Porter Stansberry is here with the defining story of 2024 and beyond.

He's teasing a shocking event that he calls the “Financial Reset of 2024” which is about to rip the financial world in two and unleash the greatest wealth transfer in history.

The Teaser

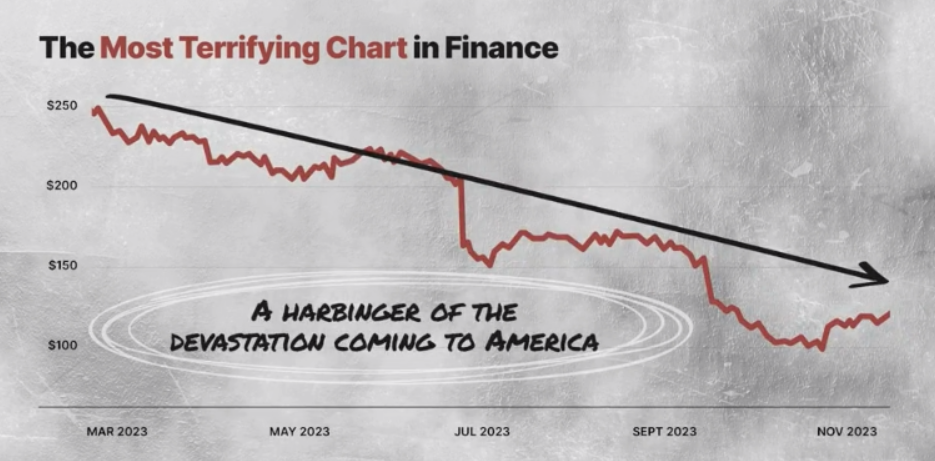

One terrifying chart reveals just how bad things are and how much worse they can get.

What we're looking at here is a chart of Dollar General Corp. (NYSE: DG), which primarily serves a lower-income demographic and usually sees more customers coming through its doors during downturns when people tighten their belts.

Not this time around.

Porter says many people aren't even able to afford discounted household staples like the kind Dollar General sells and calls it a harbinger for the destruction of wealth that is coming to the rest of America sometime this year.

This might sound like a typical doom-and-gloom presentation, but Porter Stansberry has a history with this sort of thing.

He predicted the 1998 emerging market crisis, the 2008 financial crash, and the loss of America’s AAA credit rating. We have previously reviewed his “Gods of Gas” Stock Pick and Nuclear Energy Company, among other teasers.

Porter says this financial rapture will have people on one side, who heeded this early warning and protected their nest eggs, and another who chose to put their full faith and trust in the same financial system that said the 2008 housing market crash would be contained and that inflation would be transitory.

For the latter group, losses of 50% or more aren't just probable, but inevitable. Yikes!

The Official Narrative

All of this flies in the face of The Fed and federal government narrative, which says the consumer is strong and the economy is sound.

Porter is calling bs on this and points out the “catastrophic levels” of demand food banks are experiencing, coupled with spiking credit card and mortgage delinquency rates, which are up more than 50% and 16% year over year, respectively.

So what should we be doing with our money against this backdrop?

Porter has a unique approach.

A contrarian-like way to earn equity-type returns with far less risk and volatility. We're talking “double-digit annual yields with sometimes double and triple-digit capital gains on top.”

It's a strategy that's only viable during periods of disruption and it could yield its best returns ever during the coming financial reset.

The Pitch

For the first time, Porter is inviting non-partners to access his distressed debt advisory, Porter & Co. Distressed Investing.

The advisory is designed to help us profit from the coming default wave in U.S. corporate debt, what Porter calls “The Greatest Legal Transfer of Wealth in Human History” and it has identified no less than ten high-quality distressed investing opportunities.

Annual access to the advisory costs $2,500 and includes distressed bond and equity recommendations, a model portfolio, bi-weekly updates, access to The Big Secret on Wall Street equity research service, and more.

Is a Credit Crisis Coming?

Many people realize that something is amiss with the economy.

Years of zero percent interest rates and out-of-control spending have begun to weigh on the dollar, weakening it, causing inflation, and more people to awaken to the dangers of a completely fiat currency than the powers that be care to admit.

However, few, if any, have any idea how this will end.

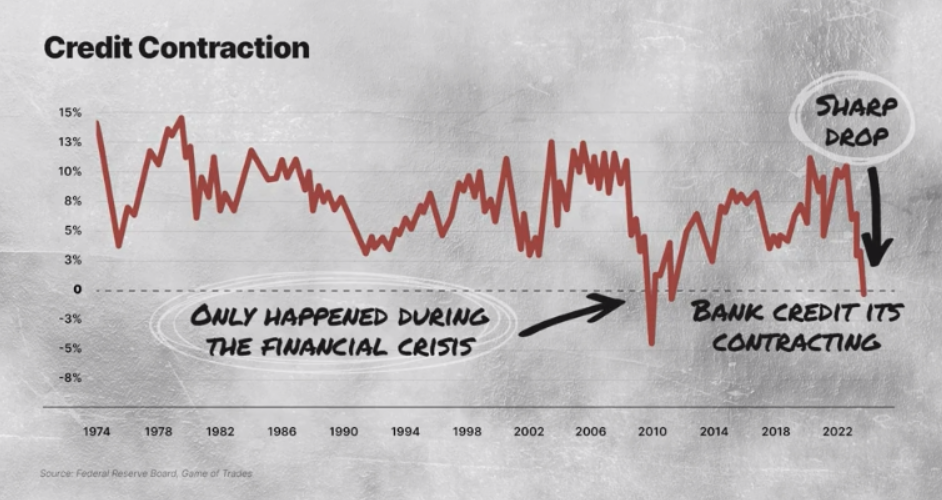

Porter believes the beginning of the end will come in the form of a tsunami of credit downgrades and corporate bond market defaults.

Zombie Companies

Since 2008, the number of “zombie companies” defined as those only able to repay the interest on their debt, thus requiring perpetual debt to operate, has been steadily increasing.

Today, more than 10% of all publicly traded companies in the U.S. are considered ‘zombie firms.'

Thanks to inflation, the cost of borrowing continues to rise, meaning many of these firms will not just be unable to service their existing debts, but they won't be able to raise any new financing either.

This combination of more expensive credit and a tapped-out consumer will spawn bankruptcies and wipe out trillions of dollars in wealth.

US corporate bankruptcy filings are already on the rise, closing out 2023 with the most filings since 2010.

Against such a bleak backdrop, there is one type of investment that delivers exceptional returns.

It's not equities, options, or any other type of alternative investment. Porter is talking about high-yield bonds and because of the magnitude of the forthcoming credit crisis, their returns could surpass anything we've seen in the past.

Let's find out if any clues are provided or names mentioned insofar as high-yield plays are concerned.

Porter Stansberry's Financial Reset 2024 Picks

At this stage, Porter brings in Marty Fridson, a well-known fixed-income credit analyst, to accurately assess the opportunity.

Marty says that similar to when the stock market sells off, a broad sell-off in corporate debt will cause the bonds of a lot of profitable companies to fall below any reasonable estimate of fair value.

This is where the chance to buy high-quality debt for pennies on the dollar comes in.

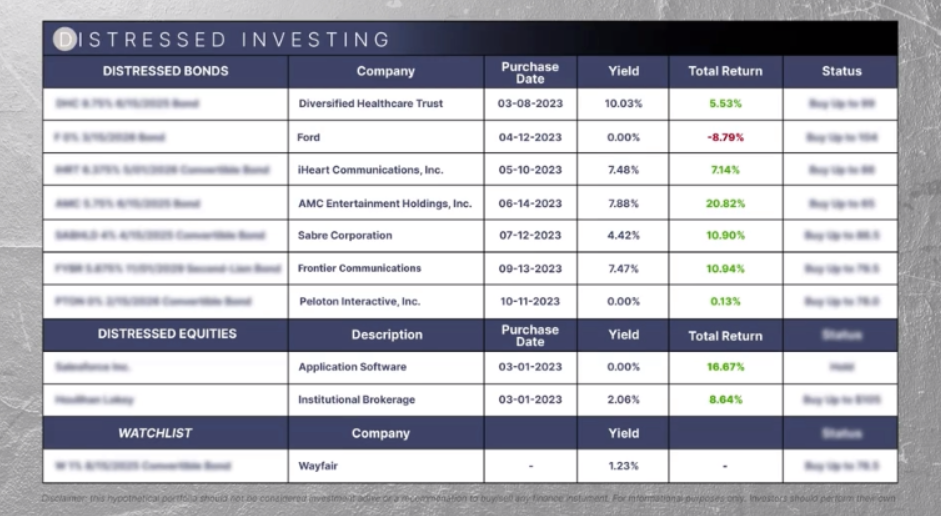

All we get regarding the ten high-quality distressed investing opportunities teased throughout the more than hour-long video presentation is a blurred-out snapshot that I managed to capture.

It does reveal the names of seven of the distressed bond issuers, one watchlist company, as well as the yield of each of the bonds. From this info, we can track down some of the individual bonds that trade on the OTC market, like AMC's 7.5% with a maturity date of February 15, 2029.

Are Marty and Porter right about distressed debt offering the best combination of safety of principal and a satisfactory return during the coming debt crisis?

Is Distressed Debt the Best Way to Build Wealth Amidst Chaos?

I had to go back to the basics for this one and dust off my copy of Benjamin Graham's Intelligent Investor, where “the father of value investing” offers his criteria for investing in fixed-income securities like bonds and preferred stocks.

Graham primarily recommends a minimum interest coverage ratio when selecting such securities or in other words, the number of times that total interest charges have been covered by available earnings (or income) in a significant number of past periods.

In this regard, a coverage ratio of 4-5x over the past five years is conservative.

Of course, it's not this simple, as a business's long-term prospects, the discount to par at which its bonds are selling, and other factors should also be considered, but this is a good starting point for analysis.

Also noteworthy is that Ben Graham recommended keeping no more than 75% and no less than 25% of your money in high-grade bonds and common stocks.

Distressed debt doesn't fall into the high-grade bond category, so even more stringent buying criteria should be applied to such securities. Still, opportunities can and will be found in this category, given the inevitable day of fiscal reckoning we're spiraling towards.

Quick Recap & Conclusion

- Porter Stansberry is teasing a shocking event that he calls the “Financial Reset of 2024” which is about to rip the financial world in two and unleash the greatest wealth transfer in history.

- This financial reset will be a major credit crisis that will see a wave of credit downgrades and corporate bond market defaults and Porter has a little-known strategy that could yield its best returns ever during such a cataclysm.

- What is being teased here is an investment in distressed debt and the Porter & Co. Distressed Investing Advisory has identified no less than ten high-quality, high-yield bond recommendations. Annual access to the advisory, which includes the names of all ten picks, costs $2,500.

- From the more than hour-long video presentation…with no playback feature, we extracted the names of eight of the ten recommended debt issuers and included a screenshot of them above.

- Distressed debt is a strategy for enterprising investors, but it can also easily be played via several distressed debt ETFs from the comfort of your brokerage account.

Do you believe a major credit crisis is just around the corner? Tell us in the comments.