Michael Carr's One Trade system is claimed to be, by him, "the perfect trade".

But how good is One Trade really? Is this advisory service legit and will you really have 52 chances to double your money over the next year?

In this review I'll be going over what One Trade is and how it works, what subscribers get, the cost & refunds, pros & cons and more.

Let's begin by going over some of the teaser for this opportunity. Bear with me here... the claims are hyped-up as usual.

The teaser:

There are likely multiple variations going around promoting this service, but here's what I came across...

Mike (Michael) Carr is the guy behind it all (shown above), but I'll talk more about him in a bit.

We are told that the team at Banyan Hill (the company Carr works for) has been trying to find the perfect trading strategy for years... and now they've supposedly found it.

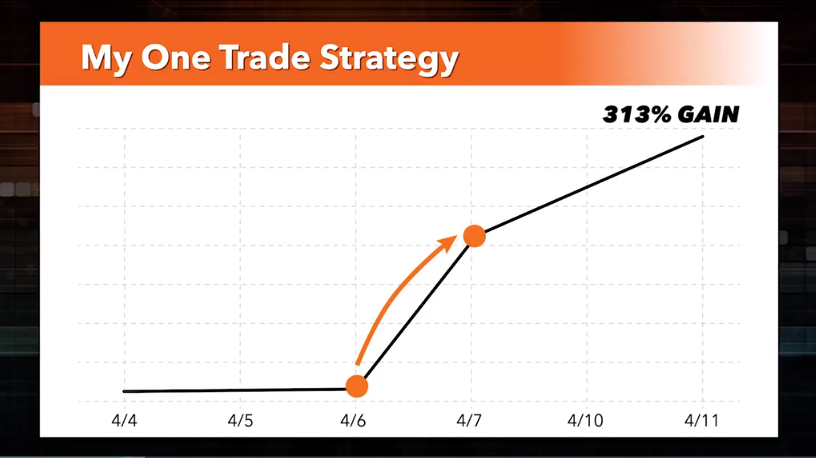

In the teaser, Carr shows us a bunch of big gains that we could have made following his "one trade" strategy, such as this one for 313%...

However, he conveniently leaves out any mention of loosing recommendations, and it's pretty annoying when half of the presentation is just talk about all the winners.

Some of the hyped-up claims for this service include:

- it's "a single investment you can use to target gains of 100% or more week in and week out"

- that you will have 52 opportunities at 100% or more over the next year using this strategy

- it's so simple it can be replicated every week

- this is "the secret for uncovering the greatest riches the stock market has to offer"

- with this service he wants to give us "the chance to make more money in the next year than you've ever made in your life"

Sounds amazing... I mean, who wouldn't want to make more money this coming year than they have their entire life? But then again, this claim sounds a bit ridiculous, doesn't it?

You have to take some of this promotional content with a grain of salt. Let's dive into what this service really is and what you get...

Overview of One Trade

- Name: One Trade

- Type: Trade advisory service

- Editor: Michael Carr

- Publisher: Banyan Hill

- Cost: $3,997 (but usually heavily discounted)

One Trade is an advisory service run by Michael Carr over at Banyan Hill Publishing. In a nutshell, it's a follow-along service where subscribers are provided with trade alerts, market analysis, and more. They are told what to do and when to do it, so that no experience is necessary.

Like Adam O'Dell's "Green Zone" and Altucher's Weekly AlphaBrain Alert, this service is also focused on options trading. However, what makes it unique is that it is only focused on "one trade"... one trade, once a week.

It's a somewhat expensive service and there aren't any refunds offered, but it might be a good fit for some people. It depends on what you're looking for.

Who Is Michael Carr?

Carr started out his career at the Pentagon when he served in the Air Force. During his time he was involved in an early version of the internet (for a local area) and worked on designing codes for nuclear missile launches... pretty impressive.

But now he's an investor. Carr is a Chartered Market Technician (CMT) and a Certified Financial Technician (CFTe). He has been able to take some of the skills developed in the military and put them to good use trading. Much of what he does is develop indicators with his extensive knowledge of coding, and this is what he has done to bring to us his "One Trade" system.

Currently Carr is employed by Banyan Hill publishing, which is the publisher behind his newsletter advisory services... and the company behind the often ridiculous teasers.

The One Trade Strategy

This "One Trade" strategy is pretty simple, and similar to Jeff Clark's "3 Stock Retirement Blueprint" except there aren't 3 stocks to trade... just... one... trade.

One trade, once a week, and the average time this trade takes is 2 days.

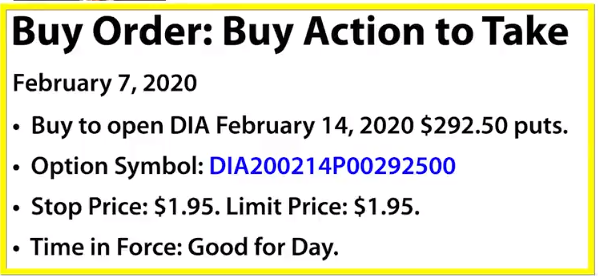

He refers to these trades as "momentum orders" at one point, but what he's talking about here is good old options trading.

The trade: he targets the stock index, SPDR Dow Jones Industrial Average ETF (DIA).

Sounds simple enough, right?

In summary, he suggests trading options for the SPDR Dow Jones Industrial Average ETF (DIA) just once a week... and that's pretty much it.

But of course this is much easier said than done, and the whole point of this "One Trade" advisory service is to be able to follow along and place the exact trades Carr recommends, which you'll be able to do because of the trade alerts he sends out...

Trade Alert Example

How does he determine trade prices and when to take action?

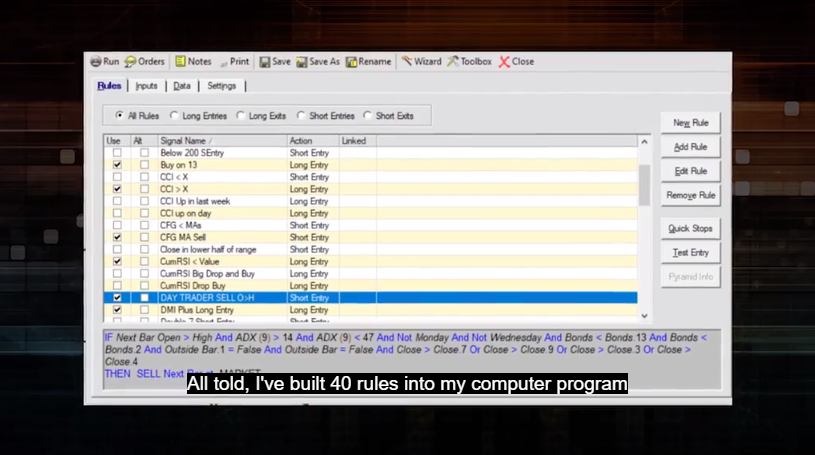

Well, there are several criteria that must be met before he makes a recommendations.

Firstly, he has a computer program he developed by compiling 20 years worth of market data. This uses an algorithm that scans 40 rules he coded into the program and looks for patterns in the market. It looks at recent price action and provides an alert when it has a prediction of where the market will be in one week with at least 75% probability.

Once this provides an alert, he then cross checks the trade with another indicator he uses to predict the price action 2 weeks in advance, which is a type of volatility indicator.

And then lastly he looks at the trade himself to determine if it's worth taking.

What You Get

When you join as a subscriber you get access to these trade alerts. Subscribers are told when to buy and when to sell, just as with most follow-along type advisories. But there's more than just that.

Here's everything you get:

- Daily Briefings - Each day by 9:15 am subscribers are sent out a new morning update on what to do for that day, whether it be to simply hold onto a position or make a trade.

- Weekly Trade Recommendations - For each trade alert there will be instructions on how to go about executing it along with an analysis provided. These updates are provided via email and/or text message. A minimum of 50 trades are provided each year, with about 1 per week, sometimes 2.

- Weekly Newsletter - In the weekly newsletter that is sent out, subscribers are provided with insight into which direction Michael thinks things are heading, what his volatility indicator is telling him, and what he thinks you should expect for the coming week.

- Model Portfolio - Here subscribers can find all the current trades to keep track of what's going on and what Michael is recommending... and how things are performing.

- The One Trade Starter's Guide - This is a guide for beginners, but even experienced traders will want to read it. It goes over the basics of options trading and using this strategy.

- The One Trade Rulebook - This goes over all the rules that he has programmed into his One Trade system, although I'm not entirely sure how detailed it is... and I'm guessing not very.

- Website Access - Here subscribers will be able to login and access and archive of all past and present reports, alerts, newsletters, etc.

- Bonus Newsletter - Subscribers also get access to his "Market Intel" newsletter service. This is another newsletter that provides in-depth information on the markets and Michael's opinion on where he thinks things are heading.

Cost & Refunds

The normal cost is supposedly $3,997/yr, but it's been discounted to $1,997... or at least is has through the sales funnel I went through.

Pretty expensive... but then again, he claims you could have 52 chances at 100% gains in the next year.

The "100% Guarantee"

There is also a "100% guarantee", which states that if you don't get the chance to make 100% over the next year you can get a second year of the service for free...

But what happened to refunds?

If the service isn't performing up to par, then why would you want a second year of it?

Well, there aren't any refunds.

NO REFUNDS

Here's the excuse they use to not give out refunds: "Because of the incredible nature of this discount, we cannot offer any refunds."

I don't know about you, but I don't see any "incredible nature" that would make it too hard to give out refunds... but it is what it is.

*Note: Although they state there are no refunds, if you are looking to get one it still might be worth the attempt. You can contact Banyan Hill at 866-584-4096 or send an email to onetrade@banyanhill.com.

Pros v Cons

Pros

- Simple strategy - just one trade, once a week

- Easy to follow and well laid-out service

- Guy behind it, Michael Carr, is a professional

- Don't need a lot of money to start out (I'm talking about for the trades) since it's options trading

Cons

- Expensive

- No refunds

- Trading options is more complicated than stocks (not that hard though, and training is provided on how to do everything)

- Promotions are a bit over-the-top and can be misleading

Quick Recap & Conclusion

One Trade is an trade advisory service run by Michael Carr where he provides subscribers with weekly options trade recommendations on just one thing... the SPDR Dow Jones Industrial Average ETF (DIA). It's well laid-out and easy-to-follow, but is fairly expensive, over-hyped and there aren't any refunds offered.

Ultimately the decision to join or not comes down to you. What I can say, however, is that this service isn't for everyone. It's much different from a buy & hold long-term investing strategy, which I know a lot of our readers are looking for.

Hopefully this review has provided some value to you. As always, let us know what you think about it all in the comment section below...

would be much more useful if you showed some portion of recent recommendations [

? 5 months]

They started out trading DIA options, then came up with sad stories about how the volatility and expiration dates weren’t working, so they switched to SPY options and leveraged ETFs and it has been just as bad or worse. It’s really not a bad service to subscribe to, if you do the exact opposite of what they tell you. I also subscribe to green zone fortunes, and home run profits, from Money and Markets, which is also owned by Banyan Hill, but run by Adam O’dell. They are quality services that I would recommend. Home run profits is an options service with about the same price tag as this, green zone recommends stocks for a 6-18month holding period. I just buy options based off the recommendations, which has done me well. It is cheaper than both the other two.

I have the new wave crypto program Ian King is the guy that runs that portion. It also came with strategic fortunes and Alpha Investing. I’m new to options and was thinking of doing this one but after reading I’m thinking again lol. Do you recommend anything for a brand new person trying to learn “swing or day trading/ options” any of those methods. I have the long term thing down pretty good. Thanks in advance!!!

I am reading the review of One Trade Michael Carr. He guarantees 100% return after 52 weeks. Your review does not report if he delivers on his guarantee. What was his return on the last 52 weeks of recommendations? How many trades were wins or losses in the 52 week period? Do you recommend going in with this concept?

Thank you

Hi Richard. The track-record for this service isn’t publicly available.

Positions: 161, Average Gain: -4.80%, Average Hold: 2 Days

Last Updated: 10/08/2021

From the header of the closed positions portfolio. Might not get my money back, but maybe I can keep someone else from wasting theirs.

Anders, Thanks for your great review of the One Trade investment advisory service. Like you I would have been very interested in learning about what percentage of the 52 trades are losing ones. Also thanks for pointing out the trades are all Options.

I just counted up the last 70, which includes a hot streak he had at the beginning to be generous. 40 losers, 30 winners. More important to note the average loser is probably -70%, while the average winner is probably 40%, again being very generous. Bankruptcy in no time.

I made the costly mistake of subscribing to this service. Had I done the OPPOSITE of everything trade recommended, I would have made huge money. He even came out and said his performance was poor and added additional options to his program. Unfortunately, these have done no better. I have no idea what they used to test their modeling on but it obviously wasn't vetted well. I am still trying to get someone from Banyan Hill to contact me and tell me how they intend to compensate me. I asked to cancel, providing all the trade losses he has cost me, and no one responds. It's been almost 6 months now of constant calls and emails with no response.

I am looking into this system. D.G., how many trades did you make, what percentage were losers? Did you finally hear from them?

Thanks for your insights. Paul

By far the worst service I have EVER used. I tried doing the exact opposite of his recommendations for a month and made back the 50% I had lost. This guy is an absolute laughing stock. Last 10 trades-

-93%, -86%, -18%, -85%, +18%, +32%, -53%, -95%, -67%, -69%. Current open trade is -33%. Just to be transparent the 11th and 12th closed trades are winners, +46%, +62%, but 13 is -98%, 14 is +26%, and 15 is -85%. Got to stop somewhere, but you see the pattern.

Thank you for your honest review. It is refreshing to find one

I joined OneTrade and Market Leaders this week. The presentations are fairly compelling and the suggested Back Testing of Positive result hit home for me. Once I had access I started to look at the past result for both programs and was shocked. Over the last 3 years the closed 190 trades = wins = 91 (47.9%) , losses = 99 (52.1%). The scarier part is the $ net, it was -$1,018 for 3 years. Hard to make sense of this with a $1,500/yr subscription fee.

Results of Market Leaders = for 2022 Total trades 35, Wins = 13 (37.1%), Losses = 22 (62.9%). Net $ Losses = $-9,223.41.

Buyer beware…….

Hi Steve,

Thank you for this detailed comment. I’m sure it will be beneficial for others readers looking to possibly buy into this service.

Hopefully, One Trade performs better in the future.

When I attended his interview . He said that , he will be trading the QQQ every day at 9:46Am . Any one who has any questions on Options ,they can ask him, and he will give the answer up to an hour.How so that the QQQ changed into DIA with in a night ?