Is Omnia Research legit and can you trust this place? Or, is it better to just avoid investment advice coming from here?

In this review I'll be going over what this company is and what they provide, some strange business ties, complaints and more.

Let's begin...

What Is Omnia Research?

Omnia Research is a publisher of financial information, mainly investment advisory services - similar to Laissez Faire Books and Money & Markets. The company was registered as a LLC with the Florida Department of State's Division of Corporations in 2017.

There really isn't all that much information on the company, but it appears to simply be the legal business name behind a number of financial advisory businesses, including Jeff Clark's Delta Report (JeffClarkTrader.com) and The Opportunistic Trader (OpportunisticTrader.com).

I first came across the company after signing up for a free email service from Jeff Clark in which he provides market updates and investment advice... and a lot of promotions. I kept seeing the name, and finally decided to look into things more before writing this review.

Businesses Under The Name

The only businesses that I have been able to find that are owned and operated by Omnia Research include, as mentioned above, Jeff Clark's Delta Report and The Opportunistic Trader.

Jeff Clark's Delta Report:

Jeff Clark is the guy behind "The 3-Stock Retirement Blueprint" that we've exposed here at Green Bull Research. He's an options trading guy, having taught options trading and securities pricing at a university in California and having ran his own options-trading firm where he helped train over 1,000 people to become licensed brokers. He also trades stocks, but options seem to be his main focus.

On his JeffClarkTrader.com website (Jeff Clark's Delta Report) he publishes several advisory services.

- Market Minute - Free e-letter where he provides insight on technical patterns, volatility, momentum, etc. Very basic information.

- Jeff Clark Trader ($199/yr) - Flagship service. Provides options trade recommendations on just 3 stocks.

- Delta Report ($5,000/yr) - Builds on the foundations from the Jeff Clark Trader service. Provides more speculative options trading recommendations. More profit potential here, and much more costly.

- The Breakout Alert ($4,000/yr) - Focus on small-cap stocks. Provides stock recommendations for potential breakouts with large profits.

The Opportunistic Trader:

Larry Benedict is the guy behind this service. He has over 30 years of trading experience, having started on the floor of the Chicago Board of Options Exchange, and has been wildly successful ever since. Some of his biggest successes include the hedge fund he ran, which was ranked by Barron's in the top 100 for years, and his record-profit in 2008 during the big recession where he managed to bring in $95 million.

At OpportunisticTrader.com he has just one advisory service...

- The Opportunistic Trader ($4,000/yr) - Provides options recommendations with large profit potential with the help of his rolodex and industry contacts.

Other Business Connections

Besides these businesses, Omnia Research has some other connections, but I'm not all too sure how close they are. There is little information provided on them.

Omnia Research is located at:

55 NE 5th Avenue, Suite 100, Delray

Beach, FL 33483

While researching I found that Bonner & Partners is also listed as being located at this address.

Bonner & Partners is another publisher of financial information, but larger than Omnia Research.

Again, I'm not sure of the connection, I just know they have the same address and that many of the financial information publishers out there are actually connected via business deals, buyouts, etc.

Not only that, but when I was looking into the business details of Omnia Research LLC, I found that its Officer (MGR), Arnold Mark, is also listed as the Officer for Legacy Research Group LLC, Stansberry & Associates Investment Research LLC, Tradesmith LLC and others. This makes sense because these are all very similar financial information publishing businesses and they are run much in the same way, providing similar services, using similar promotional methods, etc.

What They Provide

As you already know, what Omnia Research provides is financial information. Most of the services under this company are follow-along-type investment advisory services, which tell subscribers what to invest in and when.

But...

"Omnia is a publisher of financial information, not an investment adviser"

This is something they state on the Terms of Use pages on both OpportunisticTrader.com as well as JeffClarkTrader.com.

What this means is that they don't provide individualized investment information. The statement falls under "publishers exclusion" from the Investment Advisors Act of 1940, and it's basically a way to say "hey, you can't sue us if you lose all your money from our recommendations". But don't worry, every financial publisher has some sort of statement along these lines. It's just a way for them to protect themselves legally, which is very important with all the suing going on nowadays.

Complaints

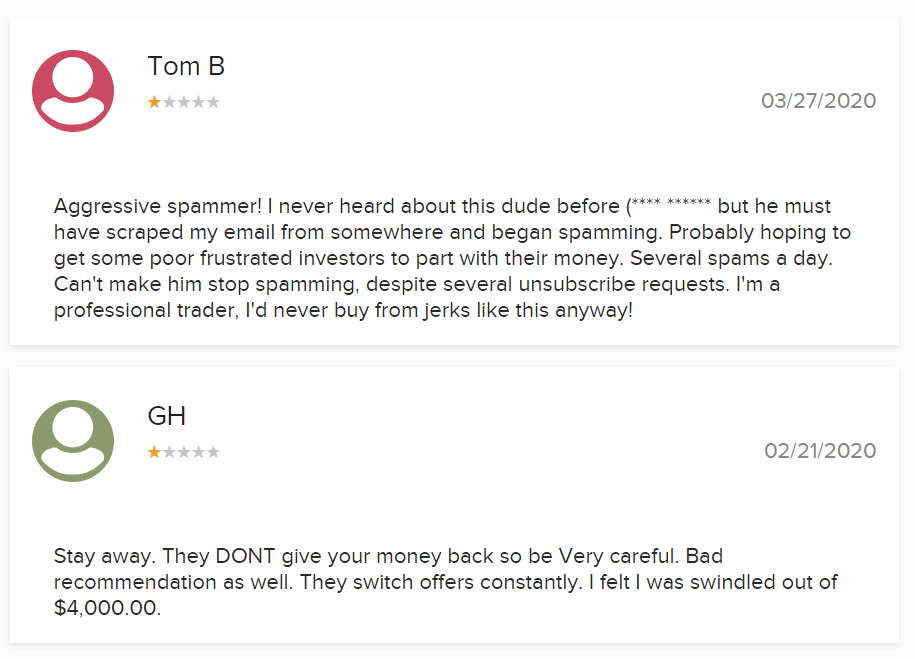

There aren't many complaints about the company as a whole, but I was able to find a couple with the BBB.

Below you can see a complaint from someone who was upset with the constant barrage of emails as well as another subscriber to one of their services who felt "swindled"...

I'm not sure which of the services either or these people are directing their complaints at, but I know that complaints like this are very common for investment advisory firms such as Omnia Research, and since we know that this company has connections with other similar companies, it makes sense that they would be run in similar fashions and because of this would get similar complaints. The complaint about email spam is an extremely common one. If you ever give them your email you will soon find this out - lots of promotions.

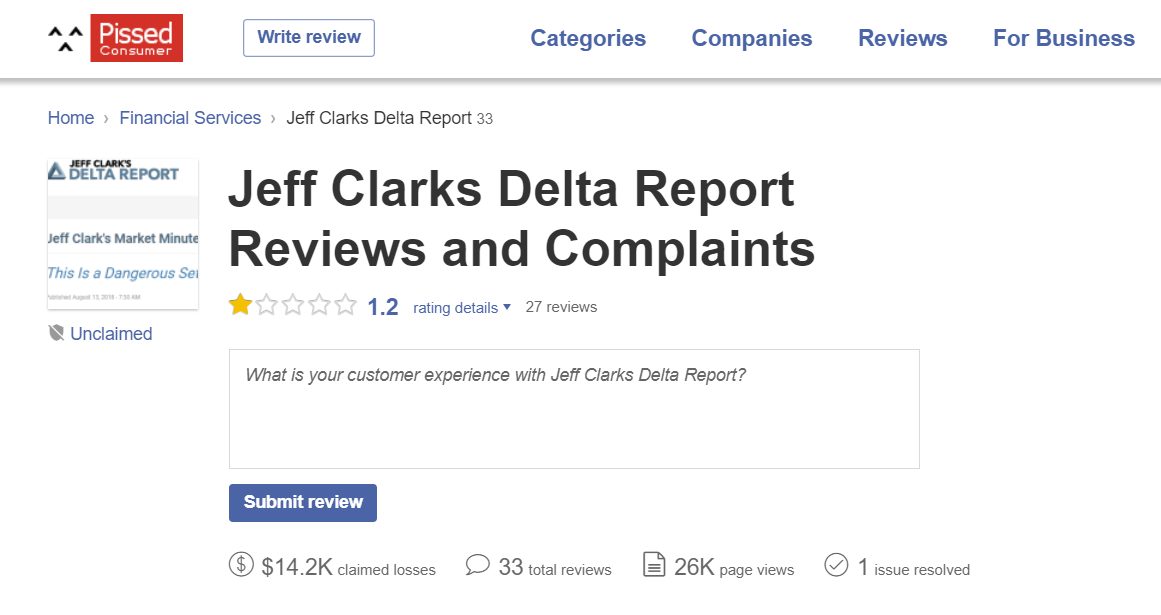

If we dive a little deeper and look for complaints on the specific advisory services that they offer, there is a lot more to be found.

For example, you can see that Jeff Clark's Delta Report has a number of negative reviews on Pissed Consumer here, which a low overall rating...

However, you have to take this with a grain of salt. People usually only go to websites like this to complain... so the ratings are usually low.

Is Omnia Research Legit?

While there are some people that call some of the services provided scams, Omnia Research is indeed legit. They are a legally-registered company in the US and there is no reason to think they aren't legit.

That said, what seems to be leading to most people calling their services scams is their marketing practices. Like many other financial information publishers, they market their services in hyped-up and somewhat misleading ways, which often leads to people being disappointed and feeling scammed.

Quick Recap & Conclusion

- Omnia Research is a publisher of financial information - registered as a LLC in 2017.

- They own and operate JeffClarkTrader.com as well as OpportunisticTrader.com, from which various investment advisory service are sold.

- The company has connections with other publishers of financial information, such as Bonner & Partners, Stansberry Research, Legacy Research Group and others.

- There aren't too many complaints about the company, but are a number about the services it sells, much of which stem from misleading promotional methods.

And that's it. There really wasn't all that much information on the company so I couldn't go into as much detail as I would have liked to, but hopefully you've found some value in this review and learned a thing or two.

As always, be sure to comment below and let us know what you think. Here at Green Bull Research we like to hear from our readers!

I am an options trader. I signed up with Jeff Clarke about 18 months ago. At that time he was an SPX direction oracle. Now he is confused about the Index, not the anybody has it nailed. Just know that he has an obsession with gold. In the long term I'm sure he will be proven correct. But that is potentialy a very long time and my not happen until there's colapse of the USD. So my point is be very leary of his bullish gold option trades.

I miss the days when investors bought gold as a hedge against bad times in the markets & sold it in good times, creating high-probability bets on gold in the markets. I guess what eroded that common belief was crypto. But with the recent crash in crypto, what will happen now? Will stricter regulations fix it, or destroy it? Crypto was & is driven by a desire to get off of the USD as the world’s reserve currency, which (IMHO) is one of the primary reasons the USA can print dollars like it’s going out of style & largely get away with it (recent inflation, though mostly due to biden’s war on AMERICAN (only) fossil fuels &, thereby, the American economy, indicates that there IS still a heavy price to be paid for printing large amounts of fiat money). But if the USD loses it’s status as the world’s reserve currency, I believe it will have a HUGE negative effect on the economy of the USA. The USD almost surely will plunge, & gold &/or crypto (& other stores of value, like land, food production, & other basic necessities) will soar. Non-necessities will tank (e.g., Hollywood will essentially go out of business until the economy improves (years later), as there are lots & lots of existing movies to watch). But if biotech currently in the pipeline survives (presuming the expected huge Red Wave this November), it could provide a huge boost to our economy no matter what else happens. As will the EV revolution, if it happens naturally rather than by fiat.