Jeff Brown, the man, the myth, the legend. Who is he really? Is Jeff Brown a scammer and a fraud, or can you trust him enough to invest your money in his recommendations?

When it comes to the world of investing there are a lot of “gurus” and “experts” out there, many of which are only so by self-proclamation. Jeff claims to be an expert indeed, and claims to have graduated from top level universities as well as having worked at high-level positions at tech companies in Silicon Valley and Japan.

This is why he tells you to trust his tech stock picks and buy his advisory services.

But, can you really trust these claims? After all, there is quite a lot of concerning content about the man posted online, such as one comment I found on Quora questioning the legitimacy of his claims: “you cannot find him, and you cannot check anything he claims”.

Well, to the person who wrote this, maybe that's just because you haven't done very good research.

It seems that most reviews looking into this guy just rehash the same old information, but in this review, I dug a little deeper and even hired a private investigator to help find out if Mr. Brown really is who he says he is.

Let's get to it… first by going over some of the bold claims made by Mr. Brown about himself.

Bold Claims Made

In just about any promotion you find from Mr. Brown you'll hear all about his expert experience.

Why should you trust him?

Well, he claims to have around 30 years of experience in the tech industry working for large, globally-known companies. And, he says he has invested in over 130 startups with a 93% success rate.

Pretty impressive by the sounds of it. But let's make one thing clear before we dive any deeper.

That 93% success rate he claims from his personal investments is a bit misleading.

It sounds great and all, but this only means he made positive returns on 93% of these investments. There is no information given as to how large these positive returns were. So, while the numbers seem good, if the average positive returns he's made here are only 0.005%… then that's not all that great. I'm sure the returns he's made are better than this, but I'm bringing it up because we don't know all the figures here.

Besides this, Brown also boasts of his education. According to him, he's attended…

- Yale University from 2018 – 2019 for the Global Executive Leadership Program

- London Business School from 2003 – 2004 for a MSc

- Purdue University from 1987 – 1991 for a Bachelor's degree

- Stanford University from 2006 – 2008 for some type of certificate

- and there are some others too

Remember how I mentioned he's also claiming to have worked for large, globally-known companies? According to him, these companies, along with his position at the companies, include…

- Vice President of NXP Semiconductors from 2008 – 2012

- President at Trident Microsystems Japan from 2010 – 2011

- Head of Global Strategy & Development at Qualcomm from 2005 – 2008

And there's more. Most of what I've gone over above can easily be found on his LinkedIn profile.

Additionally, Jeff claims that:

“I’ve attended private meetings, along with some of the top lawmakers in the U.S. We typically gather in the Congressional Auditorium, which sits beneath Capitol Hill. It is a highly secured space often used for national security briefings.”

This is supposedly him in the second row here…

And here is a picture of him behind the podium at the Department of Defense…

To get invited to attend private meetings at the Congressional Auditorium as well as speaking at the Department of Defense sounds like a big deal.

The pictures seem to be legit. However, I haven't been able to confirm any of these claims. I've spent quite a bit of time looking into them and checking the public records of visitors to the different federal buildings, but have come up empty. I suppose that “private” meetings might keep their attendee list a secret anyhow. So this could explain it.

More Boasting..

Some more claims:

“I was one of the first to learn about self-driving cars… inspecting one at NASA’s famed Ames Research facility way back in 2011. The semiconductor play I recommended after that visit, Nvidia, was the best performing stock on the market in 2016, going up over 3,000% since then.”

There was a mention of a “Jeff Brown” as a test conductor at an event where NASA conducted high speed tests of a space exploration vehicle to learn about its stability during flight, but this was back in 2006 and this seems to be a different guy.

Jeff states that he was at NASA's facility back in 2011, and what's not mentioned here, which I've found from other sources, is that he supposedly got to sit and test-drive one of Google's Waymo cars.

I haven't been able to back up this claim, but have heard him mention it on more than one occasion in his marketing material.

That said, it is true that Brown recommended buying Nvidia's stock back in 2016, which performed extremely well.

Another claim:

“I was one of the first to cover gene-editing therapies and recommend exciting companies in this space… months before they made headlines in Financial Times, The Wall Street Journal, and Wired magazine. The small company I recommended went up over 300% in 16 months.”

This is true. Brown was recommending investing in companies involved in gene-editing technology back as far as 2016 from what I've been able to find, one company's technology he teased as the “God Key”. This was before there had even been any human trials conducted with this new technology in the US.

He was early on this new tech, and another that he invested in early on was Bitcoin…

“And, I was invested in cryptocurrencies long before most people even heard of Bitcoin. I recommended Bitcoin back in 2015 at $240. Today, it’s trading for more than $30,000.”

*Now trading for much more than $30k of course.

These are the claims made by Brown to try to gain credibility and trust from potential subscribers. I've gone over some that I've found to be true, but in a bit, I'll be looking more into his educational and career claims, which, if true, are very impressive indeed.

But first, let's talk a bit about his company and the services offered.

Brownstone Research & His Advisory Services

If you do a quick WHOIS search of brownstoneresearch.com you'll find that this website is rather new, having been just registered in 2020…

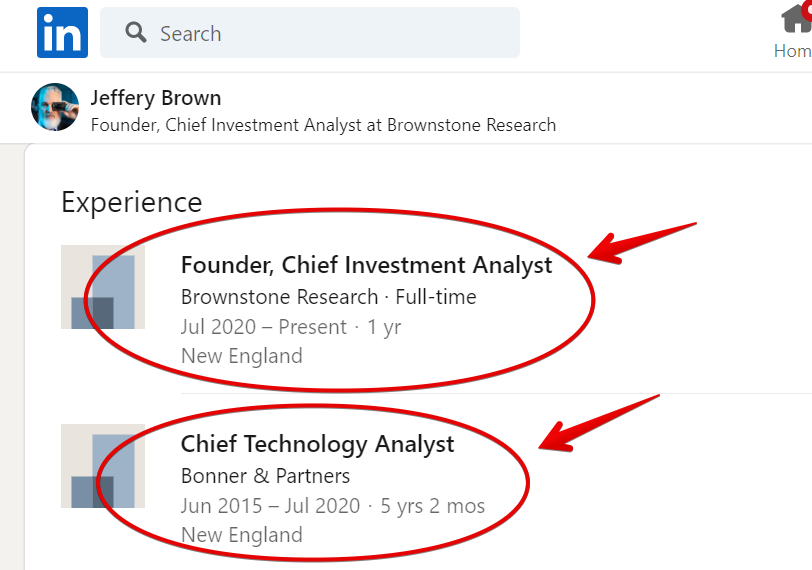

However, Jeff Brown is no newbie when it comes to running investment advisory services. He's been around for quite a while, having started working at Bonner & Partners in 2015, which you can see from his LinkedIn profile…

I still remember the days I would get emails from Bonner & Partners about Jeff Brown's next big investment recommendation. But, those days are past.

The company Bonner & Partners (BonnerandPartners.com) has been around since 2012 (Jeff Brown having started working for them in 2015), but has since spun off into Brownstone Research and Rogue Economics. If you go to their website now you will just find links to these two websites and that's pretty much it.

The website used to look like the rest of them: basically what Rogue Economics and Brownstone Research look like today, along with others that fall under The Agora umbrella, such as Palm Beach Research, Banyan Hill Publishing, Three Founders Publishing, etc.

Why did this company vanish and two new ones sprout up in its place? I haven't been able to find any good information on this, but one theory I have is that it simply had been around too long and the negative reviews surrounding the misleading advertisements these services are constantly pushing were hurting business too much… so they simply spun off two new companies with blank slates to replace the parent – just a guess, but probable I think.

It all falls under “The Agora”

Something worth touching on a little more is the fact that Brownstone Research, along with Bonner & Partners, Rogue Economics, and a handful of other investment research companies, all fall under the umbrella of “The Agora“.

It's confusing, like a messy cobweb of companies branching out to form new companies, spinning off other companies, and so on. But, what our readers need to know is that much of these independent investment research companies are affiliated, in one way or another, with The Agora.

What is The Agora? According to Wikipedia and from what I know having been digging around in this industry for years now, it is a network of over 30 publishing companies that was founded in 1978 by Bill Bonner.

*Note: Agora companies are often easy to recognize because they all seem to follow the same misleading investment teaser blueprint and all of their websites seem to have the same basic layout.

The Bleeding Edge (Free)

This is Brownstone Research's free newsletter service. You are able to subscribe to this service and get emails regularly, or you can just visit the website and read the articles without signing up.

Jeff is the main guy writing articles for this service and here you can find articles on many things related to investing, with a focus on new tech.

You'll also find articles by Jason Bodner, Wall Street veteran and editor at Brownstone, and it's no surprise that there are some from Teeka Tiwari as well. I say no surprise because Teeka Tiwari is an investment newsletter editor over at Palm Beach Research, one of the many Agora companies.

The Near Future Report ($199/yr)

This is Brown's flagship service. It costs $199/yr and through this newsletter service he helps guide investors with investment opportunities in new tech, providing new investment recommendations on a regular basis as well as detailed analyses and more.

Exponential Tech Investor ($4,000/yr)

Another service by Mr. Brown, here he focuses on micro-cap investment opportunities in breakthrough new tech. The goal is to make exponential gains, and the same basic layout of providing regular investment recommendations, analyses, etc. is what subscribers get.

Early Stage Trader ($5,000/yr)

This is the most elite service he offers, and the price tag reflects this. If you have an extra $4k lying around to join you can get access to the early stage companies that Brown is targeting, which mostly are in the biotech industry. Subscribers also get regular investment recommendations along with the rest.

Blank Check Speculator ($4,000/yr)

With all the hype around SPACs, it's no wonder he came out with this service. Blank check companies, aka SPACs, are the focus and basically what you get access to as a subscriber are the companies he is targeting at “pre-IPO” prices.

Outlier Investor ($4,000/yr)

Jason Bodner, another editor at Brownstone runs this service. Here the goal is on finding “outlier” investment opportunities that have been overlooked by Wall Street, and to get in on them right before they do.

Unchained Profits ($5,000/yr)

This is a newer service launched by Jeff Brown in the spring of 2021. Here, Brown is assisted by fellow employee and analyst, Andrew Hodges, for finding blockchain and cryptocurrency-focused recommendations.

Brownstone Unlimited

This is a subscription that provides access to all the services offered. I'm not sure about the cost here. You'd have to contact them to find out.

Are his services worth it?

Well, if you Google around online you'll find a lot of mixed reviews. You'll find plenty of complaints, which I'll go over in more detail in a bit, and you'll also find a lot of happy subscribers.

However, after years of looking into investment advisory services, I can say that the services Jeff Brown provides seem better than most just based on subscriber reviews I have found. He gets complaints, sure, but not as many as a lot of the other more shady services out there.

This could be because 1) He really does have high level connections in the tech industry which provide the ability to make good investments at early stages, and 2) He does put a lot of effort into providing top-notch services, for example by giving updates on every portfolio position each month… something you won't find often in this industry.

But, to answer the question of whether or not his service are worth it, let's first start by taking a look at his background. Is he just some guy off the street? Or does he really have all the credentials he claims to have?

A Look at His Background

The PI I hired was able to find that a Jeffery N Brown bought a $6 million house in Darien, CT in 2021.

Is this our Jeff Brown? Well, it's still hard to tell, but it seems so since I've found him to have quite a bit of ties to Connecticut.

A $6 million home? He must be doing pretty good for himself. But is this coming from profits from his amazing investments? Or, is this coming from the loads of subscribers he's been getting to pour into his services? This is the real question.

Let's start off this background section by talking about his ecuction. Did Brown really attend those prestigious Ivy League schools?

Here are some of his more important education claims..

Education:

- Yale University from 2018 – 2019 for the Global Executive Leadership Program

- London Business School from 2003 – 2004 for a MSc

- Purdue University from 1987 – 1991 for a Bachelor's degree

- Stanford University from 2006 – 2008 for some type of certificate

- and there are some others too

Information on this is limited here due to privacy laws surrounding education records.

I have not been able to find any proof of him going to London Business School after looking on a 3rd party website that allows you to look up university alumni (graduates.name). That said, since this isn't a website run by the actual university and since it's normally not that easy to find lists of graduates from universities, just because I can't find any proof as to him going here doesn't mean it isn't true.

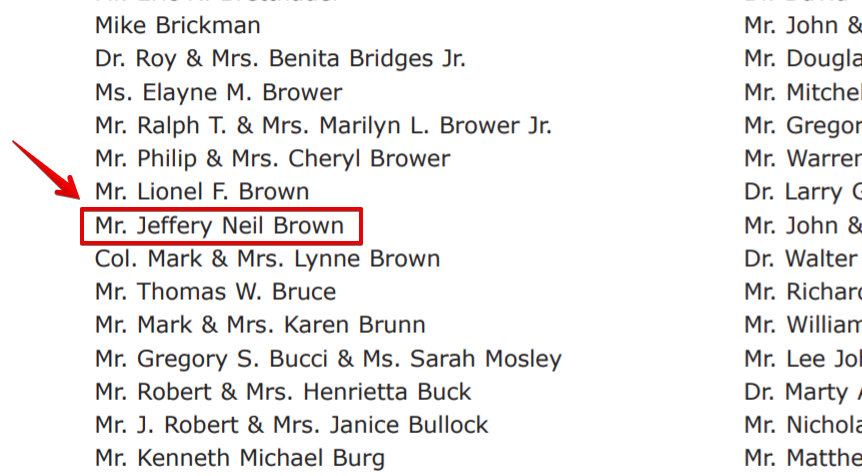

As for him attending Purdue, I was able to find his name on a list of Honor Roll Donors in a newsletter that was sent out to alumni of the School of Aeronautics & Astronautics back in 2007…

Other than this there wasn't much I could find regarding his education claims. Unfortunately (in this case), due to Family Educational Rights and Privacy Act (FERPA), student records are private. Because of this, I am not able to contact these universities and request official verifications. All I have access to is what's public.

A picture of him with a dog and a Yale School of Management curtain in the background is some evidence that helps validate his education claims at this university, but certainly isn't concrete. That said, through the investigation of the PI I hired, I was able to find out that he did indeed live in Connecticut when he claims to have have attended Yale in 2018 (Yale is located in New Haven, CT).

Did he go to all of these schools? Well, I guess you can decide whether or not to take him at his word.

Career Experience:

Again, these are the claims (some of the more prominent ones)…

- President & Representative Director of Juniper Networks from 2012 – 2014Employment Duration1 yr 8 mos

- Vice President of NXP Semiconductors from 2008 – 2012

- President at Trident Microsystems Japan from 2010 – 2011

- Head of Global Strategy & Development at Qualcomm from 2005 – 2008

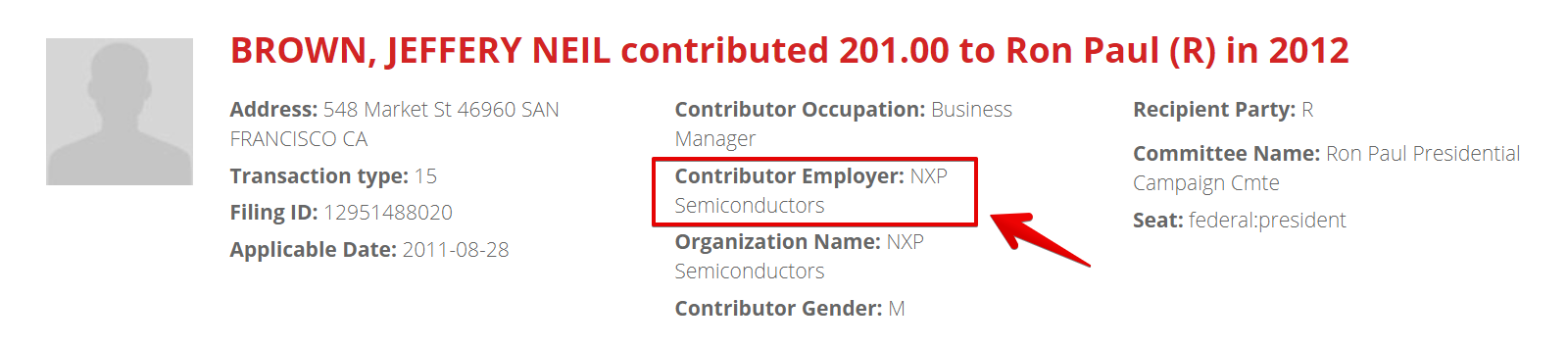

Some evidence that backs these up includes a people search where I found irrelevant information about him contributing money to Ron Paul (presidential candidate) in 2012, with additional information about him being employed at NXP Semiconductors…

Additionally, I was able to find some evidence of Brown working for Qualcomm.

Below is a screenshot of an article talking about Qualcomm's business success in Japan and the UK, with mention of “Jeffery Brown, director of international business development”…

Now, if you look on his LinkedIn profile it states that he was the “Head of Global Strategy & Development” at Qualcomm, but these titles seem to be referring to the same position.

Another article I found on RCR Wireless News, a website focused on wireless tech news, mentions a quote from Brown and states that he's (at the time) an “executive at Qualcomm Inc.'s MediaFLO division”.

This was posted in 2007 and goes along with what Brown claims on his LinkedIn profile as you can see here…

Validating some of the 3 educational claims above is good. I couldn't find information on him working for Trident Microsystems Japan, but searching through Japanese websites is rather difficult to do unless you speak the language (Brown is fluent in Japanese by the way).

Some Concerns..

Did he really work at Juniper Networks?

As for the claim of working at executive levels at Juniper Networks, I haven't been able to find evidence of this.

The concerning part: The private investigator I hired was able to find a list of the last 1,800 employees at Juniper networks and Brown's name wasn't listed anywhere.

Brown claims to have worked here from Nov 2012 – Jun 2014. Now since his name isn't in the records this means that either this company has an incredibly high turnover rate or somehow his name has been scrubbed from the company, which brings me to the next concern.

Why so little about him on social media?

When I was looking into Whitney Tilson, another guy that I reviewed lately that runs investment services similar to Brown, I was able to find quite a good bit of social media activity.

Looking into Brown I've come up short. Even the PI I hired couldn't find anything, which is likely because “someone is doing a good job scrubbing the internet of him”. His LinkedIn profile is all you'll find.

But why go through the trouble to scrub the internet of his existance?

Is he really an angel investor?

Back to that claim about investing in 130 startups with a 93% success rate.

What Brown seems to be referring to is investing in these companies as an angel investor, which is something he's mentioned being involved with.

Angel investors are high net-worth individuals that invest in start-up companies early on and usually are rewarded with convertible debt or ownership equity (shares).

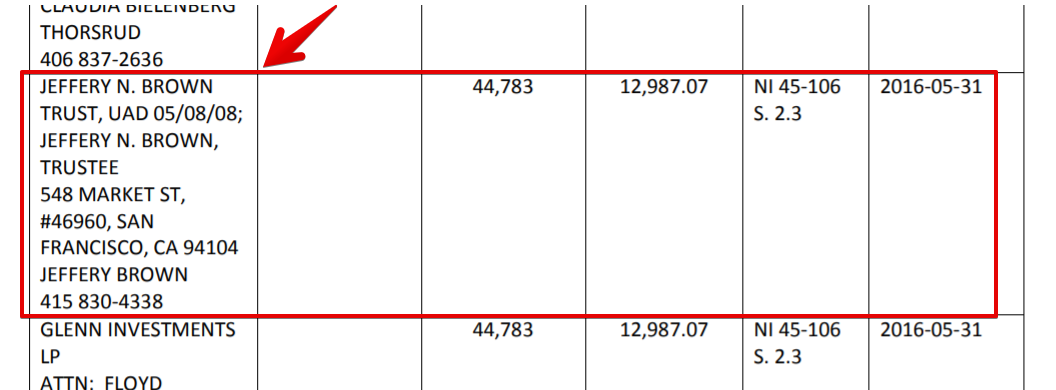

I looked into this more and found some proof of his angel investor status being true.

Below is a document showing he invested early in a mining/exploration company in Canada…

Not much, but it's some proof and I have no reason to doubt his angel investor claims.

Fraud Claims?

There have been some questions about an SEC fraud case surrounding a “Jeffrey Brown” and his real-estate investment scam called Quadwealth. This is NOT the Jeff Brown of Brownstone Research. It's just another guy with the same name (well, almost the same name – different spelling).

I've read some content online where people are accusing the Jeff Brown from Brownstone Research as being this man, saying things like “he has the same name” but we aren't exactly sure if it's the same “Jeff Brown”. This is ridiculous. The two men absolutely do not have the same name. The man we're reviewing here is Jeffery, and the man who was running some real-estate investment scam is Jeffrey… two different names!

Complaints

The complaints I've been able to gather mostly come from websites like Trustpilot, the BBB, and Pissed Consumer. A number of these complaints are more of a reflection of Brown's company (Brownstone Research) being a part of “The Agora”, which is known for rather unethical business practices, but I'll go over them as well anyhow because they are relevant.

1) Misleading Advertising

Hyped-up claims, the idea that you're going to strike it rich, talk about being able to set your kids up with an inheritance that will guarantee them prosperity. Maybe it's just good advertising, but I don't think anyone will disagree with me when I say that much of Jeff Brown's investment teasers are misleading.

After watching these you often walk away with thoughts of cruising around in your future private yacht or buying that new sports car just because you can.

Sure, nothing he's doing here is illegal, but he does know how to play with his words and the goal here is to lure in as many subscribers as possible.

Since you're reading this review of Mr. Brown I'm sure you are familiar with the investment teasers I'm talking about. Some recent ones I've come across have included this “Tech Melt” one where he teased massive gains investing in a biotech company…

And then there was his “Elon Musk's Next Big Project: S.A.V.” teaser where he teased a company supplying Tesla with image sensors for their autonomous vehicles…

And, for example, in this teaser, it was mentioned that investing in this company “could put up to an extra $30,000 in your pocket every year”…

Misleading? Absolutely.

We are told here that you could make an extra $30k per year, but there is not much information on where this number comes from. How much would I have to invest to earn this much? Of course, the starting investment needed makes a world of difference, but they don't mention anything about this… just a bunch of vague claims to get people excited so that they buy into the investment advisory service being pushed by Brown here, which in this case was The Near Future Report.

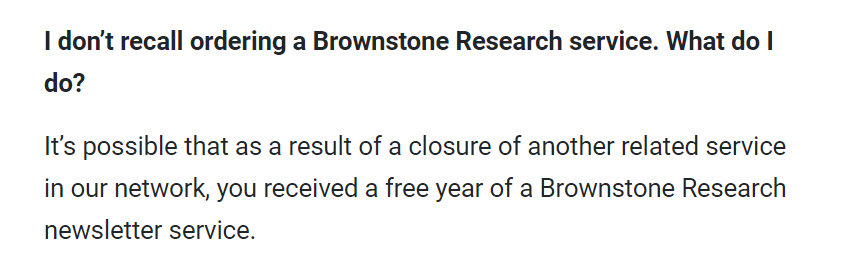

And sometimes the way they push people into subscriptions is even more tricky. In fact, sometimes subscribers to one of their services, or to a service of another Agora company, will get a “free year of a Brownstone Research newsletter service”. It sounds fine and all, but the problem is that this service will auto-renew… and the people getting signed up for it didn't even want it in the first place. So what often ends up happening is in a year's time people will get billed for the additional service and have no clue, or have forgotten, they were even a part of it.

This is crooked business in my opinion… not very ethical.

From a FAQ page at Brownstone Research

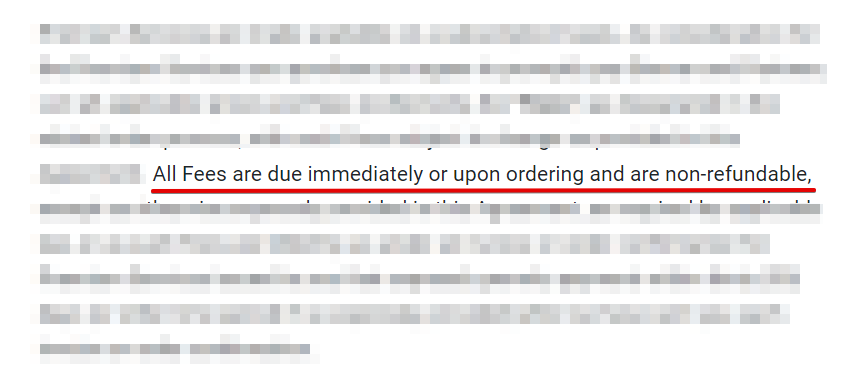

2) No Refunds

This is another common complaint you'll find surrounding Brown, but it's a complaint about the business rather than the man himself, which happens to have a no-refund policy…

However, that doesn't seem to be universally true and depends on what service you buy into. There are some moneyback guarantees, such as this (which was for his The Near Future Report service)…

However, they seem to be rather tricky to get, and the customer service is has been described as almost non-existent.

3) Losing Recommendations

It's expected to find complaints about losing investment recommendations. Of course, people are going to be upset if they lose money and of course, not every investment is going to be a winner, no matter whose investment advice you follow.

Below is a complaint I found on the BBB's website talking about how a key recommendation Brown made has been performing poorly since 2016…

Other than that there's not much to say because there is no information as to what this investment was.

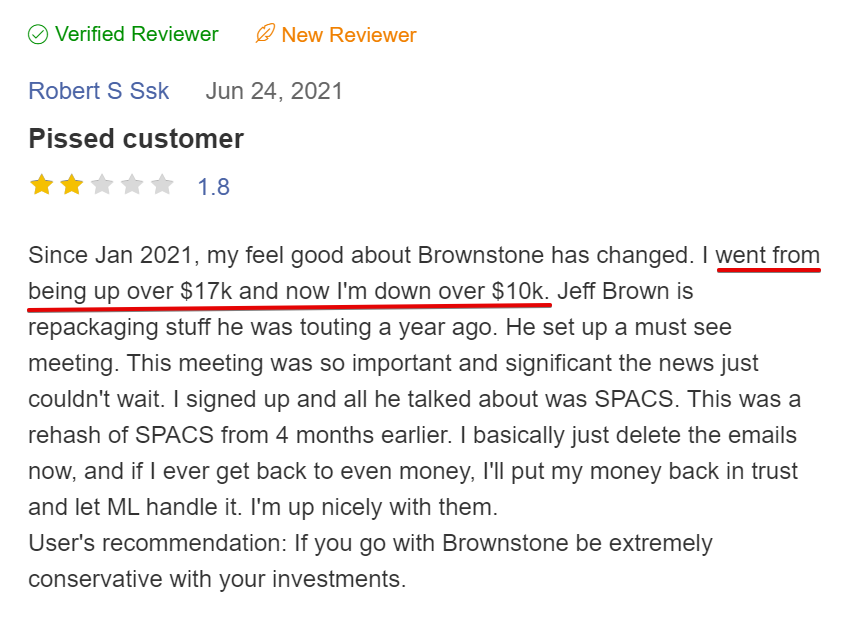

Another complaint I found on Pissed Consumer mentions is from a subscriber who claims to have “went from being up over $17k and now I'm down over $10k”…

That's quite a big loss, but again, there isn't much information provided here so it's hard to say how good or bad these recommendations are actually performing, not to mention that we don't even know what Brownstone Research service this is related to.

But going along with these, here's another mentioning that “Jeff is full of crap” and that, while he has claimed to have a 97% success rate, the actual rate is more like 10%…

Sounds horrible and all, but I can't say much without more information and proof.

4) Fraudulent Fees

Here's another complaint that is more to do with the company, not the man himself.

Some people, such as shown below, have complained about fraudulent and unauthorized charges to their credit cards after signing up for their services.

This is nothing new. If you've read our Agora review you'll know that companies under The Agora umbrella don't have the best reputation.

In my opinion, Jeff Brown seems like one of the most legit investment advisors you can find when it comes to investing in new tech. He's worked high-level jobs in the industry for years, and even since semi-retiring he still is heavily involved as an angel investor and advisor.HOWEVER, you already know that he's on the payroll of The Agora. So it's not like he's running his own independent research service here, and this is why the pushy and misleading ads coming from Brown are common. It's just the typical blueprint that all of The Agora companies seem to follow to a T.

Track Record

I already spoke a bit about Jeff Brown's track-record in the complaints section, because there are people complaining about losing money, but let's dive a little deeper here. After all, if you're going to be putting your hard-earned money into his recommendations it would be nice to know how well they perform beforehand, wouldn't it be?

We've already looked into his background and can see that he is a highly qualified individual to provide advice on investments in the tech world, but just knowing this isn't good enough.

Unfortunately, due to a lack of transparency on his recommendations, I'm not going to be able to paint a clear picture of his performance. All we can do is put together some pieces and extrapolate.

Let's start off by looking at a few positive reviews since we've already read some complaints from subscribers to Brown's services that have lost money.

The subscriber below claims “I made more money than I have lost on his recommendations”…

And here we have someone who claims to be subscribed to several newsletters and has made the most money from this one, referring to Brown's Near Future Report as well…

And here's another, newer, review also from StockGumshoe from someone who has joined both The Near Future Report as well as Exponential Tech Investor and claims to be up anywhere from 11% – 140% on every single one of his recommendations…

So, there are good reviews too. And I could show you more, but what's the point. There aren't any detailed reviews that clearly lay out his winners and losers so that we can understand how well his recommendations perform. And not only that, but we want to know how they perform over an extended period of time. Most people leaving reviews are either happy because they made some quick gains or upset because they lost money fast… but a short-term view doesn't really tell you much here.

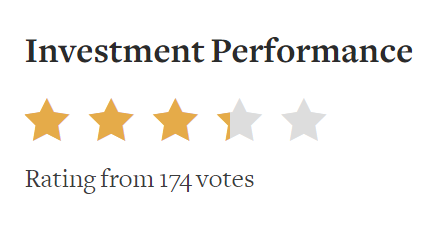

What's also worth bringing up are the investment performance ratings at StockGumshoe. If you look at the investment performance rating of The Near Future Report you can see that it's a little over a 3 out of 5…

Now that is fairly decent if you compare this service to other investment newsletter services… even though a 3 out of 5 really isn't that good.

That said, this really doesn't give us much information.

So, pretty much the only way to find out how well his recommendations actually perform would be to sign up to all of his services and keep track of everything, and you'd have to do so for a decent amount of time.

As mentioned, his track-record isn't transparent at all, which is nothing unusual considering he works for an Agora company. According to some people, like the subscriber who left this review, “he conveniently removes his losing picks rather quickly while continuing to tout his winning picks”…

Or maybe it would be better to say that “The Agora conveniently removes his losing picks…” in order to rake in as much money as possible.

Anyways, the point here is that I have no idea exactly how good Brown's track-record actually is, but I hope the information presented here helps you out some.

Everything above is about the track-record of the recommendations Jeff Brown has made for subscribers. In addition, we can also take another look at that claim made of his personal investments as an angel investor, which is that he has invested in over 130 startups with a 93% success rate.

Sounds good, but this is yet another very vague statement that tells us not much of anything. If he has winners 93% of the time this means he has losers 7% of the time. And what if the 93% that are winners are only winners by a small margin, and the 7% that are losers are absolute disasters? Then this means overall he loses money. Now I don't actually think this is the case here, but it's something worth thinking about.

In conclusion, Jeff Brown's investment performance record lacks transparency and is unclear. It's filled with vague statements and incomplete data.

*Any comments on his track record from subscribers to his services would be greatly appreciated!

Conclusion – Fraud or Legit?

I've already known about Jeff Brown and his investment services for years. At first it seemed to me that he could be a scammer. However, after learning more about him and digging deeper, I do not think he is, although there are still definitely some concerns about his claims that I haven't been able to verify.

At first you just see the surface… the over-hyped marketing teasers about how you can make big money following the advice of an expert. Sounds good, but many will simply exit the sales page and write it off as a scam.

It's a shame that The Agora companies all seem to follow the same deceptive marketing blueprint. And, unforunately Brown works for one of these companies, which puts somewhat of a stain on his name.

That said, the guy most definitely has an impressive background in the tech world. He's been involved in the industry for decades and know what it takes to make an investment-worthy company, having worked at high level positions (at least some of them are proven).

If the “next big thing” in the tech world is what you want to put your money into, then Brown might be the guy to listen to. Just don't fall for the marketing hype when you join his services.

I hope you've enjoyed this write-up and I hope it's provided value. As always, I'd love to hear what you think in the comment section below.