The teaser:

Alex Koyfman

“I'm so tough that 4 days out of 5, I skip breakfast”

“This little-known industrial site holds the key to what could be the investment of the decade”

“under-the-radar discovery”

“This 7-Decade-Old Industry Is About To Enter Its Next 100x Super Cycle”

last time it hit this “super cycle” it “made early investors incredibly rich”, but this time he thinks it's going to even be better because of three specific catalysts that are in place:

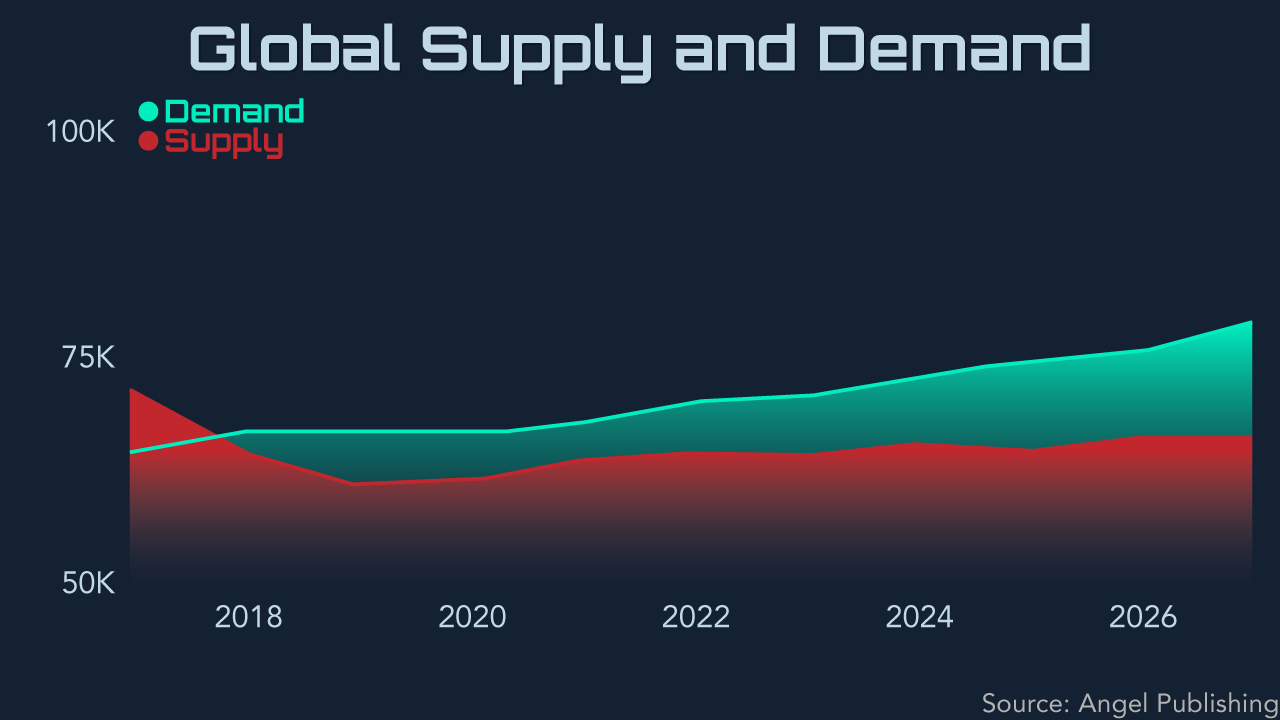

- Demand is exceeding supply

- There are only 50 suppliers left (actually fewer than 50)

- “A once-in-a-decade market event is imminent” – says it normally happens once every 5 to 10 years and the indicators confirming that we've now entered this phase are undeniable

After blabbing on for quite some time, Koyfman finally got to the point of this all. The “hated metal” he's talking about here is uranium.

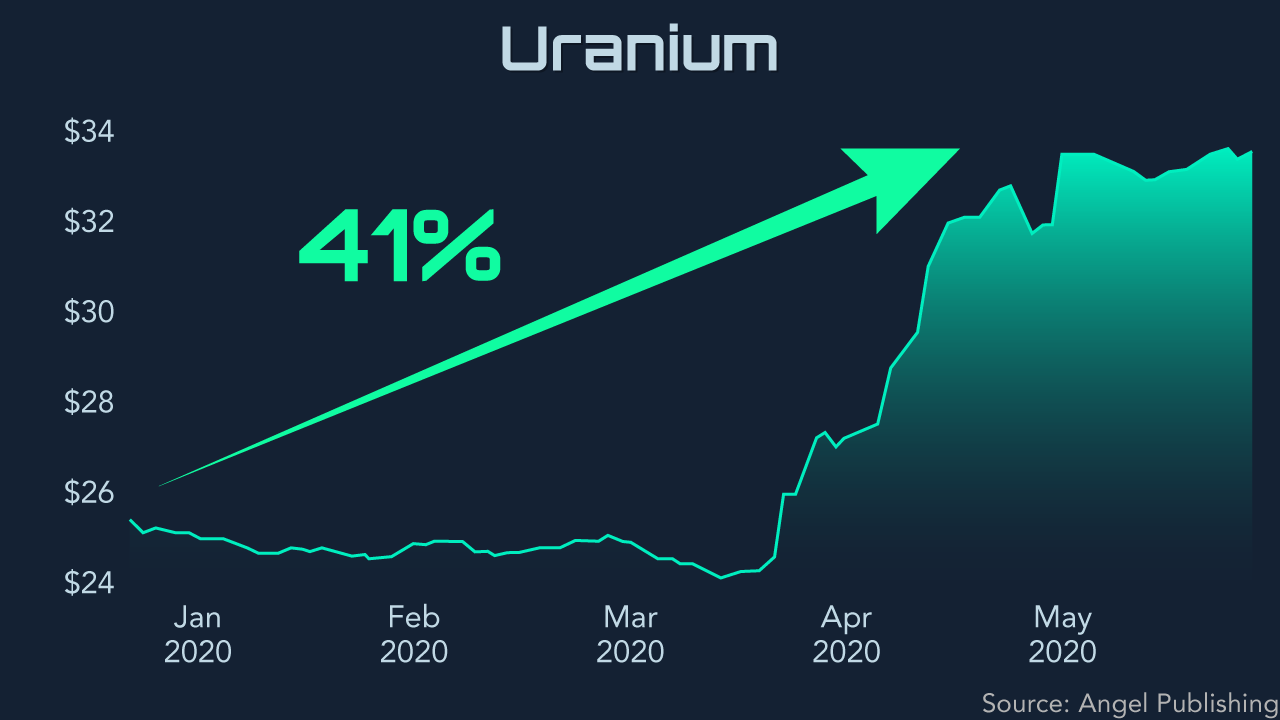

There had already been a supply shortage for the metal and on top of that COVID decreased supplies even more.

his favorite pick “could hand you a payday of 29,594%”

The sales pitch:

“free report”

“The Amazon of Uranium”

Heading H2…

half of the world's uranium comes from Kazakhstan and one of their big state-run miners, Kazatomprom, shut down it's in-situ sites on April 7th after COVID started happening.

gives examples of how investors could have easily become millionaires from the 2006 uranium shortage and claims that this is repeating today… “only this time, it's four times bigger” because of the COVID situation

In the teaser Koyfman also talks about how “Only around 67% of European and 28% of U.S. utilities’… requirements are currently contracted”.

Power plants usually secure long-term uranium contracts that last for up to 15 years… and with many contracts up for renewal in the near future we could see prices increase just from this – Koyfman thinks they could “easily double”.

On top of that, you have the US stockpiling uranium and trying to get back in the lead in nuclear energy technology

teases 3 investment opportunities, each of which are speculative and trade at less than $2 a share, all of which are US companies.

Koyfman's Uranium Stocks

Azarga Uranium (OTCMKTS: AZZUF) and Uranium Energy Corp. (NYSEAMERICAN: UEC)

His “#1 Stock for 29,594% Gains”

calls this company the “Amazon of uranium”

- “Its stock trades for less than a pack of gum right now” – “trading for about $2 each”

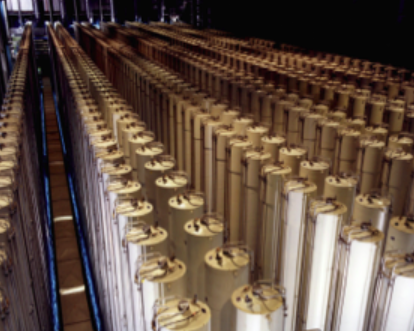

- “It holds the second-biggest domestic inventory of uranium after giant Cameco”

- It “owns a whole range of mines and production sites in Texas, New Mexico, Arizona, Colorado, Utah, Wyoming”

- Its “licensed production capacity amounts to a huge 11.5 million pounds per year”

- “Its market cap is 20 times smaller than Cameco’s”

Heading H2…

tells us that based on the 2006 uranium bull run this stock would have went up 29,594%, but since the current situation is around 4x that, “we could even be looking at an incredible 103,579% opportunity”

Heading H2…

Enter your text here…

Heading H2…

Enter your text here…

Heading H2…

Enter your text here…

Heading H2…

Enter your text here…