In this article, we will answer this question: Is The Altucher Report a scam or a legitimate service?

James Altucher is either a peculiar specimen of a genius, or a tireless self-promoter and pseudo-intellectual. This depends on how you perceive him, his views, and his actions. The man is behind a podcast, several books, and a blog.

Included in a long list of his activities is his role as an editor of several investment newsletters.

Though he stands by the quality of his work, many criticize him. He is mostly style and little substance, they say. But you can’t argue with success, others reply.

Read our review and share your thoughts in the comments section.

Overview

- Name: The Altucher Report

- Editor: James Altucher

- Publisher: Three Founders Publishing

- Website: www.threefounderspublishing.com

- Service: Monthly investment newsletter

- Cost: $299

This newsletter encourages its readers to “Choose Yourself”. We put the phrase in quotation marks because this is also the title of the Wall Street bestselling book written by Altucher.

He claims that through this newsletter, you will “find success”, lead a “good lifestyle”, and live a “secure and happy life”.

You may be asking, “What’s with the quotation marks again? Are these titles of his books also?”

Well, no, they are not. Or at least there are no books with those titles yet, among the 20 he has already written.

We quote these phrases because we want to show you that these are the exact words he uses on his website. For a service that asks you for $299, we find these statements to be too vague and ambiguous.

But maybe his sales page is not enough to assess him and his service. So let us study what details are available so we can help you decide if this is worth your time.

Who is James Altucher?

In our previous review on Altucher’s Secret Income, we presented a list of what the guy is busy with. We said that he is an author and a chess master. The man is an entrepreneur, investment pundit, and podcaster. We also mentioned that he is a former hedge fund manager.

Oh, and Altucher is a stand-up comedian.

We are serious about the last part. He does own a comedy club and he often performs in it.

Also, he does have a widely accepted history of success. Choose Yourself, Altucher’s most successful book, is a national bestseller and named as one of the best business books of all time by USA Today.

He is a fixture of various media outlets as well. People are interested in his insights because, as he claims, he has seen it all. He experienced millions, has been bankrupt, and made millions again.

Aside from this, millions also listen to his podcast and read his website. Altucher is also listed as a top LinkedIn influencer.

Green Bull Research also wrote reviews on his StarNet companies teaser and Weekly AlphaBrain Alert.

What are some of Altucher’s Beliefs?

This time, more than a litany of his accomplishments, though, what we want to get to know is his worldview. We feel that this would give us a better perspective if we can indeed trust his judgment.

Due to his high-profile nature, there is no shortage of interviews, profiles, and media appearances. He has lots of thoughts and he wants everyone to hear about them.

We have looked at his blogs to know some cornerstone ideas he holds.

The Perfect Investment Strategy, Storage, and $1 trillion

In an article on his website, he says that he has simple steps for the perfect strategy when investing.

- Identify an area of life that grows annually at an exponential rate.

- Buy all the stocks in that industry.

- The optional third step is to research first and buy most stocks in that industry. This will guarantee better returns.

Of course, he is saying these in very simplistic terms. But his logic is that you can never go wrong in the long run with such a strategy.

Even if you lose money in most of your investments, because the industry constantly grows, even one or two good stocks will be extremely good stocks.

His example is computers. In 1970-1990, what you needed to do was put $1,000 in the next 100 computer companies that went public.

Towards the end, the majority would obviously not have survived. But even if you succeeded with just two, say Intel or Microsoft, you will be fine.

This will hold true even if that meant only $2,000 of your original $100,000 investment will have worked for you.

He contends that you will still have emerged as a winner. With that strategy, the surviving $2,000 would have earned $3.5 million from the remaining two successful companies.

The two have offset your other failed investments.

He adds that he has researched the next $1 trillion companies. These will follow in the footsteps of Amazon, Apple, Microsoft, and Google.

The area that he sees will follow the model of the success of computers in the past is data storage.

More and more people and industries are relying on it. It is only bound to grow bigger in the coming years.

He reveals that he knows exactly what these stocks are, but he will reveal them at his event. That was the cliffhanger in his blog.

Looking at his logic here, would you say that he has captured your imagination? After all, the whole promise of his newsletter is that he will give you such ideas.

His promise is that his pieces of advice will make you survive and thrive in our economy today.

As you assess the way he thinks, try to evaluate his marketing style also. He builds up his idea in two articles released days apart.

Then he will say that you will only learn about the information at the world premiere of his event.

This is not an unusual or even a sketchy tactic. But it does tell you what to expect when you enroll in his services.

We based the commentary above on two recent articles on his website. Our next discussion, meanwhile, is about his most read posts at the moment.

On Not Going to College

Altucher has gotten attention for saying that he no longer believes in going to college.

Of course, he mentions the irony in his views and his advocacy against the college system. He did graduate from Cornell and Carnegie Mellon.

But according to the multi-hyphenate, his experiences only reinforced his belief.

In a list, he cites his reasons.

- It is not true when people say that kids learn to socialize in college. He argues that students’ lives revolve only around sex and booze, nothing more. Kids can do this without spending $100,000 to $200,000 a year, he says.

- When others argue that kids learn to think in college, he believes it’s not the best place to do so. People learn to think more clearly when they live their life in the real world, not in an artificial campus setting.

- The data that says that college graduates make more money than non-college graduates is a product of faulty statistical analysis. He says that because most post baby boomers attended college, the only ones who did not are the ones who actually failed. Thus, you will naturally get skewed data.

- A more accurate measure, he counters, is if you study 2,000 students accepted at Harvard. You force half of them not to attend college. After 20 years, look at how well the two halves are doing.

- He argues that the 1,000 who did not study in Harvard will be doing much better because they had an earlier start in their careers.

- College is an investment that is ultimately not worth it.

- Based on his experience, he did not learn much in college. The majority of his knowledge and core principles were formed outside the classroom. What he got in college was mostly debt.

- Parents are scammed because they work hard for something their kids will not get much out of.

- There are better alternatives to college.

Incidentally, his other popular website post about his college ideology is on such alternatives. These are:

- Start your own business. Even if you fail, you will at least learn from your mistakes and will eventually find success.

- Travel the world and experience things beyond your comfort zone. This will enrich you as a person.

- Create art. It will teach you discipline and passion, the values you need to succeed.

- Make people laugh. This will help you communicate and understand other people better.

- Write a book. Engaging in writing is meditating about life.

- Work in a charity. Helping others will serve you better in life.

- Master a game. It builds discipline, teaches you social skills, and develops killer instincts.

- Master a sport. It helps you stay in shape.

An article in Yahoo! Finance also says that he is convincing his daughter not to go to college.

We hope this lengthy discussion is helping you put together the dots. We are doing this so you will know what to expect in his newsletter.

Based on limited information, it appears that he will be providing insights like these to his subscribers. Altucher says he will help you maximize ways on how to be a great entrepreneur through simple hacks.

Altucher Says No to Owning Homes

His next mindset also gives us a peek at his framework on the kinds of assets he values.

Altucher believes that smart people should not buy homes. Here is a condensed version of the reasons he cites:

- He does not believe that a house is an investment. Once you sign the check for a down payment, it is money that is gone forever. He cites data that says housing has returned 0.4% per year from 1890 to 2004.

- Further, a house has the three qualities of a bad investment. These are illiquidity, high leverage, and no diversification.

- Closing costs, maintenance, and taxes also put homeowners at a disadvantage.

- A home traps you in a job and a geographical location. He likes the idea of being free to move and live in different places whenever he wants.

- Maintaining a house can be stressful and time-consuming.

This blog also appears in Business Insider.

What do you think about him and his views so far? We did mention that he has out-of-the-box ideas. Through these examples, we hope that you get to learn more about him and his perspectives.

Hopefully, you will then be able to discern if you can count on his investment advice.

What is The Altucher Report?

The investment newsletter is one of the many offerings of Three Founders Publishing. It is under the banner of Entrepreneurial and Lifestyle Services.

The Altucher Report is founded on the belief that the “corporate system that most people thought they were safe in is ending.”

The newsletter’s core principle is that all of us are entrepreneurs. Our main products are ourselves: our time, energy, dedication, and commitment.

The goal, according to the publisher, Doug Hill, is to help you succeed in today’s information economy.

The first link does seem like a page from the less technical side of Altucher. It seems to borrow from his “Oprah of the Internet” persona as it dishes out “life guru” statements.

Here are the things he will provide you in his newsletter:

- updates on emerging income opportunities that can make you a fortune for a secure and happy life

- insights into the most up-to-date research on leading a good lifestyle

- hacks for leading a healthier, happier, more fulfilling life

But the marketing page does say that the service will also give you investment research and a model portfolio, among others.

How it Works

There is not enough information on this, unfortunately.

We would have wanted to get more insights on this. We would have wanted potential subscribers to know if the $299 subscription fee is worth it.

Not giving enough information on a service can be interpreted as confidence in the product. Maybe the publishers and the editor think Altucher is enough of a trusted brand that will make people subscribe.

Another way to see this, though, is that it smacks of arrogance. They do not feel compelled to justify their fees.

For sure, readers need more information to see how their money will work for them.

We have already pointed out that the sales page is mostly filled with motherhood statements. If you would be subscribing, it seems like you will do it by blind faith.

What you get

This is the list from the website:

- Continued research and recommendations from The Altucher Report

- Updates and alerts on the model portfolio

- Special reports and exclusive updates

- Unadvertised bonuses

- Exclusive access to the members-only website

- Free subscriptions to three daily e-letters:

- Altucher Confidential

- One Last Thing

- 5 Minute Forecast

Cost and Refund Policy

Cost

$299 annual subscription

Refund policy

Unlike Altucher’s Secret Income which we reviewed recently, The Altucher Report says that they will return your money if you unsubscribe within three months.

This is a welcome change and we hope that Altucher will offer this also to his more expensive newsletter that costs $4,000.

Even if it says in the image below that it is risk-free, do not count on it. Any investment has risks.

This is especially true for financial investment advisory firms, as they tend to be lax with your data and credit card. More on this in the section below.

Reviews

There’s not much we can find that directly reviews The Altucher Report.

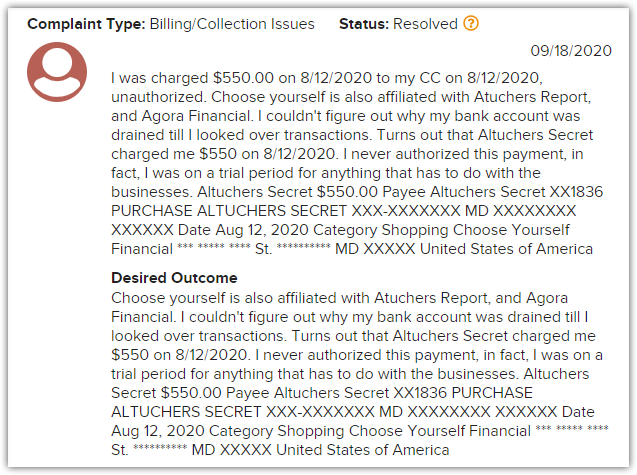

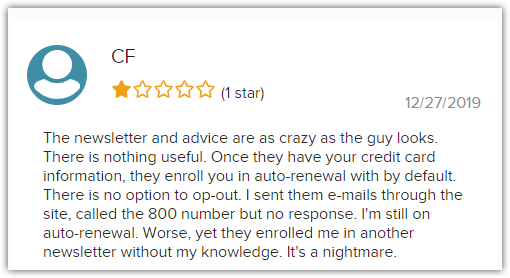

One relevant page that we have for you here is a review of Choose Your Financial (1 out of 5 stars) on the Better Business Bureau website.

Choose Your Financial used to be the publisher of Altucher’s newsletters. Based on the information we gathered, his current publisher, Three Founders Publishing, is still composed of the same people. Both are also connected to The Agora.

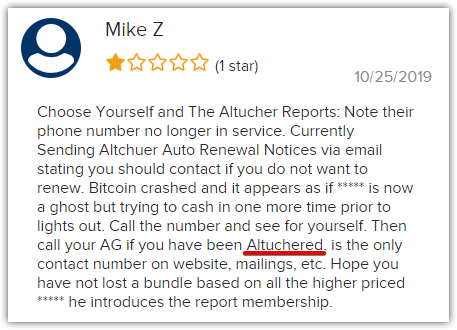

The comments below show issues with credit card charges and the advisory firm’s non-responsiveness to complaints. One even coined the term “Altuchered”.

Choose Your Financial has a 1 out of 5 stars rating as of this writing from the wesbite.

Meanwhile, only his other services, Altucher’s Investment Network and Altucher’s Top 1% Advisory have reviews on Stock Gumshoe at the moment. The former’s score is 2.1 and the latter’s is 1.9 out of 5 stars.

Altucher is also the man at the center of an article with the title, Who the Hell Is This 'Crypto-Genius?'. It discusses his controversial cryptocurrency ads and the questionable marketing practices of The Agora.

Pros v Cons

Pros

- James Altucher has out-of-the-box, innovative views

- The writer is an entertaining read

Cons

- Mostly negative reviews

- Lack of information on the service

- Ambiguous goals of the newsletter

Conclusion - Should you trust him?

Due to the scant information on the newsletter itself, we took a different route with this review. We know that you expect only our honest take on such newsletter services. This is why we still wanted to arm you with enough information.

So we looked at what he promised on his sales page. From there, we researched the types of insights you might expect from his investment recommendations and life advice.

We wanted you to also see how others' experiences have been with his other services. Though these are subjective, you can at least get a rough idea so you can make your decision.

So what is our answer to the question: Is The Altucher Report a scam? Our reply is consistent with what we have said in the past. This is a call you have to make to make based on the information you have seen.

well this page didnt help me at all. i still am stumped on … scam or not a scam??? guess i have to keep on doing my research.