Jeff Siegel is an American financial writer, and the publisher and managing editor of Green Chip Stocks, a newsletter service he founded in 2006.

Jeff, who calls himself an advocate for the legalization of cannabis, an MMA enthusiast, and a libertarian tree hugger, has written some books on energy investing and claims to have been featured in different media in the course of his career.

However, some people have asked a few questions lately about whether Jeff Siegel is a fraud.

Claims

First of all, let's see what Jeff Siegel claims to be.

Jeff describes himself as an investment publishing veteran with more than two decades under his belt, an analyst, consultant, and public speaker.

He has been featured as a guest on Fox, CNBC, and Bloomberg Asia, according to his profile information on Angel Publishing's website.

“Jeff continues to spot the most lucrative alternative energy companies in the world. And his thousands of loyal readers have made small fortunes in the process” following his alleged accurate predictions of “dozens of trends in the ever-changing landscape of alternative energy.”

We'll investigate these claims in the course of our discussion.

Green Chip Stocks & Teasers

Green Chip Stocks is “an independent investment research service that focuses primarily on alternative energy and transportation markets, sustainability and agriculture.”

Let's now examine a few of Jeff Siegel's teasers that he uses to promote his Green Chip Stocks.

“Bigger Than Tesla”

“Bigger Than Tesla: The Next American EV Powerhouse” is a sales presentation where Jeff Siegel promotes a new electric vehicle manufacturing company founded by former executives of EV manufacturer Tesla, saying the new company could unleash a new “army of millionaires” and you could grab its shares while they still trade for around $5.

Source: angelpub.com

He's probably teasing Proterra Inc. (Nasdaq: PTRA), which shares some similarities with the new company.

Proterra produces heavy-duty electric transit buses, drivetrains, batteries, and charging systems, and recently announced a new EV battery factory in Greer, South Carolina.

According to reports, Proterra has booked more than $750 million in orders to date.

“Solar Window”

“Solar Window” is Jeff Siegel's sales presentation about a “breakthrough” in solar window technology that could be “mankind's single greatest invention.”

Although Jeff didn't mention the company he was teasing, he appears to be talking about SolarWindow Technologies, Inc. (WNDW), a U.S. company which is into solar window technology development, predicting, “It can power the 90 million-plus buildings and homes in America alone… more cheaply than any fossil fuel in the world can today. It can do it virtually for FREE… 24 hours a day… seven days a week!”

Source: angelpub.com

He believes, “You could be there BEFORE 99% of investors even know it exists…Before this small $3 company single-handedly reshapes the world power markets…And before this company’s stock begins an ascent capable of turning every $1,000 you invest into $95,000 or more.”

While the development of solar window technology could be a game changer in power generation for millions of Americans, he failed to disclose how this technology could be used to power homes.

“Spray-on Solar Cells” and “Elon Musk's Big Bombshell”

“Spray-on Solar Cells” and “Elon Musk's Big Bombshell”—a somewhat resurrection of Jeff Siegel's “Solar Window” teaser—pitches the alleged breakthrough of “an elite tech company” that is “About to BANKRUPT Every Single Utility Company in America… and Make You RICH….”

Source: angelpub.com

“Day Zero”

“Day Zero” is a pitch where Jeff Siegel touts that “November 13th, 2019 will be the most profitable day in the history of mankind” when an announcement will be made about the company that will “end aging and make you rich.”

Source: nobsimreviews.com

However, he keeps changing the date. He first teased about the stock on March 29, 2019, then on Aug. 4 after which he settled down for the Nov. 13 date.

As if that wasn't enough, he still pushed “Day Zero” a little bit further—from Dec. 4, 2020 to Dec. 9, 2021.

Books

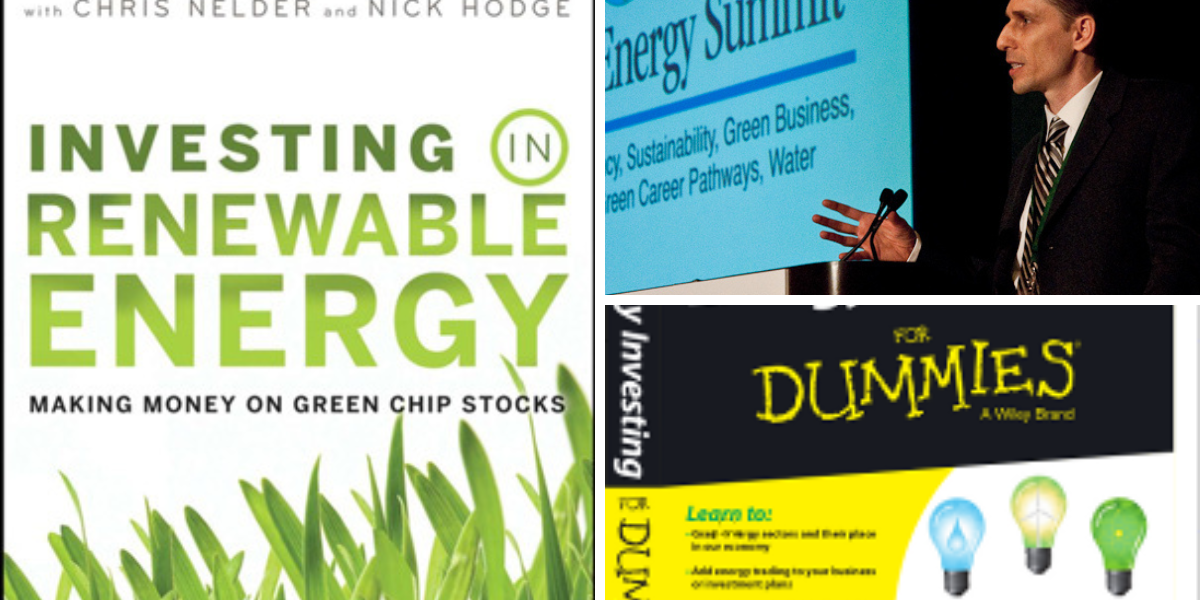

Jeff Siegel is the author of “Investing in Renewable Energy: Making Money on Green Chip Stocks,” and co-author of “Energy Investing for Dummies.”

“Investing in Renewable Energy”

Source: amazon.com

“Investing in Renewable Energy: Making Money on Green Chip Stocks” is a book written by Jeff Siegel with Chris Nelder and Nick Hodge, and published in 2008 by Wiley, an American multinational publishing company that focuses on academic publishing and instructional materials.

The book “puts the depletion of finite resources such as oil, natural gas, and coal in perspective, and discusses how renewable energy solutions–from solar and wind to geothermal and biofuels–will usher in a new generation of wealth for investors and a new way of life for everyone” to help you “discover various renewable energy technologies that are at the forefront of transitioning our energy economy, and learn how to profit from next-generation renewable energy projects and companies that are poised to take over where fossil fuels will leave off.”

Past readers have both praised and criticized the book, which has 4.2 out of 5 stars from 14 reviews on Amazon.

Source: amazon.com

Felix Cardona says the book is a “marvelous insight [in]to the life cycle of every energy source” as it delves into the fact that we're running out of conservative fuels and time is running out before the coming catastrophe hits is well displayed with corroborable references. “There is no other way to address the energy needs for the present generation and the following,” explains Felix, who was “very glad for purchasing a copy of this book for my loved ones.”

Source: amazon.com

“Studying this book made me more aware of the pitfalls on alternative energy development,” according to Thomas Segar. “I avoided some losing investments with this book.”

Source: amazon.com

For Jerry Liu, “This book provides the excellent background knowledge for investing in renewable energy and also provides the reference and even involved companies,” while noting that its major drawback is “missing financial analysis of involved companies. So overall it is rather a 101 book. You must do further research by yourself to make money in [the] renewable energy area though it's hot.”

Source: amazon.com

“This book offers more than just opinions about renewable energy. It contains a lot of research on what has happened already, and some insight as to what may lie ahead,” Duane Hixon explains. “Not only does the book explain the major sources of renewable energy, it also details who the players are (both the companies and the countries) that are involved in pushing these ideas forward. The books aim of course is to show an individual how and where to invest to capitalize in the next age of energy, and I believe it delivers.”

Source: amazon.com

Jack Lee, who came across the book at a local bookstore eight years after it was published, says, “The projections made on various trends of energy were all off. The claim of peak oil is wrong due to recent advances in fracking. The growth of renewable energy sources were too optimistic. Sorry, this book is a bust.”

Source: amazon.com

Daniel Hammer, who reviewed the book in 2017 on Goodreads—an American social cataloging website—however agrees with Jack, saying, “Many of the tickers used for examples in this book are either out of business or not doing well at the time of this review,” while warning you to “do you[r] research on the companies before you invest.”

Source: goodreads.com

“Energy Investing for Dummies”

Co-authored by Angel Publishing editors Nick Hodge, Jeff Siegel, Christian DeHaemer and Keith Kohl, and published on Amazon by Wiley in 2013, the book, “Energy Investing For Dummies,” is regarded as the “fast and easy way to grasp energy sectors and their place in the global economy.”

“With timely, substantial information about energy stocks, Energy Investing For Dummies teaches the ins and outs of energy sectors and how to incorporate them into business and investment plans. As a savvy investor and business manager you will find the important information and advice you need to incorporate these growth areas into your investment portfolio,” according to the authors. “In Energy Investing For Dummies, you'll find important information on the big-three markets of electricity, natural gas, and oil; growing markets for liquefied natural gas, emissions, coal, and alternative energy; primers on advanced topics like storage, wheeling, load forecasting, and pipeline transportation; tips on investing in and trading energy stocks, ETFs, dividends, and derivatives; and much more.”

At the time of this writing, the book has 4.3 out of 5 stars from 31 customer reviews on Amazon.

Source: amazon.com

However, R. Huntington, who hoped to find details about how to short oil in the book, was disappointed after realizing that the book “only gives an overview of the highlights of various types of energy investing from A to Z” without any information about “how to execute a trade.”

Source: amazon.com

“It’s really for dummies,” Kalil says about the book, which “took a lot of pages” to mention “a lot of companies, funds and ETFs that you would not care about if you don’t invest in the US,” hoping that the authors “made the price of the book cheaper” at the current price of $16 and $26.99 for the Kindle and paperback editions respectively.

Source: amazon.com

For Gordon Lee, the book contains more of an “intro to energy / electricity generation” rather than “energy investing,” regretting that “many of the topics (for ex. history) aren't quite investing related as they do not remotely offer investing guidances.”

Source: amazon.com

Lorraine Belliveau sees the book as containing a very “positive and optimistic opinion on oil stocks,” while Fredrick Snow believes it's an “excellent” book with some “insights.”

Source: amazon.com

“Overall, this was an O.K. book. It was a bit too basic for my needs and specific tastes, and it did have a number of holes in key subject areas, but overall it served as a passable introduction to the topic,” says an Amazon Vine customer, who found the book “most appropriate for a target audience consisting of novices to the energy industry, students studying energy and environmental issues in a lower-division or general studies elective college/university course and those that are simply curious about the topic but lacking a strong, in-depth science and technology background.”

Source: amazon.com

A Look at Jeff Siegel's Background

Before we go further, I would like us to look at Jeff Siegel's educational qualifications and professional experience.

Educational Qualifications

Jeff Siegel attended York College of Pennsylvania between 1989 and 1993, according to his LinkedIn profile, which did not provide further details about his education, including his area of specialization.

Source: linkedin.com

I was also able to find information about his education on Wikipedia which affirmed that he attended the same university.

Source: wikipedia.org

Apart from LinkedIn and Wikipedia, no other source available to me at the time of this investigation provided any details about the education of the self-styled green market expert, thus suggesting that something could be wrong somewhere, including but not limited to a lack of the necessary education.

Professional Experience

Jeff Siegel is the publisher and managing editor of Green Chip Stocks—a premium investment newsletter service focusing on renewable energy, organic agriculture, and legal cannabis—which he co-founded in 2006 and is affiliated with Angel Publishing.

He's also a contributing analyst for the newsletter “Energy Investor” and the editor of several other publications at Angel Publishing, namely “Energy and Capital,” “Wealth Daily,” and “Liberty Briefing.”

He started his career as a managing editor at Angel Publishing in 2005.

Source: linkedin.com

Between 1994 and 2001, he worked at Agora Publishing.

Source: angelpub.com

Having known a little bit about Jeff Siegel's background, we can now investigate some of his claims to see if they're true.

First of all, he describes himself as an investment publishing veteran with more than two decades under his belt. But is that true? Let's find out first.

He started working at Agora Publishing in 1994—a year after his graduation from college—and left the company in 2001 before joining Angel Publishing in 2005, where he has been up to the moment of this research.

Source: angelpub.com

If you do the math—from 1994 to 2001 and from 2005 to 2022—you'll see that he spent seven years at the former company and 17 years with the current employer. That gives you 22 years altogether.

So, it isn't out of place for him to say that he has more than 20 years of experience in the investment publishing industry.

That notwithstanding, I also tried to find out if he had ever worked for either of the two publishing houses, but found nothing about him on the company's website, which could be used as a landing page with everything you need to know about the company on the same page.

Source: theagora.com

Even if you click on the homepage, the about us page, or the career page on the website, you'll be taken to the same page.

If you scroll down to the footer, you'll see the company's motto, address, phone number, email address, social media handles, and what looks like a privacy policy page advising users to visit the websites of each of The Agora affiliates and read the privacy policy there.

Source: theagora.com

However, I decided to look up The Agora's website on Whois, a domain and IP lookup service, and discovered that the company's website was registered on March 23, 2003, two years after he had even left the company.

Source: whois.com

So, there's no information about him on the website of his former employer at this point.

But I didn't stop there. I still went ahead to verify whether he's an employee of Angel Publishing, where he claims to be currently working as a managing editor, and I was able to find his name—alongside six others, namely Brian Hicks, Christian DeHaemer, Alex Koyfman, Keith Kohl, Jason Williams, and Sean McCloskey—on The Experts section of the company's website.

Source: angelpub.com

Complaints

I have found quite a few complaints from Jeff Siegel's subscribers and possibly a handful of other people who may have come across his newsletters and teasers, but I'm going to group these complaints under the following subheadings for convenience.

Complaints About Green Chip Stocks

Bill A., who subscribed to Green Chip Stocks for a year and four months before finally leaving in April 2011, has a few complaints to make about the service.

“The thing is they send you these introductory emails claiming big scores in the 100% or more to get you to sign up. The reality is much more sobering,” explains Bill. “When they say that their top stocks average blah, blah percent they are describing only their best stocks since they began.

Source: stockgumshoe.com

“… Most of the gains already occur[r]ed before they sent you that newsletter. You find out when signing up, that the stock has already been in their portfolio for quite sometime.

“That means as new subscribers you are just entering now and pumping up their stocks even further for the last crowd. That burns me up.”

Bill adds that he “never bought their stocks at first, because they always went down shortly after they would suggest a buy” and suspects that “this might be because they or previous members of their elite services sell it after they suggest the buy to the rest of us. They [their portfolios] did well some 3 or 4 years ago, but since then they have been mysteriously closing most positions at a loss, sometimes big. Only 1 or 2 stocks out of the suggested 10 stocks ever becomes a big winner.

“… On average their stocks barely make it over 5% a year.”

He claimed that while he was with them, Green Chip Stocks sent him “spam email[s] to join their other services” and failed to send him “emails about sell positions half the time.”

Source: stockgumshoe.com

Complaints About “Day Zero”

For example, Ozzgold, a reader on Stock Gumshoe, a review website for stock advice newsletters, says Jeff Siegel's “Day Zero” pitch is “another sale[s] ploy” and “rings bells of a scam” because “one single company…claims “a miracle announcement” about something that no [one] else knows about.”

Source: stockgumshoe.com

For Michael Prestridge, “Day Zero” is “a setup for another pump and dump.”

Source: stockgumshoe.com

According to CGM, “The stock keeps dropping and the day keeps getting pushed out.”

Source: stockgumshoe.com

“I guess we now know what ‘day zero’ means,” says Tanglewood. “It’s when the stock goes to zero!”

Source: stockgumshoe.com

Complaints About “Spray-on Solar Cells” and “Elon Musk's Big Bombshell”

“Listening to this snake oil salesman Jeff Siegel is an insult to one’s intelligence,” says Rolf Loth, who believes Jeff Siegel uses “the same format used to promote other snake products in order to get to the $49 end of the presentation,” adding, “It sounds like a clever scam.”

Source: stockgumshoe.com

“America is in the midst of a clean energy revolution — one that is generating hundreds of billions in economic activity, which has produced little,” David Tippie explains. “Fraudsters, too, are cashing in.”

Source: stockgumshoe.com

For Rick C., the “spray-on solar cells” technology teased by Jeff Siegel is “very over-hyped” because it has many drawbacks and “would require all windows to be connected by wiring to an inverter to be useable,” arguing, “It may be better to invest in an inverter maker, copper wiring company or controls company.”

Source: stockgumshoe.com

Concerns

I couldn't find Jeff Siegel's name on any of the websites of the media houses he claims to have been featured in, including Fox, CNBC, and Bloomberg Asia.

A search on Fox's website returned no results with Jeff Siegel's name.

Source: fox.com

The name of Jeremy Siegel, a finance professor at the Wharton School of the University of Pennsylvania, mostly shows up when you look for Jeff Siegel's name on the CNBC website.

Source: cnbc.com

On the website of Bloomberg Asia, the name of one Jeff Siegel, the Senior Vice President of Distribution at Group Nine Media Inc., an American digital media holding company in New York City, appears instead, but it's unclear if he's the Jeff Siegel we're talking about.

Source: bloomberg.com

Track Record

Notwithstanding these complaints, I think I have seen some good reviews about Jeff Siegel's books and a few testimonials about his newsletter services in the course of this research.

His first book, “Investing in Renewable Energy: Making Money on Green Chip Stocks,” has 4.2 out of 5 stars from 14 customer reviews on Amazon.

Source: amazon.com

The second book, “Energy Investing For Dummies,” has 4.3 out of 5 stars from 31 customer reviews on Amazon.

Source: amazon.com

Just like his books, Jeff Siegel's newsletters are also doing well, according to some subscribers.

For example, a subscriber has netted “1000-3000% returns” on investments based on Jeff Siegel's recommendations. “Some investments as expected have turned to zero but others have been phenomenal more than compensating for the losses,” says the subscriber.

Source: stockgumshoe.com

Another subscriber, Richcat, praised Green Chip Stocks, saying it “has been good for my IRA,” presumably an individual retirement account—a savings account designed to help people prepare for retirement with many tax advantages.

Source: stockgumshoe.com

For Bill A., who was mentioned above, Green Chip Stocks is “having better success with more double digit scores and then some big wins” in their “Alternative Energy Speculator” newsletter, although “it’s much the same circus” as others.

Source: stockgumshoe.com

Are His Services Worth It?

I wouldn't know if Jeff Siegel's services are worth it, but I can give you a little clue to help you decide on your own.

For example, Green Chip Stocks—his newsletter service—has an overall three-star rating on Stock Gumshoe.

Source: stockgumshoe.com

Again, each of his two books has a decent rating on Amazon, with over four-star ratings.

So, you should know if you're OK with those ratings.

Wrapping up

If you've been wondering whether Jeff Siegel is a fraud or scammer, I think you should have been able to come to a conclusion now because I've given you enough clues about his investment services and even reviewed his books to help you make an informed decision.