The Oxford Club's Chief Investment Strategist, Alexander Green, finally shares the secret behind his investment success and “The Most Powerful Investing Secret in Stock Market History.”

It's not something he learned from Wall Street or an investing legend, but rather from a 3-minute conversation he had with a mysterious Costco manager 30 years ago.

The Teaser

Alex has personally used this secret to make an investment that went up roughly 100-fold, securing his family’s finances forever and he's recommending three stocks this secret is pointing to right now.

He's also used this “secret” to crush the market over the last two decades.

Besides the credentials just mentioned, Alex also previously worked as a Portfolio Manager at one of the biggest financial institutions in the country, with $2.75 trillion in assets today, and he helped build one of the world’s largest private financial research firms.

I just reviewed his “Next Magnificent Seven” AI Stocks teaser and we have also done a deep-dive on his time with the Oxford Club in the past.

As the story of the mysterious Costco manager goes, Alex was a research analyst at the time and also an avid basketball player.

Every Tuesday and Thursday after the market's closing bell, he would head to the local gym for some pickup hoops.

One afternoon, Alex was sitting in the bleachers after finishing a game, when he met a man who seemed like a regular guy. When Alex asked him what he did, the man sure enough told him he was a regional manager at Costco.

However, what the man shared with Alex radically altered how he viewed the world, specifically financial markets.

So much so, that Alex woke up the next morning and made an investment he had never made before, which years later would end up changing his family’s future.

So, what is this thing Alex calls “the single most important element to his success as an investor and analyst”?

He dubs it “the magic of thinking small”, which is code for small-cap stocks with one special attribute and he knows of a few that he doesn't expect to stay small for long.

The Pitch

Alex has a top stock recommendation and he's put all the details on it inside a special report titled The #1 Insider Stock for 2024.

The report is “free” with a one-year subscription to The Insider Alert research service, which costs $1,995. Included in the price is a 60-day money-back guarantee, 2-3 monthly trade recommendations, email instructions when it’s time to take profits on a position, plus access to an insider trading screener.

The One Attribute Every Small Cap Should Have

Getting back to our Costco manager story from 30 years ago…

What that man told Alex was that business was too good!

“You wouldn’t believe how fast we’re growing,” he said. “We can barely keep up with demand. I’ve been with the company seven years now, and let me tell you, it’s the craziest thing I’ve ever seen.”

That was the end of the conversation, but it was all Alex needed to hear.

Even though this Costco manager wasn’t a Wall Street trader or a Ph.D. economist he had something those people couldn’t ever get, real day-to-day experience inside a business.

The valuable lesson Alex learned on that faithful day was that when people inside a business signal things are going well, act on that information.

But how do we know when business insiders are signaling buy?

The Formula for Discovering Which Stocks Are Set to Skyrocket

As Alex puts it “To gain an investment edge, we need an information advantage.”

The only way to legally obtain some semblance of an edge is by systematically tracking a “Form 4“, which corporate officers and directors must file every time they buy or sell their company’s shares.

Unlike insider trading, which is what Martha Stewart did, Form 4 filings are public information and anyone can access them from the SEC's EDGAR database. However, it can still serve as an advantage because insiders can and do buy shares of their own company before big announcements are made public.

An early 2000s joint study by Harvard and Yale found that following insiders can help beat the market by 11% per year.

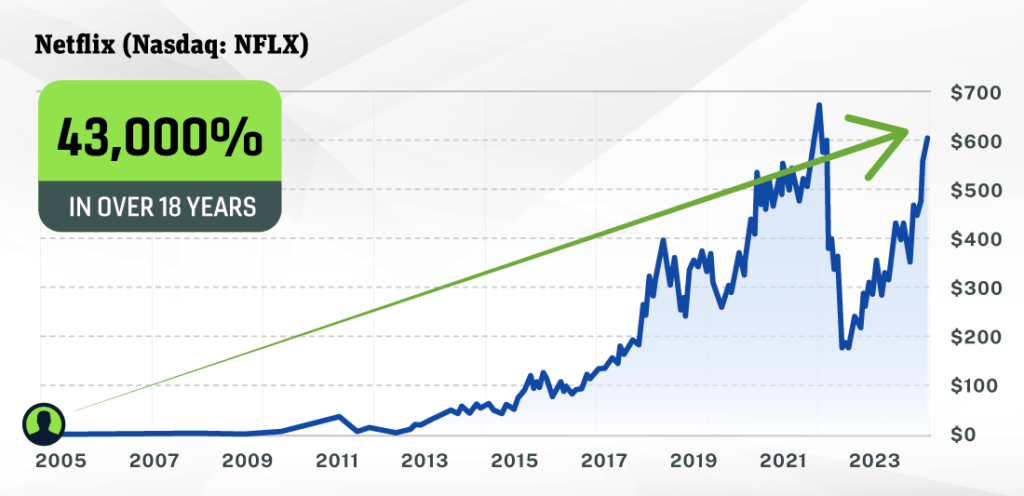

As for the investment that changed the future for Alex's family, it was Netflix (Nasdaq: NFLX) in late 2004.

The stock had just stumbled by 55% and things weren't looking so good.

But, Alex noticed that Netflix Director Michael Shuh wasn’t shaken. He bought $1 million worth of Netflix shares in late 2004. That's a lot of money for anyone, so he followed his move into the stock, buying a modest $5,000 stake.

Sure enough, after this insider buy, Netflix announced a partnership with Walmart, and the stock took off like a rocket. By the end of 2005, the stock had jumped 199%!

Today, Netflix is up some 43,000% over the past 20 years.

Alex admits that he still holds every share today and he's found a few small caps with major insider moves that could be huge winners as well.

Revealing Alexander Green's #1 Insider Stock for 2024

We get a few clues about Alex's #1 recommendation and two other small-cap picks, so let's dive right in.

- This company uses artificial intelligence to help companies discover new drugs at breakneck speed.

- They’ve supported 80% of all FDA-approved novel drugs over the past five years.

- The CEO has bought over $1 million of his company’s stock and the COO has bought over $200,000.

Going by this description, Alex's #1 pick is AbSci Corp. (Nasdaq: ABSCI).

- AbSci describes itself as a “generative AI drug creation company, creating better biologics for patients, faster.”

- I wasn't able to confirm the “80% of all FDA-approved novel drugs over the past five years” stat, but CEO Sean McClain has been buying shares, as have other executives.

1st Small Cap Stock

- This is a revolutionary royalty company in the agricultural gene editing field.

- Their technology is protected by 400 patents, giving it a significant advantage over competitors.

Given its unique profile, arriving at Cibus Inc. (Nasdaq: CBUS) wasn't hard.

- Cibus' gene editing technology is protected by 400 issued patents, which it licenses to seed companies in exchange for royalties.

2nd Small Cap Stock

- This last pick is a small-cap artificial intelligence company in the biometric space.

- It uses computer vision and machine learning to verify identity, scan biometrics, and authenticate documents.

Alex's final pick is authID Inc. (Nasdaq: AUID).

- authID is a business-to-business biometric identity authentication platform.

- Albeit from a small base, the company's fiscal year 2023 revenue grew by 1,200%.

Triple Digit Gains in Under 3 Months?

Alex has made his strategy seem very simple and straightforward, but there's a bit more to it.

Besides focusing on small caps with insider buys, there are three specific things Alex looks for inside Form 4 filings:

- Big purchases – typically $1 million or more

- Cluster buying – multiple insiders buying at once

- Moves from high-level executives – these are the top-ranking people at the company with titles like CEO and CFO.

If these conditions are met, the longest we should expect to hold onto a stock is 3 months after a major insider purchase, which seems counterintuitive as the primary reason for buying small caps is because of their long-term potential.

I suspect this could be because of the 6-month rule, which states that company insiders must hold onto the shares they purchase for a minimum of six months, per the Securities Exchange Act.

Alex says this strategy has beaten the market over a long period, as proven by multiple peer-reviewed studies and his own track record as Chief Investment Strategist at The Oxford Club over the past 20 years, which has produced gains of 526% versus the S&P’s 293% return.

One can't argue with results, right? Although, I would add that no strategy or indicator has outperformed in all market conditions.

Every small-cap purchased should also be a sound business, with profits, a decent return on equity, and trading at a fair price. This combination along with insider buying swings the odds decidedly in our favor.

Quick Recap & Conclusion

- The Oxford Club's Chief Investment Strategist, Alexander Green, finally shares the secret behind his investment success and “The Most Powerful Investing Secret in Stock Market History”, which he got from a Costco manager.

- This “powerful investing secret” is to buy small-cap stocks with insider buying that meets certain criteria, like big purchases of $1 million or more, cluster buying, and buys from high-level C-Suite executives.

- Alex has a top recommendation that meets this criteria and he's put all the details on it inside a special report titled The #1 Insider Stock for 2024.

- A few timely clues were dropped and that was enough to reveal Alex's top pick as AbSci Corp. (Nasdaq: ABSCI). Just for good measure, we also unveiled his two small-cap stock picks as Cibus Inc. (Nasdaq: CBUS) and authID Inc. (Nasdaq: AUID).

- No strategy or indicator is infallible during all market conditions. However, when strong insider buying is paired with a small cap that is also a solid business, the odds are decidedly in our favor.

Is insider buying one of your investment criteria? Drop a Yes or a No in the comments.

Thank you, Theodor.

Chuck W

Yes, I believe that’s a sound way to invest so I wouldn’t call Mr. Green a scammer.

The reveal was EXAI, Exscientia, not AbSci. EXAI will merge with RXRX in the spring of 2025. the merger will complement both as their platform approaches are different.