Whitney Tilson... should you trust this guy? Is he legit? Or is he just another scammer or fraud trying to grab hold of your hard-earned cash?

These are some common questions people have been asking about the guy, and I've finally got around to throwing together this review. Here we'll be taking a look at his background, some controversy surrounding his investments, investment performance and a whole lot more.

It's no wonder people are questioning his legitimacy. After all, when you're making hyped-up and bold investment predictions (like in his TaaS teaser for example) you have to expect people to be suspicious of it all being a scam.

Is this wealthy, ex-hedge fund manger really trying to help normal Main Street folk earn good money on investments? Or is he just trying to sell as many subscriptions to his advisory services as humanly possible?

On his Wikipedia page page (yes, he has a Wikipedia page about him... must be a big deal right?) it says he's a philanthropist... but let's not believe everything we read just yet.

Let's start out this review, or rather dossier, with a look at some of the claims made about him.

Claims Made

In a nutshell, Tilson is said to be a Harvard-educated, ex-hedge fund manger who has met with President Clinton and Obama, has attended numerous Berkshire Hathaway meetings held by Warren Buffett in Omaha, has spoke at Harvard, Columbia, and Wharton business schools, has appeared on 60 Minutes multiple times, has supposedly "accurately predicted the decline of 88 different stocks, including three bankruptcies over his career", has been featured in magazines such as Kiplinger's, Forbes, the Wall Street Journal and more... AND... he has been a special guest on various news programs with CNBC once calling him "The Prophet" due to his ability to predict future prices moves in the stock market.

That's a lot to take in, and quite impressive if it's all true.

Now whether or not you're a Democrat or Republican is besides the point. I think we can all agree that if you've met with not one, but two presidents... you're probably not just an average Joe. The same goes with being invited to the annual Berkshire Hathaway meetings.

And being called "The Prophet"? He sounds like a big deal.

*CNBC gave him this nickname years and years ago and for some reason people still bring it up. I don't think they would give him this same nickname anymore. You'll see what I mean when we look at his track-record.

But first, let's talk about his company, Empire Financial Research.

Empire Financial Research (Tilson's company)

There's a good chance you heard about Tilson after being hit with a promotion for one of his investment newsletter services, which would be the product of his company here.

Empire Financial Research is an investment research company that was launched by Whitney Tilson in 2019, but not by him alone. He was already friends with Porter Stansberry of Stansberry Research (another investment research company), and the two decided to partner together to bring about Empire Financial Research, which Tilson is the head of. You won't even see Porter Stansberry's name mentioned on the website, but it's pretty obvious it's another "Agora"-run website (Stansberry Research is also an "Agora" website).

Quick History Lesson: "The Agora" is a network of publishing companies, many of which in the investment realm, which was started in 1978 by Bill Bonner and has since branched out in many areas. Other popular Agora website include Banyan Hill, Palm Beach Group and Brownstone Research. They all have the same basic layout and follow the same investment advisory and promotional blueprint.

So, Tilson runs Empire Financial Research, but he also has a team of other editors/analysts working on the advisory services provided. The others on the team at the moment, who as usual have impressive educational and career backgrounds (it's common to see ex-Wall Street fund managers moving to work with advisory services like these), include Enrique Abeyta, Berna Barshay, Gabriel Marshank and Alex Griese.

All together they provide a handful of newsletter/advisory services. Here are some brief descriptions of each, starting with the two free newsletter services offered.

Free:

- Empire Financial Daily is a newsletter service run by the team at Empire Financial Research that is basically focused on, well, news. The post topics you'll find here can be anything from McDonald's minimum wage, to a recent price move in the stock market, to inflation, investment advice, and just about anything else they find worthy of talking about.

- Whitney Tilson's Daily is a another free blog-type newsletter service that covers anything Tilson finds important to talk about. You'll find things economy-related, about investing of course, innovations in tech, updates to his newsletter services, etc.

Paid:

- Empire Stock Investor is the flagship service sold at Empire Financial Research. Tilson is the editor here too and in this service he looks to identify large-cap US-listed stocks with long-term potential. Recommedations are made monthly.

- Empire Elite Growth is a long-term buy and hold focused investment advisory service that is mostly focused on finding and recommending small to mid-cap US-listed stocks. Enrique Abeyta runs this service and he makes recommendations on a monthly basis as well.

- Empire Elite Options' focus is on trading short-term options on small to large-cap US-listed stocks, and it's another service run by Enrique. Here subscribers are provided with trading recommendations twice a month.

- Empire Elite Trader looks at trading mid to large-cap stocks for short-term pofits. Enrique is the editor here too. He sends out new recommendations more frequently with this one - on a weekly basis.

- Empire Investment Report takes a value investing approach to finding off-the-radar small to mid-cap stocks. Tilson runs this one and he sends out new recommendations monthly for subscribers.

- Empire Market Insider is run by Berna Barshay and her team. With the help of her 20+ years managing portfolios and analysing stocks on Wall Street, here she recommends her favorite stocks on a monthly basis.

- Empire SPAC Investor is focused on SPACs, as you can tell. With this service Enrique's mission is to take advantage of the trend in SPACs and recommend what he thinks are the highest upside SPAC oportunities each month.

Out of these paid services, Tilson only runs Empire Stock Investor and Empire Investment Report.

Is he qualified to be running these services? Let's take a look at his background and see if those claims I mentioned earlier hold true.

A Look at His Background

Not that it matters much, but young Whitney had what sounds like quite an exciting life growing up. His parents are said to have met in the Peace Corps and young Whitney spent much of his childhood traveling between Tanzania and Nicaragua with his parents working on social projects.

Went to Harvard

As far as higher education goes, he claims to have attended Harvard, both for his bachelor's and master's degree.

- Harvard University from 1985 - 1989 for his bachelor's degree

- Harvard Business School from 1992 - 1994 for his MBA

Luckily for us it didn't take that much time finding out that this is indeed true. Besides the same old information being rehashed by other reviews of Tilson and his newsletter services, the fact that he graduated from Harvard is mentioned on the CFA Society New York's website, by the Wall Street Journal, Business Insider and some other higher-authority sites leads me to believe that this is indeed the truth. There's no need for me to hire a private detective like I had to when investigating Jeff Brown's claims.

Tilson ended up graduating magna cum laude from Harvard College and at Harvard Business School he obtained his MBA as a Baker Scholar, which means he was in the top 5% of his class.

So not only did he attend Harvard, but he excelled while there.

Started a Hedge Fund

Well, actually three hedge funds.

Tilson founded Kase Capital Mangement in 1999 and ran this money management company until 2017, managing three hedge funds and two mutual funds.

If you read his profile anywhere you'll likely hear about this background as a hedge fund manager. However, what you're less likely to hear, especially if you're reading information about him on his Empire Financial Research website that of course is going to paint him in the best light, is that his hedge funds were failing and this is why he ultimately decided to shut them down.

Kase Capital Management performed well from its inception in 1999 through mid 2010. In Tilson's words, his "fund grew from $1 million to $200 million under management" (it seems that much of this growth was simply from new money coming in from investors, not from positive returns).

It was during the bull market from around 2010 onward that Tilson's funds underperformed the market, but I'll go into more detail on this in the following section about his investment track-record.

Published Books

Being educated with knowledge to share, Tilson is also the author of several books, including: More Mortgage Meltdown in 2009, The Art of Value Investing in 2013, and then his most recent book, The Art of Playing Defense in 2021 (instead of being about investing, this is more personal - talks about his mistakes, gives life advice based on lessons he's learned)...

None of these books are extremely successful, but all have received decent customer ratings based on what I've seen (decent, not great).

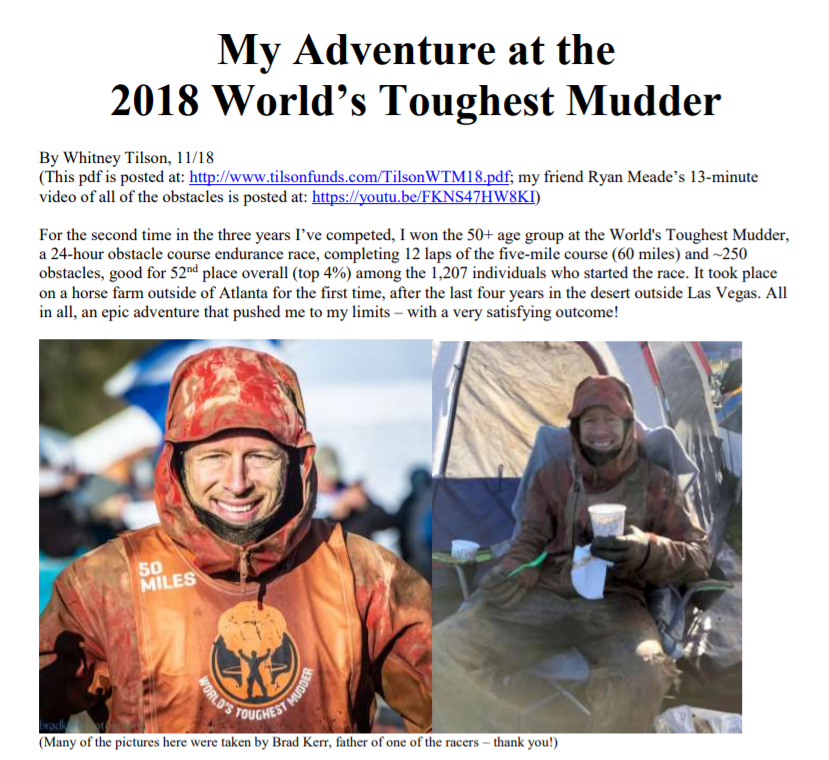

Tough Mudders & Mountaineering

During the last years of managing his failing hedge funds over at Kase Capital, Tilson admits that the lousy performance of these funds led to a lack of interest in continuing with his money management service, and at this time he began to take up running in Tough Mudders and climbing mountains more frequently.

Tilson claims to have competed at the World's Toughest Mudder in 2016 where he became a record holder in the 50+ age group.

I have not been able to confirm this record, but this is likely due to the unorganized database of Tough Mudder Records - they need to organize this information better!

That said, I don't doubt that he holds a record because he seems very physically active, looks to be in good shape, and I've found plenty of evidence that he does indeed compete in Tough Mudders.

Here's a screenshot of him vloging at Tough Mudder - his personal Youtube channel...

He also wrote a detailed 47 page pdf document about his experience at the 2018 World's Toughest Mudder (published on tilsonfunds.com).

Now you may be wondering what any of this has to do with investing and his credibility, which is understandable. But in my opinion it has a lot to do with it. From information like this, publicly available information, you can see that he is indeed a real human being and that he isn't afraid to talk and provide information on his personal life.

If he was a scammer do you think he'd be doing this kind of thing? Nope!.. and this is why it's often so difficult to find information on many of the more shady investment "experts" out there.

Furthermore, as mentioned, Tilson is an avid mountaineer. He's climbed Mt. Kilimanjaro, Mt. Blanc, the Matterhorn and the Eiger, Mt. Whitney, and there are probably many others.

He posts quite a bit of his mountaineering adventures on his Facebook page.

Philanthropy Work

As mentioned early on, his Wikipedia page says he's a philanthropist.

His background in this area includes serving as Executive Director of the Initiative for a Competitive Inner City while at Harvard Business School - focused on inner city economies and businesses - and this likely gave him a good look at the unfairness of different demographics, which may be the reason he's now heavily involved in education reform, mainly focused in New York and Africa it seems.

He's been given awards for his philanthropic work, has founded and served on board of several education reform organizations, and was even in a 2010 documentary focused on the topic.

All of this is positive... now let's take a look at something he's received some criticism over.

The 60 Minutes Controversy

One bit of controversy that Tilson has been involved in comes from when he made a boatload of money shorting Lumber Liquidators in 2015. He appeared on 60 Minutes and badmouthed the company, exposed evidence that he knew would cause the stock to drop like a rock, and made a fortune doing so.

Was it wrong? Well, some people were upset by the fact that he made-off handsomely from the event, but in my opinion it was perfectly fine, and I'll explain why.

Here's what happened:

Whitney Tilson was notified by a friend that he should look into the Lumber Liquidators stock. It was ripe for a shorting... valuations were ridiculously high and the company had several warehouses that had been recently raided for selling illegal flooring - hardwood drenched in formaldehyde.

Tilson went to 60 Minutes and got them onboard to help take this company down. They supplied the hidden cameras and set up an investigation which led to video evidence of Lumber Liquidators managers admitting to selling toxic products. This was at a few wharehouses in China.

So, when Tilson appeared on 60 minutes, presented the story and evidence, the stock dropped, as you would imagine.

Tilson locked in $1.4 million in profit from this whole ordeal (some sources claim he made much more than this - not entirely sure of the number).

So was this wrong? He did make a substantial financial gain from it all, but at the same time he was helping take down a company that was involved in illegal and dangerous activity (the CDC investigated and says the flooring sold by the company "could cause irritation and breathing problems").

HOWEVER, things get a bit more tricky. It turns out that Lumber Liquidators 1) may have not been aware they were selling laminate that had high levels of formaldehyde, and 2) they decided to continue selling the product even after the 60 Minutes report aired, believing it was actually safe and compliant.

Things are still a bit blurry as to what was actually going on there at the time... and it's also worth noting that Tilson has since made the decision to go long on the stock, stating that the management involved in the scandal have left the company, it has settled all lawsuits, and it has a great business.

Your opinion on this?

To me it seems that Tilson genuinely believed he was helping (and was actually helping) and decided to profit from it all in the process. Sure, he may have smeared Lumber Liquidators' name a bit much and made it seem like they were all a bunch of bad guys in on this whole scandal, but from a high-level view it seems all was done for a good cause.

Helping MainStreet Americans (The Newsletter Business)

After shutting down his hedge fund in 2017, which I'll talk more about soon, Tilson decided the investment research business was a good idea, and being friends with Porter Stansberry of Stansberry Research, Tilson was able parter up with him and hit the ground running.

However, after shutting down his Kase Capital hedge fund and before starting the newsletter business with Stansberry, Whitney started a company called Kase Learning. He formed this company with another professional investor, Grenn Tongue, and together they provided webinars, conferences and seminars to teach people how to go about value investing like a pro.

But Kase Learning only lasted, I don't know, maybe a year. I've noticed the company's Twitter account has been inactive since 2018 and now if you try to go to the company's website you will simply be redirected to Empire Financial Research's website.

So right now Tilson is mainly focused on this investment advisory website that I already talked about in detail above, Empire Financial Research. Here he draws on his decades of professional investment expertise to provide investment recommendations to Main Street Americans, along with his team (which includes other Wall Street veterans), and dare I say it... that he also tries to sell as many subscriptions as possible via hyped-up and misleading claims... in what seems to be the marketing blueprint for the types of investment advisory services like this nowadays.

Investment Performance

As we already know, Tilson's hedge fund, Kase Capital Management, which was a rather small hedge fund that managed around $200 million at its peak, failed.

He Used to Manage a Hedge Fund - A Failed Hedge Fund

He shut down Kase Capital in 2017 for "sustained underperformance".

The fund was actually shut down during the decade-long bullrun from 2009 up until 2017 when he called it quits. At the time it was trailing the S&P 500 by 9%... pretty bad.

According to Tilson, "In an ironic twist, I always built my firm to survive the worst storm, but it was a nine year bull market — complacency and sunshine — that took me out."

During the first 11 years of his hedge fund's existence he managed to make his clients 184% gains, when the market was only up 3% at the time. But during the bull run his investment strategy just didn't hold up, and his clients suffered because of it.

Tilson managed his hedge funds with a value investing approach. He tells us that at the time of the bull market, he believed that market prices were higher than their fundamental values, and so he positioned his funds defensively and waiting for downturns... which didn't end up coming.

At it's peak Tilson was managing $200 million, and by the time he shut down the funds he was at only $50 million... the decrease stemming from losses as well as clients pulling out their money.

As transparent as it gets..

While the fact that his hedge fund failed, I think it's worth pointing out that it's rather rare to find someone in this business willing to talk about their failings like Tilson is.

In one interview I came across Tilson went on about what was happening with his fund at the time, and talks about how he was getting distracted more and more due to his fund's underperformance (started climbing mountains more at this point).

But then this begs the question... Is Whitney Tilson just another talking head on the news? How can he claim to be an expert and have this "guru" status while his hedge fund failed miserably?

Well, this is a good question. It's kind of like how Jim Cramer is incredibly famous in the investment world but often gives horrible advice.

So we know that his hedge fund failed, but that really isn't what most people reading this are looking for, and probably not you either... because the way hedge funds manage their investments is much different than how a private investor like you are I are going to manage our investments.

What most people are probably interested in is the performance of Tilson's recommendations via his newsletter advisory services to the Joes and Janes of the world... us normal folk.

Tilson's Performance in the Newsletter Business

Empire Financial Research launched in 2019, so there really isn't as much performance information on the services provided yet. But, here's what I could find.

The rating of Empire Stock Investor (remember, this is one of the services that Tilson edits himself) from StockGumshoe...

These ratings are from people like you and I, and hopefully most are from actual subscribers although I think it's possible for anyone to leave a rating.

At this time, the investment performance rating of this newsletter service is also at a 3 out of 5, but without that many votes.

One comment left from a subscriber of Empire Stock Investor mentioned that he recommended MRVL at $22 and now (at the time of their review) it's at $36...

That's a little over a 60% gain. Not bad.

So that is for Empire Stock Investor, and the only other service that Tilson is in charge of running over at Empire Financial Research is the Empire Investment Report, and again this is something I haven't been able to find all that much performance information on.

That said, I have came across the following information on recommendations that Tilson has made through this service that have turned out to be big winners...

268% in 13 months on gun maker Smith & Wesson (245% annualized)

156% in 10 months on casino stock Penn National Gaming (189% annualized)

49% in four months on footwear maker Crocs (153% annualized)

68% in eight months on online travel company Tripadvisor (105% annualized)

50% in seven months on aircraft lessor AerCap (88% annualized)

37% in 15 months on language learning software firm Rosetta Stone (31% annualized)

... but this information was found in promotional-type material, so of course they aren't going to talk about the losing recommendations.

The Performance of Other Recommendations Tilson has Made - Misleading

I've also read the claims about Tilson recommending Netflix, Apple, and Amazon in the early days. These were all recommendations made publicly, most of which I've been able to verify.

The claims:

- In some promotional material I came across, it was mentioned that Tilson bought Netflix at $7.78 a share, Apple at $1.42 a share, and Amazon at $48 a share

I've come across ads for Tilson's services referring to him as "the legend who bought Apple at $1.42".

Yep... the "legend".

Anyways, I got confused by these statements because I also came across information in other promotions claiming that "he bought Apple at $0.35"...

It turns out it's a "split adjusted" $0.35 per share. Confusing.

But either way, I'm a bit confused by this.

If he did buy Apple for this price then he would have had to purchase shares much prior to 2010.

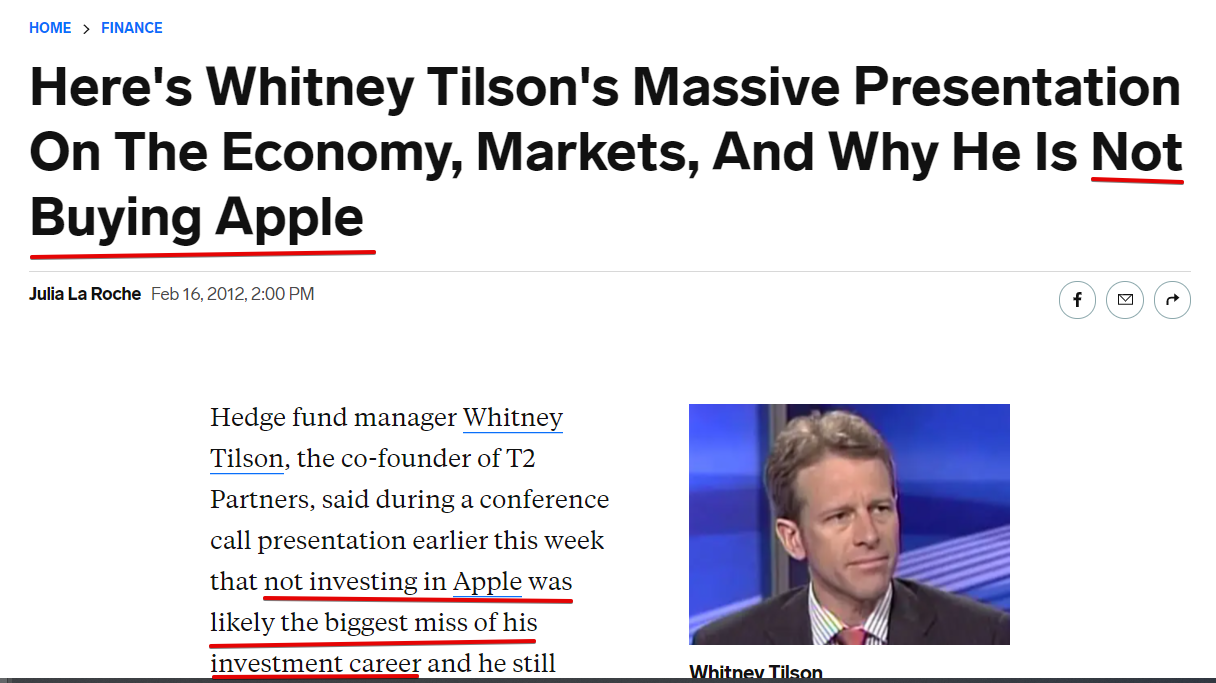

However, I've found a 2012 article on Business Insider where Tilson mentioned having not bought Apple and was still saying he wasn't going to buy it...

So I don't really know what to make of all of this. Is it a lie? Is it true? I don't know exactly.

Moving on...

The other claims about him investing in Netflix and Amazon in the early days are both verifiable... although a bit misleading.

- Tilson was bullish on Netflix since 2011 at least, since it was trading around that $7.78 price, stating on CNBC that it could "go crazy to the upside" - this was after he shorted Netflix in 2010!

- This was after stating that he thought it was mathmatically impossible for the company to generate good returns moving forward!

- In 1999 Tilson bought Amazon at $48/share in his hedge fund

While True... Some of These Statements are VERY Misleading!

When investors are talking about their performance and throwing out numbers and statistics... while they are also trying to sell you their investment advisory service... you have to take things with a grain of salt - sometimes a giant grain of rock salt.

Let's take this example of Tilson claiming he bought Amazon for $48 a share, which is true from what I have found.

Amazon, at the moment of me writing this, trades at over $3,000 a share, which would be over a 6,000% return!... IF... IF he had held onto the stock.

In an article on Yahoo Finance that I found, Tilson mentions that he only held the stock for 9 months, and that he had forgot about even owning this stock for years probably because, in his words: "my brain was protecting me from the pain of knowing I’d sold one of the greatest stocks of all time!"

So, yes he did invest in Amazon at $48 a share, BUT he sold out so darn early he hardly made any money from it!

More recommendations he's made...

Another, more recent, statement I found by Tilson was when he announced he was selling stocks in May of 2020... not the best idea it seems...

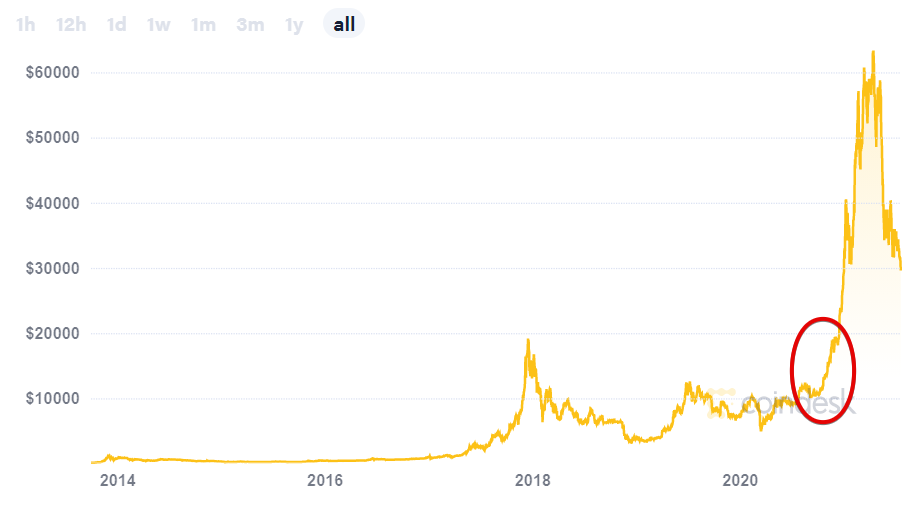

And then there was his position on cryptocurrency, which for years he was bearish on, even going as far to call it "a techno-libertarian pump-and-dump scheme".

One incredibly accurate prediction he made was that of Bitcoin's bubble bursting, a prediction he made back in 2017 after seeing signs of a classic bubble market.

And let's remind ourselves of what happened. Bitcoin crashed hard and remained below record levels for years to come...

Even as recently as December 2020 Tilson was warning people to avoid Bitcoin, saying that you will "lead a happier and more prosperous life" if you do.

Well, I've circled in red the time-frame that Tilson said this, and you can see what happened to the price of Bitcoin after that...

Although he accurately predicted the Bitcoin bubble burst that happened back in early 2018, this prediction was lousy. But in his defense, the crypto market is, and has always been, extremely unpredictable.

More recently Bitcoin has exceeded the highs from the previous bubble and as recently as April 2021 Tilson has changed this position on Bitcoin and cryptocurrency in general, and has even started to recommend crypto picks in his Empire Stock Investor newsletter service.

He still doesn't recommend Bitcoin however, having called it "fundamentally worthless", but now he sees that there is enough adoption and enough people believing in it to actually give Bitcoin value.

Conclusion on His Track-Record

It's difficult to come to a conclusion here. I know most readers are mainly interested in hearing about the track-record of the recommendations he makes in his newsletter advisory services, but the information available publicly is lacking in this area.

***If you've joined any of Tilson's advisory services and have any comments on this recommendations' performance, let us know in the comment section below this article!***

Investment Strategy

Tilson takes and old school value approach to his investments. He analyzes the fundamentals of a business and buys companies trading at a discount to their intrinsic value, or at least that's the goal.

Let's not forget that Tilson co-authored the book "The Art of Value Investing" with John Heins and that at his now-defunct Kase Learning company this was the strategy taught.

That said, it's important to note that Tilson does include a bit of speculation in many of his recommendations as well. He is often making recommendations on trendy new tech stocks that have big potential but require a good deal of speculation due to the new markets they often operate in as well as other factors.

And his investment strategy also varies depending on what advisory service you are looking at.

Here is how he goes about making recommendations for his Empire Financial Research and Empire Investment Report services:

- Empire Financial Research

- One large-cap stock recommendation per month

- 3 - 5 year expected hold time

- Empire Investment Report

- One small or mid-cap stock recommendation per month

- 2 - 3 year expected hold time

There are differences, but all-in-all Tilson is a buy & hold type of guy, or at least when it comes to his recommendations to private investors via his newsletter advisory services.

So if you are looking to be more active with your investment approach, or are looking for quicker profits, then subscribing to his service might not be the best idea for you.

Complaints

When you receive as much publicity as Whitney Tilson, you are bound to receive some negative remarks and complaints about you or what you offer.

Doing hours upon hours of research into this guy led me to quite a lot of complaints, as expected, but I'm not going to list all of them because some just didn't make much sense and some are inaccurate.

Here is what I've found worth mentioning, some of which are complaints about Tilson's company rather than he himself.

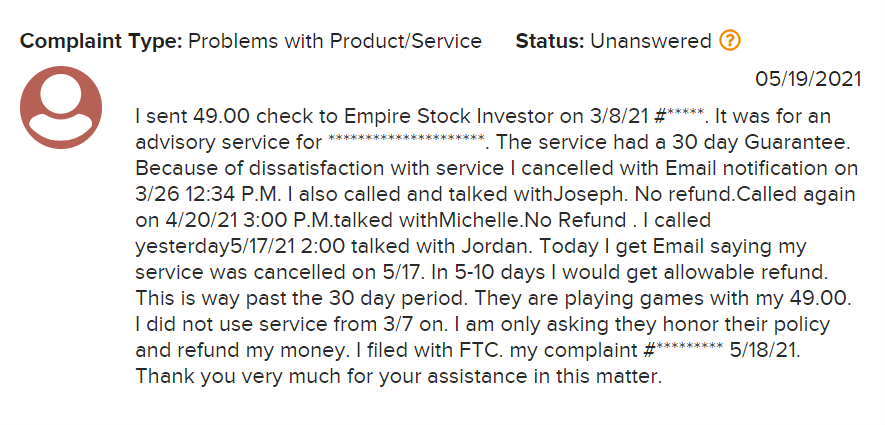

#1 - Problems Canceling Subscription

One of the most common complaints you'll find surrounding Tilson comes from subscribers having trouble canceling their subscriptions for his newsletter services.

Apparently it is quite a difficult task.

I was able to find some complaints about Empire Financial Research with the BBB about this...

And many others on Reviewopedia...

This is a common occurence. So I'd recommend not signing up for his services unless you are positive they are what you are looking for.

This "tought to cancel" subscription business model with absolutely horrible customer service seems to be commonplace these days with services like this. But, as mentioned, this isn't really a compliant against Whitney Tilson himself, but rather the business... which is an "Agora" business as you should remember.

Remember: Tilson didn't create his Empire Financial Research company by himself. He partnered up with good ol' Porter Stansberry to bring this service to fruition. And, if you noticed in the one screenshot I posted above, Porter is referred to as "Porter 'the used car salesman' Stansberry"... and his Stansberry Research company is also an Agora company (other Agora companies include Brownstone Research, Banyan Hill, etc.).

#2 - Promotes a Marxist Ideology

One complaint I came across mentions how you will often find Tilson "promoting his progressive Marxist ideology"...

The reason I think this is worth talking about is because, of course, most people joining his services probably have no clue what his political affiliation is.

Now if you're thinking about joining a newsletter service he runs solely for his stock picks then that could be fine, but you should know that his stock picks are usually in line with his political ideologies (obviously not all of them - he recommended Smith & Wesson remember?), as expected, and that he does come off as being very liberal, and is an outspoken Democrat, and you can easily get a good idea of what I'm talking about by simply visiting his Facebook page.

It depends what your cup of tea is, but most of the investment newsletter advisors out there seem to be more right-leaning in their political affiliations, like Jeff Brown for example.

#3 - Spam Galore

Yes, spam, spam, and more spam. If you do join any of his services, be ready for the spam to start bombarding your inbox.

This is a complaint I expect to see much more of in the future, and a common one.

If you join you can expect to get lots of upsell promotions for more expensive services offered by the company as well as possible promotions for other investment newsletter services from other Agora companies.

#4) Lost Money

This is a complaint you'll find for any investment advisor out there. The stock market doesn't rise in linear fashion. Even in a great bull market there will be pullbacks, and people will lose money.

It doesn't matter how good an investment advisor is, there will be times when subscribers lose some money. BUT, this is often short-term and doesn't necessarily mean you lose money in the end.

That said, since I haven't been able to find any clear picture of Tilson's track record I can't really speak as to how much money subscribers gain or lose following his picks.

Conclusion - Can You Trust the Guy?

That was a lot to cover, and the ultimate question still needs to be answered... can you trust Whitney Tilson and his recommendations? Is it worth it to join his advisory services? Will he help make you filthy stinkin' rich?

Well, first of all, from what I've found Tilson seems like an honest and straightforward man. He isn't afraid to talk about his failings and is transparent when he's made mistakes. HOWEVER, his Empire Financial Research company is in the business of selling subscriptions, and because of this they aren't all that transparent with the performance of their services. What you see in the promotional material is often over-hyped and a tad misleading. So joining his service would, in my opinion, be at least somewhat of a gamble.

On the plus side, although Tilson's hedge fund did flounder and he had to shut things down, the man has talked openly about this and has analyzed the mistakes he made back then. Additionally, Tilson does have years and years of professional experience where he has been able to meet and talk to some of the brightest minds in the investing world and, because of his background, he still has access to meeting with high-level management of companies before he invests.

Following the recommendations of someone with a background and the "insider" access that Tilson has could definitely be beneficial. As always, just be sure to do your own due diligence beforehand (if you do join his services) and know the risks.

I hope you enjoyed this review. I've tried to cover things as fair and balanced as possible.

If you have any comments or questions about Whitney Tilson, please leave them below in the comment section. We're always glad to hear back from our readers.

In the beginning of Tilson's video I believe he states he will tell of a stock pick or whatever and it will be free to anyone. Then as I scroll down to the end, it becomes NOT free for his advice. I see this bait and switch all the time. Also, if he's making big money like he says, then there's no need to charge for advice, right? As he's got a "great" cash flow already! So making a few $ off people is not needed as the big dough is in trading, right? I always use that to measure these shysters!

This guy is a scammer. This article confirms it. It tries too hard to make excuses for the shady crap this guy has pulled. It's a long article, like they're trying to convince you he's a good guy. I bet HE commissioned the article about himself to cover for his crookedness. Scumbags do things like that. Stay away from this guy's advice. He's only in it for himself. If he says something positive about a stock, you can bet he's heavily invested in it. If he says something negative, you can bet he's shorting the crap out of it. Dirtbag.

Hi Jim. Tilson didn’t commission our article.

100%

I think its important to give the guy his due AND simultaneously recognize the truth that you probably shouldn't follow his advice in this day and age, at least possibly until the next market crash. Market gurus almost universally never last more than a 4-5 year market cycle, precisely because the investment philosophies that made them a bunch of money came up in certain climates. This is just part of the market guru life cycle – the end stage, if you will. In a constantly changing market defined by cycles, the financial and geo-political conditions that made one guru's practices viable and profitable will eventually change. When that happens, the guru almost always starts a newsletter. They know nobody is going to entrust them with money anymore, but they can still bank a bit on their former fame for a couple bucks. Now, I'm not making any indictments on this guy, I don't know him personally. Maybe he does want to help retail guys, maybe he's a huckster.

All I'm saying is this guy uses the resources available to him, which is only what we should all do. Tell the truths about your prophetic investing and omit the other truth about how invalid it now is. A quick look at his timeline and his own words sheds a great deal of light on this topic. He started his hedge fund around the time of the dot.com bubble bursting and ended his run of profitability around the time the market started recovering from the housing crisis. It seems he was able to catch 2 major bear markets to confirm his strategies and himself as a guru, but people need to remember being a guru at one point in time doesn't mean you remain a guru. To the contrary, it all but assures that you won't and that your brilliant strategies will one day come to be regarded by a new generation is a good way to donate money to institutions. He seems like he may even be a fairly decent guy. wouldn't go trusting him for financial advice in a vastly different market though.

Also, I dont think the debate should be over whether or not he is a prophet or a huckster as much as whether he has been both, which is likely true. You can't become a huckster with a newsletter if your aunt Sally tells everyone you are awesome at stocks. You generally can only become even moderately successful in the newsletter business when you have some real credentials and track record of success. Thing is, wall street is a demanding game. No investor or trader who continues to be successful at his age, meaning prior to natural retirement age, has time to waste on a newsletter. They barely have time for family between the rigors during market hours and the extra hours they put in after 4. They only ever start a newsletter after they become recognized as false prophets and can't stay in the game anymore, thus freeing up a lot of time.

So, this guy is not one or the other but probably both at different times, and this is all in line with the life cycle of market gurus to begin with.

Gurus get laughed because their ideas are radically different from what's worked in the past, then become revered as the market falls in line with their ideas, then become reviled for losing many people money when the market shifts, then starting a newsletter is usually their last stage. By the time you read about one a guru in a major magazine, it's time to drop him like hot coals. By the time he starts promoting himself, you know he's already been dropped some time ago.

The market is just a cruel, cruel place. Imagine telling someone in any other trade that all of sudden every technique and convention he used will simply not work on anymore. I'd have trouble believing that in any other walk of life, especially if those techniques had been wildly successful at some point. We are defined by our life experiences. You can't expect a guru to just wake up and realize that he needs to start again at square one because the things things made him an expert now suggest he is an idiot. No constants in the stock market. Except Warren Buffet. Over the long term, the only certainty we know is death and taxes and that Warren Buffet will most assuredly make money.

HIs stock pick was META..(Facebook)…not to exceed $250 a share.

I subscribed to Tilson’s service several years ago … $6,000 for a Lifetime Subscription, plus $500 a year maintenance fee. BIG MISTAKE.

This is text from an e-mail I sent to Empire Financial Research more than a month ago. No reply, of course:

“Following your advice has not worked well AT ALL for me. I guess I’ll pay for another year, because I bought a $6,000 lifetime membership. But I appetite for reading your articles and following your advice is GREATLY DIMINISHED. You cost me about $250,000 in 2021!!! So that sucks.

The adventure in SPACs was disastrous, and most of Enrique’s other recommendations were almost as bad. I lost $17.9K on ARVL, $6.7K on BTWNW, $9.2K on BYND, $6.7K on CCOI, $2K on CGNT, $1K on KBH Puts, $20K on KPLT, $3.7K on IPOF, $8.3K on GDRX, $2.5K on MDLA, $1.3K on MUDS, $20K on PINS, $36K on PSTH, $3.8K on QELLW, $4K on RBAC, $2.2K on SJB ProShares, $1.9K on SPNV, $2.4K on TPGY, $0.5K on TRIT, $14.6K on VYGVF, $3K on VRT, and a massive $68K on VXX.

I still can’t believe that Enrique thought VXX was a good deal at $65 a share or whatever. Yeah, that one’s bound to go to $100. How long has he been doing this? Where did he get his MBA? Oh yeah, Wharton.

Berna’s greatest effect on my portfolio was negative also. She went to great lengths to trash Simon Property Group (SPG) in one article, and I sold most of my investment in that at about $120 a share. I made a LOT of money investing in SPG during 2020, because it dropped as low as $40 a share. After I sold a lot of it, it went up to over $160 a share. So thanks a LOT, Berna.

I see that the SPAC portfolio is closed out now, so all those bad calls aren’t shown anymore on your web site. Also, today, I could hardly log in. The web site is all about advertising for the 2022 Wall Street Expose’. I don’t trust you guys anymore, or believe you.

The winners were $8K on TW, $4.8K on TWTR, $4.3K on LTRPA, $4.2K on LVS and about $5K on SPCE, PALL and PAYC. I also made about $50K on the banks … WFC and BAC, but I was probably going to do that anyway.

All told, I made about $40K and lost $236K following your advice in 2021. Add in another $50,000 for selling SPG early, and that gets me to a $250,000 loss. Thanks for that!

In fact, maybe you should just fire Enrique. What good is he? He has about 100 recommendations out there right now, and 75 of them are losers.

I have enjoyed reading your articles, and I thought you guys really knew what you’re doing. But the performance outlined above is just very disgusting. AND 2021 was overall a good year for investors.

I have invested in Berkshire Hathaway for over 25 years, and am truly sorry I sold some of that to follow your advice. I also have money in the Vanguard Star Fund, Wellesley Income, etc. They ALL did well in 2021. PLUS, investing in them takes no effort at all.

Unhappy about your advice. “

Hi John,

I’m sorry to hear about your experience. Hopefully, your experience here will help give people a more realistic view of the investment advisories Tilson provides, which certainly isn’t a no-risk venture.

Hi Anders

Thanks so much for creating this web site! It’s SSSOOO good to get the truth out there. I’m a serious fan of Buffett, Munger and John Bogle. Tilson is quite the energetic promoter, and he acts like he’s part of the Buffett crowd … has a big meeting in Omaha every year during the BRK Annual meeting, reports on every word Buffett and Munger utter, etc.

But it’s all a bunch of bull.

John,

I have an experience similar to yours. I subscribed to his lifetime service, and lost about the same amount of money as you did over the past two years.

His service is totally worthless. If one examines all his newsletters’ performance since 2020 until now, his best performing portfolios have roughly matched the S&P. So why should anyone pay anything for it instead of just buying an index? And……his worst performing portfolios (mostly by Enrique) have just been disgusting. Some of the most promoted stocks have crashed more than those meme stocks that he regularly makes fun of.

I just canceled the subscription. It’s not worth paying several hundred dollars for every year, in fact it should be worth a negative number…

I attended (as a stay-at-home mom who happens to have a series 7 and an Electrical Engineering degree), Tilson’s Value Investing Congress in 2008. (Turns out if you pay you can go). Einhorn (just off his Lehman call), full of VIP and vinegar, ridiculed St. Joe (which is now the famed 30A Santa Rosa Beach Community) and Ackman (a Harvard buddy) presented. Ackman seems to be more in tune with numbers, market risk vs reward, and his lane of expertise.

I’ve received basic investing ‘newsletters’ (from Tilson) ever since, but always take him with a barrel of salt. He ‘seems’ nice enough, but to say he’s a ‘tad’ misleading is kind. The bluster and the ego wouldn’t be so hard to swallow were he at least truthful. Not to mention his emails detail his private life and adventures in a format fit for a teen Insta page. Hardly professional and often the mark of someone a bit disconnected (to say the very least). I could go on, but the market is in near free-fall. So glad I didn’t buy his latest picks!

It was recently random that I started getting pounded in my inbox with emails from Empire. I’ve heard Whitney Tilson’s name before and thought him credible. The teasers in their emails are not very compelling but I was interested in finding out more so i Bing..ed him and your sleuth came up. I think that your analysis of Whitney Tilson was comprehensive, intelligent and fair. I was not going to sign up for the newsletter but now I can reasonably move on with my day and say hey, Whitney is probably a good dude but not my cup of tea for investment advice.

Good job!

do you have an update on Tilson?

thanks