Former trader, stock market analyst, and Goldman Sachs VP, Dr. David Eifrig has a number one investment recommendation for the upcoming election.

It's a secret way to get out of the U.S. dollar using something he calls a “Gold Bank.”

The Teaser

David says few people know that this type of trade is even possible and the handful who do would much rather keep this lucrative secret to themselves.

Dr. David Eifrig has been a part of the revamped Stansberry Research since it came under the ownership of the Beacon Street Group. We have reviewed Stansberry Research here in the past – Are The Services Legit? We have also covered their subscription-based trading advisory newsletter, The Stansberry Innovations Report.

Nobly, David is stepping forward now “because America has reached a financial breaking point” and what happens next is going to separate a small number of winners from a very large number of losers.

This is common investment newsletter fodder, but what David says next got me paying closer attention.

He states “Even a relatively small amount of money can go a long way when every $10 or so leverages the upside of two solid ounces of pure gold.”

The estimated upside we're told is “1,000% in the near future.”

So what exactly is he teasing here?

The Greatest Currency Trade Ever

Under conditions very similar to what we're seeing today – inflation, bank failures, war. The trade David is proposing resulted in a 995% gain.

It entails getting at least some of our money out of the failing U.S. banking system and into what he calls a “gold bank.”

Is he talking about gold coins in a vault, a gold deposit account at a private bank, or something else? The answer is the latter.

What is being promoted here is a plain old gold mining stock, with one significant difference…

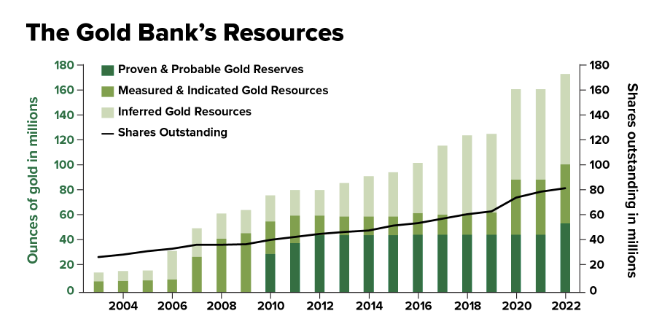

Unlike most gold miners, who raise money by issuing shares of stock and diluting shareholders. This company has grown its gold resources by more than 1,000% from 2003 to 2024, while its outstanding shares are up by only 212%.

Right now, it has more than two ounces of gold resources per common share.

This beats the metal value per share of any gold company in North America by a wide margin.

The Pitch

Everything we need to know about this investment is in a new special report called My No. 1 Gold Investment.

The report is reserved exclusively for members of Stansberry's Retirement Millionaire investment research advisory service, which costs $49. Stansberry's offer includes a 30-day money-back guarantee, 12 investment recommendation reports per year, two bonus reports centered around investing in times of crisis, and more.

The De-dollarization of The World

No matter who wins the presidential election this coming November, blue or red, it's likely not to matter, as they won't be able to stop the world from de-dollarizing.

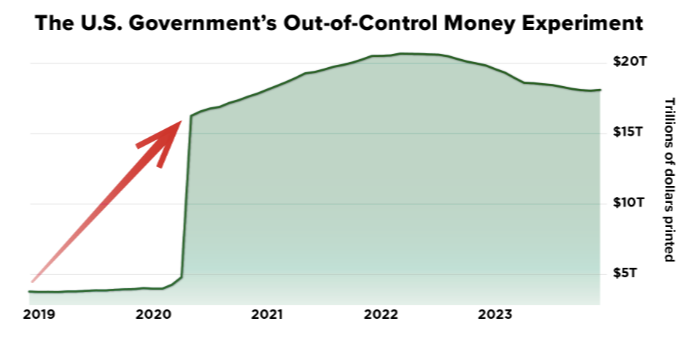

Reckless money printing and an expanding national debt have been happening for decades, but it may have just hit a wall. Here is one stat that proves it:

The U.S. money supply has grown nearly fivefold since the start of 2020, pushing the debt-to-GDP ratio to a dangerous 124%.

Of course, the U.S. is not the first and it probably won't be the last to have tried to print massive quantities of money in a short period of time.

Germany, Russia, Austria, Argentina, Brazil, Chile, Poland, and Ukraine, to name just a few, have all done the same thing, at one point or another.

So far, this experiment has a perfect track record.

Without exception, printing and borrowing money on such levels has always led to financial and economic crises.

When this happens people usually turn to one thing.

Early Stages of the Greatest Gold Bull Market Ever?

Gold has been money for thousands of years since the first gold coin was minted around 700 BC.

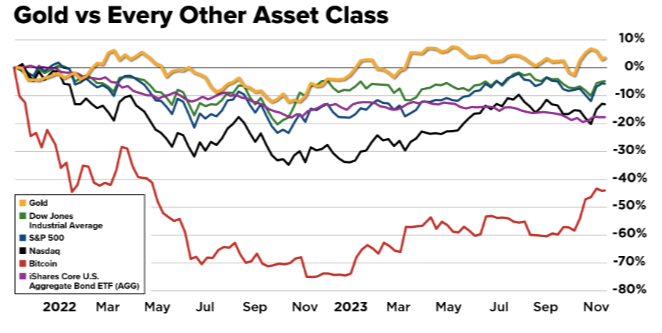

Many investors understand this, so gold has quietly outperformed every major investment class over the past two years.

But this is just the beginning.

David expects gold to easily hit $3,000 in the next year or two and $4,000 is not out of reach either, a double from today's levels.

He's confident in making this call because central banks themselves have been buying up gold in ever-increasing quantities. As this continues in the weeks and months ahead prices are expected to continue rising, leading to the greatest bull market we've ever seen in gold.

Others, like Forbes, have also echoed this sentiment, calling for gold to hit $3,000.

However, most folks will likely miss out on the biggest gains, unless they invest in this little-known “gold bank” stock that could 5x our initial investment, or more.

Revealing Dr. David Eifrig's Gold Bank Recommendation

We already know David is teasing a gold mining stock, but which one?

Here are the clues we have to work with:

- Since the company's inception, its business model has been to buy gold deposits on the cheap, explore for more gold, and, when the time is right, sell its assets to another company to construct a mine.

- It owns the world's largest undeveloped gold project, as measured by reserves and resources.

- The company has two ounces of gold resources per common share.

This was more than enough info to reveal the “gold bank” as Seabridge Gold Inc. (NYSE: SA). The clues align like gold bars in a central bank vault:

- On its website, Seabridge describes itself as “Continuing to search for gold projects in North America which would be accretive in terms of gold resources. Fund exploration and engineering work likely to expand resources, and sell its projects when they reach the production stage, to limit risk and share dilution.”

- The company's Kerr-Sulphurets Mitchell (KSM) gold project is the largest undeveloped gold deposit in the world, with estimated resources of approximately 4,793 tons.

- Seabridge's 2 oz of gold resources per share is tops amongst gold miners.

The Best Time to Invest in Gold?

Insofar as investing in gold, I'm a long-time gold owner myself and firmly believe in always keeping a portion of my savings in the shiny stuff.

When it comes to gold stocks, David is right when he says that “when gold goes up, gold stocks go up even more.”

The question is, how likely is Seabridge to outperform a gold stock index?

Well, between 2001 and 2008, Seabridge soared by more than 10,000%! But this was an outlier and should be treated as such because of the extraordinary circumstances leading up to the financial crisis.

However, a fairer comparison would be in the years that followed when gold jumped around 150% in less than three years, gold stocks rose by as much as 277%, and Seabridge stock went up by 293%.

From a valuation standpoint, the stock is only trading at 2x book value with a market cap of $1.4 billion. Of this, $1.1 billion is mineral assets on its books, $600 million in secured notes are its only major liability and $719 million makes up shareholder's equity.

Seabridge Gold is a quality find from a value and growth standpoint, as gold continues its climb against fiat currencies. The stock has the potential to be a 5-bagger and more.

Quick Recap & Conclusion

- Former trader, stock market analyst, and Goldman Sachs VP, David Eifrig has a number one investment recommendation for the upcoming election.

- It's a way to begin de-dollarizing with something he calls a “Gold Bank”, which is actually just a gold mining stock with two ounces of gold resources per common share.

- The name of the company and its ticker symbol are only revealed in a new special report called My No. 1 Gold Investment. It's ours with a subscription to Stansberry's Retirement Millionaire investment research advisory service, which costs $49 for the first year.

- David made the classic mistake of dropping one too many clues and we were able to swiftly reveal the “Gold Bank” stock for free as Seabridge Gold Inc. (NYSE: SA).

- Overall, Seabridge Gold is a good quality find. It has a relatively low valuation at 2x book value, is backed by more than $1.1 billion of mineral reserves, has relatively little share dilution, and is well-positioned for the future, as it owns the largest undeveloped gold resource in the world.

How high do you see the price of gold climbing in the next five to ten years? Let us know in the comments below.

Thank you, Theodor. SA is already one of the gold stocks in which I have a small position, and I appreciate the trouble you went to. I respect Dr Eifrig’s work; he often turns out to be right. Hope he is this time! Thanks for the encouragement.