Is Brownstone Research legit and can you trust their investment recommendations? Or, should you avoid this place like the plague?

There have been some questions about Brownstone Research and so we finally decided to review it. In this review I'll be going over what the company does, what it provides, the people behind it, complaints and more.

Let's begin…

Overview

- Name: Brownstone Research

- Type: Investment advisory firm

- Website: brownstoneresearch.com

- Founder: Jeff Brown

- Services: Investment newsletters

What Is Brownstone Research?

Brownstone Research is an investment research firm, similar to others like Profits Run and Omnia Research, that was founded by Jeff Brown in 2020. Their mission is to provide high quality investment research to the general public… a quality grade often just available to large institutions and high-net worth clients.

They a handful of different services, good for both beginner investors as well as those with experience. These range greatly in price and are the typical “follow-along” type services where subscribers are told what to invest in and when… although of couse we'd never recommend just blindly following advice.

The company is based in Florida, with their address listed as…

55 NE 5th AvenueDelray Beach, FL 33483

The reason I bring this up is because this address is actually the same as that of Bonner & Partners, along with a handful of other investment research companies such as Legacy Research, Casey Research, etc. The reason for this is because all of these companies are under the umbrella of The Agora, the parent company.

You could think of it like this: Bonner & Partners branched off of The Agora company and now Brownstone Research branched off of Bonner & Partners – layers upon layers here.

*Note: Brownstone Research has a better reputation and isn't as “sleazy” as some of the other Agora companies.

Who Is Jeff Brown?

He's the guy behind it all and he has a pretty impressive background, which is what you'd expect from someone who was one of the first invited sit in a self-driving car on one of NASA's campuses back in 2011.

Brown studied Aeronautical and Astronautical Engineering at Purdue University and went on to work as an high-tech executive in both Silicon Valley and Tokyo. He was actually the vice president of NXP Semiconductors at one point, which supplied Apple with some of the needed hardware for their Apple Pay payment system, and worked in executive positions at Qualcomm and Juniper Networks (not all are proven, as you can read in our extensive review of Mr. Brown).

He has over 25 years total of experience at high levels in the tech world and is still heavily involved in it, being an angel investor in tech startups with a good track-record to show for it.

In short, he knows what it takes to be a successful tech company and he's the type of guy you'd probably want to give you advice in this area. He also has developed a network of contacts over the years and has access to information that most people do not, making him an “insider” of sorts.

Other FAQ's

Is Brownstone Research a scam?

Brownstone Research is legit, I can assure you. Questions about whether or not this place is a scam usually arise from the hyped-up marketing material that is used to bring in new subscribers to their services, but they are legit.

How do I get a refund?

They don't offer refunds on all of their services, so it will depend on what service you are looking to get a refund for.

We'll cover this in more detail later in the review, plus a little trick you can use even if they claim to not offer refunds.

Experts

The list of experts on the Brownstone Research team can be found on the website. Right now there are only a handful, but I wouldn't be surprised if they brought more people on-board in the future.

Here's who will be responsible for the investment recommendations made if you decide to join any of their services:

- Jeff Brown – Of course… he's the main guy behind all the operations – no need to explain more about him.

- Nick Rokke – He's an analyst at the firm and a certified CPA. His background includes working for a hedge fund accounting firm and taking the chartered financial analyst (CFA) tests to earn his charter. The main thing he does is use his analytical skills to support Brown's research.

- Joe Withrow – This guy is another that works behind the scenes. He comes from a background in finance and corporate banking, where he worked as a credit risk analyst. Later he went on to work in loss mitigation and in 2014 became an early adopter of bitcoin (good or bad?, you decide). He also, more or less, provides a backing on Brown's research.

- Jason Bodner – It seems that Jason was originally an editor at Palm Beach Research but has since moved over to here at Brownstone Research. After spending 20 years on Wall Street, including working at Cantor Fitzgerald as a partner and head of equity derivatives North America as well as selling derivatives and ETFs for Jefferies, he then started his own hedge funds as well as a market research company that caters to billion-dollar money managers providing advice and such. At Brownstone Research Jason runs his own investment advisory service, Outlier Investor, and also writes for the free service (Bleeding Edge) every so often.

- Andrew Hodges – He's an analyst working at the company with an educational background (undergrad and grad school) in economics (studied undergrad at Clemson and Georgetown University). During his time at graduate school he worked at the National Oceanic Atmospheric Association – he also studied water markets at the time – and later his obession with digital assets began. Now he's a full-time analyst working behind the scenes.

These are the guys that are actually part of the team at Brownstone Research. However, as expected, this company works closely with other Agora companies and so you may find some guest posting at times, in which experts from other research firms come over and write articles for the free newsletter service that Brownstone offers. It's usually to “cross-pollinate” and promote outside services.

Services

All the services here are provided in a follow-along format with the exception of his free service, which I'll talk about first…

Free

The Bleeding Edge

The Bleeding Edge is a free publication where Jeff Brown shares his insights into the tech world. Anything tech-related is fair game here, and you'll see a lot about rising technologies, which at the moment include things like 5G, AI, cryptocurrencies, etc.

In these reports Jeff gives his thoughts on new tech, advances in technology that investors should be aware of, looks at specific companies, talks numbers and speculates, and so on.

Here are several random publishings just to give you a better idea of what you can expect from this service…

- Biotech Stocks Have the Same Growth Potential as Bitcoin

- About the rise of Biotech – Jeff highlights a company that has been doing well and talks about hwy he thinks the biotech industry is a good investment.

- Waymo Teams Up With Volvo for Self-Driving Car Deal

- Talks about the autonomous vehicle maker Waymo and a big partnership the company made with Volvo. Also throws in some information on biotech stocks.

- Starlink Internet Will Work Best in Places With Low Population Density

- Provides some criticism of satellite internet – thinks it will only be good for remote locations and won't be able to compete with 5G.

Because this is free, it can be accessed at brownstoneresearch.com/bleeding-edge. You can just go there to catch up on what's been going on in the tech world.

But don't get too excited about this free service. It will help keep you updated on what's going on in the tech world, but there aren't any specific investment recommendations made and not really much actionable information. There is, however, a lot of promotions included in these posts, usually at the end, and you'll even find some guest post promotions by people like Teeka Tiwari (from Palm Beach Research – another Agora company).

As usual… you get what you pay for, and in this case you don't even pay.

Paid

Exponential Tech Investor ($4,000/yr)

This is an advisory service where Jeff focuses on small and micro-cap tech companies that are poised for breakthrough growth, which are usually in trending new tech fields, such as AI, 5G, 3D printing and so on. The goal here is to alert subscribers to these companies early, before they become well-known, this way investors have the potential to double or triple their money “at a minimum”. It certainly isn't cheap, but the potential for big profits is definitely there with this service.

The layout of how you receive things is like most advisory services of its kind…

The Monthly Newsletter is the meat of what you get, and this provides detailed write-ups on specific stocks that Brown recommends buying into. These are very detailed and go over exactly why he thinks they are solid investments poised for big growth. Market and Portfolio Updates are also provided. These are sent out as needed so that if any important news comes out or if a stock should be sold, it will be known. If action does need to be taken, detailed instructions are provided. Subcribers aren't just left in the dark here. Bonus Reports are something else to be expected. They are constantly changing, but Jeff will often write up special reports when there is a new opportunity he's eyeing. Subscribers get access to these… and everything mentioned can be accessed through the members-only website.

The Near Future Report ($199/yr)

This is his flagship service and is the best for beginners because it is reasonably priced, costing $199/yr, yet is still a follow-along service that really helps guide investors.

With this service Jeff looks to identify trends in technology that will be mass-adopted in “the near future” and single out companies positioned to take good advantage of these trends. Large-cap tech companies that still have the potential for good growth are what you can expect to be alerted to here.

The layout of what subscribers get with this service is the same basic thing as that listed above. Monthly Newsletter issues are the core of the service. These provide new stock recommendations, detailed analyses on what's being recommended and market commentary, etc. Alerts and Updates on specific recommendations and general market commentary are also provided as well as special reports that focus on new opportunties.

*Note: This is the service that is most heavily promoted. For example, in Jeff Browns “AI Accelerator” and “#1 Tech Stock” teasers it was this service being promoted.

Early Stage Trader ($5,000/yr)

Early Stage Trader is another one of Jeff's more elite services, comparable to Exponential Tech Investor… and the price reflects this.

In this service he targets early stage, pre-revenue companies, with a focus on the biotech industry. And we're talking about very early-stage here… the opportunities that venture capitalists and angel investors usually look for. It's these that Jeff is focused on and has a good knack for finding, being an angel investor himself.

The layout is the same type of deal here. In the Monthly Issues subscribers are provided with at least one new investment recommendation and in-depth details on the company. Updates & Alerts are also sent out each week to keep everyone informed on what's going on in the market, any potential big plays that Brown suggests getting into that are urgent, sells to make, etc. An Early Stage Trader Manifesto is also provided that goes over how exactly everything works with this service… and there are always some bonus reports for new opportunties as well.

Blank Check Speculator ($4,000/yr)

![]()

This service is run by Mr Jeff Brown himself, and the focus here is on investing in special purpose acquisition corporations, aka SPACs or “blank check companies”, before a reverse merger happens, which essentially lets you get shares of companies at a “pre-IPO” prices. This is because “blank check companies” are listed on stock exchanges with the purpose of acquiring private companies.

The idea here is to invest in a blank check company before a big acquisition occurs, offering big potential but also risk.

The usual layout is offered when subscribed to this service – monthly issues, portfolio updates, private members area access, etc.

Outlier Investor ($4,000/yr)

![]()

This service is run by 20-year Wall Street veteran Jason Bodner. It's focus is all about finding “outlier” investment opportunties before hedge funds and investment banks on Wall Street do. This is a strategy Bodner has used for years, having even co-founded the website Mapsignals.com, which looks for outlier stocks that have unusual trading activity.

Getting in early before the big institutions come in is what we all want, and with the companies being targeted by Bodner here, he claims 100 – 1,000% gains are realistic.

What you get if you subscribe for $4k/yr is, at front and center, monthly research reports by Jason providing in-depth information on two new “outlier” investment opportunities. Additionally, subscribers will be kept up-to-date with trade alerts. There are also free reports given out, one of which titled “The Outlier Investor Manifesto” goes over how Wall Street works and how retail investors can start investing like the pros – basically goes over how this “outlier investor” strategy works.

Of course subscribers will have access to all that is offered in the website members area that they'll get access to, which also includes a model portfolio and a full archive of all that the service has provided in the past.

Unchained Profits ($5,000/yr)

![]()

This is Jeff Brown's new blockchain and cryptocurrency-focused advisory service (a rather new service).

However, this service is not just focused on buying cryptocurrency as you might think. Here, he makes recommendations in stocks as well as cryptos in the field with the assistance of analyst Andrew Hodges.

There is also mention of a “pro” version of the service that is for “investors who want to take their investments to the next level”, but because the service is so new there really isn't any information on it.

We'd assume that the standard is provided: monthly recommendations provided in detailed newsletters, trade alerts, access to a model portfolio, etc.

Brownstone Unlimited

Brownstone Unlimited is the most exclusive membership they offer, and costs the most. This provides members with absolutely everything that Brownstone Research has to offer… which includes subscriptions to every service offered and every new service offered in the future. It's an all-in-one package.

The cost of this is something that changes based on what all the company is offering and what they consider to be a fair price. You will have to call them to find out more (1-888-493-3156).

Costs & Refund Policy

First off, one thing that should be made clear is that the prices I've listed above for these services are the full retail prices. However, they are often discounted through special promotions and whatnot, such as how through Brown's “6G” investment teaser people can subscribe to The Near Future Report for just $49 for the first year.

The second thing you should know is that all of these service are set to autorenew each year. So don't be surprised when you forget to cancel and you see a recurring charge the next year!

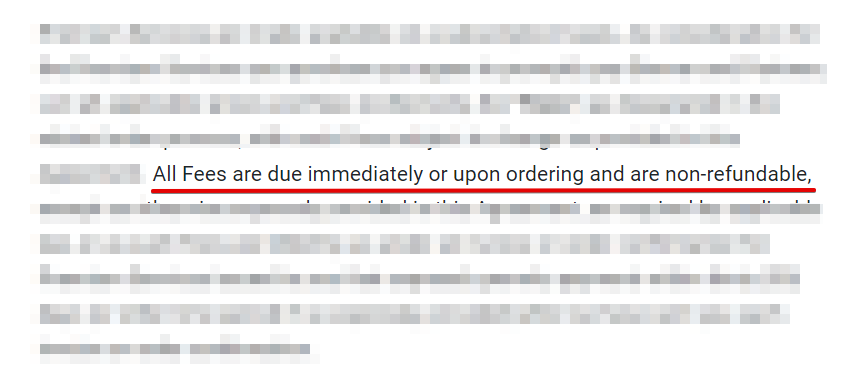

When it comes to refunds, things are a bit confusing. When you look on the their Terms of Use page it specifically states that “All Fees are due immediately or upon ordering and are non-refundable”…

However, this doesn't seem to be true and there doesn't seem to be any site-wide refund policy. You just have to check on the order page of whatever service you are looking to buy.

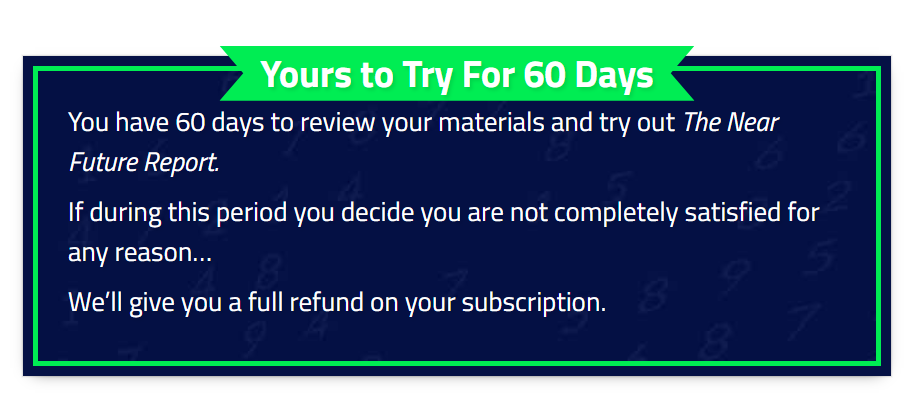

For example, I found that one of the sales pages for The Near Future Report states that you can get a refund within 60 days…

That's pretty good… a 60 day refund policy. However, it seems that the more expensive services, including Exponential Tech Investor and Early Stage Trader, only have credit-back policies. This means that your account just get's credited and you can use that money to purchase another one of their services… not a good ol' money-back refund.

If you are trying to get a refund you can contact the company by email or phone…

- Email: memberservices@brownstoneresearch.com

- Phone: 1-888-493-3156 (Mon-Fri, 9am-7pm ET)

*Tip: If you are having trouble getting a refund for any reason, you can reach out to the BBB. Usually a complaint with them helps speed up the process.

Complaints & Subscriber Reviews

As expected, there are always complaints. Although I will say that Jeff Brown isn't quite as “salesy” as most of the investment gurus out there, and because of this he usually doesn't get quite as many complaints against him.

That said, here's one subscriber calling him a “snake-oil salesman” that covers up his losing recommendations (from when he was at Bonner & Partners)…

*Note: These reviews were found on the Stock Gumshoe website.

There are also some complaints you will find from people who are fed-up with the email marketing. Once you give team access to your email you'd better be prepared to start receiving lots of promotions.

However, when compared to other investment services, those offered by Jeff Brown tend to get better overall ratings and reviews. This is because, as I mentioned, he's generally less salesy than most and because his recommendations perform well most of the time, similar to our top recommended service INSIDER Weekly.

Here's a review from a Near Future Report subscriber who says “I have made more money than I have lost on his recommendations”…

And here's another good review from a subscriber who claims that Jeff's services have “made me the most money by far”…

There are complaints, as expected, but overall the reviews tend to be good… or at the very least, better than most.

Pros v Cons of Joining

Pros

- Variety of services offered

- Subscriptions are follow-along style and uncomplicated

- Jeff Brown is a true expert tech investor

- Fairly good reviews overall (better than most other Agora companies)

Cons

- Can get expensive

- Refunds aren't offered for every service

- Promotions can get a bit carried-away and misleading

Conclusion – Worth Subscribing To?

Okay, so Brownstone Research is a company that branched off of Bonner & Partners. They provide investment advisory services and the whole operation is headed by expert tech investor Jeff Brown. The services offered are well laid-out, easy-to-follow, and we know that Jeff Brown has a decent track record and doesn't get too many complaints. But… is it worth it to join one of their services?

Well, this is a question you're definitely going to have to answer for yourself. It's up to you. One thing I will says is that here at Green Bull Research we aren't going to tell you to avoid this place. And if you're a beginner investor, The Near Future Report is going to be your best bet.

I hope this review helps with your decision. As always, let us know what you think about this place in the comment section below. We actually like to hear back from our readers!