Palm Beach Research's Teeka Tiwari is back at it, and this time he's teasing the opportunity to collect "tech royalties" by investing in cryptocurrency. In this quick review we'll be taking a look at the real opportunity here as well as what he calls his "#1 tech royalty crypto".

Let's begin by going over the teaser and some of the claims.

Update: To see our exposé of Teeka's latest "Tech Royalty" 2.0 crypto picks, CLICK HERE.

The teaser:

The teaser video, which was a back-and-forth between Teeka and Jon Alexander, was over an hour and a half long and unfortunately I couldn't find any way to fast forward it or skip ahead... and so I had to sit through the agonizingly-long video to find out what's being teased here.

As we know Teeka Tiwari is the guy behind it all. He is considered one of the best and most informed crypto analysts out there and this largely has to do with the fact that he has access to people high-up in the crypto space that normal people certainly don't. He comes from a Wall Street background, having started working for Lehman Brothers at just 18 years old and then becoming the youngest VP ever at Shearson Lehman just two years later. From what I can tell there is no doubt he's one heck of a hard worker and is able to get access to information that Main Street American's can't due to his background, but at the same time you have to take what he says with a grain of salt. Hyping the heck out of his investment opportunities is something he is very good at, as was evident from his "1170 Accounts" teaser.

This particular "tech royalties" opportunity is something that he claims is the start of an entire new journey in cryptocurrency.

He goes on to say that "something truly wild is about to happen in the cryptocurrency space" and compares the opportunity right now to when Ethereum was just $9 and when NEO was just $0.13, which let me remind you are up over 17,700% and 28,400% respectively (at the moment).

Teeka talks about how you'll be able to secure "generational wealth" for your children and their children. And this is all because of some catalyst that Marc Andreessen is behind that will propel our economy into the crypto age.

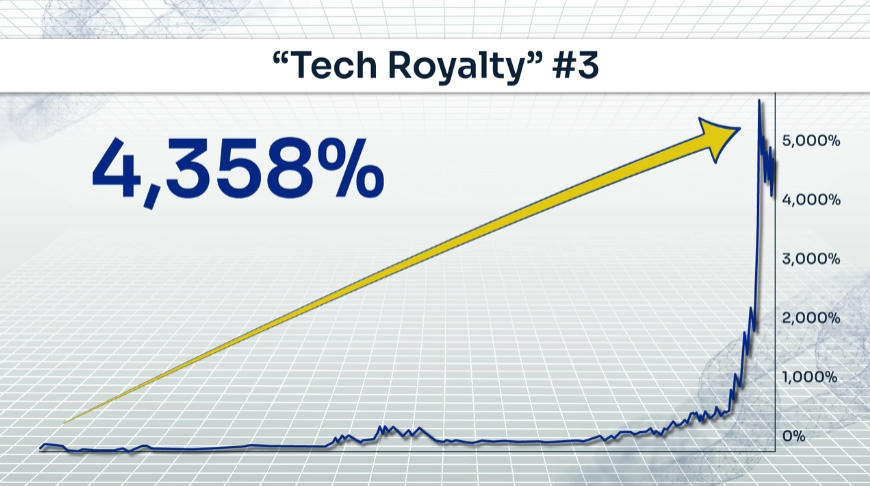

At this point I was drooling at the mouth from the excitement of striking it rich, and the icing on the cake was the series of charts he showed of a bunch of past "tech royalty" opportunities, such as this one that went up 4,358%...

On top of the capital gain shown above, investors would have received a "royalty" of $2,265 if they had invested $1,000 during this time period - this is what this opportunity is all about.

Teeka goes on and on about how "you must get into tech royalties" in order to secure your children's future and your chirdrens' children's future and how the federal government is printing money out of thin air like crazy, which is why he proposes tech royalty investments as a safeguard against the inflation to fiat money that will inevitably happen.

The good news... well he stated that he would give the name of his "#1 tech royalty" without having to subscribe to anything, which is a relief because normally you are forced to subscibe to some investment advisory service in order to get access to some "free" report that provides the details on what's being teased.

But luckily we won't have to subscribe to anything and I'll be going over his "#1 tech royalty" pick in a bit, but first let's talk about what the heck "tech royalties" are in the first place.

What the Heck Are "Tech Royalties"?

As we are told by Teeka, receiving these tech royalties is all about investing in coins that pay you to own them, and the amount of royalties that you can collect is dependent on the growth and usage of the cryptocurrency.

One way to collect these "royalties", aka dividends, by owning crypos is to own Proof of Stake (PoS) cryptos. This is a type of concensus mechanism that some cryptocurrency projects have in place to validate transactions, in which cryptocurrency holders can be rewarded by "staking" their crypto assets, which basically means just holding onto your crypto assets in a certain way... very easy to do.

This consensus model not only secures the blockchain of the cryptocurrencies using it, but also helps encourage adoption and use to propel the various crypto projects forward. And it is these types of cryptos that Teeka is interested in here.

That catalyst Teeka talks about..

In the presentation he went on and on about how there is some catalyst that opens the doors to "tech royalties" for 45 million people, which is an estimate that he even thinks is low.

What he's talking about here is none-other than Coinbase going public, which has 45 million current customers.

What I don't understand..

Sure, I do think Coinbase going public is going to help catapult crypto adoption forward, but what I don't understand is why Coinbase going public is all-of-a-sudden going to increase these "royalties"...?

As of right now, Coinbase users can already "stake" certain cryptocurrencies (Ethereum 2.0, Tezos, Cosmos, etc.) and earn rewards, aka "tech royalties", aka dividends, by doing so.

So what does them going public have to do with anything? How does them going public open up the opportunity to 45 million people?

I don't know. Maybe I'm not understanding something correctly. Or maybe Teeka is just hyping things up a bit too far as usual.

Teeka's "#1 Tech Royalty Crypto"

Teeka gave a free pick during the Tech Royalty Summit presentation. This was said to be his lowest risk, highest reward pick... one that he thinks is has extremely low risk and that he still thinks will at least 5x this year.

What is this pick?

It's just Ethereum guys and gals.

Yep... Ethereum (ETH), which we've all heard of - only the second biggest crypto out there following Bitcoin.

Earning "tech royalties" while holding Ethereum

With the latest upgrade from Ethereum to Ethereum 2.0, Coinbase users will be able to stake their coins for up to a 7.5% APR, according to Coinbase themselves. And of course this 7.5% APR is subject to change... right now it's just an estimation and will change as more ETH2 is staked.

But again... what the heck does this opportunity have to do with Coinbase going public? I don't get it.

How Good of an Opportunity Is This?

As we were told, this is Teeka's safest pick to collect these tech royalties. That said, it's also the pick that has the lowest potential to skyrocket in price. He tells us that he still thinks it will increase 5x this year, which is great, but in the crypto investment world we are often looking for larger gains than this.

What we are looking for is to invest in cryptos that will skyrocket in price, providing large capital gains on top of the gains we will be able to make by staking them. Not only that, but getting in early when prices are low allow us to purchase much more crypto, which means much larger earnings via staking.

Unfortunately for us, in order to find out the other handful of cryptos that Teeka is teasing here we'd have to buy a subscription of his Crypto Income investment advisory service which would cost us $4,000/yr (retail price). Only after purchasing the subscription would we get access to his "Top Tech Royalties" report shown here...

In this report he gives access to his top 6 picks - not sure if Ethereum counts as one of these picks or not.

So since I don't have access to these picks and he doesn't provide any hints or clues as to what they are, I can't provide any insight into how profitable they might be. However, I am generally bullish on cryptocurrency and think that earning dividends via Proof of Stake does present some amazing investment opportunities.

UPDATE: Since publishing this post I've stumbled across a microblock on StockGumshoe where someone shared several of his picks: Synthetix (SNX), Algorand (ALGO), and Nexo (NEXO), which do make sense from a staking standpoint although I haven't been able to confirm these.

Quick Recap & Conclusion

- Teeka Tiwari has been teasing the opportunity to earn "tech royalties" by investing in cryptocurrencies

- What he's referring to here is buying and "staking" crypto, which helps support the various blockchain cryptocurrency projects and rewards investors

- Teeka claims there is a big catalyst that will provide large gains for "tech royalty" investors who get in now - he's talking about Coinbase going public here and I'm not entirely sure why this is as big of a catalyst as he thinks

- He provides us with his #1 "tech royalty" crypto for free, which is Ethereum

- The other picks are only available by first purchasing a subscription to his newsletter investment service

I hope this quick review helped clear the air on what's going on here and the opportunity being presented. It's unfortunate that I couldn't expose all of his crypto picks, but hopefully this still provided some value to you.

Take care and be sure to let us know what you think of this "tech royalty" opportunity... and share with us his other picks if you know them!

Besides your service, are there any others you would recommend??? I’ve checked out quite a few but have never acted on them. They all seem to have the same B. S. In their structure. I’d be interested in hearing Your comments on this query. Thanks Alex

Hi Alexander. Well I actually recently purchased a subscription to Teeka’s Crypto Income, but it’s too early for me to give a good review of this. That said, I have been a member of his Palm Beach Confidential crypto investment service for a while now and do recommend this… and from the looks of his Crypto Income portfolio things should turn out well.

So if you’re interested in crypto investing then I would recommend his services. However, be prepared to be bombarded with upsells if you do sign up. Teeka puts out great research and his crypto recommendations have done well overall, but he is also a very good salesman and the company he works for, Palm Beach Research, really pushes the upsells.

Hi, can yo tell me which are those 6 picks, because i think i bought the wrong information from a user forum?

yeah let me know too will ya thanks bonnie

Hi Daniel did you ever find out what the top 6 picks for Tech Royalties were? Would you mind sharing?

What a huge waste of time. It’s like the idiot co-host on the segment replaying everything Teeka says – “because he’s old and hard of hearing” and the fact that the video player doesn’t let you skip… uuuuugh. 2 hours to learn ether is a great investment… are you kidding? Thankfully I found this article and could search “#1 tech” and get to it in seconds. Don’t waste your time or money with Teeka… he’s a salesmen, and if he were truly so good at this, he wouldn’t be wasting so much time on these productions and spending more time looking at graphs… and if he really cared about his “followers” he would be doing this on YouTube for free…

Exactly…. He first started out with…I don't need your money I have plenty…I do this for free for my loyal followers….nekminit…get in tonight…now is the only time you have and I'm dribbling cause I can't believe how many people don't listen and are going to give me$2000 that they cannot get back once they have subscribed and yes his video was so painful to watch cause he was frothing at the mouth says he's about is in the trough.

you're absolutely WRONG ! It wasn't ETH idiot and why we he make a fool of himself doing something so stupid. You missed the boat. It was NOT ETH. You can find the webinar online…go rewatch it moron.

Have you heard of GRT?

Hi. I think you are probably referring to Teeka’s picks teased in his “Tech Royalties 2.0” teaser. Take note that the post you have commented on is simply about his “Tech Royalties” teaser… not the “2.0”. This is actually a new teaser that is still on my list to review soon. Hope to get that done quick!

Hello. I too almost wanted to kill myself after an hour and a half of his twaddle. You omit however. His first top pick “ the graph”. Trading at $1.02. At Coinbase. Not clear though wether simply buying. GRAPH. Will get me royalty dividends? Also, Must I buy ETH2. To get royalties? Thanks for your take on the long winded video. Michael.

You just saved 2 hours of my life! THANK YOU!

Was this the first one or 2ND phase?

I assume the first one, for they 'twisted the arm of publishers' to lower entry price for $2000.

I just watched the 2nd phase presentation, I didn't hear anything about coinbase. I did hear ETH, but in passing as very important.

The Graph (GRT) was his top royalty pick, for the new second phase video.

Now the special report on how to get it and the royalties are locked behind the pay wall I believe.

Ahh I see comments were back in March, so it must of been the first video. Well now you now for the 2nd phase what the free one is, and how about ETH since March?

“His pic was not Ethereum… It was “the graph”

Hi. Please read our newest review of his “Tech Royalty” picks, which he calls his “Tech Royalty 2.0” picks. Here The Graph is indeed his free pick. It was in his first “Tech Royalty” teaser that Ethereum was his free pick. This one is different.

My first visit to this site, and I'd hoped that you'd paid at least enough attention to his presentation to know that his 1st pick was NOT Etherium – it was The Graph (GRP) – and that you'd have some valuable insight into the workings of this so-called "royalties" thing… but I found neither to be true.

The upside is that I didn't have to spend nearly 2 hours here to not get any answers (or the wrong one, re: GRP vs. ETH). Disappointing.

Hi MoJoe. You need to read our “Tech Royalties 2.0” review. It seems that you read the old one exposing Teeka’s first “Tech Royalty” teaser. The latest version is his “2.0” teaser. You can read that one here: https://greenbullresearch.com/teeka-tiwaris-tech-royalties-2-0/

I even put a link to the newest expose right at the top of the old post.

Guys . . . My Screenshot states The Graph a.k.a. GRT NOT GRP ? Where are you getting the "P" ?

I wouldn’t invest a dime with this guy from Nigeria, Palm…., or his affiliated cryptoelitemarkets.com – TOTAL SCAM artists. He rushed me into opening and account, told me to select 1 year plan/no cash out for 1 year (which i didn’t know), without providing details then wouldn’t activate my deposit of 548 bitcoin asking for another amount up 4500 bitcoin to activate account. The plan was locked in. They would not change it to 6 week plan at 548 bitcoin with cash out option in 6 weeks (surely they have glitches/locks attached to this plan too). This meant I lost my 548 bitcoins and they will not even give them back. STAY away from him and anything he is affiliated to.

I think you are mistaken. Teeka has nothing to do with the website you mentioned or any Nigerian scams.

Teeka Tiwari is the editor of the Palm Beach Research Group’s Palm Beach Letter.

On November 23, 2022 he contacted me via Twitter, asking me if I would like to make some extra money. He said that he would offer me to trade on my behalf on IndexTradeHive. I trusted him and said “yes”.

In the follwing 4 months he urged me to invest $ 196,093 into the plattform and for his comission. Everytime I wanted to cash-out he found another excuse for not doing so.

It all culminated on March 24th after he promised me again I could withdraw and nothing happened. Then he stated that the money was lost without giving a reason. Teeka then offered I could switch to his private trading platform to trade again and recoup the losses.

Teeka pretends to be the world’s most trusted cryptocurrency analyst and investing expert. In fact he is the least trusted “expert“ in crypto.

He lives a double life from which Palm Beach Research Group doesn’t know about. One part of his personality has a trustworthy image, the other part is just a plain scamer.

Further down you will find my conversation with him, spanning from late November 2022 to late March 2023. As you read through you will find that he is a chronic liar and a cheat. Don’t ever trust him in any way, shape or form.

What a travesty to read his mission statements considering what he has done to me.

Andreas Ryser

More info: https://the-least-trusted-expert-in-crypto.com/

Hi Andreas. This sounds horrible, but are you certain that the scammer behind this wasn’t possibly someone impersonating Teeka? I know that this happens because he’s involved in the crypto space and the rampant scams in this area. He also often warns people about impersonators and I believe he even says that he never contacts people on Twitter. This sounds like it wasn’t him to me.

On second thought, I just looked over the article you wrote about this and it does look convincing. Whatever the case, I hope you find justice for this scam.