This review of Jim Rickards’ Strategic Intelligence will examine the man and his service. We will go behind his gloomy predictions.

The newsletter claims that it can help protect and grow your wealth even as the dollar collapses.

Indeed, fear seems to be the main ingredient in Rickards’ research service. From his perspective, a picture of the near future is dark and scary.

The man even says that he holds “shocking pieces of proof”. According to the investor, it will take a very long time before things go back to normal.

Rickards also asserts that what the media and politicians describe as “recovery” is only artificial, a mirage.

At best, the appearance of recovery is only temporary. He claims that the “don’t panic” posture of people will only hurt them in the long run.

The brutal fact, says Rickards, is that the five-year Great Depression is at hand. Investors and regular people need to hear this so they know how to respond.

The author believes that having this information is power.

But right now, many cannot take control of their finances. This will continue in the years to come.

Further, the crisis we are in will only get worse before it gets better. So it is crucial for you to take action right now.

He says this because he believes that there is still hope. Of course, you need him to have that ray of light.

Another claim is that only very few in the world can navigate in these times. As an economist, lawyer, and finance executive, he holds the keys to a crisis-proof future.

The man spent 40 years with leading thinkers and doers developing his special formula. In the past, this was only available to his friends and elite clients.

But now, the situation prompted him to make it available to his subscribers.

What does he have that others do not? How can he see what experts do not seem to have an idea of?

We will dive deep into the dire situation he paints and the solution he offers.

Overview

- Name: Strategic Intelligence

- Editor: Jim Rickards

- Publisher: Paradigm Press

- Website: www.paradigm.press

- Service: Monthly research newsletter

- Cost: $79, $149, $199 (special discounted offer: $129)

Strategic Intelligence relies on the track record its writer has built over the years. Will his expertise in various areas rub off on his investment advice?

Let's answer this question together.

Who is Jim Rickards?

A person like Jim Rickards demands attention. His persona and his ideas scream very loudly, it is impossible to ignore the guy.

Some people might call him a provocateur. His insights spark interest, controversy, and/or action. Further, you are bound to think about his ideas for a long while once you hear about them.

Others might refer to him as a doomsayer. After all, he has been predicting a new Great Depression after the pandemic.

According to his estimate, it will take at least thirty years before we experience 2019 economic levels again. That's three long decades.

But what is it about Rickards’ background that allows him to make such pronouncements?

In a promotional pitch for his newsletter, he used President Joe Biden as his anchor. The host of The Great Biden Swindle, introduces Rickards as “one of America’s most respected financial authors”.

There seems to be merit to this.

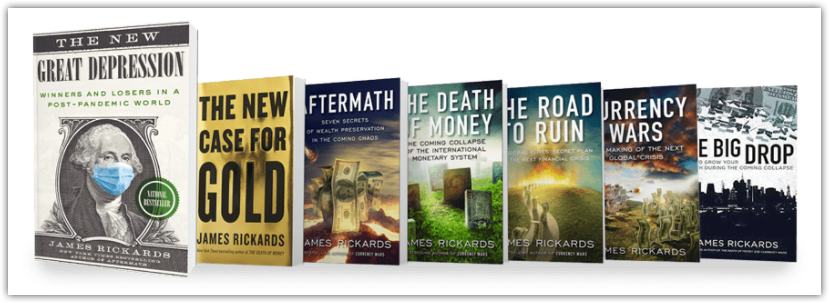

Since his books will also show us his worldview, we will briefly describe them to you.

Amazon lists down his highly-rated books:

- The New Great Depression (2020)

Wall Street Journal and national bestsellerReveals the true risks to our financial system and what savvy investors can do to survive -- even prosper -- during a time of unrivaled turbulence

- Aftermath (2019)

Wall Street Journal bestsellerShows why and how global financial markets are being artificially inflated -- and what smart investors can do to protect their assets

- The Road to Ruin (2016)

National bestsellerReveals the global elites' dark effort to hide a coming catastrophe from investors

- The New Case for Gold (2016)

USA Today and Wall Street Journal business bestsellerSteps forward to defend gold as both an irreplaceable store of wealth and a standard for currency

- The Death of Money (2014)

New York Times bestsellerShows why money itself is now at risk and what we can all do to protect ourselves

Explains the power of converting unreliable investments into real wealth: gold, land, fine art, and other long-term stores of value

- Currency Wars (2011)

New York Times bestsellerUntangles the web of failed paradigms, wishful thinking, and arrogance driving current public policy

Points the way toward a more informed and effective course of action

The author also boasts that the Pentagon and the CIA have gotten him in the past as an adviser.

According to his World Bank profile, he was an “adviser on the international economics and financial threats to the Department of Defense and the U.S. intelligence community.”

It also adds that Rickards “served as facilitator of the first-ever financial war games conducted by the Pentagon.”

Further, his introduction paints him as someone deeply embedded in halls of power. To prove the weight the publishers put on his credentials, we will quote the following based on the transcript.

The Great Biden Swindle says this about Rickards:

Spent 40 years building high-level contacts both in Washington and on Wall Street

Advised on a Presidential campaign and befriended four-star generals

Was on a first-name basis with members of Trump's cabinet

Negotiated the $4 billion bailout for Long Term Capital Management in 1998

Called by the CIA when they wanted his help uncovering anomaly investing patterns on Wall Street, just before the 9-11 attacks

Plugged into the Washington, DC machine since the late 1970s

Fraternized with four-star generals and NSA director, Michael Hayden

Made friends in Donald Trump's cabinet

Advised John McCain when he ran for President

If the goal is to show the extent of his experience, the pitch is effective.

But the unintended message is this. It appears that he takes advantage of every association he has for clout. Or in this case, for sales.

Aside from the collapse of the dollar, the pitch claims something more. It says that he warned the US Treasury about the certainty of a market collapse in 2006.

Further, Brexit and the presidency of Donald Trump did not come as a surprise to him because he has foreseen them.

In summary, we could say he has been around. He is an analyst, lawyer, economist, op-ed contributor, and inventor, among others.

The editor of Strategic Intelligence has also attended prominent schools. He holds an LL.M. (Taxation) from the NYU School of Law and a J.D. from the University of Pennsylvania Law School.

Moreover, Rickards has an M.A. in international economics from SAIS and a B.A. (with honors) from Johns Hopkins.

Our goal with this lengthy profile is not to promote the man and his newsletter. We merely want to show you that the person himself has a long list of credentials.

But this does not always guarantee a great newsletter service.

In our experience, even the most well-established personalities get ugly reviews. Usually, the comments revolve around the marketing tactics employed or credit card issues.

Of course, there are those dissatisfied with the actual investment advice. Some say the recommendations made them lose money. Others do not find anything special with the advice given.

So even if he is impressive on paper, we will still encourage you to read further. This article will discuss more details about his newsletter and how it works.

What is Strategic Intelligence?

Since the collapse of the dollar as we know it is inevitable, Jim Rickards wants to help you prepare. He wants you not just ready, his goal is to make sure you will profit from it.

This is the thesis of Strategic Intelligence.

The author has created a unique way of looking at the financial system and stock markets. This allows him to securely direct your investments.

He knows exactly how the dollar's depreciation will play out. Moreover, the analyst can predict which equities would plummet. The economist adds that he is able to tell which assets might skyrocket in value.

Rickards refers to this prediction technique as "complexity theory". It will alert you well ahead of the impending collapse. According to him, this is a unique and unrivaled instrument in the financial world.

This is what he will use to assist you in establishing secure investing positions. With his help, you can still invest in “stocks, bonds, cash, art, land, precious metals, and other hard assets.”

Through his monthly advisory, you will regularly get direct updates from him. Rickards will give his regular insights on:

- how the dollar’s collapse and replacement is unfolding

- the potential triggers that may set off the coming crisis

- specific investment recommendations

- wealth protection strategies during the meltdown

The author is no stranger to big, bold claims and predictions.

He even has a teaser that we previously reviewed here at Green Bull Research. We tackled Rickards' "#1 silver mining stock" that could have "gains of up to 1,000%".

How it Works

The strategy, according to the lawyer-investor, is the very method he uses for his family’s wealth. It also works with whatever amount you have in your bank account.

He arrived at his formula through more than 4 decades of market analysis. Moreover, it is a result of 19 years of studying risk algorithms.

To ensure its efficacy, he has also collaborated with special advisors. His consultants include Nobel Prize winners and former heads of the Federal Reserve.

When you subscribe, you will access this information.

In addition, he will reveal why one of his prized strategies involves gold. The former hedge fund manager believes it could soar to at least $14,000 an ounce.

He believes this could happen in 2024. Since this is already very near, you need to know about it right now: how much gold to buy and in what form.

We have documented Rickards’ leanings towards investing in gold. In our article on his “10x Gold Script” teaser, we discuss his claims on “the biggest gold boom ever”.

The investor also lists three steps that you need to do to protect and grow your wealth.

- Step One:

Own Physical Gold Before It Hits $14,000 Per Ounce - Step Two:

Go Beyond Gold For Gains as High as 2,000% - Step Three:

Brace Yourself For Joe Biden's America

Of course, these are broad statements. To maximize his advice and get instructions, you need to subscribe.

It is laudable that there is a lot of information from the newsletter.

But, the majority of these are about the author and his prognosis. We expected more insight into how his process works so subscribers would get a better idea.

Without this, all the other information just becomes fluff.

For sure, Rickards stands by his predictions. But since you will spend on his advisory, you need a clearer picture of his formula.

What you get

Jim Rickards claims that what he will share in the newsletter used to be unavailable to the public. This information was only for his high net-worth clients and members of the U.S. intelligence community.

But now you have a chance to learn from him.

When you click on the publisher’s website, it will lead you to his regular basic package. For a one-year subscription, prepare to shell out $199.

Strategic Intelligence Includes:

- Jim Rickards’ Strategic Intelligence delivered directly to your inbox monthly

- Free Monthly Live Intelligence Briefings with Jim Rickards where he will answer your questions

- Private access to the Members-Only Website

- Master Archives of all Jim Rickards’ Strategic Intelligence newsletter issues and report library

- Free daily e-letters

- The Daily Reckoning

- Agora Financial Executive Series, featuring the 5 Min. Forecast

You would know by now that publishers always come up with promotional offers. Rickards has special deals included in The Great Biden Swindle.

Here are the inclusions in different price points:

- Special PLATINUM Offer: $129 (from $199)

- Digital and print issues of the newsletter

- Weekly updates and other regular benefits

- Free report library and free Master Class series

- 10 Winning Trades For the Post-Pandemic World

- Twenty Stocks to Dump and Five to Own

- The $4 Company Behind the World's Last Pure Silver Mine

- Biden Survival Master Class

- Free copy The New Great Depression: Winners and Losers in a Post-Pandemic World

- A new hardcover copy of Rickards’ national bestseller

- Discusses the hidden costs of the lockdowns, post-pandemic boom, and the best way to invest in the five to thirty-year fallout

- Free copy of The New Case For Gold

- Shows proof for soaring gold prices for years to come

Includes secrets on gold: buying, storing, investing

- Shows proof for soaring gold prices for years to come

- SILVER Level Offer: $149

- Digital and print issues of the newsletter

- Weekly updates and other regular benefits

- Free report library and free Master Class series

- Free copy of The New Great Depression

- Bronze Level Offer: $79

- Digital-only issues of the newsletter

- Weekly updates and other regular benefits

Will you get your money's worth when you subscribe? Are you going to benefit from his perspectives?

A close look at his credentials reveals that he has interesting things to say. He even writes opinion pieces for the Financial Times, Evening Standard, New York Times, and Washington Post.

Media like BBC, CNN, CNBC, Bloomberg, Fox, and The Wall Street Journal also frequently have him as a guest.

Cost and Refund Policy

Cost

Regular one-year subscription: $199.

The Great Biden Swindle offer:

- Special PLATINUM Offer: $129 (from $199)

- SILVER Level Offer: $149

- Bronze Level Offer: $79

Refund Policy

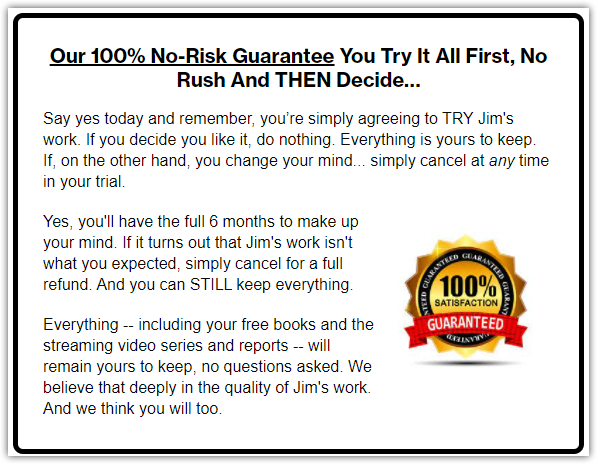

In our reviews, we always strive to be fair and give credit where credit is due.

We want to highlight this refreshing refund policy that seems to give subscribers a great deal. Strategic Intelligence gives its readers a full six months to change their minds.

If you think the investment advice is not worth your money and time, call them. Then, they will give you a full refund. On top of that, you get to keep all the freebies and reports, including the editor’s books.

This is a reassuring gesture. We hope many investment advisory publishers will follow suit.

Reviews

This will be interesting for you. If you are already leaning on subscribing to Strategic Intelligence, read further.

It's important to note that you will also see frequent mentions here about Agora. The reason for this is that its publisher, Paradigm Press, is under The Agora.

You may also read more reviews of newsletters associated with the company here. We recently wrote about Nomi Prins’ Rapid Growth Opportunities and The Altucher Report.

First, we looked at the website of Pissed Consumer. We did find some comments on Jim Rickards under Agora Financial. But these were reviews of his other newsletter services.

Reports there were mostly negative. But we can expect this from a website documenting customer complaints. To be fair to the specific newsletter at hand, those were not included in this article.

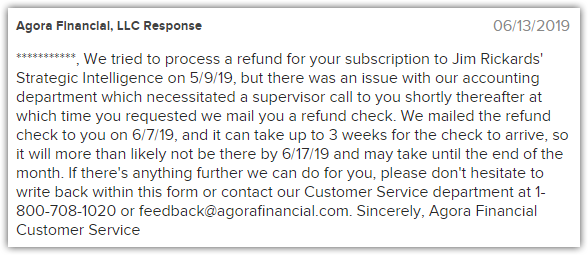

Second, in the Better Business Bureau, we have also looked at reviews. There was one comment that specifically mentioned Strategic Intelligence under Agora Financial.

The images below show an irate subscriber complaining about the whole ordeal. Even after a reply from Agora, the customer threatened to bring this up with the Attorney General.

Third, in Stock Gumshoe, you will see different points of view on the newsletter service. It is not shocking as Rickards’ entry-level advisory received a 2.5 out of 5 stars from more than 300 voters.

Moreover, the comments below give a balanced view. They acknowledge that the author is credible and smart. But what they have issues with is his competence in investing.

This is the reason why we want our readers to have a deeper understanding of each newsletter. One aspect may be good, such as an accomplished investor, a proven publisher, or some other factor.

But when seen as a whole and it does not deliver, would you still spend your money on that service?

This commenter below has some harsh words for Rickards and his advisory. It seems the person experienced trauma from the experience.

The next one is a constant complaint with The Agora. Often, even if the services seem legit, their reputation suffers because of bad customer service.

Also, everything today is digital, why can’t they respond better to subscribers? In the first place, why are there sketchy credit card charges? This can all be frustrating for the regular consumer.

On one hand, we commend their great refund policy. But on the other hand, if it will not be implemented well, it will be useless.

We also want to point you to these next comments, which to us are sober and fair.

They seem to understand Jim Rickards and his limitations. But they still see the value in what he brings to the table.

One even says that he reads the newsletters more for the information than the financial advice. Despite this, he still calls out Agora.

Pros v Cons

Pros

- Jim Rickards is among the most prominent and experienced of the editors we have reviewed

- Compelling arguments for his worldview

- Has affordable options

Cons

- Negative reviews

- Uses fear to drive sales

- Makes outlandish claims and predictions

- Lacks details about the newsletter's methods

Conclusion - Will Fear Drive You to Subscribe?

What kind of an investor are you?

Interestingly, the editor uses doom and gloom as a strategy to get more subscribers.

It might be effective in driving you to action. But how will this affect you in the long run? As investors, we often hear the adage that we must not act on impulse like fear.

Of course, for Rickards, he does not believe he employs scare tactics. What he preaches is the truth. And this argument holds water if you believe in his predictions.

What's clear is that there seems to be a consensus on his track record. It is impressive.

But still, the question is: can he give credible investment advice?

Based on this review of Jim Rickards’ Strategic Intelligence, what do you think? Let’s talk in the comments section, we would love to hear your take.

I am wondering if anyone has compiled a list of his predictions over the years and how many came true or not. If anyone knows this, please comment.

The subscription comes with a daily updated accessible portfolio that shows all the current and past recommendations, with the exception of two add on newsletters that were closed out.

You can see al the details of the winners and losers as well as links to the actual recommendations when they were made. Also, continuous updates of hte recommendations.

Thank you for your perspective. I have unsubscribed from every investment newsletter I’ve received. I have been scammed one to many times in my life, unfortunately in a big way. Every one of these newsletters hangs on fear mongering. There is so much information coming at you from so many people trying to scare you into thinking that they have the answers. I don’t know if Biden really signed that EO, or if it even means what Rickards says it does. I think the United States turning into China or N. Korea or Canada even is a slim possibility without a Revolution happening. I hear that President Trump has been working behind the scenes & things will never get this far. It’s to the point that one doesn’t know who to believe anymore. This is paralyzing. And most of us don’t even have ‘wealth’ to hold on to. If we are lucky we have a nest egg that we will probably outlive unless we can figure out how to grow it. So, for some reason I read, didn’t listen, to the latest iteration of the Strategic Intelligence which BTW is $49 now & I don’t do anything with out checking on it. So I am going to unsubscribe from it as well. I never signed up to receive any of these emails & I find them very upsetting added to all the upheaval & chaos in the world. I think there are just a few kernels of truth, just enough to make you interested if you haven’t already been burned.

All you need to do to convince yourself that Jim Rickards knows what he is talking about is to read The Big Drop that was published in 2015. Then look around at what is going on right now, he talked about virtually everything we see today.

I just signed up for the newsletter to get the history infor he shares, but am not interested in investing. That was threed days ago, and they said it would be downloaded in my computer within 20 minutes. I still have not received it, and was concerned I had been taken advantage of as I had put it on my credit card. email is scacwastt@windstream.net