A lot of you continue to ask if Luke Lango is a fraud or if he is indeed the real deal.

We can't blame you. There are a lot of negative reviews about him and his publisher. However, when you listen to him, he sounds credible. He is also very relatable when he speaks, which makes him look trustworthy.

So it can be confusing. But in this review, we will tackle everything relevant about Lango so you can decide if you will subscribe to his services or not.

This website is no stranger to Lango and his various teasers. We wrote about his “G.C.T.” Technology Stock teaser. In the article, you learned that it is actually Ginkgo Bioworks Holdings Inc. (NYSE: DNA).

Aside from this, the tech futurist also had us guessing with his "#1 Electric Vehicle Stock of the Decade." Apparently, his pitch is about a "Solid-State Battery Technology" for car companies.

Lango even calls it the biggest breakthrough in a century because it is a forever battery. To know more, read our article on this "energy revolution."

The other teaser we exposed is his stock, “The Real Tesla Killer.” For free, we revealed to you that this is actually Luminar Technologies Inc. (Nasdaq: LAZR).

As you can observe, he is most comfortable in tech trends.

This article will tell you how his interest in the field started and where he got his initial training. The review will also look at his strategies, perspectives, services, and background.

Of course, we will also tell you how subscribers from various review sites perceive him and his work. We believe showing you actual comments, even if some of them are harsh, will help you assess him better.

So do read the review until the end and tell us what you think. We welcome your comments and insights, especially those who have subscribed to his newsletters already.

Background

College years

Luke Lango was a California Institute of Technology (Caltech) student from 2013 to 2017. He graduated with a Bachelor of Science degree in Economics.

While studying, he was already very much interested in technology. In fact, Lango says that a specific technical research in school is among his most exciting endeavors on campus.

What is it about? The editor says it was on "Electrophotochemical Research for nanowire Solar Cell Technology." Indeed, it is a mouthful, especially for us less tech-savvy individuals.

But it does reflect his fascination with technology early on.

Moreover, he indicated that he was keen on quantitative analysis even then. For him, it was the best approach to studying Finance and Economics.

Aside from this, he was also active in extracurricular activities. Lango was a top-performing player for the Caltech Beavers, the school's basketball team. Its official page highlights his rebound, assist, and shooting skills.

Career

As a student, the investor was already starting to build a career in finance. He began as a research analyst in the school. Later, Lango became an investment analyst at Feinberg Investments.

The firm made him analyze equities and design financial models. Since this is his first foray into the investing world, we consider this a significant turning point.

After that, he and his group ventured into a startup. They used quantitative techniques in using analytics for the professional sports disability insurance market. He served as the team's lead business analyst.

Lango also became an equities analyst for Seeking Alpha, where he shared his investing insights with the public.

Today, he has three major involvements.

The newsletter editor is an investor at L&F Capital Management, LLC. According to the company, it is a "boutique investment fund with a growth/tech focus." It is based in San Diego.

As the founding manager, he helps oversee its quantimental analysis and behavioral economics activities. The firm's goal is to spot "long-term growth investments" during its early stages.

Lango is also the founder of Fantastic, an app that offers personalized services. Customers will receive curated information on restaurants, movies, and music based on their personality.

This "social discovery company" claims to use "Big Data and advanced machine-learning algorithms."

Investorplace

For InvestorPlace, Lango holds the position of Senior Investment Analyst. He offers five premium services in the company and one free newsletter, but we'll talk about those later.

Also, the former basketball star considers himself an analyst and investor in growth stocks.

Investorplace even claims that he has a solid track record in the space. It says Lango frequently identifies "next-generation, small-cap stocks and cryptocurrencies" with massive high returns.

He does this by drawing on his IT experience and "big-picture" investment mindset. According to his press releases, various publications named Lango one of the world's foremost stock pickers today.

In addition, his publisher also claims that he spotted numerous up-and-coming growth stocks before they became household names. Examples include Chegg, Advanced Micro Devices, Tesla, Shopify, and NIO.

Moreover, Investorplace says that the editor has plunged into immense new opportunities.

Lango is now keen on cryptocurrencies and blockchain technology. The editor says he is just following his instincts regarding tech innovation, and he has mostly been right.

In fact, he considers these two the most "disruptive technology since the Internet." Lango claims to have combined his knack for spotting soaring small-cap stocks with his keen eye for the latest innovations.

Further, the investor also says that he has successfully identified explosive hypergrowth businesses with "10X-plus upside potential."

In addition, Lango claims to be a master at this. As proof, he has spotted rising stars among the highest yielding megatrends. In fact, the analyst says that his life revolves around technology.

For him, it has the power to inject life and wealth into generations of Americans who yearn for financial freedom.

Services

Newsletters

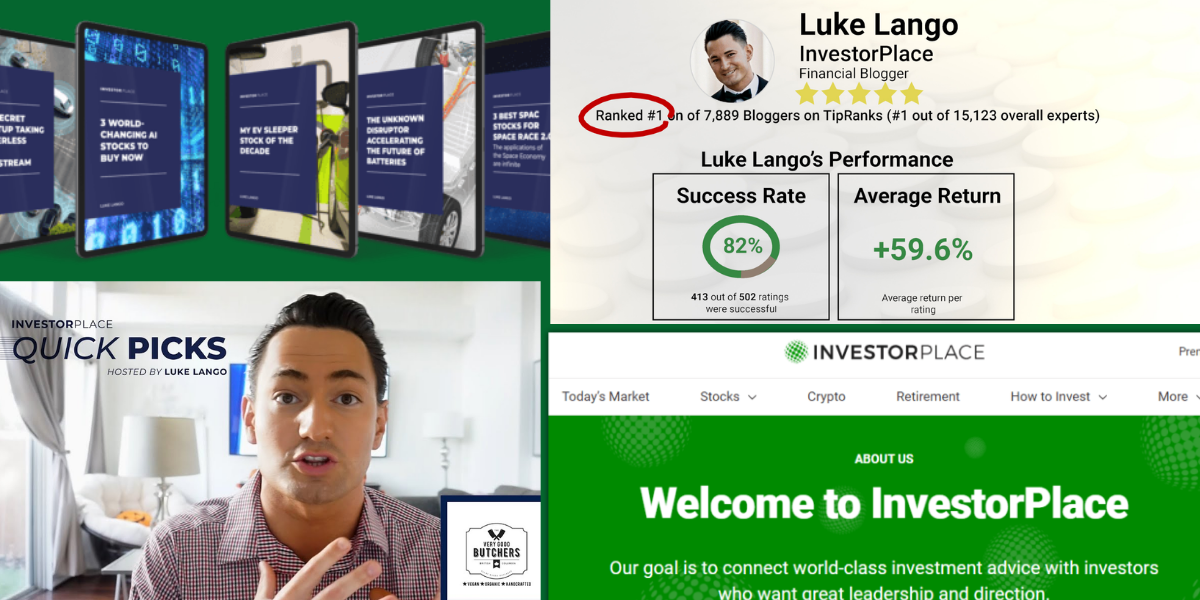

The editor does not seem to miss an opportunity to tell people about TipRanks. Lango makes it a point to boast that he was the rating agency's top stock picker in 2020.

Investorplace likes to brag that its senior staff was the number one among more than 15,000 analysts on the field.

If you follow this sort of stuff, it might indeed matter. According to TipRanks, he had an 82% success rate at the time. Moreover, the agency says that Lango had an average return of 59.6% in 2020.

With this type of reputation, Investorplace offers six Luke Lango services.

Innovation Investor focuses on mid- to large-cap stocks, while Daily 10X Stock Report looks at small-cap opportunities. He also has an aggressive monthly trades service, Early Stage Investor.

The analyst also has two digital currency newsletters. The first is Crypto Investor Network, his collaboration with the controversial Charlie Shrem.

You may read about it on our previous review here at Green Bull Research. We featured actual reader reviews and gave our take on the service.

Lango's other newsletter, Ultimate Crypto, is about what he predicts will be bigger than bitcoin.

Aside from these, he also has a free newsletter called Hypergrowth Investing. Based on how Investorplace markets it, this looks like the firm's hook for the other services.

This title is also the name of his podcast and Youtube channel.

Based on these, you could really tell what Lango's priorities are. It is consistent with his brand and focus. Indeed, you would see that he loves early investments, tech trends, and innovative solutions.

Publisher

Due to this, he has a secure place in the roster of Investorplace. Since the publisher advertises itself as a premier source of financial information, it does need a financial and tech geek.

Operating for more than 40 years now, the firm claims to be one of the most independent in the space. For this reason, media outfits and universities frequently collaborate with them.

The company says it is transparent, and its transactions are all above-board. That's why their subscribers have remained loyal through the years.

It has various categories of services:

- Active Trading,

- Small-Cap,

- Growth Investing,

- Macro Trends,

- Options Trading,

- Private Investing, and

- Invitation Only.

So, what is our impression of the guy thus far? Well, there is still a lot to tackle to get a fuller picture. But we checked his current TipRanks profile, and we saw an unflattering update:

Ranked #11,298 out of 11,401 Bloggers on TipRanks (#19,193 out of 19,346 overall experts)

Further, the site says he only has a 25% success rate. Also, his average return per rating is -27%.

So, if Lango thinks the rating agency was right in 2020, would he say the same thing for 2022? Is this still a legit ranking and computation? On a more relevant note, how does this affect your perception of the editor?

Before making a final judgment, do hang on. Read the rest of our review as we will tackle more issues in the following sections.

Framework

To provide you insights into the investor-analyst's thought process, we will look at his perspectives on recent issues.

When tech stocks entered a bear market in March 2022, in an entrepreneur.com article, Lango said that it's "exciting stuff." Though he admitted that it was indeed a scary phase, he was optimistic for long-term investors.

According to him, this hasn't happened in two years. He saw that "the tech-heavy Nasdaq Composite closed 20.1% off its November highs."

So why is he excited? Well, he sees it as an opportune time to buy stocks. Lango says that historically, when these happen, tech stocks tend to soar during the next few years. They rise dramatically.

Instead of being frightened, you just need to know which ones are worth investing in. When you spot the right companies at the right time, you already have a comfortable life ahead of you.

He even cites a few examples to bolster his case that innovation will solve society's ills.

One area that he cites is the opportunity for renewable energy and electric vehicles. Due to the various global crises, oil and gas prices would continue to soar. Obviously, we would look at alternatives.

Lango says that this is the very reason why you should be buying such stocks while these tech stocks are getting crushed. In the years to come, they will prove to be highly profitable.

Another example here is diamonds. According to the editor, most of diamonds come from Russia. However, it is having huge problems right now. As a result, there could be a global shortage which would spike prices.

So we now turn to technologies that make "lab-grown diamonds" possible. These companies may look unattractive now, but this is precisely why you should be buying now.

When you read his articles on cybersecurity and clean energy stocks, this is the same worldview.

On the former, this is what we saw:

Like the rest of the market, cybersecurity stocks have been crushed over the past few months.

What he saw:

The investment implication? It's time to buy the dip in these stocks. In both the near and long term, they should win big!

It is the same pattern since this is how he thinks about such global events. True, there is merit to what he says.

But the question is, are you as optimistic as he is? Do you trust his recommendations? More importantly, do you trust his way of thinking?

Communication strategy

Among the editors we have covered, Lango is indeed one of the most tech-savvy. In fact, this is evident not just in his services.

He also harnesses technology to connect to more people. Aside from writing newsletters, he also regularly appears on the Investorplace YouTube channel.

Moreover, he has his own channel there, as well as a weekly podcast. The multi-platform speaker tackles a lot of tech and market topics.

Once you listen, you will observe that he often uses plain language. This way, he sounds more accessible. Even heavy topics become light and more understandable.

He even answers a few questions from his listeners. In response to a "disappointed" listener, he defends his process in the video below.

For us, he provides a convincing argument for the specific stock in question. Moreover, he sheds light on his overall investing philosophy.

Lango says that others look at stocks in terms of "what's there." For him, it's different. The editor tries to see "what will be there." The former strategy is like looking at the rearview mirror and seeing ugly things.

If this is the case, no one will invest in exciting prospects. He believes in looking at the possibilities. Specific to Lucid, his team looked at the technology, investors, and potential.

In fact, Lango believes it will be the next Tesla. So this approach gives people the courage to invest in small stocks before they explode. If you believe him and his predictions, you will make lots of money.

The investor clarifies further that this is not a pump and dump scheme. If you recall, we discussed this term in our Stock Gumshoe Review.

It refers to pumping up shares through exaggerated claims and selling the initially cheap stocks at higher prices later on. Those enticed by this scheme end up losing money in the end. It is a fraudulent activity.

In addition, Lango says he is merely an optimistic investor because he is excited about new technology. It is consistent with his overall philosophy.

Moreover, the video also has him claiming that his team is the best in the tech sector.

We think this multimedia approach is helpful to his subscribers.

It makes him and his ideas accessible to readers who may doubt his picks. The strategy removes the common impression that most editors are hard-to-reach and out-of-touch.

In addition to the podcast being broadcast on various channels, he also presents clips via "shorts." These are under-30-second clips designed for those who love browsing such content on YouTube or TikTok.

Based on what we have heard and watched so far, Lango explains concepts well. When you listen to him, it's likely that his talking points will sway you.

But course, we all know that talk is cheap. A person may be eloquent, but an editor's competence can only be measured by how his recommendations perform.

He may be a smooth talker, but if subscribers end up losing money, it's useless. That will just make Lango a convincing motivational speaker.

In this space, it is not just about how you communicate. A great investment research editor is one whose strategies work. Their subscribers must make money from their investments.

That's why it's imperative for us to know more about his actual performance. In the next chapter, you will read the experiences of regular subscribers.

We believe it is worth listening to what readers have to say. After all, they have tested Lango and his strategies.

Feedback

We start this section with what Reddit users are talking about. In recent years, the platform has increasingly been more influential. People speak freely on the site, so we get unadulterated opinions.

We saw one thread with the title, Thoughts on Motely Fool vs Luke Lango vs Others?

A user commented about the editor's continuous upselling, which turned him off.

Luke Lango has a subscription for $50 then tries to upsell for $100.

After, he tries to upsell for $400 lifetime membership with no refunds for some crazy ideas about a Solid State Battery that will change the world and its a big secret.

Then he floods my email trying to get more money out of more get-rich-quick schemes like Alt Crypto. Then it's like a thousand dollars.

We agree with the comment because Lango's pitches have this formula. But then again, this is standard for most, if not all, editors.

We are not saying this is a legit practice, but we will acknowledge that the style isn't exclusive to Lango. It might not even be the editors like him who design such hooks.

It could actually be the publishers and the copywriters who know a thing or two about marketing. Nevertheless, since the editors' names appear on the newsletter, it's on them.

They cannot just say that they are only focusing on the research and meat of the articles. Ultimately, each word on their services is their responsibility.

In fact, another user concurred with this comment. "Run_LikeAntelope" said he couldn't even finish the analyst's "$3 amazing secret stock" video.

Aside from this feedback, two others gave essentially the same feedback. "rnwhitey2020" and "Anomalous17" opined that Lango makes excellent picks. However, the big downside is that he has terrible timing.

Their strategy is to study what the investor recommends. But they do not invest in them right away. The two follow their own timeline and not Lango's, which made them successful.

We don't know if this is a valid compliment or not. Maybe it's a backhanded praise? But isn't timing a critical area of an editor's strengths?

We believe it's a crucial aspect of investing, especially in more aggressive portfolios. But when you can't trust an "expert's" timing, what's the use?

What do you think about this? Will you give Lango a pass on timing because the companies he recommends are somewhat solid? Is this enough to make you subscribe and upgrade? Kindly tell us your thoughts.

BBB

There are no significant performance discussions on Lango in Better Business Bureau. What you will read on the Investorplace BBB page are mainly refund and spam complaints.

This is why it got a measly 1.06 rating from website readers as of this writing.

However, this does not mean that the investor-editor is off the hook.

First, he has a position in the publishing house. So complaints on Investorplace reflect on him as well. Second, the reason why subscribers want refunds is because they're not satisfied with the services.

Obviously, this includes his newsletters. In fact, some even mention his name or his subscriptions.

By the time we published this review, all messages were complaints. Not one individual talked about a positive experience.

The closest you can get to a commendation is when readers thank the Investorplace for finally returning their money. The reviews are that bad on the website.

As a result, it seems like the company itself is getting miffed. Here is one of their standard answers:

The Company includes a clear and conspicuous "unsubscribe" link at the bottom of commercial emails, including e-letters and promotions, enabling email recipients to unsubscribe from receiving future commercial emails.

The response looks like a diplomatic way of saying that those who complain about spam are idiots. Why can't they just press unsubscribe, right?

Well, the reality is that it's possible that it doesn't work for some people. Or the spam emails go away for a brief period but return after a while. If it were that simple, it would not have been a problem in the first place.

But why the harsh rating and comments? Maybe these are planted to disparage the company? Well, let us look at other review sites like Pissed Consumer and Trustpilot.

Pissed Consumer

Based on 42 reviews by the time we published this, Investorplace got 1.3/5 stars on Pissed Consumer. So it would seem like commenters here have the same sentiments as those on BBB.

This website even has a breakdown of ratings. Apparently, it asks readers to rate the publisher's website, product or service diversity, style and design, price affordability, and coverage area.

Investorplace received an average of 1 star across the board.

Of those who reviewed it as of this writing, only four subscribers gave it 3 stars. Six gave it 2 stars, while 32 readers gave the company 1 star.

One commenter who gave it 3 stars was initially impressed. "Brenda B Rxy" says that the recommendations in the beginning were great. It seemed like there was long-term thinking involved.

However, when the software did not tell her to sell when it was supposed to, she was done. The company lost her trust and interest.

All the other reviews mentioned negative experiences. Some called the company an outright scammer. People said those interested in subscribing should instead run away fast.

Others said its editors mainly use old information and scare tactics. Subscribers also reported that a lot of the other claims have been misleading. Also, they add that they actually lost money from the recommendations.

Aside from these, there were also complaints about refunds, customer service, and unauthorized charges.

We do not wish to focus on the negatives unnecessarily. However, these are the sentiments of actual people. If they are all true and accurate, subscribers do not deserve this kind of treatment.

This review below is particularly heartbreaking:

This is someone who deserves our utmost respect, a retired military person. Yet, he had an experience like this.

Such a complaint is among the main reasons why we do what we do.

This website hopes that there will be fewer people who will experience heartache while investing. This is why we strive to provide you with objective reviews so you will be more informed.

Of course, we are again not saying that all of this Lango's fault. But he is still a member of the publishing team.

Trustpilot

An overwhelming 98% of the 306 reviews as of press time gave Investorplace a "Bad" rating on Trustpilot. Here are a few of the actual comments on the page:

First of all: their recommendations are just stupid. But more important: once you unsubscribe, your inbox will be flooded with emails from similar companies.

Scam, scam, scam!!

If I can put 0 stars I would. This is a garbage organization that works with hedge funds to attack certain stocks.

Poor quality and not trustworthy, it’s been getting worse and worse every month.

Yes, the reviews are that bad. We even saw one that specifically mentioned Lango. According to the commenter, they have already tried canceling the editor's services for three weeks.

The reviewer said that Investorplace is "totally untrustworthy and appalling."

In the 15 pages of complaints, we have seen all kinds of deficiencies possible in a newsletter. We sympathize with such subscribers as they really seem to be irked at many different aspects of the company.

It's unfortunate because regular investors like them just want to get credible and reliable information. After all, who doesn't want to grow their money, right? Since the newsletters promise a lot, they have high expectations.

Instead, many of them receive stress from unauthorized charges and spam emails. Many also claim that the problem has a lot to do with the kind of recommendations the firm makes.

In the end, instead of getting profits, subscribers lose money. In addition to the comments above, we found this review.

What do you think about this specific insight from user "Larry"? Do share what your thoughts are on his assertions.

Insights

What do all the comments above mean? How should they affect potential subscribers who are thinking about trying out Investorplace's Lango?

First, we should clarify that not all the negative comments pertain to him, his newsletters, or his insights. Some are directly about other editors. However, it has a bearing on him since he is with the company.

Second, we cannot validate all comments. Some could be fake, manipulated, or biased. But in the same vein, some could also be legit and have valid points.

For this reason, we tell you about them so you can weigh them for yourselves. People can often be harsh, but we also empathize with those who are irate because of their challenging situations.

Third, at the end of the day, you are the one who gets to decide. Think about your own investing goals, limit, and comfort level. If you can still trust the editor, go ahead.

But these comments are only a part of the actual experiences of all subscribers.

We just want to balance the claims and marketing materials with feedback from subscribers. At least when you do subscribe to Lango, you know what you are getting into.

Conclusion - Is He a Reliable Investor-Analyst-Editor?

When you look at his background, he indeed seems like he has been preparing for this career early on. When he was still a student at Caltech, he focused on finance, economics, and quantitative analysis.

It was the perfect combination of disciplines that will give credibility to an investment research editor today. On top of that, he was among his school's top basketball players.

Why is this relevant? Well, involvement in sports tells a lot about an individual. It speaks volumes about Lango's competitiveness, discipline, and focus. So we think it is critical here.

Aside from that, he already got actual financial and market training as a student. While in school, he was already in the arena, fighting with other analysts and investors.

He also ventured into tech startups, further boosting his credentials as a hands-on practitioner. But he found multiple investment research opportunities in Investorplace.

In fact, he has a total of five premium services in the company and one free newsletter in the firm. Obviously, he is a prolific editor.

In addition, he is very active on social media. Lango has a weekly podcast which is also available on YouTube. In it, he gives airtime to those who want to ask even challenging questions.

So this accessibility and his background must mean he and Investorplace are the darlings of subscribers, right? Well, that's not exactly the case.

We gave you an honest rundown of how commenters on Reddit, Better Business Bureau, Pissed Consumer, and Trustpilot feel about his publisher.

It is true that the negative comments are not all about him. But we also pointed out that these kinds of feedback reflect on him as well. After all, he is the Senior Investment Analyst.

However, we also said that these comments do not mirror the whole universe of Investorplace's subscribers.

So, with all this information, is Luke Lango a fraud? After going through our review, we hope you now have a clearer impression of the tech futurist-investor-analyst-editor.

Well in January 2023 Luke said this about SOFI:

If someone were to hold a gun to my head and force me to buy-and-hold one stock for the next five to ten years, I’d pick this one (SOFI) without hesitation.

I bought SOFI at 4 3/4 and in one month it just hit 8 dollars. best tout I’ve seen this year and he said it’s going to the moon!

but today he just sent me a list of 100 hazard stocks to avoid! SOFI is on his list!

so why is SOFI on his 100 hazard stocks to avoid?

Not so cool for a

legendary stock picker, I wonder who really does his research? Did he just buy this list and put it out as a freebee without even looking at it?

Another one of his recommendations LAZR Luminar Technologies, Inc. is also on the list!

I don’t know everything he has promoted but I wouldn’t be surprised if all his stock pics are on this list of 100 stocks to avoid!

If you know his pics it would be interesting to tell us how many on which he contradicts himself.

https://s3.amazonaws.com/marketingassets.cloudsna.com/prod/images/tradestops/reports/LL100k-100_Hazard_Stocks_to_Avoid.pdf

I parted ways with Luke Lango a year ago. I got tired of his hype which rarely paid off. By e-mail I asked him if he invested in the stocks he recommended. He wrote back that he never invested in any stock that he recommended because it was against company policy for him to do so! Need I say more?

Ever since I started looking at investing for reasons unknown I just never took to Lango I have looked at some of his presentations but never signed up for any. I get a lot of material from him of which I just delete. After this report I will be unsubscribing from Market Place altogether.

Advice from this cirucs fraudster has cost me a lot of money. Nio, Chargepoint, Lucid (bought at $38, it’s $4 now), Rivian, Tusimple, etc., etc., etc. are all down more than 90% from where he recommended, and, like most services, Luke RARELY uses the word “sell”. Yep, I was drawn in by his self-assured enthusiasm and paid dearly for it. Investor Place in general is a pump-and-dump scam, IMO. Navellier releases urgent buy recommendations to us peons about an hour after he releases the same info to his high-worth clients. When we see it, the stock is rocketing up, creating a sense of urgency to buy. It tops out about 15% higher, then all his buddies sell, and the stock pretty much goes back to where it started. It’s like clockwork. Went to Zacks for some honest info and have not been disappointed.

How’s that SOFI recommendation working out, Luke? One of many bad ones.