The headline of the sales page of Jim Woods’ Eagle Eye Opener is straightforward. It tells you right away its promise. Its unique selling proposition is: “Trade Alongside Wall Street’s Most Powerful Insiders”.Further, it claims that gains like these numbers are easy: 186.8%, 220.4%, 433.7%. There is a catch, though. You must have access to “the same secrets Wall Street’s power brokers use every single day.”How will you gain access to such a magic formula?Well, he can make that “proprietary intel” available to you when you sign up. It is his main selling point for his newsletter subscription service.

Overview

- Name: Eagle Eye Opener

- Investment Director: Jim Woods

- Publisher: Eagle Financial Publications

- Website: www.jimwoodsinvesting.stockinvestor.com

- Service: Daily investment advisory

- Cost: $139 quarterly billing ($556 per year)

Do you want exclusive access to “high-end, pre-market intel”? Are you interested in data that only professional investors used to have? If you want gains that will increase your wealth, Eagle Eye Opener has a mystery formula for you.Strictly speaking, it is not a novel method. The secret sauce with Jim Woods’ service is an insider he has teamed up with, an actual person. Unfortunately, because of an agreement he has with that expert, he cannot divulge his/her identity.Is this a believable, trustworthy, and legitimate proposition? We would love to hear your initial thoughts in the comments section.

Who is Jim Woods?

The guy seems to have the experience that you want in a financial newsletter editor. He has over 20 years of experience as a professional. He has been working as a broker, hedge fund manager, financial analyst, and author.Depending on the profile you read, he is either the number 1 or number 3 “financial blogger in the world”.

TipRanks “calculates that, since 2012, he’s made 361 successful recommendations out of 499 total.” With this number, his success rate is 72% with “a +15.3% average return per recommendation”.The former hedge fund manager has also co-authored two books.Released in 2008, Billion Dollar Green: Profit from the Eco Revolution talks about “green investing”. However, only Tobin Smith’s name (the main author) is prominently displayed on the cover. Woods’ name appears on the inside cover.But his name is written on the cover of the second book he co-wrote. Its title is The Wealth Shield: A Wealth Management Guide: How to Invest and Protect Your Money from Another Stock Market Crash, Financial Crisis or Global Economic Collapse.We wanted to tell you more details, but we are guessing the long title is already a giveaway. He and his co-authors released it in 2013.Woods graduated from the University of California, Los Angeles, with a Philosophy degree. After finishing college, he joined the military as a paratrooper.He started his gig as a financial journalist shortly after that.According to his blog, his nickname in high school is “Renaissance Man”. This explains why he has held many roles in the investment world. But the list at the beginning of this section does not capture everything yet.In his blog, Way of the Renaissance Man, he says that he is also a singer, songwriter, guitarist, and podcaster. Woods is also a martial artist, motorcyclist, Western horseback rider, an auto racing enthusiast, and a bodybuilder.

What are some of Woods’ investment ideas?

Eagle Eye Opener is a daily investment advisory released only three months before this review. Thus, there is very limited information on the service. But even with this fact, we want to give you an idea about Jim Woods and his investments perspectives. Through some of his thoughts, we hope to give you a sense of what you will expect from his service.Further, we want you to examine if your investment philosophy aligns with his. We believe this is crucial since you will be relying on his calls for investment decisions.

On Inflation and Commodity ETFs

In an article at Yahoo! Finance promoting his newsletter, Woods makes a case for commodities. He says that they are the most closely linked to inflation among the major asset classes.

He also adds that commodity exchange-traded funds (ETFs) have performed well during times of high inflation.The pandemic has brought a lot of uncertainty. As a result, the former trader says that everyone must have what he calls an “inflation playbook”. This includes having the previously mentioned commodities in your portfolio.Woods gives us three criteria when selecting commodity ETFs. These are exposure, liquidity, and K-1.First, he says that commodity ETFs have varying levels of exposure, which affect their performance. ETFs that have larger allocations in better-performing commodities will get better returns.Second, you must invest only in ETFs with plenty of liquidity so you can exit swiftly if needed.Third, it is best to look for a commodity ETF that meets the first and second criteria but with no K-1. He claims that investors and CPAs dislike it. They think K-1 adds unnecessary complications to their investments.

On Investing in China

Woods, in his articles, recommends investing in China. He holds the view that the country is still rapidly developing. Thus, you could make money through ETFs there.But he is also aware of the concerns some investors may have. The nation is controlled by the Communist Party. Obviously, they own the majority of the companies there. As a result, these will be affected should there be capricious government actions.So he recommends using WisdomTree China ex-State-Owned Enterprises Fund (CXSE). He says this about CXSE:

CXSE allows investors to avoid state-owned Chinese companies and thus exclude those enterprises whose fortunes could be especially sensitive to government decisions. Since the fund’s creation in 2012, it has averaged about a 13.5% return annually.

Further, the former broker says that you may also explore other industries in the country. Examples of these are the Internet and Information Technology.He cites KraneShares CSI China Internet ETF (NYSEArca: KWEB) as an example. It is a unique ETF with “pure-play exposure to Chinese software and information technology stocks.”KWEB, a foreign stock index, monitors Chinese internet businesses that are publicly traded in other countries.

The ETF provides exposure to firms that offer services comparable to US internet giants. Examples of these are Google (NASDAQ:GOOG), Facebook (NASDAQ:FB), and Twitter (NYSE:TWTR).It also provides exposure to businesses that experience success because of the country’s expanding middle class. The fund focuses on Chinese markets. Its portfolio includes large-cap equities like Alibaba (NYSE:BABA) as well as smaller- and mid-cap firms.

What is the Eagle Eye Opener?

In a nutshell, Jim Woods will be bringing you daily briefings of special insider information. Such will contain details on what is moving the markets.

He says that he will also add his take on why the markets are moving the way they do.What’s special about Eagle Eye Opener? It is the unnamed Wall Street insider Jim Woods is partnering with.He swore to keep his whistleblower’s identity a secret, so he will not say anything more about this person. But he wants you to trust his word that his insider knows a lot.His friend, according to Woods, is one of the smartest and most in-demand analysts in the industry. They promise that you will get sure profits from any which way the market behaves.Of course, even with such assurances of his service’s effectiveness, he has a disclaimer. He maintains that his newsletter is not some form of a crystal ball.We wholeheartedly agree. The promises are lofty and it does seem too good to be true. Compared with other advisory services, this relies on your trust alone. With others, you would at least have an idea of their process for their stock recommendations. To push the idea further, we do not even know if such a person exists. No one can vouch for his/her existence. Besides, anybody can just come up with a so-called mystery person. People can just claim that they have as an adviser someone who knows the ins and outs of the financial world.So who’s to say if this is only a marketing ploy? While we applaud the novel approach to a research service, we find the strategy odd. Of course, it will be an entirely different story if the recommendations will prove to be outstanding picks. In this scenario, if there is a proven history of success, other details would seem insignificant.But still, this industry banks on the credibility and the word of the newsletters’ editors. This is the reason why we spend so much time getting to know each of them on this website. We want to provide you a thorough background check. You will be entrusting your money to their financial advice. It is only right that you know where they came from, what their credentials are, and what their track record is.Sadly, we do not have those here. We only have information on Woods, who is only half of the team.Aside from the Eagle Eye Opener, Woods is also the editor of other newsletters. These are Intelligence Report, Successful Investing, Bullseye Stock Trader, and The Deep Woods.

How it Works

This is the premise of Jim Woods’ Eagle Eye Opener. Even before the opening bell rings at the New York Stock Exchange, the game has already begun.Professional investors already know what will happen. How? They have access to “private intel”. Regular retail investors do not have a clue about this.Woods claims that pros are armed with information on:

- What’s moving in the market today

- Why it’s moving

- What the trends are

- What’s likely going to happen that day, in the short term, in the medium term

- The best action to take in each of those scenarios

With such knowledge, they are aware of what drives the markets on any given day. This guides them to create a playbook.In the newsletter, you will get the advantage they have.

You will also get information on which sectors will skyrocket. Further, you will know key points that may signal a massive rally. One other benefit is that it will provide advanced information on market dumps.Despite a lack of useful details, Woods does give a concrete example. He hopes this is enough to guide his potential readersHe said that if you were his subscriber, you would have received crucial information on 28 October 2020.

His claim: he was able to advise his readers about the potential for travel during that period. His bases: lesser COVID-19 cases and the stimulus.If you were following his research advisory then, you were lucky. You would have gotten 21 gains just 5 months later from his ETF plays and straight stock picks.We believe this information is crucial. Here is the performance of those on his list:

- + 433.7% from AMC Entertainment Holdings (AMC)

- + 220.4% in TripAdvisor (TRIP)

- + 186.8% from Cinemark Holdings, Inc. (CNK)

- + 180% from Tanger Factory Outlet Centers (SKT)

- + 144% from Six Flags Entertainment Corp (SIC)

- + 141.2 from SeaWorld Entertainment (SEAS)

- + 135.4% from Carnival Corporation (CCL)

- + 99.1% from MGM Resorts International (MGM)

- + 95.9% from Expedia Group (EXPE)

- + 95% from Simon Property Group (SPG)

- + 80.9% from Imax Corporation (IMAX)

- + 71.4% from Live Nation Entertainment (LYV)

- + 70.3% from U.S. Global Jets ETF (JETS)

- + 70.7% from Royal Caribbean Group (RCL)

- + 69.2% from Marriott International (MAR)

- + 64.6% from Hyatt Hotels Corporation (H)

- + 61.3% from Disney (DIS)

- + 56.6% from World Wrestling Entertainment (WWE)

- + 48.05% from Hilton Worldwide (HLT)

- + 42.5% from Booking Holdings (BKNG)

- -0.58% from Hertz Global Holdings (HTZ)

He also points out in his sales pitch that there is only one loser here. It lost for only less than 1%.This is his biggest proof of the effectiveness of his service. It is true that others would have invested in them after such trends have become more obvious.

However, these investors would already have lost on the biggest gains they could have gotten. It was already too late for them.If you want more of these gains, he says you must subscribe to his newsletter.But he does not have a special method of determining these winning stocks. What he has is a Wall Street insider.This informant holds a goldmine of research like the ones Morgan Stanley and Goldman Sachs have access to. Jim Woods has partnered with this mystery person.

Through their partnership, you, a regular investor, can have better success.Together, they will open your eyes to new investing secrets through the aptly named Eagle Eye Opener. When you subscribe, you will have access to the daily briefings that contain their top-secret investment research.

What you get

He says that he will give you “proprietary intel” that will supply you with opportunities in these areas:

- Stocks

- ETFs

- Bonds

- Currencies

- Commodities

The advantage of his briefings is that he will spoon-feed you with only what you need. He does away with the “meaningless jargon and statistics.” Plus, it will only take you five minutes.You will receive these advisories at 8:00 am every trading day, before the opening bell.Woods also promises to give you “the latest economic data that impact investors in the market”. From time to time, you will also receive special bonus features. These will “more deeply analyze certain market sectors or developments.

Green Bull Research has written about other daily advisories. You may read about our opinions on Alan Knuckman’s Daily Double Club and Tom Gentile’s Daily Flash Cash.

Cost and Refund Policy

Cost

Jim Woods’ Eagle Eye Opener charges $139 every quarter, amounting to $556 per year.

Refund policy

This is what he says:

You MUST be 100% thrilled with your results from Eagle Eye Opener in the first 30 days of your membership, or you pay nothing.

It is not clear though, what his “risk-free” trial means. Newsletter service providers usually say this.

However, the implementation of these policies is inconsistent. Some return your money, some give credits. We advise you to exercise caution here.

Reviews

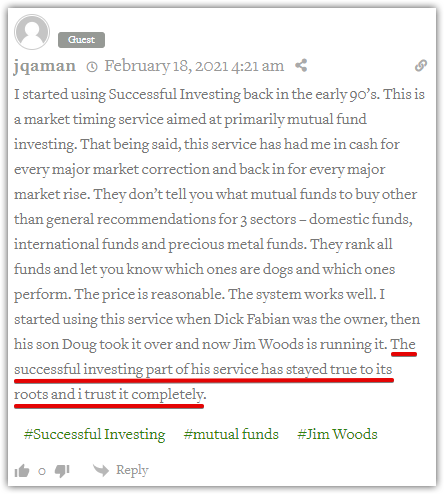

There are no reliable reviews yet for Eagle Eye Opener. Jim Woods just launched it three months before this review.As always, we do not let this limitation hinder us from giving you more useful information.At the Stock Gumshoe website, there are reviews for two of the editor’s other subscription services.The Successful Investing newsletter was originally from investor Dick Fabian. He then turned it over to his son, Doug. In 2017, Jim Woods took over as editor.Although most comments were about the father-and-son duo, there was one relevant comment. It mentioned how the commenter has been a subscriber during all the transitions. For him, the service has been consistently reliable even under the current supervision of Jim Woods.

The newsletter received a 3.6 out of 5 stars from over 20 votes on the websiteThe former trader’s other newsletter, Bullseye Stock Trader, received 3.4 stars out of 5 as of this writing.From our assessment, these are decent reviews from the subscribers themselves. The comments we found also do not contain complaints about deceptive credit card charges.Though these reviews are helpful, they still do not give us the full picture. Often, customer experiences vary, so use these information as you see fit.Also, if you want to read our review of a newsletter from the same publisher, we have one here. We have already written about Bryan Perry’s Cash Machine from Eagle Financial Publications.

Pros v Cons

Pros

- Good ratings for the other services of Jim Woods

- The editor publishes regular articles online which reflect his investing worldview

Cons

- Lack of details

- Reliance on a mystery insider whom subscribers cannot evaluate for themselves

Conclusion – Should You Open Your Wallet to the Newsletter?

Jim Woods offers a bold and interesting proposition. Trust him and his mysterious Wall Street insider. As a result, you will experience gains only the big players previously had access to.They claim that their daily briefings are comprehensive yet straight to the point. Reading them is akin to “reading tomorrow’s Wall Street Journal today”.What’s the catch? Well, he will not reveal who this whistleblower is. So you need to trust him that his friend is among the best financial minds in the industry.It is creative, we must say. But it seems to require too much blind faith. A quick scan of the reviews of Woods’ other services indicates a level of reliability in his newsletters, though. So we proceed to the bottom line. Is Jim Woods’ Eagle Eye Opener worth subscribing to? Honestly, only you could answer the question based on your assessment of the details we provided.