At 81 years old, is the technology futurist still a leading voice in the investment world?

Read our review of The George Gilder Report. Here, we will try to find out if he can really give you triple- and quadruple-digit gains.Truthfully, the man has had a profound impact on capitalism and the economy. He also has a reputation as among the best financial minds in the country, if not the world.But will you get top-notch advice from his entry-level subscription service? Or will he leave you with crumbs and whet your appetite? Is his goal to entice you to his more expensive newsletters?Let us take a look at what he has to offer.

Overview

- Name: The George Gilder Report

- Editor: George Gilder

- Publisher: Three Founders Publishing

- Website: www.threefounderspublishing.com

- Service: Technology Investment Research Advisory Service

- Cost: Annual subscription fee of $299. Special offer: $49

His website wants you to take action right away. Additionally, he says “do not delay”, “do not hesitate”.

There is even a countdown timer at the top of the page. Interestingly, after the 15-minute timer, nothing happens.

But should you hurry and be excited with the legendary guru’s service?

To go deeper, we will take a look not just at his specific newsletter. We will look at his worldview as well, to know if your values are aligned.

Also, we will examine his publisher and its associations. Based on experience, such affects the quality of the newsletter.

What is Three Founders Publishing?

The people mentioned in the name of the company are Addison Wiggin, Doug Hill, and Bill Bonner. They set the firm up from what used to be Laissez Faire Books.The presence of these men behind the company consequently signals its association with The Agora. If you are a regular reader here at Green Bull Research, you would know why we need to point this out.The Agora and its subsidiaries have been a subject of controversy in this industry. In fact, their marketing tactics often received complaints from financial pundits and subscribers.We have already written about their legal troubles. As a matter of fact, you may read our review on The Oxford Club for more details.A recent review of Altucher’s Secret Income also touches on this topic. We even mentioned how Yahoo! Finance has documented complaints about the company’s exaggerated claims.Going back to Laissez Faire Books, it was initially a bookstore of “libertarian economic texts”. Eventually, they released a newsletter promoting economic and financial freedom. This was The Laissez Faire Letter.Due to their new services, they renamed the firm to Three Founders Publishing. Further, the company says that its goal is to provide an inside look into the markets.

Contrary to what the mainstream media does, they look to the future. As a result, this gives them the best profit-generating ideas to give their subscribers.Currently, they have four major clusters of research products and courses for their subscribers. Each of the four classifications offers different advisories from high-profile editors. These are:

- Foundational Investment Research

- Altucher’s Investment Network

- The George Gilder Report

- Strategic Impact

- Laissez Faire Letter

- Advanced Trading Services

- Secret Income

- Top 1% Advisory

- Altucher Weekly AlphaBrain Alert

- Altucher’s Angels

- George Gilder’s Moonshots

- The Great Barrington Project

- Graham’s 90-Minute Trader

- Snapback Profits

- Entrepreneurial and Lifestyle Services

- The Altucher Report

- Real Estate Trend Alert

- The Choose Yourself Guide to Self Publishing

- Publisher-Level Memberships

- Altucher Alliance

- Gilder’s Millionaire Circle

- Three Founders Society

Are you also interested to know our insights on the other newsletters of Three Founders Publishing?

Go ahead and read our reviews of the services of a prominent editor in the company. You may check details of James Altucher’s The Altucher Report and Secret Income on our website.

Who is George Gilder?

The technology futurist is no stranger to our regular readers.

In fact, we have exposed the three stocks in his 5G Killer and Spectrum Millionaire Makers teasers. We said that these were Qualcomm (QCOM), Comcast (CMCSA), and Infinera (INFN).Indeed, Gilder is a major name brand. As an illustration, Three Founders Publishing introduces its editor in a big way.

His profile says he is “the most knowledgeable man in America when it comes to the future of technology.” No one comes close to him on issues about tech’s impact on ordinary lives, they also claim.Further, they say that he is “the best stock picker in the world” during the big tech boom in the 1990s.In addition, his New York Times bestseller, Wealth and Poverty, is considered a classic and the ultimate guide to capitalism. For those looking for the ultimate explainer on supply-side economics, this is the go-to book. Notably, it gives a defense of the “moral superiority of free-market capitalism”. Through the book, the author makes the case that supply-side economics will reduce poverty. In particular, he asserts that government regulations can never accomplish this.Further, Gilder recently released an updated version of the 1981 classic. Wealth and Poverty: A New Edition for the Twenty-First Century includes commentary on recent times. This version makes a connection on America’s present economic issues to its previous crises. According to the techno-utopian advocate, Obama’s big government redistributive policies are actually harmful. Instead of helping the poor, they in fact do the opposite.All in all, the prolific writer has written a total of 19 books:

- The Party That Lost Its Head Alfred A. Knopf; 1st edition (1966). With Bruce Chapman.

- Sexual Suicide (1973)

- Naked Nomads: Unmarried Men in America (1974)

- Visible Man: A True Story of Post-Racist America (1978)

- Wealth and Poverty (1981)

- Men and Marriage (1986)

- The Spirit of Enterprise (1986)

- Microcosm: The Quantum Revolution In Economics And Technology (1989)

- Life After Television (1990)

- Recapturing the Spirit of Enterprise (1992)

- The Meaning of the Microcosm (1997)

- Telecosm: The World After Bandwidth Abundance (2000)

- The Silicon Eye: How a Silicon Valley Company Aims to Make All Current Computers, Cameras, and Cell Phones Obsolete (2005)

- The Silicon Eye: Microchip Swashbucklers and the Future of

- High-Tech Innovation (2006)

- The Israel Test (2009)

- Knowledge and Power: The Information Theory of Capitalism and How it is Revolutionizing our World (2013)

- The Scandal of Money (2016)

- Life after Google: The Fall of Big Data and the Rise of the Blockchain Economy (2018)

- Gaming AI: Why AI Can't Think but Can Transform Jobs (2020)

Moreover, Forbes named his book, Life after Google, as one of “7 Technology Books Every Entrepreneur Should Read” in 2019.An economist, people also regard him as an institution when it comes to writing investment newsletters.

Through the years, many of his readers benefit from his provocative thoughts. They also contain insights on various breakthroughs in different industries.In fact, it is in these articles where he first advocated for technology and the Internet. In the past, the investor has served as Lehrman Institute’s Economic Roundtable Chairman. Meanwhile, during his time with Manhattan Institute, he was designated as its program director. Moreover, his views on supply-side economics are also prominent in his writings. Proof of this are Gilder's contributions to A.B. Laffer’s economic reports and The Wall Street Journal’s editorial page.Currently, his publishing house credits five newsletters to his name. These are The George Gilder Report, George Gilder's Moonshots, The Great Barrington Project, Gilder's Millionaire Circle, Gilder's Daily Prophecy.

What are some of George Gilder’s ideas?

Due to the lack of details on the tech pioneer's newsletter service, we turn to his big ideas. This way, we will know key aspects of his investment and financial philosophy.

On Wall Street and The Fed

In a CNBC article in April 2016, Gilder highlights the curious case of Wall Street and the economy after recessions. Oddly, the former recovers quickly while the latter always falls behind.Why is this happening?

His observation is that the Federal Reserve and the government have established a closed-loop economy. Consequently, the Fed continues to generate money for Washington and the S&P 500.

However, the Main Street is left out.What happens is this. The Federal Reserve establishes the value of money, as well as who receives it and in what amounts. It is then priced at zero interest rates by the Fed. Their justification for this is to encourage economic growth. But when something is free, it is distributed by a queue. As a result, only the privileged and well-connected at the front of the line get the goods. So not much is left for the entrepreneurs who drive Main Street's development and potential.Because of this, there is merit to the notion that the economy is rigged against regular people, Gilder says.Unfortunately, the Fed today oversees the entire financial industry. Its role was supposed to just be “a lender of last resort”.

But now, it seems to only serve Washington and large banks. It practically governs the whole economy as a result.The remedy? In his own words:

“The first step to a new prosperity is to give up the god that failed and break the government monopoly on money.We don't have to have a formal gold standard: A combination of bitcoin for the internet and treating gold in tax terms as currency, not an investment, would go a long way to restoring money as a measure of learning and growth, and jump-starting growth.”

On The Pandemic and Going Back to Work

As early as April of 2020, the tech futurist has already declared the pandemic to be over.

At that time, he was already pushing for policymakers to open the economy. Whether you agree with him or not, his insights are worth listening to.For instance, Gilder minces no words in his article on Real Clear Markets. For him, the lockdown and effort to flatten the curve have caused “economic suicide”.

The efforts undertaken by the government, he adds, are a “gigantic botch of policy and leadership”.In reality, he says that the lockdown in the United States has extended and aggravated the medical crisis. We have even prevented herd immunity.

This is particularly true among students and other non-susceptible young people.As a result, we have hurt and damaged the economy in ways we can only accurately calculate long after the crisis.

On Capitalism Versus Socialism

Meanwhile, the economist has an enlightening exchange with Mark Levin. In an interview on Fox News, Gilder says that capitalism represents liberty while socialism represents tyranny.The tech guru asserts that capitalism is a mind-based system. It is anchored on the idea that people are creative. In its essence, creativity is even the foundation of capitalism.Why? He believes that due to the uncertainty of the future, people have to learn to be successful. As one learns, increases his/her knowledge, and adapts, s/he unlocks the keys to economic growth.In capitalism, you continue to learn because you acknowledge that you do not know everything yet. Gilder even quotes Princeton economist Albert Hirschman, who said that creativity always comes as a surprise to us.In contrast to this, socialism banks on the idea that we already know all that we need to know. Thus, there is no more room for creative discovery. What’s needed to flourish is merely to plan and “redistribute” everything. Gilder adds that it is not true that socialists depend on science. In reality, the basis of their actions is dogma and doctrine.

What is The George Gilder Report?

The newsletter is the entry-level subscription service of the economist-investor. Every month, he provides his readers crucial investment advice on breakthrough technology trends.

What’s unique about his service? As a tech futurist, he knows what will emerge as mega stocks before others discover them.

According to the promo page, his Gilder Technology Report in the 1990s generated impressive gains.

“The profits ranged from 4,132%, 3,781%, 1,969%, 4,234%, 3,453%, 1,807%, 1,074%, 2,415%, 1,008%, 19,295%, and more…”

How it Works

Our research on official literature pertinent to the newsletter reveals little. We do not get a deep dive on the investment guru’s process. It appears that most of the pitch anchors on his reputation.Such a tactic is a double-edged sword. If you believe he is a genius, you may just take his word for it. Results are the best indicators of an effective method, whether you see it or not.But if you are an admirer who still requires more proof, the strategy will make you stay away. After all, believing in an advisory service means entrusting your money to its editor.

But if you cannot trust him without seeing the method to his madness, you will not take the risk.

What you get

When you go to the website of Three Founders Publishing and click on The George Gilder Report, here is what you will get for $299:

- Monthly newsletters

- In-depth take on today’s market

- Explosive investment opportunities

- Weekly email updates

- Model portfolio

- Important movements in the market

- Email alerts

- Urgent buy or sell a portfolio position

- Optional text message alerts

- Actionable trade advice

- Free special reports and subscriber-exclusive updates

- Unadvertised bonuses

- Free subscriptions to three e-letters:

- Gilder’s Daily Prophecy

- One Last Thing

- 5 Minute Forecast

The special promotional page that we have seen offers a better deal.His 5G Killer and Spectrum Millionaire Makers teasers offer an annual subscription for only $49.These are the inclusions:

- Report #1. Three Spectrum Millionaire Makers

- Individuals will come to learn of three stocks likely to increase investors’ profit.

- Free Copy of Life After Google

- It expounds on the influence that blockchain technology is likely to have on the economy.

- Life After Google: The Missing Chapter

- 12 monthly issues on stock recommendations

- Weekly updates on portfolios

- The ability to ask George anything at every financial quarter

- Bonus Report #1. The Truth About Artificial Intelligence

- Bonus Report #2. Our Robot Future

- Bonus Report #3. The True 5G Revolution

- Bonus Report #4. Immediate access to Gilder 360

- Access to free daily e-letters:

- Gilder’s Daily Prophecy

- One Last Thing

- 5 Minute Forecast

Cost and Refund Policy

Cost

Regular price: One-year subscription to the newsletter will cost you $299.Special offer from his 5G Killer and Spectrum Millionaire Makers teasers: Annual fee of $49.

Refund policy

The advisory service reiterates that their offer is a risk-free subscription. Their encouragement to those interested is to merely try it first. If you are not satisfied with the first three issues, cancel your subscription. They will return your money, no questions asked.

Reviews

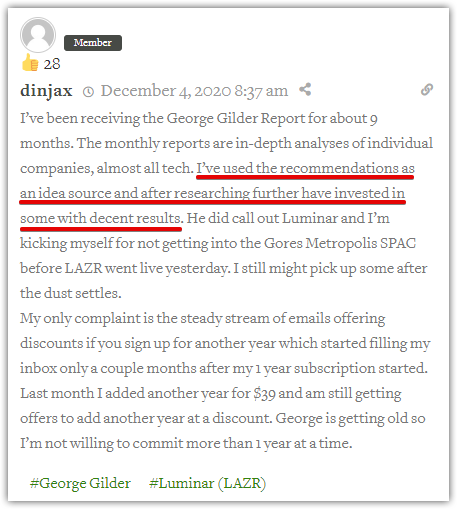

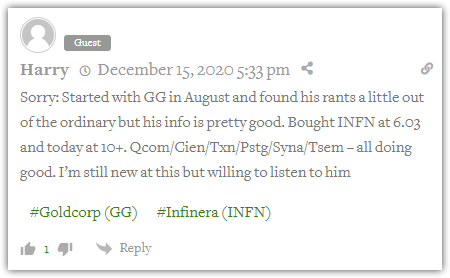

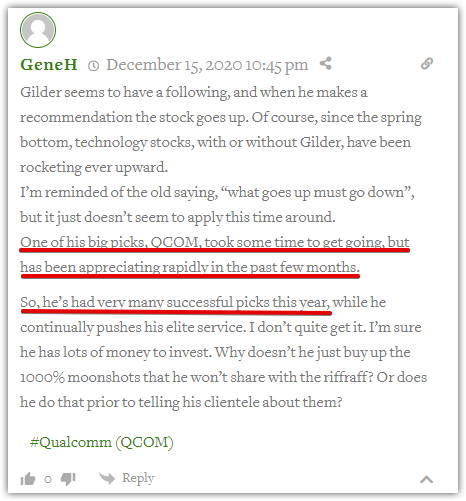

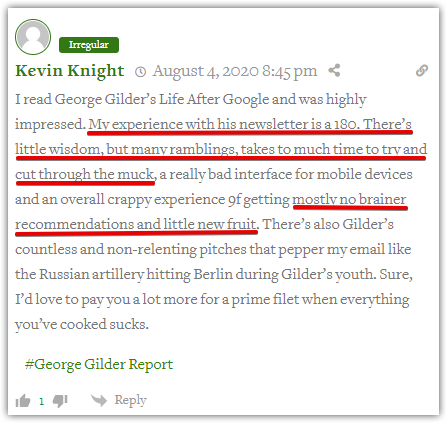

The newsletter was able to get an admirable 4.2 out of 5 stars in Stock Gumshoe as of this writing. Commenters on the page gave mixed reviews.

It is important to note though, that there are only 14 comments at the moment, compared to the 113 voters who give him high marks.These comments point to their positive experience with the “technology prophet’s” advice.

Meanwhile, one subscriber talks about his dissatisfaction with Gilder’s recommendations.

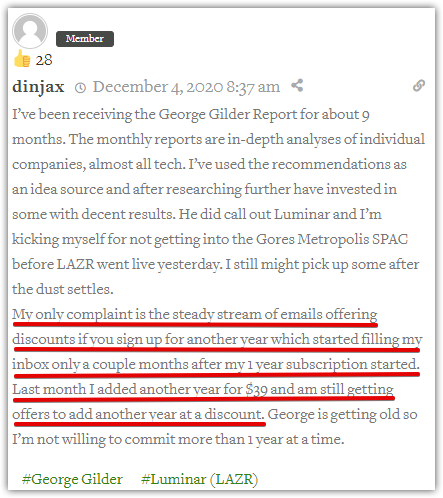

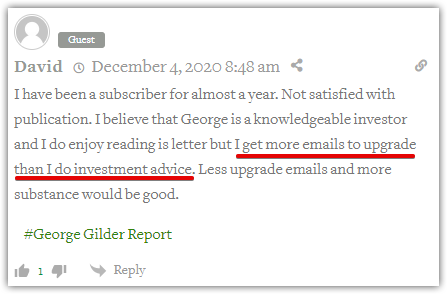

What’s noticeable are the comments about the steady dump of upgrade offers, which many found annoying.

Also, an article on Business Insider mentions George Gilder.

What the economist promises is not as easy to achieve as it sounds, says “Millionaire Teacher” author Andrew Hallam.Since his book talks about spotting investment scams, the author investigated Gilder’s newsletter. Here is what Hallam discovered:

“Unless you held the stocks during the time they were on the rise, it doesn't mean too much. In reality, if you'd invested $40,000 into Gilder's top bets for the year 2000, that money would have shrunk to a paltry $1,140 by 2002.”

Pros v Cons

Pros

- George Gilder is an established pioneer in investment newsletters and technology trends

- The editor is the leading voice on the service he offers

Cons

- Complaints of constant annoying upgrade offers

- Lack of transparency on his method

Conclusion – Will Gilder deliver on his promises?

George Gilder is a pioneer in technology trends.

Long before the Internet, he was the lone voice predicting its dominance in the future.And we are living in that reality today. Clearly, he knows technology. But that’s not all. He also practically wrote the bible for supply-side economics. As a result, his ideas became mainstream not only in the U.S. but in the world.So he also knows a thing or two about economics and the financial system.But will this newsletter supply you with emerging tech breakthroughs so you can earn more money?

Based on what we have discussed in our review of The George Gilder Report, we would like to know your take on the question. Post your comments below and let’s talk.