Teeka Tiwari… is he a fraud or a savior for Main Street Americans?

In this post we'll be taking a look at who the guy is and whether or not you can trust him, with a focus on the actual performance (track record) of his investment recommendations.

Update: Teeka got fired (Feb 2024)! More info on this here.

Truth be told, when I first came across Teeka in one of his many hyped-up promotional videos, I thought for sure he was nothing but a scammer. He certainly has a way with words and his offers are oohh-so enticing, but being a natural skeptic he just came across as one of the many snake oils salesmen out there.

Teeka is a master of hype, which has become evident from many of the investment teasers of his that I've come across.

In his “The Investment of The Decade” teaser it's stated that investors could “turn a simple $1,000 into $1.6 million or more”…

This was all about investing in blockchain technology.

And then there was his “America Reborn” teaser in which was stated that an “unstoppable trend is set to create 818,236 new millionaires” and that “those who get left behind could slide into poverty”…

*And some other recent teasers I've found include one for his “1170 Accounts” and his “Tech Royalty Summit”, among many more of course.

Now of course we all want to be millionaires and none of us want to fall into poverty, but you have to be careful with taking what he says to seriously… take things with a grain of salt.

It's easy to listen to Teeka, start daydreaming about your future newfound riches and cruising on that new private yacht, and then before you know it you have your credit card out and just spend $5,000 on one of his advisory services.

Due diligence is key. Don't let emotions get the best of you and always take a minute, hour, day, or however long you need to think before buying into anything.

The good news is that this is exaclty what you are doing reading my post right now.

So, anyways, let's talk about who this guy is and then get into the performance of his recommendations, which were better than I initially expected.

Who The Heck Is Teeka Tiwari?

It's often mentioned that teeka is “widely considered one of the premier crypto analysts in the world”. He's been on Fox Business Network, Fox News, CNBC, ABC's Nightline and other TV shows. He's all over the internet and he has tens of thousands of subscribers to his investment newsletter services… so he must be legit, right?

Well what I've found is that nearly all of the information about him that is available online is the same re-hashed information that I'm about to re-hashed once more here.

Tiwari's Background:

The story that has been repeated again and again goes like this: Teeka came to the US out of foster care in the UK at the age of 16 with only $150. By the age of 18 he was the youngest employee at Lehman Brothers and became the youngest VP ever at Shearson Lehman just two years later. Later on he made a bunch of money shorting the market during the Asian crisis in 1998 and subsequently lost it all and had to file for bankrupcy. Then he launched his own hedge fund a couple of years later that went on to do very well and has since made the transition to helping out Main Street Americans by running various investment advisory services through Palm Beach Research Group.

But is there really any truth to this?

As I mentioned, most of what you'll find online about the guy is just re-hashed info, but luckily I was able to find some better proof after digging around a bit.

What I found at FINRA supports his background working at both Shearson Lehman and Lehman Brothers…

However, the facts are still a bit confusing to me. In Tiwari's author profile at Palm Beach Research it is stated that he was the youngest employee (at the age of 18) at Lehman Brothers and then two years later became the youngest VP ever at Shearson Lehman. But according to the screenshot I took from FINRA above, he worked at Shearson Lehman first and then two years later at Lehman Brothers.

Is this just a simple mix-up? I suppose so.

Additionally, I was able to find some supporting evidence of Teeka launching his own hedge fund – a SEC filing for offering of securities by his company Teeka Tiwari & Company, LP, which is indeed a hedge fund. This was first filed in 2010.

Barred from FINRA?

Going back to FINRA for a second… Teeka was actually barred by this regulatory orginization. This is the type of thing you won't here him say about himself.

This is information that was hard to find, but it turns out that he was barred in 2005 for this reason:

NASD CONDUCT RULES 2110, 3040, 3030 AND 8210 – TEEKACHAND TIWARI EFFECTED SECURITIES TRANSACTIONS AWAY FROM HIS MEMBER FIRM BY SOLICITING PUBLIC CUSTOMERS TO PURCHASE SECURITIES IN A LIMITED PARTNERSHIP. PRIOR TO EFFECTING THESE PRIVATE SECURITIES TRANSACTIONS, HE FAILED TO PROVIDE WRITTEN NOTIFICATIONS TO, OR OBTAIN WRITTEN APPROVAL FROM HIS MEMBER FIRM. IN ADDITION, TIWARI FAILED TO PROVIDE WRITTEN NOTIFICATION TO HIS MEMBER FIRM OF OUTSIDE BUSINESS ACTIVITIES. FURTHERMORE, HE FAILED TO APPEAR FOR AN NASD ON-THE-RECORD INTERVIEW.

Now I'm no expert on these matters and don't know all the details to assess how serious this really was, but what we do know is that Teeka started to work outside of his member firm and this is what landed him in trouble. He got a little carried away and started to freelance for a bit.

But does this mean he's a fraud and that you shouldn't trust him?

At the present moment

His past may be a bit sketchy at times, but let's move on to the present and where he's at now. One of the most obvious things we know about Teeka is that at the moment he is working for Palm Beach Research, which is the company he's running his various investment newsletter services though. These include:

- The Palm Beach Letter – entry-level newsletter service providing investment recommendations in the stock market and cryptocurrencies

- Palm Beach Confidential – cryptocurrency investment advisory service where Teeka targets (mainly) smaller crypto projects for potentially large asymmetric gains

- Alpha Edge – based around Teeka's “alpha edge” strategies to beat the stock market, strategies he used to manage money for high-net-worth clients back during his Wall Street days

- Palm Beach Venture – investment advisory service where he looks for sweetheart deals in big trending markets for asymmentric returns

- Palm Beach Quant – investment advisory service focused on making regular earnings via options, all based on a computer program that detects market patterns

- Palm Beach Crypto Income – cryptocurrency investment advisory service for investments that pay out “dividends” in the crypto space

*Note: According to Teeka's Linkedin profile, he also recently (Feb, 2021) started working as an Executive Chairman Strategy Board at Routemaster Capital, which will be changing their name to DeFi Technologies. His role here will be to manage DeFi blockchain investments.

That's right… blockchain investments. This is where Teeka is most involved, including with his newsletter advisory services.

Due to the cryptocurrency boom and excitement alongside this new form of investment, his crypto services have been some of his most successful, and in the rest of this review we'll be talking a look at just how successful they've been. In particular, we'll be looking at the track-record of his Palm Beach Confidential newsletter service. This service costs $5k a year to get access to and the reason we'll be looking at this one in detail is because I don't have access to all of them, but do have access to this.

But first let's look at some common complaints about the guy.

Complaints & Scammer Accusations

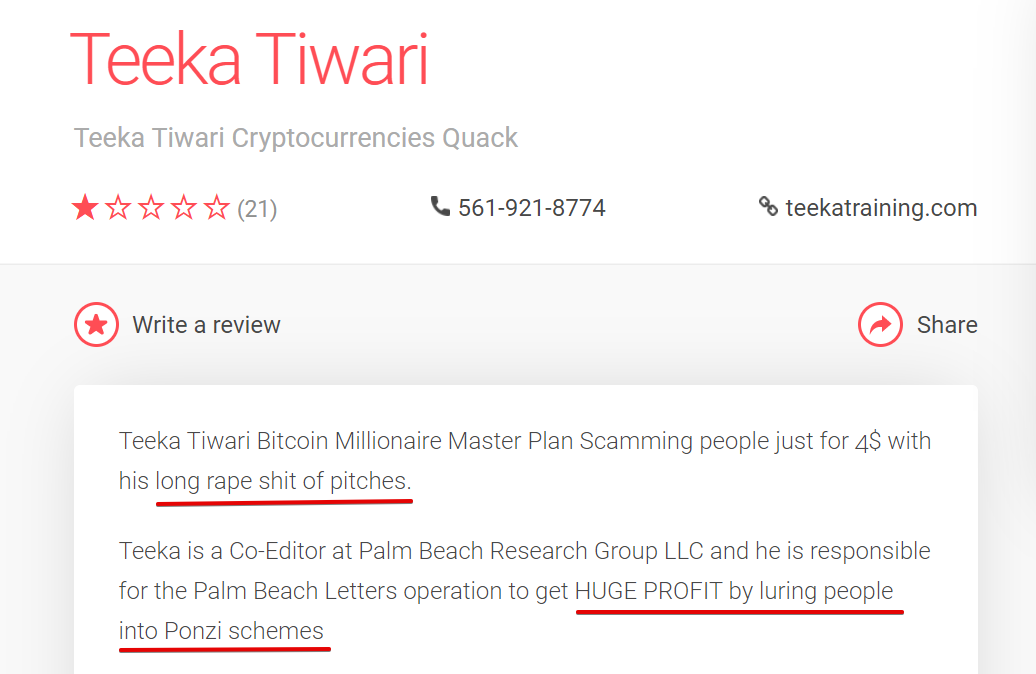

Okay, so we've talked about how much Tiwari hypes up investment opportunities to bring in new subscribers to his advisory services and we've just talked about how he was barred by FINRA. Now let's take a look at some complaints from normal folks.

If you simply Google “Teeka Tiwari scam” you'll find plenty of results… people accusing him of all sorts of things. But most of them hold no weight.

For example, here's a complaint post on the Dirty Scam website accusing him of running a Ponzi Scheme…

A Ponzi Scheme? Nope, doesn't make any sense. A Ponzi Scheme is a scheme where investors are lured into a fake investment opportunity and paid profits with the money coming in from newly lured in investors. Teeka recommends real investment opportunities so this is certainly not true.

It seems that most of the baseless complaints and scam accusations come from people who see his ridiculously hyped-up pitches and immediately write the whole thing off as some sort of scam without really looking into things… which is understandable.

However, there are some legitimate complaints out there. Let's take a look at a few…

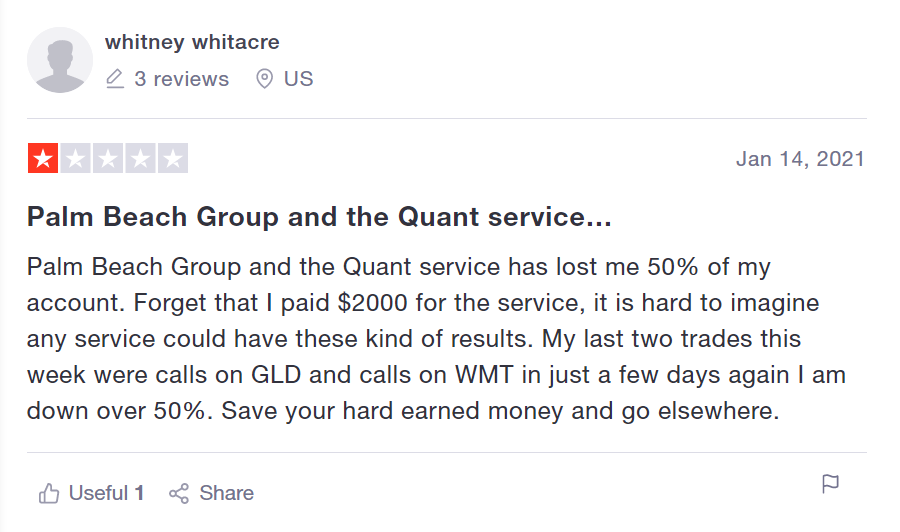

Lost Money:

Yes, it's true that Teeka makes looking recommendations at times. Some people lose money, such as this subscriber to his Palm Beach Quant service…

I personally have made money following his recommedations, but not all of his advisory services perform equally of course.

Something else to consider about he above complaint screenshot and others complaints about losing money is that… well… we can't see the big picture here. Sure, there are losers, but what about the winners? In the screenshot above the person is complaining about “my last two trades this week”… which turned out to be losers.

But this is just 2 trades.

Pump & Dump:

One common accusation I've come across is that Teeka is running nothing more than a pump & dump scheme, which is a reasonable accusation. But does it hold any weight?

A pump & dump scheme is a form of securities fraud when the price of a stock (or other) is artificially pumped up by hyping up the opportunity and getting others to buy into it through false and misleading statements, then selling (dumping) when the price is much higher.

So what accusers are saying here is that Teeka is buying into his recommendations first, then alerting his herd of subscribers about them, they're all buying in and driving up the price, and then he's cashing out with some handsome profits.

But let's think about this for a second.

The concern of investment advisory services, like those that Teeka runs, being pump & dump schemes is always somewhat there. After all, if you have enough subscribers then alerting them to invest in something is always going to drive up the price of that particular investment. This is just the way it works. So does this mean you can't run an investment advisory service then? Absolutely not.

The prices of the recommendations Teeka makes do “pump” in price right after they go live, and this is something he's completely aware of. In fact, he actually alerts subscribers to this with this stating that:

“Important Note: Immediately after our buy recommendations, we often see an initial price spike. We understand this can be frustrating. But don't worry. This is par for the course in the cryptocurrency space. Most of the time, the recommendation falls back below our buy-up-to price. Use a limit order. And just be patient and let the price come to you.”

So then what does this mean? Does it mean that Teeka and other insiders behind this service are buying in and selling out after the price spike? Could it be that there are just regular subscribers taking advantage of the spike? Or is this just the market responding to it naturally?

It could be a number of things, but what we do know… or rather what we are told by Teeka Tiwari himself… is that he doesn't buy into any of his recommendations. And I have no reason not to believe him, although I think it would take a lot of self control to be able to find great investment opportunities and alert others to them without buying in yourself.

The real problem here

As far as I see it, the main problem here is the hype, the marketing tactics used to lure people into his subscription services.

If Teeka could tone-down his marketing pitches a bit I think this would largely solve things.

The work he actually does (reports and recommendations) is impressive, but this is undermined partly due to his overly-salesy marketing.

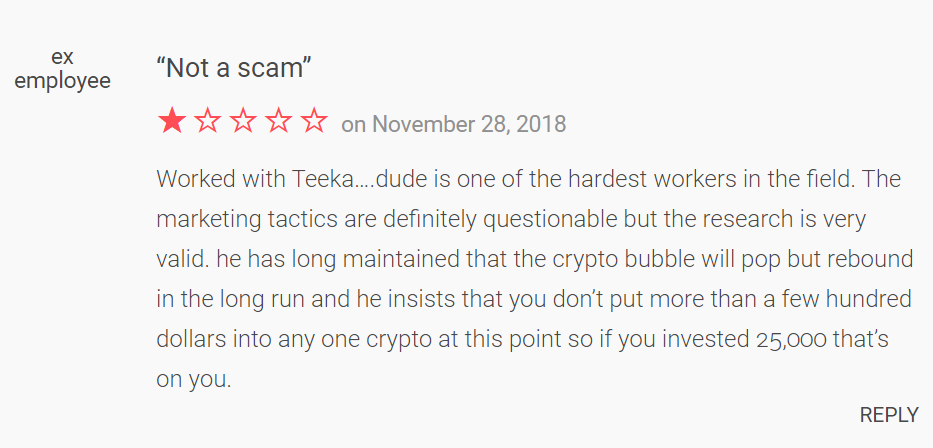

One rebuttle to a complaint I found on Dirty Scam sums things up nicely, stating that Teeka is “one of the hardest workers in the field” (evident from the research he puts out), but that “the marketing tactics are definitely questionable”…

The above comment is supposedly from someone who has worked with Teeka.

Investment Strategy

We know that Tiwari offers many different investment advisory services. So the investment strategy taken will depend on what service you are following along with.

For example, his Palm Beach Quant service is all about making regular income via options trading and following patterns in the market that his computer system provides alerts on, while his Palm Beach Confidential service is focused on assymmetric cryptocurrency investments.

Very different.

But since Teeka's cryptocurrency investment advisory services are some of the most popular, and since I have access to his Palm Beach Confidential service, let's go into more detail on how he invests in the crypto world.

As we know, this investment service is all about finding asymmentry. He's looking for opportunities not to double or triple your money, but to potentially 100x your money or more. This way, he can be wrong about the majority of his recommendations and still come out with a big profit if he finds those big winners.

And in order to find those big winners he looks at cryptocurrencies that have a market cap of less than $1 billion, generally speaking. These are the ones that still have loads of growth potential.

As far as portfolio weighting goes, his suggestion is to invest no more than $1,000 per recommendation: $500 – $750 for smaller accounts and $750 – $1,000 if you're a high roller.

While I don't follow his advice to a T, and tend to invest more in certain cryptocurrency projects that I find to be more promising, I think his suggestion of spreading things out evenly is a good one, especially when investing in a newly-emerging industry like this where volatility is high.

Track Record

As we know, Teeka is a master of hype and certainly has a way with words. He really knows how to appeal to the masses, get people excited, and ultimately part with their cash by buying into his research services. But is this a good thing? Are people making money from his recommendations?

Well, Palm Beach Confidential, his asymmentric cryptocurrency investment advisory service has been doing well for me.

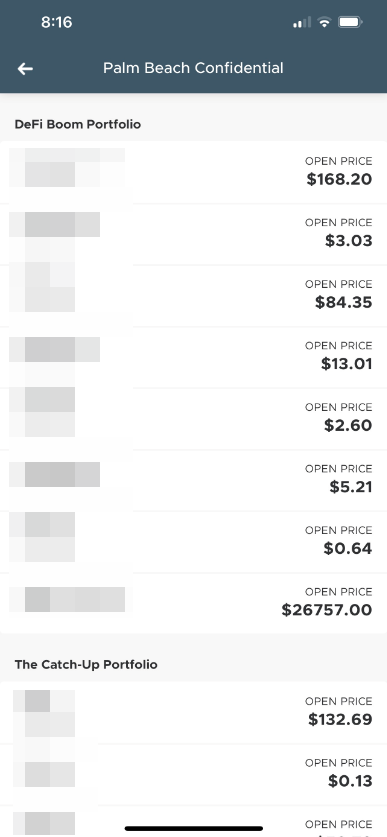

In this service he provides in-depth research on the crypto world and guides investors what projects to invest in, when to sell, etc. If you join the service you get access to his model portfolio that provides all the details on his recommendations. This portfolio is broken down into subgroups, which he also calls portfolios. Below you can see his DeFi Boom Portfolio along with his Catch-Up Portfolio… (of course I had to blur out the details)

Other categories (sub-portfolios or whatever you want to call them) of recommendations in the Palm Beach Confidential portfolio include…

- First Five Coins to $5 Million

- The Final Five Coins to $5 Million

- Cryptocurrenies (just a general category)

- Cryptocurrency Trading (another general category)

- and a few Stocks that have to do with blockchain

All in all here is what the returns look like currently:

- DeFi Boom Portfolio = 244.11% average gain (8 recommendations)

- The Catch-Up Portfolio = 260.14% average gain (5 recommendations)

- The First Five Coins to $5 Million = 2,440.24% average gain (5 recommenations)

- The Final Five Coins to $5 Million = 618.88% average gain (5 recommendations)

- Cryptocurrenies = 3,056.73% average gain (21 recommendations)

- *Note: This number is largely distorted due to extremely large gains from recommedations like Bitcoin which is up over 12,000% and NEO which is up over 30,000% since Teeka alerted his subscribers to them.

- Cryptocurrency Trading = 554.75% average gain (22 recommendations)

- *Note: This number is also largely distorted due to the over 12,000% gain that one of his recommendations had. The majority of recommendations here actually are at losses at the moment.

- Stocks = 972.43% average return (3 recommendations)

So in total here, all in all, the average return of everything in the portfolio at the moment is 1,163.90%.

However, as mentioned, this average number isn't the best metric to go by due to the astronomical gains that have been realized from early recommendations Teeka made in Bitcoin, NEO and others. These gains, while amazing, certainly shouldn't be expected and although Teeka has had recent recommendations that have shot up over 1,000%, nothing comes close to the early recommendations he made at the beginning of this advisory service.

So what does this mean? Does it mean it's too late for you to get filthy rich off of his recomendations? Well, only time will tell, but to get a more realistic view of what you can expect, let's look at some of his most recent crypto picks…

His two most recent portfolios, the DeFi Boom Portfolio and The Catch-Up Portfolio are up 244.11% and 260.14% respectively (on average). Those are decent gains but nothing spectacular, but many of the picks in these portfolios still have a lot of potential to boom higher. So as I said, only time will tell.

But what about sold positions?

Everything mentioned above has to do with the current Palm Beach Confidential portfolio. However, there are a number of positions that Teeka has sold out of, many at a loss.

Now I'm not going to go over all the sold positions over the years, but what I will do is show you his latest sell alert at them moment…

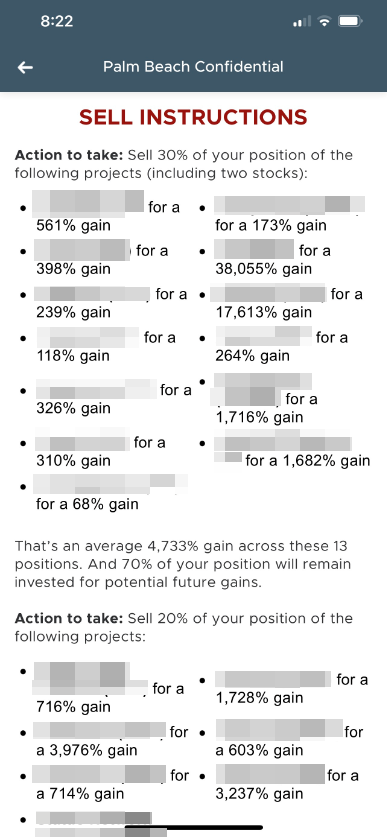

In this sell alert Teeka recommends selling 30% of some current positions…

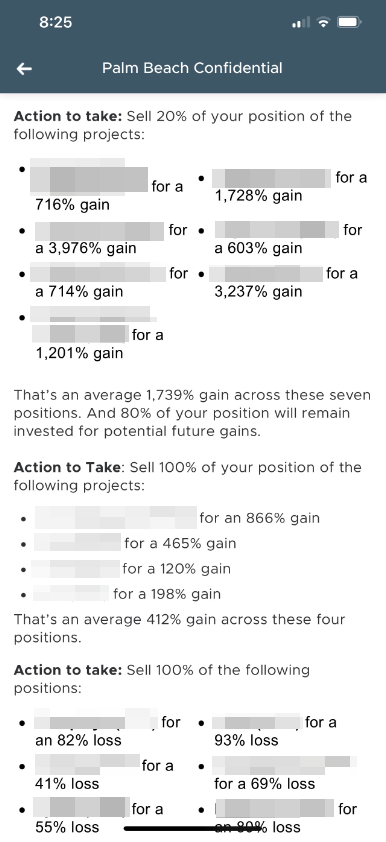

…selling 20% of some other current positions…

… and then selling completely out of a number of others.

*Since those that he recommended selling out of by 30 or 20% are still in the portfolio and were included in the calculations above, we're only interested in those that he sold out of completely.

Most of his recommendations were losers…

In this sell alert there were four positions sold out at an average profit of 412% and eleven positions sold out at an average loss of 63%…

If you had put $1,000 into each of these positions (4 profiting positions + 11 losing postions = 15 positions total) you would have made $9,550 in profit.

(4 x $1,000)412% – (11 x $1,000)63% = $9,550

And this is the beauty of the kind of asymmetric crypto investing that goes on in Palm Beach Confidential. Obviously most of his recommendations in the latest sell alert here were losers. But, if you had positioned your investments evenly, as Teeka recommends, you would have still made a profit. In the crypto market you only need a few big winners to clear out all the loses from the losers and provide you with nice profits.

Should You Trust Him?

While it's hard for a lot of us to trust someone with the type of salesperson personality that Teeka shows in his presentations, from what I've been able to find out about his background he seems to be trustworthy, or at least trustworthy enough for me to feel okay with being a part of his advisory service.

Sure, his past is still a little iffy. He doesn't come out saying that he's been barred by FINRA, but then again… who would? That is the past and I'm not even sure how serious Teeka's wrongdoing actually was in the first place.

The choice to trust him or not is up to you, but the bottom line for me is that I'm making money from his Palm Beach Confidential service. The research his team and him put out is very good and the profits have been very good. Now of course this is going to vary depending on which of his services you join, but I can only speak from personal experience here.

Conclusion

Is Teeka Tiwari legit? You can form your own answer to this question. My thinking is that, well… he's a little too salesy, but yes, he's legit none-the-less.

I know a lot of people have been questioning his legitimacy and trustworthiness, so I hope this review has helped clear the air on a few things and helped you out. You know how I feel about his services and I would recommend joining at least his Palm Beach Confidential service if you are interested in crypto investing, but only you can determine if they are right for you.

*PS: If you're going to join any of his Palm Beach Research services, be sure that you know what you are getting yourself into. The company, Palm Beach Research, doesn't exaclty have a very good reputation for customer service and honoring their refund policies.

Take care,

-Anders