worded statements. So it is a mixed bag of comments. But you know this about almost every newsletter, editor, and publisher.

So it will boil down to what kind of investor you are. Based on the comments, you could see what's appealing and unappealing about Mampilly.

In fact, you could learn a lot from his background as well. This is the reason why we gave you a lot of relevant details about his career.

Relevant to the discussion is the controversies he has faced as well. He tried to sue a blogger for damaging his reputation, but it was dismissed. We also saw reports that people were actively reporting him to the SEC.

So, is Paul Mampilly legit? Tell us below what your conclusion is.