This review of Nomi Prins’ Rapid Growth Opportunities will give you a detailed look at what “America’s Top Market Expert” offers. She says that she is practically giving away her research package worth $20,275. She will gift it to her subscribers for the affordable price of only $1,998 for a two-year subscription. What a kind-hearted financial research analyst.But that’s not all, she will even make you rich. Together with analyst Dan Amoss, she will show you her top small-cap recommendations. They will do all the research and analysis, all the work behind the scenes.You just need to follow their advice and you will see stocks that triple and double, with gains of 200% up to 300%. These are indeed opportunities for rapid growth. Of course, there is much more to discuss about her claims. Oh, and we must mention that her publisher has ties to The Agora. Makes you all the more excited, doesn't it?

Overview

- Name: Rapid Growth Opportunities

- Editor: Nomi Prins

- Analyst: Dan Amoss

- Publisher: Paradigm Press

- Website: www.paradigm.press

- Service: Research service

- Cost: $1,995 for two years of subscription

Nomi Prins is a well-known author, journalist, and commentator. She claims that with her knowledge of the economy and financial markets, she knows what stocks will be most profitable. Her goal is to give you exclusive access to her research. She will spill on companies that will thrive as the economy recovers from the pandemic. These stocks will mainly focus on small-cap opportunities. According to her, this is where you need to invest in.Aside from this newsletter, Prins’ other services under the research company are Dark Money Millionaires and 25 Cent Trader. Continue reading our review as we have something about this later.Green Bull Research has already written about other publications of Paradigm Press. Read our honest take on Robert Kiyosaki’s The Rich Dad Poor Dad Letter and our review of Jim Rickards’ “10x Gold Script” teaser.

Who is Dr. Nomi Prins?

Before anything else, Nomi Prins is not a medical doctor. According to her profile at the Paradigm Press website:

Nomi received her BS in Math from SUNY Purchase, and MS in Statistics from New York University, where she completed all required coursework for a Ph.D. in Statistics.

We found the phrasing somewhat awkward. What about you? She could just have said she has a Ph.D. in Statistics, right? Plain, simple, and clear.In the said profile, there was also no mention of any other institution where she could have earned the title of Dr. Nomi Prins. So does she have a Ph.D. in Statistics from NYU?We then turned to Wikipedia. We know, it is not always reliable. But at least we have another reference. This is what we found there:

Prins received her Ph.D. in International Strategic Studies with a specialization in International Political Economy from the Federal University of Rio Grande do Sul in Porto Alegre, Brazil.

In her LinkedIn profile, we saw the same details in the Education section. In these last two sources, there was no mention of her completed Statistics Ph.D. units at NYU. Seems odd.You may be asking: What is with the emphasis on this? Well, as it is, Nomi Prins seems to be a competent individual with a host of credentials attached to her name. So we found it strange that Paradigm Press would seem to downplay her association with the university in Brazil. Instead, the publisher opted to go with her “completed coursework” at NYU.Both can be right. They seem to be legit. But this is a classic example of a marketing tactic often seen in this industry. Maybe the publisher thinks the words “NYU” and “Ph.D. in Statistics” will be more marketable than the “Federal University of Rio Grande do Sul” and “International Strategic Studies Ph.D.”. After all, they want to highlight her background in finances.Are you getting our drift here? Let this be your takeaway from the discussion above: take promotional tactics with a grain of salt. Verify. Cross-check. Research.The truth is, we are glad to have you here on our website because this is the kind of service we provide. As independent reviewers, we want to help you navigate the muddy world of financial advisory services. Often, they over promise but under deliver. We have already seen so many examples of this. People, especially the elderly, have been deceived by clickbait marketing. Some say that the newsletters offer crappy recommendations. But that’s not all. A lot also comment that once these companies get a hold of your email address, they will bombard you non-stop with upsells and new services. Worse, some hide their auto-renewal provisions. Subscribers cannot easily stop the credit card charges. Even if there are money-back guarantees, these are not fulfilled. Further, most of these companies’ customer service departments suck.So we want you to be extra careful about these kinds of investment advisory services. After all, you are putting your hard-earned money on the line.

Now, we go back to Dr. Prins. She is an author, journalist, and speaker whose main areas of interest are the economy, Wall Street, global markets, international relations, and investments.Among her high-profile affiliations are companies you most likely have already heard of. She has worked at Goldman Sachs as a managing director and in Bear Stearns as a senior managing director. Prins was also a senior strategist at Lehman Brothers and an analyst at Chase Manhattan Bank.As an author, she wrote:

- Collusion: How Central Bankers Rigged the World

- All the Presidents' Bankers: The Hidden Alliances that Drive American Power

- It Takes a Pillage: Behind the Bonuses, Bailouts, and Backroom Deals from Washington to Wall Street

- Other People's Money: The Corporate Mugging of America

- Jacked: How “Conservatives” are Picking your Pocket (whether you voted for them or not)

- Black Tuesday

In these books, you would be able to sense some political undertones. Her book, Collusion, discusses how “central bankers control global markets and dictate economic policy”.

She elaborated on this in a 2018 Fox Business segment with host Charles Payne.Prins has also been consistent. Her article on The Guardian one month after Donald Trump was elected said that leaders and lenders always act in their own interest. One of her past books, Other People’s Money, was named The Best Book of 2004 by Barron’s, The Economist, and The Library Journal. Here, she gives “an account of corporate corruption, political collusion, and Wall Street deception.”Of course, the title of this book is a giveaway: Jacked: How “Conservatives” are Picking your Pocket (whether you voted for them or not).She is not shy about it. Her Paradigm Press and Wikipedia profiles state that she was a part of Senator Bernie Sanders’ panel of top economic experts.But Paradigm Press wants nothing to do with this affiliation. They made this clear in her “Economic Super Convergence” event.

That is from the official transcript of the press show.Prins is also a regular at major television programs where she gives her take on current political and economic issues.

Aside from being a contributor at Forbes, her writing has also been featured in top publications nationwide.

What is Rapid Growth Opportunities?

The newsletter promises to provide you with the perfect macro research so you can enjoy the benefits of the rapid development in the small-cap market. With the guidance of Nomi Prins, you can invest in them before they achieve large-cap status.Another newsletter that gives small-cap analysis is Ian King’s New Era Fortunes. Read our comprehensive guide on that service here at this website.According to its sales page, you do not need to do the grunt work anymore. That is their job and they will supply you with all the information they will find. In fact, you do not even need to track all the data they are working on. You just need to trust them, their judgment, and their analysis. Sit back and enjoy the benefits of their hard work. Soon, you will see your money grow like never before.Does this sound too good to be true? Well, they are banking (pun intended) on the combined experience and efforts of Dr. Prins and investment analyst Dan Amoss. They are assuring you that they can make this happen. So go and give them $1,995 immediately. What is a couple of thousand compared to the money they can make for you in the future anyway?Further, we also want to point out that she promoted her newsletter in an event called Economic Super Convergence Webinar last April 1, 2021. Yes, that was April Fools’ Day. Anyway, she mentioned in the video that she will be offering her much-discounted newsletter package for a limited time only.We clicked on the newsletter link on the website and it led us to a page saying the offer has already expired. What a bummer for those who missed it!What you need to do is type in your email address and you will be the first to find out when, or if, the newsletter offer reopens.

However, some other links on the Internet are still available and they lead to these:

So, obviously, these links still work, and the offer is still up and available. What did we really expect?We sound like a broken record, we know. But for as long as there are complaints about misleading marketing tactics, we will continue to point them out. Our goal is to protect our readers.Read more about actual reviews in one of our sections below.

How it Works

In the long-winding video presentation of Prins, she offered an insightful take on the goings-on in the US and global markets. She gave us a situationer on the economy given the pandemic and current vaccination rates.Then she went on to discuss articles and opinions citing that the best investments now are small-cap stocks. She will show them to you so you can invest in them before they become superstars. No rocket-science formula there.Our discussion on the New Era Fortunes newsletter already mentioned that small-cap stocks have outperformed large-cap companies historically. Although small-cap stocks have indeed been resilient, we also cautioned about investing in them. Why?Well, they are also risky and volatile. So it will be wise to diversify and to invest only what you can afford to lose.Apart from her strategy of going for small-cap companies, we saw no other specific formula. Even if she mentioned that she has a Reopening America Index, there were no further details. Instead, she gave us a foretaste of her top 5 plays in 2021:

- Small-Cap Stock Pick #1

-

“a tiny energy play that has been on fire recently”

-

“a company that could at least double by the end of the year, and maybe even triple at some point in 2022”

-

- Small-Cap Stock Pick #2

-

“a backdoor way to play the booming EV industry”

-

“this small stock could rise at least 200% in the next few years”

-

- Small-Cap Stock Pick #3

-

“our favorite tiny stock to profit off the massive infrastructure trend”

-

“revenue should hit $1 billion the next 3 years which is just huge for this small player”

-

“a potential 200% gain is in the cards over the next few years”

-

- Small-Cap Stock Pick #4

-

“an industrial stock that’s also set to boom with new infrastructure”

-

“generated $3.5 billion in revenue in 2020”“shares could triple over the next 2 years”

-

- Small-Cap Stock Pick #5

-

“a very small company that has huge potential as people start going back to restaurants”

-

“the stock could double in a matter of months, and rise several hundred percent over the next few years”

-

Again, we do not know much about her specific strategy as her webinar did not elaborate on this. But through her picks, she wants you to know that she has a magic formula. Even if it is kept top secret for now.Given the kind of reputation Prins has, we honestly expected more from her and her service. We believe anyone who claims to be an expert who dishes out investment advice owes it to their readers to give them specifics. We are not talking about hypotheticals here, people are not playing around. They put their money on the line, money they need for their medical bills and their retirement. The least that newsletter editors and writers can do is show people their process so readers can make informed decisions.Maybe some would argue that these kinds of information are to be included in the newsletters.Well, that may be the case. But still, since readers will spend money already, they need to know what they are going to pay for. It will be a different case altogether if unsubscribing and getting your money back was a walk in the part. Based on the many complaints we have read about various newsletter providers, companies give them a hard time in this. So our position here at Green Bull Research is for publishers to provide as much information as they can.

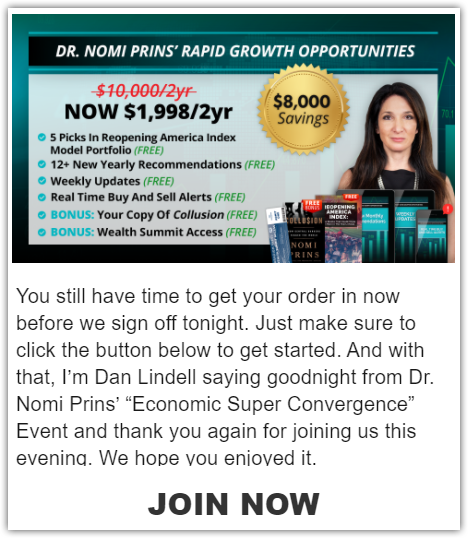

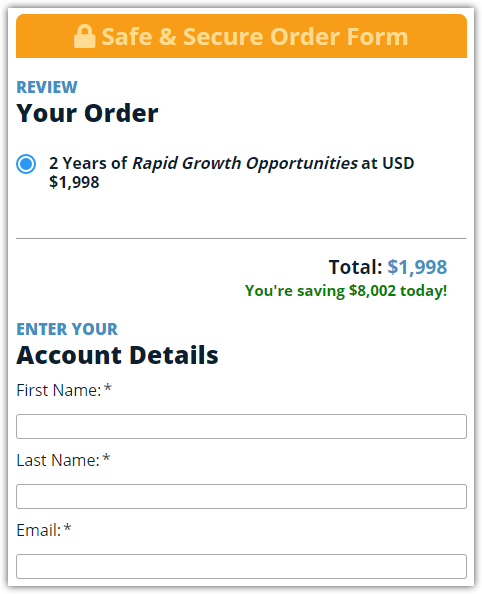

What you get

According to her sales promotions, the total value of her whole package is $20,275. But due to the goodness of her heart, she will only charge you $1,998. Plus, when you join during her limited promo duration, your second year of subscription will be free.What a treat, right?After you roll your eyes, let us show you what you will receive with your subscription:

- Reopening America Index Model Portfolio ($3,500 Value)

- Top 5 top small-cap picks as America reopens

- Two years of Dr. Prins’ Rapid Growth Opportunities for just $1,998 ($10,000 value)

- At least 1 new small-cap recommendation every month

- Full write-up and research on the company

- Access To The Wealth Summit Video Featuring Dr. Prins, Jon Najarian, and many others ($1,500 Value)

- Full Write-Up On NASDAQ:POOL ($250 Value)

- Best-Selling Book Collusion ($25 Value)

- Weekly updates on the state of the economy and the markets

- Real-time buy and sell alerts

Cost and Refund Policy

Cost

Prins offers a two-year subscription for $1,995. This is already a steal, she says. She claims that the value of her whole package is a little over $20,000.

Refund policy

Everything that Prins offers in her newsletter is highly priced. Even her “100% Satisfaction Guarantee” has a $5,000 price tag. According to her, if you are not satisfied with her newsletter, get in touch with her team at Paradigm Press. But, you will not get your money back. She will give you credits, though. That you can spend on HER other research services. A couple of issues here.First, she will not return your money. We feel that this is such a let-down for potential subscribers like you, our readers. If these experts are confident about their recommendations, they will gain loyalty. People will continue to subscribe because they are getting their money’s worth. Since they are becoming richer, they will cling to their source of valuable information.We think this no money-back policy is a form of insecurity on the part of the publisher and does not reflect well on the editor.Second, unlike most who give back credits instead of cash, her policy would limit you to spend them only on her other services. So it seems you will not even get to transfer to her colleagues at Paradigm Press or their affiliates. You are stuck with Prins.What do you think? Does this seem like a good deal? Tell us your thoughts in the comments section.

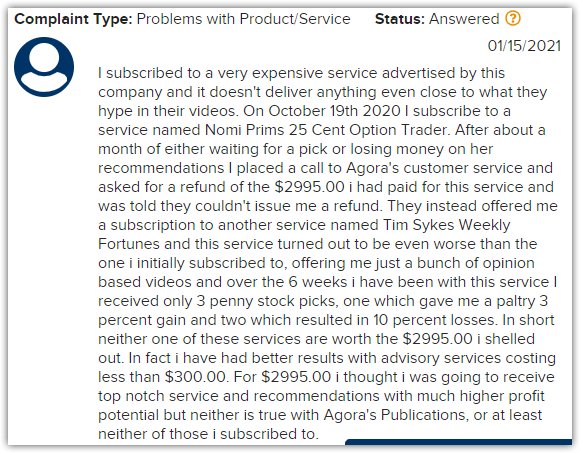

Reviews

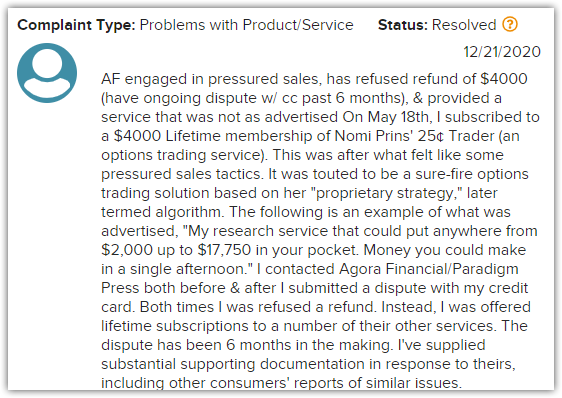

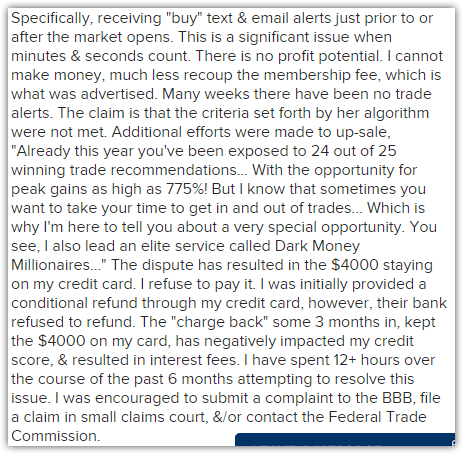

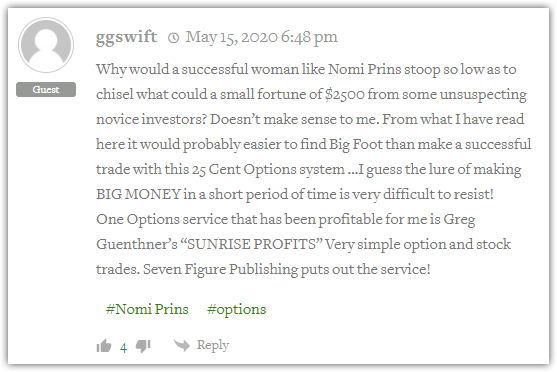

We searched online for reputable reviews of Nomi Prins’ Rapid Growth Opportunities. Unfortunately, as of this writing, there was none we could report to you.But as usual, we checked on her other services. On the Better Business Bureau website, there was no page about her or her newsletter directly. But her name has been mentioned a few times under Agora Financial.The comments were not positive at all. The reviews for her 25 Cent Trader newsletter mentioned how deceptive the marketing tactics were. Some reviews were also about the very recommendations she gave.

We also turned to Stock Gumshoe for more insights on Prins. Again, only her 25 Cent Trader service had a customer review page. The newsletter got a rating of 2.6 out of 5 stars from more than 250 votes.The majority of the comments were also negative. One even questioned why someone of her caliber would engage in such marketing practices.

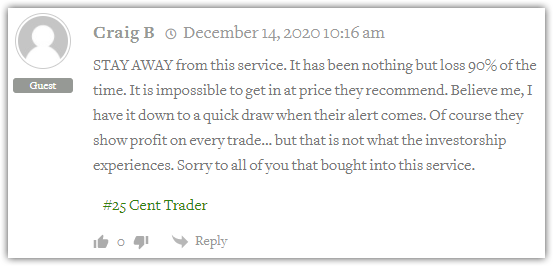

To be fair, we did see one positive comment.

As always, we will be the first to caution you that online reviews are only a part of the whole picture. If ever you would subscribe to her newsletter, we want you to be aware of the risks. This is true for the subscription service itself and the investments you will make based on these experts’ recommendations.We must also mention that Paradigm Press is connected to The Agora, whom we have mentioned a couple of times already.The review of Altucher’s Secret Income newsletter briefly touched on Agora and Yahoo! Finance’s criticism of their get-rich-quick advertising tactics.Our discussion on Alexander Green and The Oxford Club also mentioned Agora’s legal issues related to their marketing style.

Pros v Cons

Pros

- The editor has a credible reputation as a thought leader

- Small-cap stocks perform well even in crises

Cons

- Lacks details on her process

- Gimmicky marketing tactics

- Negative reviews of her other newsletter

Conclusion – Will You Experience Rapid Growth with Dr. Nomi Prins?

The author claims that her Reopening America Index will give you the top 5 small-cap stocks of the year (2021 at the time of this review). Also, her methods will reveal to you the best small-cap companies you should be investing in.However, she did not elaborate on her specific process on how she can help you grow your money.We also found negative reviews about the marketing tactics employed by her newsletter’s publisher/s. But, we also want to point out that she has a solid background as an investor. She has worked with the biggest companies in the industry.With this review of Nomi Prins’ Rapid Growth Opportunities newsletter, you were able to see all the pros and cons in detail. Are you inclined to subscribe? Tell us in the comments section.