The so-called King of Crypto promises to give your investments gains of up to 1,000% in only one year. Our review of Ian King’s New Era Fortunes will discuss if this is indeed achievable.If you are a regular reader of our website, you would know how we feel about such claims. Often, the marketing and promotions of these services go over the top. Since there are many newsletters out there, it seems like they are competing on who can make the most outlandish claims.King was even introduced on the sales page as the only investor the host knows “who has developed a strategy to detect the DNA” of the most profitable companies.So if you are reading this, you are in the right place. Part of being a smart investor means you are also vigilant with the investment advice you listen to. Add to this the fact that such advisory firms cost money. Continue reading as we go deep into New Era Fortunes — its editor, process, and service.

Overview

- Name: New Era Fortunes

- Editor: Ian King

- Publisher: Banyan Hill

- Website: www.banyanhill.com and www.iankingguru.com

- Service: Investment research service

- Cost: $1,995

The publisher is a reputable research firm. We have written a recent review about one of its other experts' newsletters, Charles Mizrahi's Alpha Investor.Banyan Hill's New Era Fortunes focuses on small-cap companies. Its goal is to point you to companies that have the potential to make it big. Ian King adds that he will show you these stocks before others see their potential and invest in them.Using his five-step method, he claims that he can make you rich. And who does not want a large retirement fund? Who does not dream about a new car, a bigger house, or a grand vacation in some exotic part of the world?Even if his newsletter is costly, the trader is confident that his stock picks are all worth it. You only need to follow his advice and you are on your way to yields you have never seen before.As proof, he says that he has put in place a unique double guarantee. First, if you do not get the investment gains he promised, his service will be free for your second year. Second, if you are not satisfied with his advice, you may cancel within 90 days. They will give you company credit you can use for their services.Thus, he says that this is a deal you must take right now. This seems like an exciting offer, we understand. But before filling out your information details on the subscription page, read our comprehensive review first.

Who is Ian King?

Boasting over 20 years of experience in financial trading and market analysis, Ian King is the man behind New Era Fortunes. His career started when he worked as a clerk at Salomon Brothers Mortgage Trading Desk.King has also been a long and short equity hedge fund manager. Further, he was the head trader for Peahi Capital, a New York-based hedge fund, for more than 10 years.Today, aside from being a professional trader, he also serves as the lead instructor of Investopedia Academy's Crypto Trading. This is an online course for investors who want to learn about capitalizing on cryptocurrency despite its volatility.He has also engaged with various media outfits like Fox Business News, Cheddar, Real Vision, Investopedia, Zero Hedge, Seeking Alpha, and other outlets. As an expert trader, he loves talking about trends in new technology.Dubbed as the “King of Crypto” in his promotional video (no surprise there, it's a Banyan Hill production), he claims to have the ultimate investment blueprint.Examples of opportunities he preyed on way before everyone else are Tesla and Amazon. He says that before the rise of Elon Musk, he was already investing in electric cars. Way ahead of the majority, he took notice of Amazon in 2011. Its stocks have already soared 720% since then.Of course, his main claim to fame is that he was among the first believers of bitcoin. According to King, if you have invested $1,000 in 2010, it was already worth $1.2 million in early 2018.For sure, Ian King has the credible financial background we all want in someone who gives us advice on stocks. His experience with reputable companies has given him more than enough knowledge. We can all learn from his perspective.He even offers his insights on the latest trends in the investment world through the articles he regularly releases. That’s a plus.But we want to give you the good, the bad, and the ugly. So we will present all sides so you can be the one to decide in the end.Our previous reviews gave impartial assessments of his past teasers. You may want to read our articles on his MaaS stock teaser and what he refers to as his 20-Minute Retirement Solution.In them, we tell you why we think some of the claims he makes in these pitches can set too many expectations (and often too high). As a result, some may invest much more than they can afford to let go.

We always caution our readers to study the risks before believing in lofty promises.

What is New Era Fortunes?

An investment service that uses a five-step system, New Era Fortunes is a newsletter from Ian King. It offers small-cap market analysis and stock recommendations.Its focus on new technology that paves the way for a new era is the reason why King named his newsletter as such. We will have a detailed discussion on his investment recommendation process in a while.Under Banyan Hill, he has two other newsletter services. Strategic Fortunes, formerly called Automatic Fortunes, “identifies trends or massive developments that are set to trigger a technological revolution.” Next Wave Crypto Fortunes, meanwhile, used to be called Crypto Profit Trader. This service equips subscribers with insights on how to best understand and invest in the crypto market.

How it Works

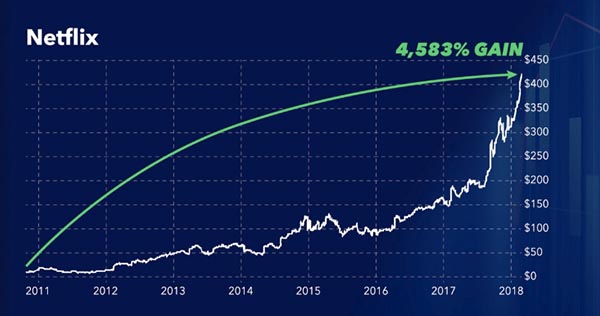

Small-cap companies have relatively small market capitalization. Think $300 million to under $2 billion. On his website, King regards companies under $10 billion as small-cap also. In general, these have outperformed large-cap stocks. This is why some investors prefer them. However, one caveat here is that these stocks are also risky and more volatile.King says that he looks for “tipping-point trends gearing up to trigger a revolution.” He no longer minds companies such as Apple or Netflix. New Era Fortunes are on the lookout for those who are next in line. As a result, you can make more money with them as they grow.His bold promise is that as a subscriber, your investments have the potential to earn 1,000% in only one year. All that this requires is that you follow his advice and invest in small-cap tech stocks.He has made such claims in the past. In our No. 1 Stock teaser review, we exposed that the company he was referring to was Square. We also offered a healthy skepticism about its 10,000% profit potential.Another teaser article we have written is on his New Era Fortunes Summit. Green Bull Research also figured out that Beam Global (BEEM) was one of three high-yield stock picks he was teasing us with. We mentioned that this could be a lucrative pick based on the problem it wishes to solve. It also has a good price forecast from Wall Street. But we also warned you to invest wisely, should you choose to proceed.Further, the former hedge fund manager says that his five-step system is his fool-proof method. This is the formula he uses to determine the kinds of stocks he teases us with, like the ones we just mentioned. Take a look at the image below and tell us in the comments section if you think these are innovative and enterprising steps. Remember, his boast is 1000% gains in just 12 months.

The idea that he has is that his system is like a funnel with all these filters. Since the stocks are being filtered at every stage, he will only recommend what’s left. These are the best picks. We will go through them briefly and give some examples for each. Since you will be investing in his newsletter, you need to have a good understanding of his process. You need to see for yourself if his service is worth the $1,995 investment.1. Identify tipping-point trends that are on the verge of a big breakthroughAn example he cites is video games streaming. Among the many models he provides, one company is Turtle Beach, a gaming headset manufacturer. It made gains of 1,568% in 2018.

2. Invest in small-cap tech stocks that will be the next giant superstars like Waze, Twitter, and Uber.He highlights Helo Corp. here. The smartwatch developer’s shares grew 17,900% in 18 months.

A recent Yahoo! Finance article holds a similar view to King’s first two filters. The writer says that the ability to spot good stocks before they become famous and expensive will make an investor successful.The article also lists 10 small-cap stocks worth investing in based on 866 hedge funds they track.3. Look for companies that have the “X-factor”. These are the ones underpriced by investors.The classic example here is Netflix. Although it was its mail-order DVDs that toppled Blockbuster, its streaming service was the superstar. Investors did not even bother to look at it.But it was this platform that made it grow exponentially from 2011 to 2018. Vox discusses this shift at length in an article about the streaming giant.

4. Identify companies that have momentum. Their sales must be increasing by 20% every year.The pandemic staple, Zoom, is his prime model here. From January to June, its sales went up 169%.

5. Know when the right timing is.King cites the case of ACM Research Inc in 2020. If you invested in the company in March, you will have made 399% gains by August.But if you only made a move in May, you will only experience 79% gains by August.This is why timing is key, he asserts.

To be fair to the guy, he did give convincing examples.

But even King said that hindsight is always 20/20. So more than the examples, what we are looking for is his actual performance on stocks he has recommended.

What you get

An annual subscription will give you exclusive access to his stock recommendations. These are the ones that have been filtered by his much-hyped five-point system.According to the editor, these will give you a guaranteed 1000% gain in your investments. King is banking on his team of experts and his decades-long experience. Here are the things you will get with a $1,995 subscription fee:

- Access to his model portfolio

- Includes every stock on his Buy Now list

- Usually one to two stocks a month for the whole year

- Guidance on what to buy, what price to buy, when to sell

- Trade alerts

- Notifications via email about new companies the five-step system uncovers

- Alerts during times when you need to sell an open positionDetailed instructions

- Weekly webinar

- Continuous education from Ian King

- Market analysis sessions every Friday

- Updates on how political events affect the US markets and the global economy

- Special report

- Ian King’s Top 3 “New Era” Windfall Opportunities

- Details on “three tiny companies leading the way in tipping-point trends”

- These have the potential for 1000% gains for his subscribers

- Daily briefing

- Free subscription to his daily e-letter, Smart Profits Daily

- Features latest trends in technology

- Gives updates on the newest investment opportunities

- Customer service team

- 24/7 website access

- Exclusive access to all his current and past reports and portfolio

Even with the price tag, he offers a standard menu with only one special report. Others with a more affordable subscription fee offer more extras. But if his research delivers on its promises, it will be a great deal.In general, we are certain that investors would be willing to pay a premium for quality advice. If they know they will get their money’s worth, what is a few thousand dollars?But the sad reality is that most advisory firms out there rely on marketing more than substance. What's even sadder is that one scammer taints the whole industry. We are not saying that this applies to the newsletter in review here. We are merely helping you understand reality based on the number of teasers and reviews we have already written.That is why our hope here at Green Bull Research is for you to be vigilant with flashy offers. If you are diligent in verifying dubious claims, we can drive sketchy services out of business.

Cost and Refund Policy

Cost

You will be able to take advantage of Ian King’s stock picks for the discounted price of $1,995 per year. According to him, the original price is $5,000 and the slots for the service are very limited. Do not be pressured into subscribing immediately because of statements like these. It is a typical promotional tactic investment companies use.

Refund policy

New Era Fortunes says that they have an unprecedented double guarantee for their service. This is how confident they are of the quality of their stock recommendations.First, if you are not satisfied with the newsletter, you may get in touch with them within 90 days. They will return your subscription fee. But this is the catch, you will not get your money back. They will instead give you company credits you can use for the other services that they offer.

Second, if during the first year, you did not get the chance to make at least one 1000% gain, a special treat awaits you. Just call them and you will get a second-year subscription absolutely free.

What do you think about such a policy?From our end, we find the lack of a money-back option disconcerting. If you are dissatisfied with this newsletter, it is obvious that there is an element of distrust already.

It can either be with the editor or the publisher. It would be strange to just transfer under the same umbrella organization. Also, the offer for a free second-year subscription is creative, we will grant them that. But why would you stick to a service that was not able to deliver on its promise? Essentially, you can interpret this as a no-refund policy. In the end, you will not get your money back despite the verbal gymnastics.

Reviews

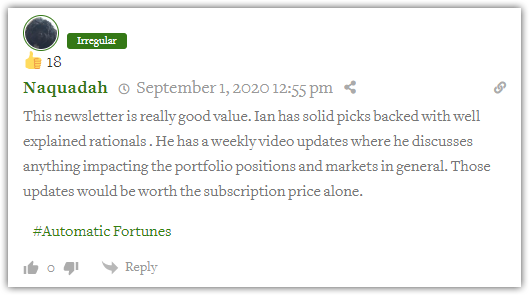

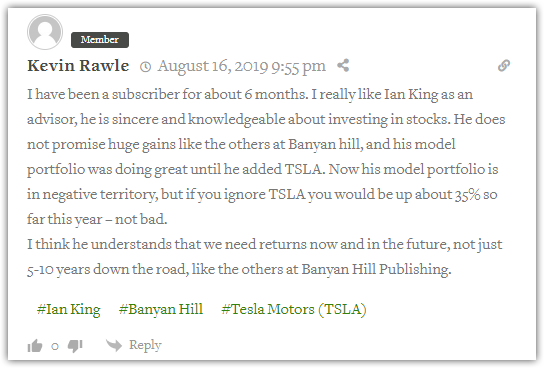

One of the commenters on the Stock Gumshoe website mentioned that Ian King just launched New Era Fortunes in October 2020. If that is accurate, it has only been 10 months in the market as of this writing. It has a rating of 3.5 stars out of 5 from 10 voters at the moment.Clearly, this is not enough. To give you a better view, we also looked at how Ian King’s other newsletter fared on Stock Gumshoe. After feedback from around 70 voters, Automatic Fortunes (the former name of Strategic Fortunes) got 3.7 stars out of 5. This is a good rating.There are also a couple of comments that reviews King’s competence.

However, we are disheartened to read this comment below from a 74-year old.

This should not happen at all. Granted that some elderly people may have clicked on some links and it could be their fault. But we hope the company can extend further assistance to such situations.Again, we would like to clarify, reviews and ratings do not reflect the whole picture. But they are there to help you decide as you learn from the experiences of others.Other reputable websites we often consult do not have ratings of this newsletter yet.

Pros v Cons

Pros

- Ian King has a solid reputation

- Small-cap stocks have generally outperformed large-cap companies

Cons

- Small-cap stocks can be risky and volatile

- Expensive subscription fee

- No actual money-back refund policy

Conclusion – Is It Worth The Subscription Fee?

Former hedge fund manager Ian King is the editor of this $1,995 per year newsletter. He guarantees gains of up to 1,000% in 12 months. Even if the price is steep, anybody will still be tempted because the promise of 1,000% is just too good. If you have such potential to make money, the fee will be worth it. He says he is so confident that he gave a double guarantee. If dissatisfied, you will get company credits or a second year of free subscription. That’s actually a creative way of saying “I am confident but if I fail, you're not getting your money back.”But to be fair, it is worth checking because New Era Fortunes focuses on small-cap companies. Generally, they outperform large-cap stocks so there is merit to what you can earn with such investments. But, you need to take note that these come with risks and volatility issues.The goal of King’s newsletter is to pinpoint stocks on the verge of becoming the next big superstars like Amazon. The earlier you spot and invest in them, the logic is that you will earn more in the long run.Does he give adequate assurance for his stock picks? Does King have a history of giving competent recommendations? In our discussion above, we have discussed these questions and more.Should you then subscribe? A lot of other factors come into play. Although we went deep into the newsletter service, your individual position is still the biggest consideration. We all have very different fiscal situations. We must make choices based on our current circumstances.Are you willing to part with $1,995? How much are you willing to invest? How do you feel about small-cap stocks? Do answer these questions to determine if this newsletter is a good fit for you. In this review of Ian King’s New Era Fortunes, we provided the dirty details so you can come up with a clean decision for yourself.