In this article, you will see a running list of Shah Gilani's stock pick teasers that we've exposed on Green Bull Research.

We know many of you are interested in the editor. He, like other “gurus,” hypes his prized stock picks like crazy. So as a form of service to our readers, we provide deep analysis and research.

This way, you can determine early on if you trust the investor and his judgment. Is he really THE “trader's trader?” Should you believe writeups that call him “one of the world's best experts on the credit crisis?”

Bookmark and share this page. We will be updating this from time to time and adding more exposed teasers. Think of this article as your go-to source for Gilani's stock picks.

As we update the list, the more recent ones will be on top. However, we will still keep the old ones as a point of comparison for you. If you are familiar with most editors' MO, you know how it is.

Most of the time, either due to laziness or pure marketing trickery, editors do not come up with new picks from recent research. Some merely repackage their old stock picks.

So we know this article will be a valuable resource for you. That said, check the list below.

*Got a recommendation that's not on the list? Let us know in the comment section below this post*

Gilani's 2023 Picks

His “Billionaire's Reserve Market” Stock Picks

- Title of Teaser Presentation: “Billionaire's Reserve Market”

- Name of “Special” Report: “Reserve Market Deal Dossier”

- Promoted Under: Extreme Profit Hunters

In this teaser, Gilani talks about an exclusive high-yield market. According to the editor, gaining access here is a sure ticket to returns you've long dreamed about. Knowing how to operate here will make you recession-proof.

Well, who wouldn't want that, right? Any investor wants more money. Not only that, but we also want to safeguard our wealth from any upcoming economic disaster.

So what exactly is this so-called private club previously reserved only for the wealthiest of the wealthy? The “investment expert” calls it the “Billionaire's Reserve Market.”

Supposedly, it involves a small elite group of companies “trading off the stock market.”

Want to get in on the action? Not so fast.

Based on his pitch, “billionaire reserve deals” here typically require hundreds of thousands of dollars. Even if you have the dough, you can't easily invest there as it takes certain know-how from experts.

This is why you need Gilani, and of course, his Extreme Profit Hunters advisory service. With the editor's help, you can invest in the market with just a few hundred dollars.

Regulation A rule as a market

Upon closer inspection, “Billionaire's Reserve Market” apparently is not a market per se.

Strictly speaking, what Gilani is referring to is a “rule” from the U.S. Securities and Exchange Commission (SEC). It pertains to SEC's Regulation A rule.

According to the agency, Reg A allows private businesses to directly offer and sell securities to the public. However, compared to public reporting companies, there aren't as many required disclosure requirements.

These companies comprise what the editor calls the “Billionaire's Reserve Market.” It came about as a way for private companies to raise capital without all the strictures of publicly listed companies.

Therefore, we see two big issues here. On the negative side, it is more risky because of the looser regulatory disclosure requirements.

However, there is also an upside to this. Because it is not as regulated, one can also get enormous gains in the space. If you play your cards right (and get lucky), you may see out-of-the-norm returns.

Primary picks

How does Gilani ensure the companies he bets on are sure winners?

According to the editor, a company needs to have a functioning product. As well, that said product must solve a big problem in a growing market. Most importantly, there should already be customers.

For Gilani, the two companies he teases meet the criteria. To take advantage of these, you must subscribe to his service to know what these are.

For the first one, he touts an earbud company.

Based on his descriptions, it is an advanced device that can control a laptop and even a wheelchair. Further, you can control other devices through an onboard computer and a Bluetooth connection.

Another positive sign for the firm is that it inked a lucrative deal with a huge global electric wheelchair company. Moreover, the earbud device itself has about 20 international patents. So for sure, it's secure.

Though difficult to know for sure, we think it actually is NAQI Logix Inc. Based on its founder's TEDx speech, we are quite positive this is the same smart earbuds.

One of the relevant clues is that NAQI has prototypes that allow advanced uses. Think robots, computers, and the like.

Moreover, the company's Chief Innovation Officer and one of its founders, inventor Dave Segal, has 21 patents.

Meanwhile, for the second company he teases, it's supposed to be a tunneling machine firm.

Gilani says the company builds industrial tunnels. In this case, though, the way they make them is faster and cheaper.

Another clue is that it is in more than a dozen states and has federal approval to work on government lands and federal waters. Also, PG&E is already supposed to be a client.

Based on these, we think it's EarthGrid. The company, based in Richmond, California, is still in its Reg A financing stage. Apparently, its plasma robot can dig tunnels 100x faster and 98% cheaper.

Although we are not 100% certain, the clues align.

***If you are a subscriber and know what his picks are, please let us know so we can update this post!***

>> Read our full write-up of this “Billionaire's Reserve Market” stock picks here.

Teaser From 2022

His “Pre-IPO Rights” Investing Vehicle

- Title of Teaser Presentation: “Activate Your Pre-IPO Rights NOW”

- Name of “Special” Report: “A Master Class on Pre-IPO Rights”

- Promoted Under: Gunslingers Trading Alliance

Are you looking for returns better than what you're getting from stocks, crypto, and options? Gilani says you can join the world's top investors in cashing in on private businesses before they become publicly traded.

Based on the editor's narrative, there's now a chance for us to activate our pre-IPO rights on companies before they go public. For less than a dollar, we can choose to invest from a list of over 500 companies.

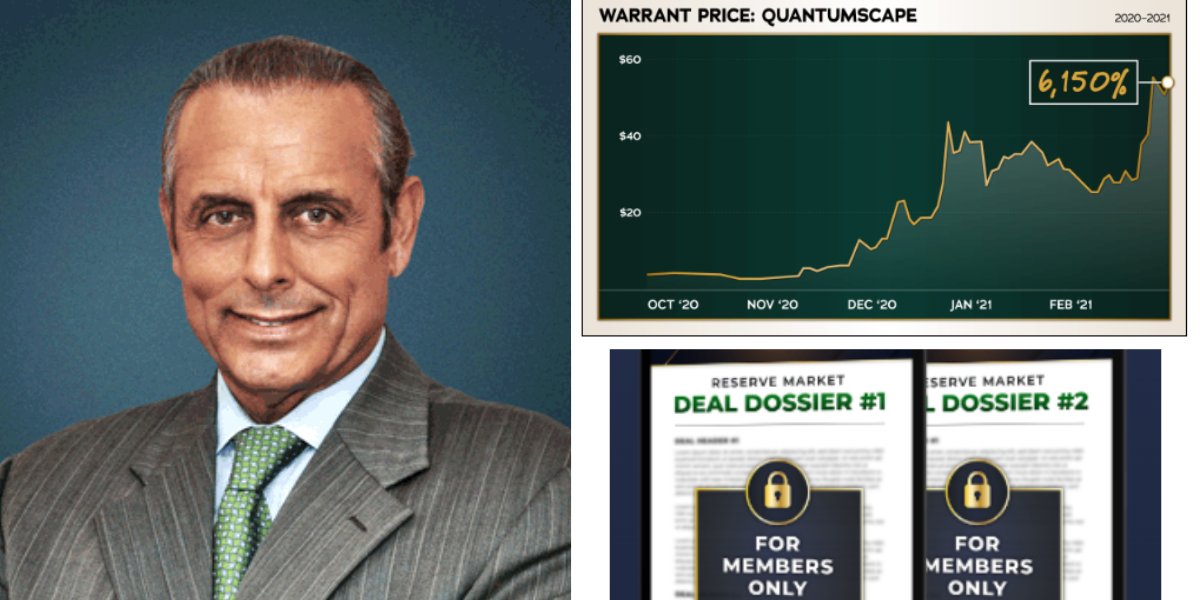

These “rights” actually come from Special Purpose Acquisition Companies (SPACs). Obviously, these exist exactly for acquisitions. Moreover, these blank-check companies are transitioning to the public.

The pre-IPO rights you will get are actually warrants that are publicly traded with unique ticker symbols. Buying one will also mean investing in SPACs that are about to go public.

If the SPAC makes it big, you can make up to 50 times your money in a matter of months. However, if it's a loser, you only lose your investment.

Further, what's great about this is that any regular investor like you can buy, sell, and trade. No extra accreditations, no other conditions.

Due to this opportunity, this investing space has produced new billionaires and millionaires in America.

However, to know where to invest, readers must subscribe to his Gunslingers Trading Alliance. For $1,750 for two years, you'll have access to his master class on the topic.

As well, subscribers will see his model portfolio of the best positions.

Due to the very nature of SPACs, investing in this space is very risky. But in our previous article, we said this:

The good news is that most SPACs trade as units and in each unit, there’s usually one share attached and 0.25 to as much as a full warrant.

***If you are a subscriber and know what some of his recommended SPAC warrants are, please let us know so we can update this post!***

>> Full write-up of this “Pre-IPO Rights” stock picks here.

2020 Pick

His “Hyperdrive” Stock Picks

- Title of Teaser Presentation: “Hyperdrive Event”

- Name of “Special” Report: “Hyperdrive Stocks”

- Promoted Under: Hyperdrive Portfolio

The editor believes the pandemic ushered in a new era. The new ways of working and doing business will propel a few work-from-home companies to rise. And you can cash in on these businesses.

He says that he will reveal five different “Hyperdrive Stocks” that could triple your money. If you invest in them, expect to see the best returns you've ever seen in your life.

According to Gilani, companies that are at the forefront of helping people work from home are going to skyrocket. Apparently, even if the pandemic wears off, people will not go back to the old ways of working.

His teaser has five tech companies he wants you to invest in.

Company 1

This is supposed to be a massive stock that already has more than $900 million in revenues in 2019. Gilani says the communications firm integrates email, chat, and videoconferencing, among others, in a platform.

Company 2

As per the editor, this can be referred to as the “Anywhere Workplace.” Another clue is that Fujitsu and Nissan Motors have already signed up for the technology.

As well, the company already has “an exclusive $1 billion cloud space contract” with a global business.

Company 3

The first clue here is the company's use of artificial intelligence to keep employees productive while doing remote work.

Another giveaway from Gilani is that it already has a partnership with a major global chipmaker.

As for the last two of the five, we were not able to get sufficient information. Therefore, we cannot tell you what they are for sure.

But based on our research, we believe the three companies are RingCentral (NASDAQ: RNG), Citrix Systems (NASDAQ: CTXS), and VMWARE (NASDAQ: VMW), respectively.

***If you are a subscriber and know what his picks are, please let us know so we can update this post!***

>> Read our full write-up of his “Hyperdrive Stocks” here.

Who Is Shah Gilani?

According to his press releases, he is the “trader's trader” and has a “financial pedigree like no other.” Gilani has a psychology and economics degree from the University of California, Los Angeles.

One of his main claims to fame is the Volatility Index (VIX). Apparently, he was a key player in its creation, which up to now, is still widely used globally.

As an investor, his associations include the Chicago Board of Options Exchange, Standard & Poor's, Roosevelt & Cross Inc., and Lloyd's TSB.

As the leading editor of Money Map Press, his services include Hyperdrive Portfolio, Extreme Profit Hunters, Money Map Report, and Total Wealth Research.

Conclusion: Should You Buy Gilani's Recommendations?

Shah Gilani talks a big game when it comes to his ideas on investing. Based on his teasers from above, it would appear that he has a solid grasp of the market.

Among his main interests in promoting his subscription services are Reg A, SPACs, and work-from-home technology, among others.

However, these are not new. We have seen these companies from other editors. Of course, since they want you to subscribe, like a desperate suitor, they will promise the sun, moon, and stars.

But we know better than to take their word for it. As for Green Bull Research, we have the only stock-picking service we actually recommend, since we know it's trustworthy.

But you may still choose to check out Gilani's picks, of course. This is why we try our best to research and tell you what they are so you can check for yourself.

Go ahead and bookmark this page so you can continue to be updated on Shah Gilani's stock picks. We are looking forward to hearing from you below.