In one of Ian King's latest investment teasers he reveals a “new” strategy to make as much as “10X your money in as little as 12 months”.

Additionally, he teases three small-cap stocks that he has already identified have the potential to 10x in price within the coming year…

The teaser:

As we already know, Ian King is the guy behind it all. He comes from a background on Wall Street having started out in the mortgage bond department of Salomon Brothers and worked his way up to managing a hedge fund (Peahi Capital) where his team and he made an impressive 339% return in 2008… which wasn't the greatest of years for the stock market. He's been on Fox Business News, is a top contributor for Investopedia and Seeking Alpha… and to make a long story short he knows what he's doing.

That said, Ian King is also the guy behind the misleading and overly-hyped Spectrum and “Great American Reset” teasers, so sometimes you have to take what he says with a grain of salt – make that a giant grain of rock salt.

new strategy targeting huge gains

three stocks that “have the potential to hand you 1,000% in the next 12 months”

small innovative companies with small market caps as little as less than $2 billion

looking for companies with low market caps and disruptive new technologies

The sales pitch:

New Era Fortunes for $1,995 a year

Ian King's Strategy

So, how does Mr. King find these 10x winners that he's teasing?

Well, this is the “new” strategy he tells us he's come up with…

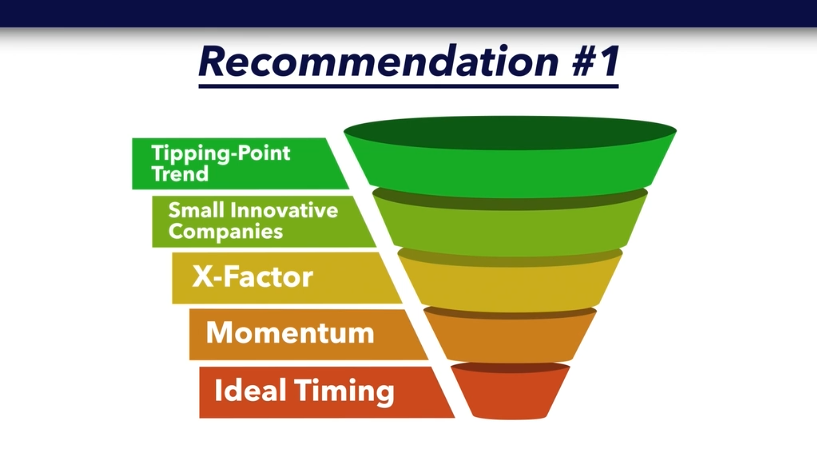

#1 – Find Tipping Point Trends – First step is to identify trends that “are on the verge of big breakthroughs”.

#2 – Look for Small Innovative Companies – Looks for companies with innovative technologies that could disrupt the market.

#3 – Companies with a Clear X-Factor – Then looks for companies with a line of business that is underpriced – types of businesses that have the potential to disrupt an industry, such as Netflix's online streaming service that was overlooked by most early on.

#4 – Momentum In Sales – Sales must be increasing by 20% or more year after year – need good sales momentum.

#5 – Ideal Timing – Want to get in at the bottom and out at the top – of course it's easier said than done however.

Now of course doing all of this is easier said than done, but he also tells us that him and his team do at least 100 hours of research before making a stock recommendation. They look at least 11 criteria in total, including others such as the lack of analyst coverage, above average trading volume, good management and more before making a pick.

The 3 stock picks teased by King are ones that he claims tick all the boxes and are poised for at least 10x growth each.

The 3 Stock Picks

all have the potential to 10x in the coming year

Recommendation #1:

36 min

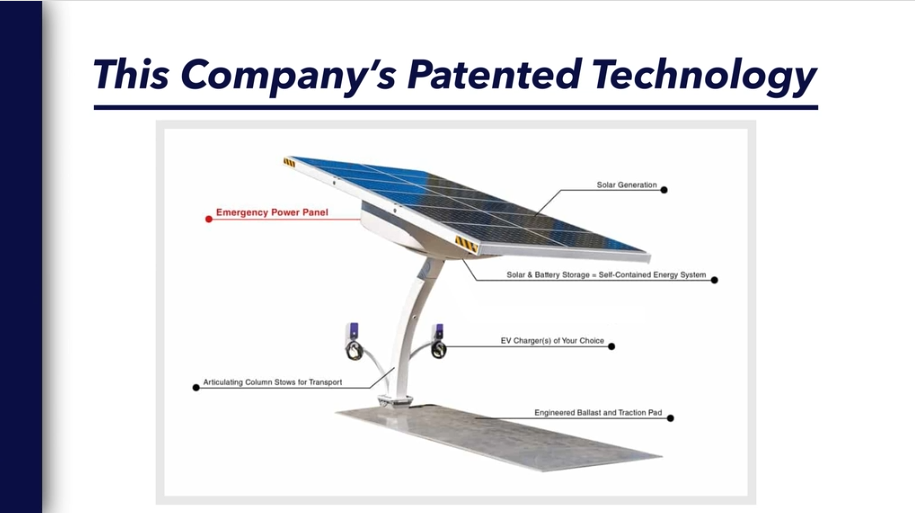

- “one tiny company” that “produces off-the-grid, solar-powered EV charging stations”

- These charging stations it makes “are mobile and can be setup in minutes” and can charge as many as 6 electric vehicles at a time

- Its market cap is less than $100 million

- S&P Capital IQ estimates that this company's revenue will grow from $5 million in 2019 to $22 million in 2021

Any guesses here?

No worries. I've been able to dig deeper into the clues given and the stock pick here seems to be for Envision Solar, which just rebranded to Beam (BEEM).

The company is a “CleanTech” leader based in California that creates the “world's fastest EV charging deployment” and other infrastructure for EV transportation, such as EV charging stations.

The picture that was shown above from King's presentation is for Beam's patented EV ARC charging station shown here…

Recommendation #2:

- “A tiny company that could potentially take a big bite out of the projected $1.2 trillion IT solutions market in the US”

- It “creates customized solutions for businesses, large and small” – pretty vague statement

- It's a “$123 million company” – referring to its market cap

- It “has only been public since the end of 2017”

- Has partnerships with AWS, Google Cloud, IBM, Cisco, Paloalto, VMWare and more

- Was awarded IBM's 2020 Business Unit Excellence Award

- Its quarterly revenues have been up 44% year after year and in the recent quarter reached $228 million

- The company's stock trades for under $5 a share

Business Unit Excellence Winners include:IBM Cloud

- Avaya, Inc.

- CENIT AG

- Hitachi Systems, Ltd.

- LogDNA

- PacGenesis

- Prolifics

- Sirius Computer Solutions, Inc.

- Skytap, Inc.

IBM Data & AI

- Cisco Systems

- Converge Technology Solutions

- IOLAP

- Logicalis Solutions Limited

- Nippon Information and Communication Corporation

- Tenbu

IBM Security

- Deloitte

- Optiv Security, Inc.

- QRIAR CYBERSECURITY

IBM Sterling

- Cognizant Technology Solutions

- Lightwell, Inc.

IBM Systems

- Connectria

- Datagroup Frankfurt GmbH

IBM Training

- Tech Data

Recommendation #3:

- Combines AI with drug discovery

- Built a supercomputer that maps the motions of individual proteins

Quick Recap & Conclusion

Ian King, ex-Wall Street hedge fund manager and investment analyst, has a new investment teaser out called “New Era Fortunes Summit” for the chancer to 10x your money in just a year.

There aren't any good details on this yet, but after it comes out I'll be sure to update this review.

*PS: This presentation will likely be posted online after it airs, so it's not like you're going to miss out if you don't attend it at the specific release time. Don't worry.