Due to high interest rates and inflation that will last the next decade, every American household will indirectly pay the Fed a whopping $63,000 in interest over the next few years.

Economist Mark Skousen has a “Profit Code” to counter this bleak reality, using something he calls a “cash collect” strategy, which is a “catch up” savings plan to ensure we’ll never run out of money.

The Teaser

Mark's “cash collect” strategy works even when economic and stock market turmoil rage on and he's going prove it with six years of historical data.

Mark Skousen is a real economist who occasionally also writes rather than an investment newsletter writer who pretends to be an economist. He earned a Master's degree in economics from Brigham Young University, his Ph.D. in economics from George Washington University, and he currently also teaches at Chapman University.

I have previously reviewed his $6 “Dark Lithium” Micro-Cap Company teaser as well as his publisher, Roger Michalski's “Operation Hoodwink” Semiconductor Stocks.

At the heart of Mark’s “cash-collect” strategy is a “Profit Code.”

11-12-23-29-S

Now this is not a code for options, warrants, or anything like that.

Instead, it's a code that can only be found in one out of 300 stocks.

Mark tells us that “Only stocks with this code can “lift off” and rise higher during a volatile market.”

As an example, back in May 2019 as the trade war between the U.S. and China intensified the DOW fell more than 600 points. But Mark’s “Profit Code” flashed green on Dolby Laboratories (NYSE: DLB).

Just two months after Mark’s call, the stock clocked a 174% gain.

This just goes to show that regardless of how bad the economy may get, there are always real businesses generating profits for their shareholders.

The problem was, that there was no system or tool, outside of basic filters to find these companies and compare their specific profit figures…until Mark Skousen took up this task six-plus years ago and came up with “the only tool in the world that can pinpoint such stocks with amazing accuracy.”

The Pitch

There's only one place to get picks based on Mark’s“Profit Code” system – the Five Star Trader research service.

The Five Star Trader is described as an exclusive, high-end research service whose doors are now opening to new members for a limited time. Normally, a membership retails for $1,995 a year, but now it's available at $995.

Membership perks include about two new investment recommendations per month, access to a portfolio, where you can see each open stock position and track its performance in real-time, a special report archive consisting of every special report Mark has written since the inception of the Five Star Trader, and more.

What in the World Does 11-12-23-29-S Mean?

Unsurprisingly, as a trained economist, Mark's “Profit Code” is based on economic and scientific principles.

To be more precise, its algorithm analyzes 30,000 data points of more than 6,000 stocks, rejecting 99.6% of all stocks it screens along the way.

This means that at any given time, only a mere 1.4% of stocks meet its stringent criteria, which Mark breaks down as follows:

- The company’s sales growth must be over 11%

- Profit margins must be over 12%

- Profit growth must be over 23%

- The price-to-earnings ratio must be below 29

- Must show institutional money buying in S

Looking at these, I personally like that Mark included a valuation metric, as growth at any cost has killed more investments than a Jim Cramer recommendation.

If you can get it, a price-to-earnings below 15 is always preferable, but in combination with double-digit growth and margins, a P/E of about 30 makes sense.

The Real-World Results

Besides backtesting, any trading system's true success indicator is how much its winning trades make up for the inevitable losses.

On this score, this is how the “Profit Code” system has fared since its inception:

- 17 wins out of 19 trades in 2016 (with a 12-win streak).

- 15 wins out of 21 trades in 2017.

- 13 wins out of 25 trades in 2018.

- 20 wins out of 22 trades in 2019 (with a 15-win streak).

- 24 wins out of 31 trades in 2020 (with a 10-win streak).

- 25 wins out of 28 trades in 2021.

Overall, the “Profit Code” system has produced an average annualized return of 136% since 2016.

At that rate, Mark’s system has outperformed the S&P 500 by 8x every year and returned 12x more than Wall Street hedge funds, according to data from Reuters.

The Profit Code's Secret

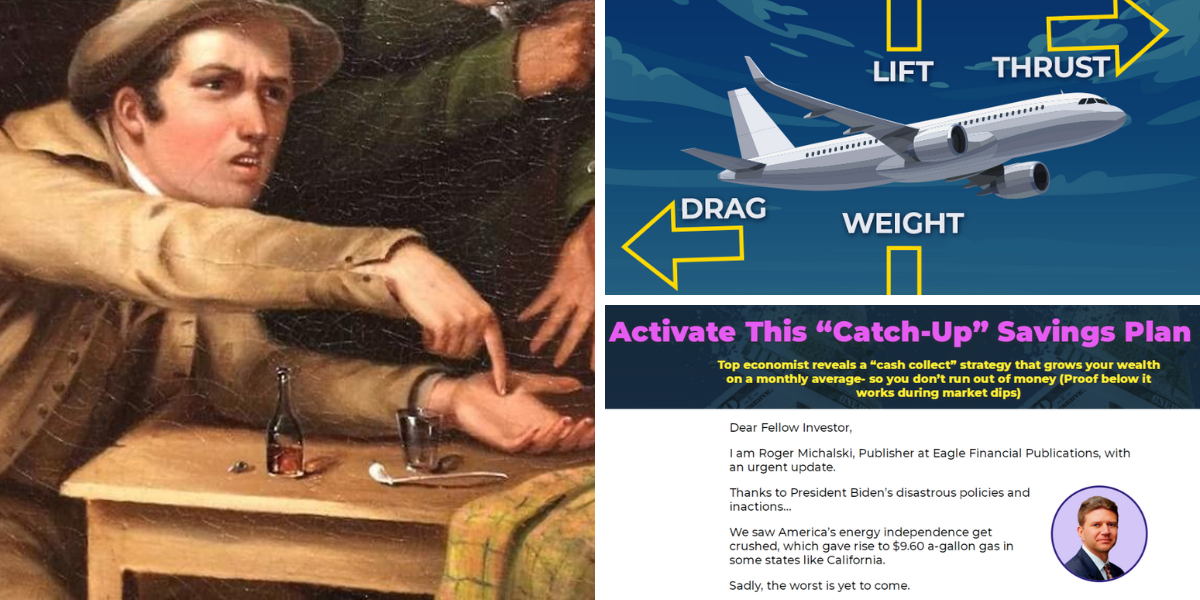

According to Mark, the Profit Code's success has been possible because of the weight assigned to each of its five factors, which could just as easily apply to an airplane as a stock:

- Thrust = Sales growth

- Drag = Profit margin

- Weight = Valuation

- Lift = Profit growth

- Weather conditions = Institutional buying

Any stock that rates well on the five factors in the code 11-12-23-29-S is crowned a Five Star Stock.

So, what stocks is the “Profit Code” system sending buy alerts on now?

Make $8,500 Every Month?

No specific stocks are teased in Mark's presentation.

It simply mentions that “Mark and his team are analyzing the data to select his #1 pick and Mark will send out a “buy” alert to a small group of readers any day now.”

This means we can get straight to the good stuff and try to find out how legit the profit claims are.

Near the end of the teaser, it is claimed that “$3,000 in each of Mark’s recommendations would allow us to collect about $8,500 monthly, on average.”

Assuming two investment recommendations per month, as Mark's Five Star Trader service advertises, and investing $3,000 into each, then $8,500 would mean a 42% return on $6,000…every month.

Not many places outside of loan sharking and following Nancy Pelosi's trades can one get these kinds of returns.

Revisiting the Average Annualized Return

Earlier, we mentioned that the “Profit Code” system has produced an average annualized return of 136% since going live in 2016.

This works out to just over 11% every month. Not 42%, but outstanding nonetheless.

If we look at the market conditions under which these outsized returns were produced, we will see that except for 2022 and 2018 to a lesser degree, the market produced an above-average return every year.

This runs counter to the claim that the Profit Code can produce gains during times of serious economic upheaval.

Not to say that it cannot work during a bear market, just a precaution that we haven't really seen it yet.

As a true blue buy-and-hold value guy, jumping in and out of stocks, accruing fees and capital gains taxes isn't for me. But, if short-term trading is more your thing, then Mark's Profit Code does have an enviable track record in good times and some bad, which is more than the vast majority of retail trading systems can claim.

Quick Recap & Conclusion

- Economist Mark Skousen has a “Profit Code” trading system that he claims can outperform any market turmoil.

- The “Profit Code” assigns five-star ratings to stocks based on five weighted factors – sales growth, profit margins, profit growth, a price-to-earnings ratio below 29, and institutional buying.

- There's only one place to get stock picks based on Mark’s“Profit Code” system – the Five Star Trader research service. Typically, a membership would cost $1,995 a year, but it's now going for $995.

- No specific stock picks were mentioned in Mark's presentation, but a few things stood out.

- Since 2016 when the “Profit Code” system went live, it has produced an average annualized return of 136% or just over 11% per month. However, the market has only had two down years during this stretch, so it is yet to truly be put to the test against a prolonged bear market, but its performance to date is better than the vast majority of retail trading systems we've reviewed.

What do you think of the Profit Code's five factors? How would you weigh them? Tell us in the comments.