Porter Stansberry says there is nothing surprising about the coming energy crisis this winter.

The disaster has been more than a decade in the making. Fortunately, Porter has identified a “Gods of Gas” LNG Stock Pick to protect yourself and profit from the coming catastrophe.

The Teaser

Porter's presentation starts off by mentioning how Boston (Massachusetts) averted its last near-blackout during the cold snap of 2018 by purchasing now-banned Russian natural gas.

Porter Stansberry is back with his first new publication – The Big Secret on Wall Street (This Week) since retiring from the company we all know him for, Stansberry Research. We previously reviewed Stansberry Research and also covered several presentations, including The Ugly Truth Behind America's Economy.

This winter could be far worse for people in the Northeast, with Porter going so far as to say that emergency generator-powered public shelters could be set up for those that remain without heat or hot water in the dead of winter.

But it won't end there. Because although the worst of the “economic catastrophe” may hit New England first, Porter claims that it could soon spread across the country.

Even credible experts believe a natural gas crisis is imminent and with prices already at their highest point in nearly two decades, it's hard to argue their point.

Converging Factors Causing a Crisis

- For starters, many power plants have reached the end of their useful lives, while coal plants have been outright shut down

- No new natural gas pipelines have been built on the East Coast for over a decade

- The current political climate and rise of ESG investing have made the construction of new LNG facilities untenable

Predictably, all of this has led to a tightening of existing gas supplies and higher prices.

Bottom line: There just isn't enough LNG that can be sourced on the open market without “very significant increases in prices.” Supply needs to be increased.

As is the case with most crises, someone somewhere is getting rich off of this and Porter is going to show us how that someone could be us with a trio of American natural gas companies.

The Pitch

Porter reveals all three of his stock picks in the new weekly newsletter –The Big Secret on Wall Street (This Week).

The cost is $1,000 annually to become a charter member or $5,000 as a one-time payment for a lifetime membership. Either amount will get you a weekly newsletter containing expert analysis along with access to a recommended stock portfolio.

Unleashing LNG in the US

America needs to produce something like 50 billion more cubic feet of natural gas per day just to keep pace with demand.

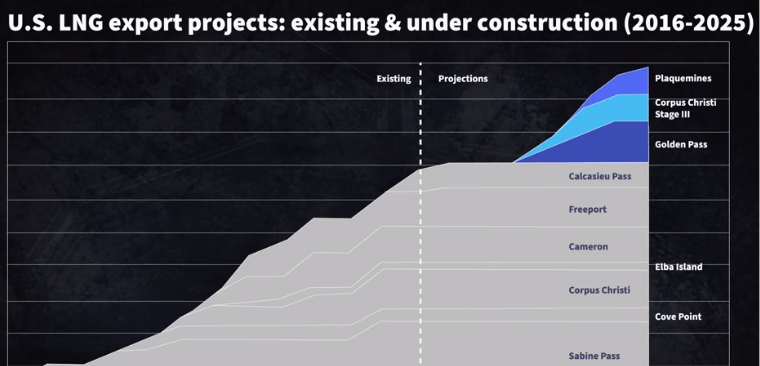

Fortunately, America has the capacity to dramatically increase production to fulfill both its own power needs and have enough left over to keep exporting to Europe.

This could make natural gas and infrastructure investors a fortune. There's only one catch…

The federal government isn't likely to change course on its misguided environmental agenda, which includes not approving any new natural gas exploration and production until its hand is absolutely forced. So what will it take? We may need to see real shortages and even blackouts before some in positions of power realize the gravity of the situation.

In New England alone, such policies have already cost residents over $3 billion in higher utility bills compared to consumers in Pennsylvania.

Currently, there are more than 170 LNG facilities operating in the U.S. performing a variety of services. Under normal circumstances, this would be enough to get by on, if it weren't for the fact that the US is now the world's largest LNG exporter as of the first half of the year. Add to this that almost all liquefied natural gas supply is sold under contract, with contracts typically decades in length and that leaves very little LNG available on the open market.

A few companies are aiming to change this, including an enterprising “Gods of Gas” natural gas producer that has been gradually building up its capacity. Let's find out what these are.

Porter's LNG Stock Picks Revealed

This was a video presentation with no transcript, so here is what I was able to gather on the go:

The Gods of Gas Stock Pick

- Originally started by three brothers in 2008.

- The company is now profitable, generating free cash flow of over half a billion dollars in 2021.

- Porter expects investors to make more than 10x their money with this “super major energy company” over the next decade.

The company is clearly EQT Corp. (NYSE: EQT). What gave it away?

- Three brothers (Toby, Daniel, and Derek Rice) started Rice Energy in 2008 and subsequently sold it to EQT ten years later in 2019.

- EQT generated $607 million of free cash flow in the fiscal year 2021.

LNG Giant Stock Pick

- This company was started by the man responsible for building the “first independent LNG export facility” in the U.S.

- It has a unique business model designed to serve international energy markets with the LNG facility it is currently building on the Gulf Coast.

- Porter thinks the stock will pop once funding is received for the next phase of its LNG export facility.

The stock in question here is almost certainly Tellurian Inc. (NYSE: TELL).

- Tellurian was founded in 2016 by two industry icons, Charif Souki and Martin Houston. Charif was indeed responsible for the first liquefied natural gas (LNG) exports from the United States Lower 48.

- Earlier this year, construction began at Tellurian's Driftwood LNG project on the U.S. Gulf Coast south of Lake Charles, Louisiana.

Energy Royalties Stock Pick

- Porter's last pick is a leading royalty holder in Texas' prolific Permian Basin oil field.

- It boasts a $5 billion market cap and pays out a 10% annual dividend.

- The stock has outperformed the energy sector 3:1 since it was publicly listed in 2014.

After consulting several high yield stock and trust lists, nothing seems to quite match Porter's description here. The closest I was able to find was Kimbell Royalty Partners LP (NYSE: KRP). Although KRP does have a dividend yield narrowly above 10% and it owns 46,000 wells in the Permian Basin, its market cap is half the $5 billion mentioned by Porter.

Will the Gods Grant Profits?

The hard truth is, despite all the splashy headlines about green energy. Fossil fuels still make up more than 80% of all electrical generation capacity today.

This isn't going to change anytime in the next decade and perhaps beyond. In this respect, owning a few proven and profitable traditional energy businesses sounds like a level-headed move.

Quick Recap & Conclusion

- Porter Stansberry is back and his focus is on the pruported blackout of the US east coast this winter. The only way to protect yourself and profit, he says is with a trio of American LNG stocks.

- America needs to produce something like 50 billion more cubic feet of natural gas per day just to keep pace with current demand. The good ol' entrepreneurial spirit appears to be up to the challenge and there's a few energy producers leading the way.

- Porter reveals these picks in his brand new weekly newsletter –The Big Secret on Wall Street (This Week). A charter membership costs $1,000 and comes with in-depth analysis and a recommended stock portfolio.

- Thankfully, enough details were revealed in the video presentation for us to identify two of his three picks. They are EQT Corp. (NYSE: EQT) and Tellurian Inc. (NYSE: TELL).

- EQT is a proven commodity with natural gas reserves that grew 20% last year, while Tellurian is betting that demand for natural gas will continue to go up with a new LNG facility currently under construction.

Are there better energy bets out there? Tell us in the comment section below.

Dear Theodor,

This is a intresting take by Porter. Just bear in mind that

LNG is very expensive to produce compared with piped natural gas from Russia, Iran, Turkmenistan and Asia is where the major world population lives. Sofar gas price is in Europe and Asia 5-8 x more expensive then in the USA. Not to forget Australia, Mozambique, Quatar, Russia too export LNG so I am not so positive as Porter.

We can consider researching on VIPER ENERGY PARTNERS (VNOM) instead of Kimbell Royalty (KRP) for the Permian Basin royalty company. VNOM has a market cap of $5.1B which is close to what the teaser says, but the yield is ~6% as of today.

I appreciate your service Theodor!

I, too, appreciate your service. Just signed up.