What is Millionacres' Real Estate Winners all about? Is real estate truly a great way to diversify your investment portfolio? Do the advantages outweigh the disadvantages?

According to its website, the well-known Motley Fool is the parent company of Millionacres. As a brand, the latter's focus is on demystifying real estate investing.

It says that its goal is “to educate and empower investors to make great decisions and achieve success.”

The truth is, there are a lot of preconceived notions about this space. Such includes the need to have a large sum to start in real estate investing.

But, according to the firm, it largely depends on the kind of investment you want. There are those with high funding requirements, yes. But you may also start with smaller opportunities.

Meanwhile, others also think that investing in this area will automatically mean passive income.

Again, this is dependent on the effort and funding you put in. Some will require much work from you; some less.

Another myth the company wishes to debunk is that all real estate investing is easy. This is due to how television shows depict the field.

However, you may lose money if you are not thorough in your research. You must fully understand the ins and outs of growing and protecting your wealth in this area.

These are just a few of the misconceptions people have. Millionacres says that aside from giving you real estate investing opportunities, it also provides educational materials.

Such will indeed be helpful since many people, even seasoned investors, still do not understand this field. In our perspective, any effort to inform the public is welcome.

Such knowledge transfer will help them make wiser choices. As long as the information is accurate, it would be great for regular investors.

The question is, will the firm provide valuable and competent advice? Will people really get top-notch service from Millionacres' Real Estate Winners?

In our review, we will get real and talk about the unfiltered details that you need. Hopefully, after reading, you can determine if the advisory is worth your time and money.

Overview

- Name: Real Estate Winners

- Publisher: Millionacres / Motley Fool

- Website: www.millionacres.com

- Service: Investment research advisory focused on real estate

- Cost: $249 annual fee

Real Estate Winners is one of the two services of Motley Fool's Millionacres. The other one, Mogul, deals with high-level opportunities for more wealthy investors. The annual fee for that is $2,999.

Meanwhile, Real Estate Winners is the company's entry-level service. Every year, you will be charged $249 for 12 months of recommendations on investing opportunities.

According to Motley Fool, its parent company, it is offering the service so more people will consider real estate. Because it is affordable, even beginners and younger people will be able to avail of it.

In addition, Millionacres says that this space is also a lucrative option for the public. According to the firm, investing in real estate is a great way to diversify your portfolio.

The advisory will provide you with consistent content to help you see double-digit returns on real estate stocks.

What is Millionacres?

Millionacres, in a nutshell, is an advisory that deals specifically with real estate opportunities.

The reason for this focus is its assertion that the space is the “best investment class in modern history.” Motley Fool set this up to help more people maximize “real estate's high returns and stable performance.”

In fact, Millionacres says that it can give you access to this investment class through its alerts on the most lucrative REITs and equities.

The term “REITs” is short for real estate investment trusts. According to a CNBC article on REITs, these are companies involved in various income-producing real estate.

What's great about it is that you can invest in this space even if you don't manage a property. The article also says that it is one way to expand your investment portfolio.

This is among the reasons why the write-up reports that around 145 million Americans own REITs. Now, people are beginning to see the investment type as accessible and even easy.

Through the services of Millionacres, you can get started with just $1,000. Obviously, this amount won't get you anywhere with traditional real estate investments. It is much too small.

But with the publisher's services, this kind of money is enough to get your feet wet. This is true, especially with its entry-level service, Real Estate Winners.

Launched by Motley Fool in 2019, Millionacres' goal is to remove the mystery surrounding real estate investing. According to its press release, new tax laws and the Jobs Act contributed to its creation.

The team has also designed its website to make educational materials accessible to everyday investors. It is not just an advisory service but a resource for people who want to learn.

This aim is in line with the mission displayed on the company's About page.

Millionacres exists to make you smarter, happier, and richer through real estate investing.

The company, it says, understands that every individual has specific financial needs. So the team has ensured that there will be a variety of topics that will cater to different kinds of readers.

Whether you are new or seasoned, you will be able to see something helpful and valuable on the site.

As we have mentioned, this is a commendable move for the publisher. We have checked, and they do have a ton of materials. Initially, we were skeptical of how much content it will provide for free.

But we were pleasantly surprised at the company's generosity.

As of this writing, there are 21 articles covering a wide range of topics. These include REITs, industrial real estate, cap and interest rates, and opportunity zones.

There were even writeups on scams and fraud trends, diversity in real estate, and income-tax-free cities.

In addition, there are also hundreds of webinars, podcasts, and other videos. There is even a glossary for real estate jargon.

Granted, not all of these resources are in-depth. Some provided information that's readily available elsewhere.

But many people find the materials helpful. For example, there is an hour-long question-and-answer video with the CEO of Vacasa.

According to its website, the company is a vacation rental management firm. It oversees about 30,000 properties in North America, Belize, and Costa Rica.

The video, which also has a transcript, talked about rental trends, SPAC, and other topics. We believe people interested in rental properties will find this valuable.

According to its website, Millionacres believes in five core things.

1. You shouldn't have to pay thousands of dollars for real estate investing education.

To be fair, we do see that the company walks the talk on this first principle. As we have just discussed, it is generous with its online educational content. There are indeed a lot of free resources.

2. You should learn from people who have been in your shoes.

Because of this core belief, the website states that the team members have adequate expertise in real estate. We will discuss this more in the following sections.

3. We believe no one is impressed with jargon.

The advisory firm says that it imparts knowledge without the need to show off. Thus, resources on the website are free of fluff and insider language. The goal is to make real estate investing accessible to many users.

4. We rate and review tools, products, services, and books that we believe are important to real estate investors.

As independent experts, they give their opinions based on how they honestly assess things. According to the team, if you are reading something from the site, you can be sure the information you read is objective.

This seems to be a significant issue for the company. Right above the company banner on its website, there is a note on Advertiser Disclosure.

We do receive compensation from some affiliate partners whose offers appear here.Compensation may impact where offers appear on our site, but our editorial opinions are in no way affected by compensation. Millionacres does not cover all offers on the market.Our commitment to you is complete honesty: we will never allow affiliate partner relationships to influence our opinion of offers that appear on this site.

As you can see, the firm seems to put its independence and editorial integrity front and center.

5. We believe that individual real estate investors are a vital part of communities.

To achieve its goal, Millionacres frequently features investors on its videos. According to the firm, it is committed to “creating a diverse and open real estate investor community that offers opportunities for all.”

What is The Motley Fool?

The parent company sees itself as a provider of “expert investment guidance.”

We have already covered another affiliate of Motley Fool in the past. You can read about our Motley Fool’s Share Advisor (Australia) review on this website.

For the American brand, Green Bull Research has written about its teasers on Triple Buy Alert and Next Amazon Stock.

Aside from the U.S. and Australia, Motley Fool also has local stations in Canada, the U.K., and Germany.

The company says that it takes its purpose seriously, without taking itself too seriously. This branding is a standout because most investment advisories are often formal. Some even have a depressing tone.

But for this one, its business and financial tips have a somewhat irreverent feel. It is consistent with the origin of the firm's name.

The founders, Tom and David Gardner, were inspired by a character in Shakespeare's comedy, As You Like It. The court jester is the only one in the kingdom who can speak the hard truths without risking death.

Thus, the company sees itself as someone who can challenge conventional wisdom. Because of humor, those initially resistant to new ideas will eventually be won over.

The Guardian seems to think that the strategy is effective. In a Motley Fool feature in April 2000, the piece starts with this:

The Motley Fool began as a hoax. Now it's a serious player in investment advice, reports Jamie Doward.

Obviously, this is from years ago. How do current subscribers rate the company, its affiliates, and services? Does Real Estate Winners benefit from the vast network of its parent company?

We will discuss more of these below.

Real Estate Winners Team

According to its website, a core belief of the publishing house is:

You should learn from people who have been in your shoes.

Because of this principle, Millionacres assures its readers and subscribers that they are in good hands. The team behind the advisory, according to the firm, are all experts.

They have a high level of expertise in real estate — be it acquisition, investments, or writing.

Also, the leadership team members emphasize that they are independent. No sponsor or advertiser sways their decisions, so you only get their honest-to-goodness assessments in their materials.

But who exactly controls the day-to-day operations of Millionacres?

Greg Martz is the company's Director of Operations. He has been with Motley Fool since 1999.

A more recent recruit is Austin Smith, the Managing Director who joined the firm in 2011. The investor has been in the real estate scene since 2002.

Its Lead Investor also has properties and investments in commercial real estate. Matthew Argersinger has been an analyst and portfolio manager since joining the company in 2008.

Focused on service and experience, Angel Hembry is Millionacres' Customer Success Manager.

Meanwhile, Deidre Woollard serves as its Editor. Her family has long been in real estate, and she continued the tradition. As a former real estate marketing professional, she uses her skills to help subscribers.

Matt Frankel, the Senior Analyst of the group, is a Certified Financial Planner. He is also an investor in real estate.

The other staff is as follows:

- Matt Bray, Director, Millionacres.com

- Emily Strassman, Marketing Project Manager

- Kayla Schorr, Content Manager

- Mike Kaplan, SEO Engineer

What is Real Estate Winners

If you want to diversify your portfolio, Millionacres wants you to consider Real Estate Winners. The entry-level service wants to help you grow your wealth in real estate.

Once you subscribe, you will receive stock recommendations from experts in the field. The firm claims that it can help you get “returns like 13.4%, 14.1%, and 16.7% per year.”

Apparently, there are “unfair advantages” in real estate from which you can benefit. Examples of these are tax breaks and government-mandated payouts.

Through the service, you'll be a real estate investor even without the hassles attached to traditional properties. In fact, all you need to do is click on the recommendations of Real Estate Winners.

The advisory service banks on what it calls the “incredible wealth-generating power of real estate.” You can take advantage of this power when you subscribe to the research.

According to Millionacres, benefits from the asset class include:

- Tax-advantaged corporate structures

- Liquidity from REITs

- Steady cash flows streams from long-term tenants

- High cash returns through legally-required dividends

This space indeed has a lot of potential. The website even quotes Forbes, saying that “real estate has minted more billionaires today than any other asset class.”

But we wonder if such a setup would be advantageous to most regular investors. Yes, there are readily-available educational resources on the website.

However, not everyone can digest vast information quickly. So we are just concerned that people would get the wrong idea.

Though real estate has indeed made many people rich, there are also serious risks involved. People who do not fully understand that space may get too enamored by the “low volatility” claim.

While this is true, the more responsible thing to do is provide balance as well.

In fact, the sales page mentions only the benefits:

No matter where you look, the evidence keeps piling up – real estate investors are cashing in with REITs

Incredible income yields that can be twice or even TRIPLE what you’ll get from the S&P 500

Investing with Real Estate Winners alerts can truly be a ‘have your cake and eat it too’ opportunity with both growth AND income

Simply put: Real Estate Winners wants to supercharge your wealth, diversify your portfolio, AND provide consistent and predictable income

Of course, we understand that this is the marketing page. Obviously, the primary goal is to sell. But other advisory sales pages provide a disclaimer.

Some editors, even those clearly exaggerating, even emphasize the risks involved.

Here, one will get the impression that all is good and pretty with real estate investing. We think this is a disservice to potential subscribers.

How it Works

The advisory's experts say that they “have identified a select group of real estate investments and REITs.” Apparently, these are at the forefront of lucrative trends.

Annually, Real Estate Winners claims that these have “generated returns of 15%, 18%, and even 21% annually!”

Millionacres does not provide the actual plays, but it does give clues. One example is “The backbone of e-commerce” which has a 10-year return of 537.9%. Annually, this translates to 15.04%.

Unfortunately, the publisher is thin on other details. If you are someone who looks at the nitty-gritty of investments, you'll be disappointed.

All that you will see are vague descriptions and rosy claims. We have not read convincing details of the specific real estate opportunities mentioned.

In addition, real estate investment trusts or REITs are also included in the primary offering of Real Estate Winners. The newsletter has a particular focus on this because of its advantages.

The truth is, many people do see the value of investing in real estate. However, they do not know how to get started. There still are those who think that it is only for wealthy investors.

Down payment for properties can indeed be high and out of reach for the regular guy. If you renovate properties to sell them later, they would also require hefty sums of money.

With REITs, you can invest in properties as well. It includes housing developments, commercial establishments, health centers, and the like. However, you do not need to manage them directly.

What you can do is expose yourself to companies that invest in such properties. The article 12 things to know about these stocks that make owning real estate easy provides more details.

So when you subscribe to Real Estate Winners, expect stock recommendations from REITs and other real estate opportunities.

What You Get

Expect these when you sign up for the service:

- New stock recommendations each month

- Regular updates on recommended stocks following earnings and other events.

- Top 10 Investment Alerts delivered each quarter

- Tons of great educational content and resources to make you a smarter real estate investor

The list above is directly from the marketing page. Even if it looks skeletal, we appreciate how straightforward it is. There are no “special reports” or “bonus features” unlike most.

It appears that Millionacres is confident that subscribers would see that it doesn't have to resort to those gimmicks. After all, there are already tons of materials on its website.

Cost and Refund Policy

Cost

One year of Real Estate Winners will cost you $249.

Refund Policy

It appears that the service does not offer refunds.

Track Record and Reviews

As a relatively new service, there aren't too many reviews available as of this writing. Obviously, it cannot claim a long track record with only a few years in operation.

Some of the more reliable review websites have not featured it yet as well. So we will rely on what we can get our hands on at this time.

Real Estate Winners does not have a review page on Stock Gumshoe, but Mogul has. The premium service from Millionacres has a 4.3/5 rating from less than ten subscribers.

If the entry-level advisory is in the same league as Mogul, it could also be good. Again, we can only speculate since no one has reviewed it on the site yet.

Since Motley Fool is the parent company of this advisory, it would be interesting to see how its other services are doing.

We admit that this might not be overly helpful or valuable. But some of you might see it as context-building, so here are the ratings from Stock Gumshoe.

- 3.7/5 stars

- 100 votes

- 3.8/5 stars

- 1042 votes

- 3.7/5 stars

- 484 votes

The Better Business Bureau page of Motley Fool has 166 customer reviews and 144 complaints as of writing. The publisher has an overall rating of 3.98/5 by the time we publish this article.

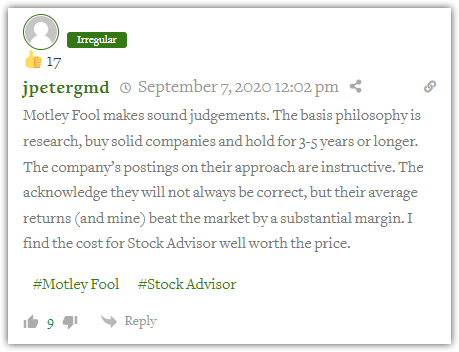

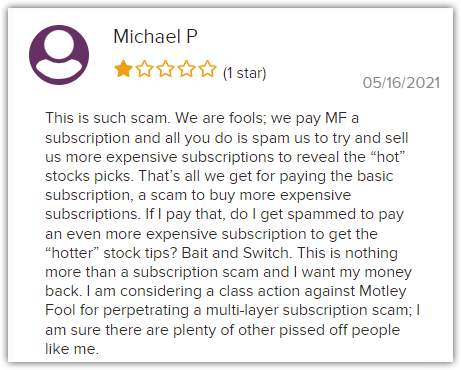

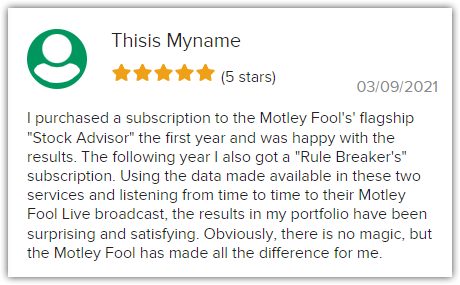

Here are a few of the comments from the pages above:

As you can see, the feedback varies from person to person. Some of the other comments praise the service to the high heavens. Others, meanwhile, want the publishers to rot in hell.

So, do exercise caution when evaluating the validity of subscriber comments.

Pros v Cons

Pros

- Vast library of free resources

- Real estate investments have a lot of potential

Cons

- Thin on specific details about criteria for “real estate opportunities”

- No refund policy

Conclusion – Is The Service A Winner?

Yes, real estate has made many people wealthy. A lot of the rich and famous made their fortune because of their skills in this space.

But will the experts in the advisory bring you to where these billionaires are? Probably not. At least not in the time frame you expect and they project.

Even if it seems risk-free, you need to practice due diligence so you won't lose money. The website offers a lot of informative resources, anyway. So you need to take advantage of that.

Is Millionacres’ Real Estate Winners worth your while? Before you decide, review all the points we made in this article. Our goal is to help guide you in your personal assessment of the service.