Doug Casey, the founder of this service is a prominent investor and political figure. As always, our review of The Casey Report will be thorough.

Here, we will discuss the perspectives of the rational speculator and contrarian. This is because even if the new editor is Nick Giambruno, Casey's views remain the cornerstone of this research service.

Whether you subscribe to it or not, this will be an interesting read.

Overview

- Name: The Casey Report

- Founder: Doug Casey

- Editor: Nick Giambruno and Doug Casey

- Publisher: Casey Research

- Website: www.caseyresearch.com

- Service: Investment advisory newsletter service

- Cost: $49, $79, $129, $199

- (We will discuss these in detail below)

In our review, we will tackle what it means to be a rational speculator and investor. Doug Casey has very interesting views and he brings them to the table as a financial thinker.

The question, still, is this: Is his newsletter worth your money? Let’s begin our review.

Who is behind The Casey Report?

Doug Casey

Doug Casey is the founder of Casey Research, the publisher of The Casey Report. We know. A lot of Caseys in that one sentence. But there is another relevant name we will get to in a moment.

According to the company's website, Casey is a “legendary investor”. In addition, the man is a “best-selling author, world-renowned speculator, and libertarian philosopher”.

He has over 30 years of experience in the financial world. Many also regard him as the foremost authority on “rational speculation”.

Before we proceed, let us discuss what the term means.

A speculator is an investor whose primary aim is to outperform traditional, longer-term investors. Essentially, s/he conducts a special form of high-risk investing based on his/her predictions about the market.

Strictly speaking, Casey does not define himself as an “investor”. He is a speculator through and through. What he does is allocate enough resources to benefit from "distortions in the market caused by government intervention”.

Before you comment that this is just like gambling or high-risk investing, let me say this. Casey asserts that the difference lies in their set of methods and research.

It is not about pure luck but analyzing and looking at the big picture. Hence, the term rational speculation.

In his 30 years of expertise in the subject, he has also gained a reputation as a financial contrarian. Simply, he does the opposite of what the majority of investors are doing. The contrarian sees something they don’t.

As proof, his breakthrough book, Crisis Investing, has put him on the map as a financial guru. In it, he discusses how one can still make significant profits even in times of turmoil. The book became a #1 New York Times bestseller in 1980.

It is still considered a go-to guide for investing during crises. However, it was controversial when it was released. This 1981 article in the New York Times gives a critique of Doug Casey and his contemporaries.

His other books include Right on the Money and Totally Incorrect.

Doug Casey appointed his protégé Nick Giambruno as the new go-to guy for The Casey Report.

Nick Giambruno

So who is Giambruno? He is the current Chief Analyst of The Casey Report. Giambruno also leads the team of Crisis Investing, the premium value investing newsletter of the company.

For sure, it is a daunting task to take over from the namesake of the publication. Casey is an influential figure not only in finance but in politics as well.

But, Giambruno seems to do just fine. He has been creating a name for himself as a keen analyst and observer of the investment world.

As an investor and writer, his interest revolves around geopolitics, the global cannabis market, and international banking, among others.

Giambruno is also a Chartered Financial Analyst charter holder. He holds a Bachelor's Degree in Finance and graduated summa cum laude.

What is The Casey Report?

Casey and Giambruno provide monthly investment information to what they call “self-directed investors.” Both analyze markets, trends, and global events.

Based on these, the research service aims to give “specific, actionable ideas” so that investors can more money.

The Casey Report's focus is to help subscribers earn money from “stocks, bonds, currencies, real estate, and commodities.”

How it Works

We will quote Doug Casey more than Nick Giambruno in most of our discussions. Although Giambruno is already the Chief Analyst and Editor, much of the guiding principles come from Casey.

According to their website, Casey Research specializes in finding new ways of investing. They want you to take advantage of what they call “market dislocations.”

Market dislocations are unusual events caused by government intervention and politics. As a speculator, Doug Casey pours capital to gain profits from such events.

But this is not as easy as it looks.

The financial guru’s perspective is this. It is nonsensical for someone to invest 100% of his/her wealth on conservative investments that could only yield 10% profit. And that 10% is already on a good day.

What he advises is for investors to allocate 10% of their money and their portfolio to speculations that could yield gains of more than 100%. With the kind of service that they give, 1000% gains are a possibility, according to the expert.

Such market projections are not easy. Again, he emphasizes that this is different from high-risk investing. It is also not even close to gambling.

The speculation that they do involves thorough research and discipline. It requires a sophisticated examination of various factors.

In fact, they use what Casey calls "The Eight Ps of Resource Stock Evaluation" to know the best investment opportunities.

These Eight Ps are people, property, phinancing, paper, promotion, politics, push, and price.

- People

For Casey, the most important thing to look at when investing are the people who run it. Their team looks at the track record of the major players in the company.

According to him, if the leaders involved in the company are not trustworthy, they move on. The people at the helm of companies should be competent. They need to have the skills, experience, and leadership capabilities.

Casey believes that this is the single biggest factor that can determine a company’s success.

Another investor who puts such a high premium on people is Charles Mizrahi. We have also reviewed his Alpha Investor Report newsletter service on this website.

- Property

This next item requires expertise in geology and engineering. Casey’s team closely examines what properties a company has and what they are going to buy.

Do they have new technology, real estate property, oilfield, or mining areas? What do they have that will add value to their investors?

- Phinancing

Obviously, this is a play on the word financing.

Casey and his team examine the amount of cash a company has on hand. This is crucial because they want to know if this is enough to meet the next goals of the company.

If credit and cash are scarce, they do not see the need to still own stocks in these companies.

- Paper

They also want to see a company’s share structure.

Are there large numbers of restricted shares and what are they going to do with them? Is there enough trading volume to buy or sell at good prices?

- Promotion

This is an important criterion. Even if a company has fantastic projects, if no one knows about them, there is no merit for investors. As a result, you may lose money. That’s why a firm needs to be able to get its message out.

- Politics

Politics and government intervention can often derail even excellent projects. This is why Casey travels the world. Also, his team analyzes local, regional, national, and global politics. They want to avoid problematic investments.

As a speculator, though, he also looks at the possibility of using realpolitik issues to their advantage. His book, Crisis Investing, discusses how one can thrive even in times of tumult.

- Push

According to Casey, push refers to “the specific set of milestones that you can reasonably expect to push share prices higher.”

An example of this is a piece of good news you are anticipating that will benefit the share price.

- Price

The last P is about all other factors that relate to the share price. This requires a big-picture approach. You need to see trends in the local and global economy that may affect a company’s market capitalization.

Casey discusses all these in detail in a nasdaq.com article called How to Speculate Your Way to Success.

Aside from this list, the team also takes time to absorb all available data. They will then step back and look at the big picture. This act requires patience and discipline.

But this is necessary so they can predict trends and upcoming events. They need to analyze their implications on the market.

Such a process is what differentiates speculation investing from gambling. The odds skew in your favor because of a thorough analysis of the market. With such information, you can then act and act fast.

Let me quote how Casey puts it, in his own words.

“That means you can stack the odds greatly in your favor. I don't just mean reducing thousands-to-one against, as in a lottery, to a 100-to-1, or even 50-to-1 against.

I mean, a one-in-five chance of winning, or 50-50 odds, and even, in some cases, better than a 50% chance of coming out ahead. And when you do win, you can win 100-to-1, which makes up for lots of little losses.”

In their profiles, both Casey and Giambruno emphasize the fact that they are well-traveled. At first, I did not think much of this. They are globe-trotters, fine.

But it is significant.

Part of their brand is their experience and research in different economies of the world. In a sense, they are saying that they literally see the big picture.

Casey and Giambruno get to see how developing countries work on their economies. Through their travels, they get to talk to key decision-makers. They get to ask probing questions.

The two also get to examine how the best companies in the world stay afloat.

Track record

Casey Research cites instances when they predicted the markets.

One such event was in 2006. Doug Casey forewarned readers of a looming credit and housing bubble in late October that year, well before the crash. He instructed his investors on how to short two businesses that were about to drop.

One was a bank that specialized in condominium loans. The other one was a mortgage-backed securities insurer. At a period when most investors were losing money, they yielded returns of 90% and 93.3 percent, respectively.

When gold was only $270 per ounce, he already suggested that people buy them. It then went on to trade at approximately $1,200, from a previous peak of $1,900 per ounce.

Also, he projected that uranium would reach $100 per pound in the late 1990s. It was selling for less than $10 a pound at the time.

But he was completely correct. His readers earned returns of up to 1,400 percent when uranium hit $107/lb a few years later.

The website also highlights how Casey Research made the most of gold price volatility in 2013 and 2014. Through their predictions, their investors netted gains from 107% to 430%.

Product inclusions, costs, and refund policy

The primary service that you get is almost the same as other newsletter advisories. For The Casey Report, the bonus features also differ depending on the subscription link.

First sales page

On the Casey Research website, when you click subscribe, the link will bring you to a page with a prominent photo of Doug Casey. Complete with a drink in one hand and a cigar in the other.

For this particular sales page, here are the things you get:

- The Casey Report

- You will have access to their exclusive newsletters. They send these monthly for your one-year subscription. They will tell you which global trends you need to be looking out for to grow and safeguard your money.

- Totally Incorrect (Electronic copy)

- This book, released in 2013, contains conversations between Casey and Louis James. You will get a glimpse of how Casey perceives events in the world as a contrarian.

- Totally Incorrect Volume 2 (Electronic copy)

- Get to know what Casey thinks about the most controversial issues. In the 2018 follow-up to Totally Incorrect, he discusses his views on cryptocurrencies, the modern space race, cultural appropriation, and the opioid crisis.

- The Gold Investor’s Guide (Special Report)

- If you are into gold trading, Casey promises that this is the book you need. He will teach you where to buy them, as well as what factors affect their prices.

All the things listed above come with a $199 price tag.

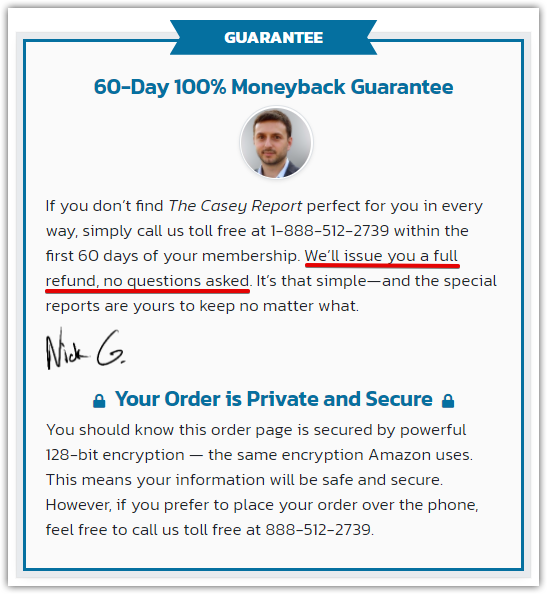

Once you sign up, they will give you 90 days to decide if you want to keep it. If you do not, they will not offer cash refunds. What they will do is give you credits you can use for their other reports or their affiliates’ services.

According to the text, this is their policy.

The subscription also automatically renews every year, so be mindful of that when you sign up.

Second sales page

On another sales page, the face of Nick Giambruno will greet you.

You can read more about his claims on that particular page in our "4th Shock" teaser review here at Green Bull Research.

The offer here is for $49, you will get 12 monthly issues of The Casey Report. But, the bonus features are different.

The special reports included here are:

- The New Crisis Currency: Why Every American Should Own at Least $100 of the Hardest Money the World Has Ever Known

- The Ultimate Privacy Guide: The Secrets Big Government and Big Tech Hope You Never Discover…

- The Biggest Gold Mania in History: 3 Opportunities to Capture Massive Gains

Although there is a July 1, 2020 date at the bottom, I checked if proceeding with the transaction will lead me to an updated official offer.

Clicking into the subscription link brought me to a new sign-up page. So the link is still active. But the rate here is different from the one on the website.

The price structure here gives you three options.

Silver $49

- 1-year digital subscription to The Casey Report

- Your Special Reports

- Locked-In Discounted Subscription Rate for Life

- Exclusive Offers on New and Existing Products

- 60-Day Money-Back Guarantee

Gold $129

- 1-year digital subscription to The Casey Report

- Your Special Reports

- 2 Bonus Partner Reports

- Gold-Backed Cryptocurrencies

- The Online Privacy Guide

- Locked-In Discounted Subscription Rate for Life

- Exclusive Offers on New and Existing Products

- 60-Day Money-Back Guarantee

Platinum $79 (Discounted price from $249)

- 1-year digital subscription to The Casey Report

- Your Special Reports

- Special gift #1 from our partners at Palm Beach Research Group:

- The Little Black Book of Income Secrets

- Special gift #2 from our partners at Legacy Research: Crypto Revolution: Bitcoin, Cryptocurrency and the Future of Money

- Bonus reports:

Gold-Backed Cryptocurrencies

The Online Privacy Guide - Locked-In Discounted Subscription Rate for Life

- Exclusive Offers on New and Existing Products

- 60-Day Money-Back Guarantee

Take note that the service offers refunds on this page.

We do not want to confuse you. As it is, these subscription services are already tricky as they are. So what is our point?

Investors looking to avail of these services come from different age groups. They are from various socio-economic backgrounds. Most avail of advisory firms because they do not have the knowledge, energy, or time to dive into details.

So if they encounter many offers with various bonus features, they will get confused. Let’s say some of these pages are already outdated. But it is very easy to update links.

In the sign-up pages we checked, readers can input and submit their names and credit card details. For the average person, that means the transaction went through.

There are two scenarios.

If they find out that they signed up for an old link, they would think they have been defrauded. They will find it strange when they receive different products from what they signed up for.

Also, if the offer is still valid, they might think that not all the options were presented to them. Imagine seeing the second sales page and subscribing to one option.

And then you see later on that you could have gotten Casey’s books with the first sales page. This could lead to frustration.

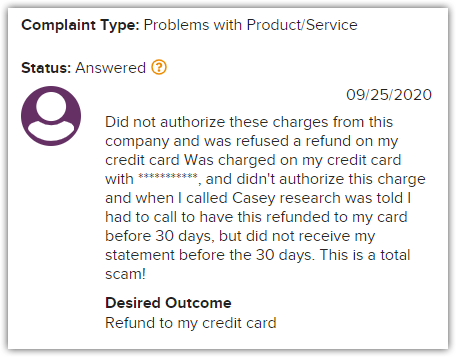

Even their refund policy is inconsistent.

These are only some of the reasons why some subscribers complain.

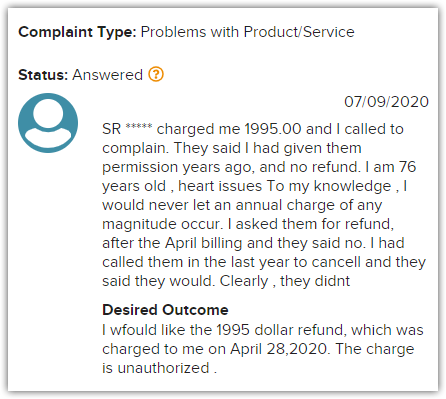

Complaints

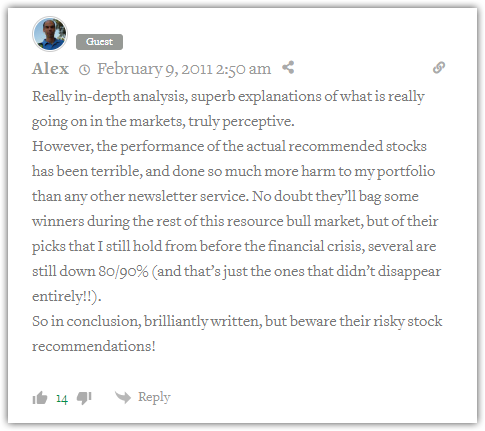

At the moment, the Casey Report has a 1.9 out of 5 rating from 300 readers of Stock Gumshoe. Very low.

You may read actual user reviews in some of the screenshots below.

In the Stock Gumshoe comment below, the subscriber talks about his experience in following The Casey Report's recommendations. All in all, the yield for the commenter was 11.3%.

However, it's important to mention two things. One, it was only for a one-year time period. Two, the commenter did not go all in on the recommendations.

Such comments from actual subscribers are often useful, but they do not always paint a very clear picture.

On the website of the Better Business Bureau, there are 44 reported complaints as of this review. Most of these are about credit card charges.

In the spirit of fairness, we want to mention that Casey Research responds to most of the comments in the website.

We have also reviewed other newsletters that have received many complaints. As an example, you may read about our review of Alex Green and The Oxford Club.

Pros v Cons

Pros

- Competent Founder and Chief Analyst

- History of success in rational speculation

- Good for those who are willing to expose more risk

Cons

- Confusing offers and refund policy

- Can be risky for conservative investors

Conclusion - Subscribe or Pass?

No doubt, Doug Casey has made an impact on the way the world invests. His thoughts, though controversial at times, always lead to new eye-opening perspectives.

His protege, Nick Giambruno, is the Editor and Chief Analyst of the regular newsletter and its premium service, Crisis Investing. Despite this, Casey still steers the ship as head of Casey Research.

There is a promise to the advisory. After all, Casey is a rational speculator. He champions thorough research, diligence, and discipline in his investment advice. This is not about pure luck.

But, there are also many complaints about the newsletter and its charging process. As a result, subscribers registered their dissatisfaction online.

Now, is the newsletter a scam? We can say that it is a legitimate research advisory service.

Are their analyses sound? We can tell you that they have a history of hits and misses.

Should you subscribe to it? This comprehensive review of The Casey Report can serve as your guide. We hope that after reading, you can already make that decision for yourself.