Ian King's Strategic Fortunes promises to give you high profits on upcoming tech trends. Here, the emphasis is on the word “upcoming” as the plan is to get to them before they become big winners.

According to King, he has a reliable system that tells him which ones will be the next Amazon, Google, or Apple.

If he is indeed able to deliver on this promise, the prospects for high profits are very good. It is true that the American economy, as he says, is transitioning. In fact, it is not just the U.S. but all global economies are becoming more reliant on technology.

Due to its fast-paced development, it only takes months (or even weeks or days) to see new winners. Before you know it, a seemingly obscure company has already become the new big thing because of innovation.

If you were able to spot them early on, you are one lucky investor. Expect to see life-changing gains that can give you a comfortable retirement. This is the scenario everyone dreams of.

Such is the promise of King through his newsletter.

The question is, will he be able to deliver? Is his exclusive system really that reliable? What are its components? Does he have a significant track record to prove his claims?

As these are all relevant questions, we will try to tackle each point as we discuss more details about Strategic Fortunes. So do stick around and read until the end of our review.

Overview

- Name: Strategic Fortunes

- Editor: Ian King

- Publisher: Banyan Hill

- Website: www.banyanhill.com

- Service: Investment Research Service focused on Tech Trends and mid-cap stocks

- Cost: $47, $79 (from $199), $129

If you are an investor looking to invest in tech companies before they go big, check out Strategic Fortunes. It is an entry-level subscription service from Banyan Hill.

Ian King will send you his recommendations based on his four-step system. Expect these in his monthly newsletters, model portfolio, and weekly webinars.

Compared with other subscriptions, this is among the most comprehensive in terms of touching base with users. It has daily, weekly, and monthly updates to keep its subscribers up to speed.

In his ad, he claims that the win ratio of his closed portfolio is 83%. Further, King says that its average gain is “146.5% with an average hold time of 256 days”.

When you subscribe, expect to get updates only on mid-cap stocks as this is the newsletter's focus. It tries to get away from a “crowded field” and looks at those in the $2 billion to $10 billion range.

The standard subscription is at $47 but you get additional reports for $79 and $129. We will discuss more of the price points and features below so keep on reading.

What is Banyan Hill?

“America's No. 1 Source for Smarter, Safer, And More Profitable Investing”

This is the line under the banner of Banyan Hill. Obviously, being number one in this industry is a tall order. There are just too many publishers who constantly come up with new services all the time.

But if only for its association with a bigger umbrella, there can be truth to its claim. You see, Banyan Hill is under The Agora.

As we have discussed in our review of the company, Agora has a wide network of smaller publishers. It has a wide influence and reach in the field of investment research.

In fact, the number ranges from 30 to 80, depending on the list you look at. Some examples of these are:

- Palm Beach Research

- The Oxford Club

- Brownstone Research

- Stansberry Research

- Three Founders Publishing

As we have mentioned, part of this list is Banyan Hill. Overall, The Agora's newsletters have a considerable reach in 10 countries and are available in six languages.

Our research on its founder, Bill Bonner, also revealed that its annual revenue from around 2.5 million subscribers is in the $1 billion range.

So as you can see, if only for its association with this vast company, there is some truth to the no. 1 claim. But that is not just Banyan Hill.

This is not to discount its impact, though. The publisher also has a strong base of 700,000 daily readers based on its claims.

Its efforts as a content provider are focused on “U.S.-based investment opportunities”:

-

Commodities and natural resources

-

Small- and mid-cap stocks

-

income-producing investments

-

Option plays

-

Deeply undervalued domestic companies

When you read about them, the publisher's history and rationale are actually interesting. It started in 1988 as a “global asset protection and investment organization”.

In the past, it was more geared towards activities outside America. Its team members helped clients with investments in other countries, as well as offshore bank accounts.

Sure, they were in the finance sector, but their priorities then were different until they rebranded in 2016.

According to its website, the team chose the banyan tree as a symbol and name because of its size and might. While not as majestic as, say an oak tree, a banyan tree is more formidable.

During natural disasters where everything is destroyed, expect this tree to still be standing proud and tall.

This picture is what the experts at the publishing house want subscribers to liken them to. With their financial advice, investors can maintain and even grow their wealth even in tumultuous times.

All in all, they offer 29 paid services from their pool of insiders and experts. Here are some of them:

- Alpha Investor – Charles Mizrahi

- The Bauman Letter – Ted Bauman

- Strategic Fortunes – Ian King

- Profits Unlimited – Paul Mampilly

- Crypto Flash Trader – Ian Dyer

- Precision Profits – Michael Carr

- Slingshot Profits – Clint Lee

- Fast Lane Profits – Chad Shoop

Aside from these premium content, they also have six free newsletters:

- Bold Profits Daily – Paul Mampilly

- Winning Investor Daily – Ian King

- Bauman Daily – Ted Bauman

- True Options Masters – Mike Carr and Chad Shoop

- American Investor Today

- Great Stuff

Who is Ian King?

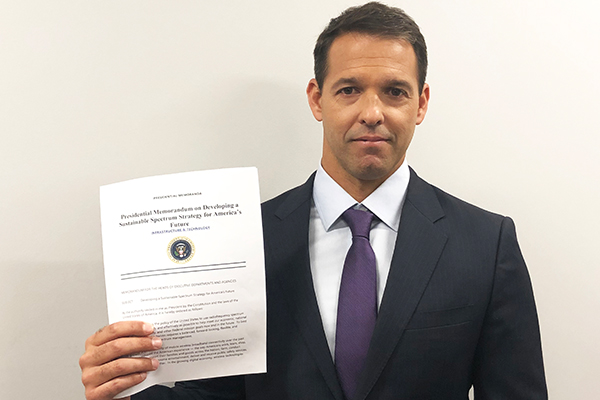

Ian King has come a long way from starting as a clerk at Salomon Brothers Mortgage Trading Desk. Now, he authors three premium services and one free newsletter at Banyan Hill.

These are Strategic Fortunes, Next Wave Crypto Fortunes, New Era Fortunes, and Winning Investor Daily.

Further, he is also the Lead Instructor of Crypto Trading at Investopedia Academy. This online course is for regular investors who want to try cryptocurrency.

In the past, he has also been a hedge fund manager who worked on long and short equity funds. For 10 years, he was the Head Trader of Peahi Capital, a hedge fund company in New York. Before this, he was with Citigroup.

In one of his advertisements, he was also dubbed as the “King of Crypto”. We could not verify the veracity of this label or what led to the title, though. But since it is a marketing material from Banyan Hill, we expected some sort of self-promotion.

We are not saying it isn't true. For someone who has been investing for over twenty years, we are sure he already has significant achievements. But you also know how it goes with these publishers and advertisements.

What are some of King's Recent Investing Ideas?

For us to know the editor deeper, we decided to look at some of his recent articles. Since we will be counting on his recommendations, we need more information about his point of view.

Sometimes, it just works better this way. Copywriters often put too many flowery words in the profiles of the editors. As a result, we still do not know much even after 2,000 words. If only they would just go straight to the point.

But that would be asking for the impossible, it seems. So we just take it upon ourselves to research more and find things out on our own.

Here are some of King's ideas as articulated in his recent writeups. Check them out and see if you would agree with him.

On Web 3.0

We are now slowly entering the next phase of digitalization. This is the assertion of the editor.

According to him, blockchain is the catalyst for the next generation of the Internet. This is due to the technology's ability to do straight transactions. In the past, all of us were controlled by middlemen, but soon, this will no longer be necessary.

An example of this is bitcoin. Two people can do direct transactions involving this cryptocurrency “without the need for a centralized intermediary”. No one monitors what you own. They are only “accounted for by a decentralized network of computers”.

This is possible because of blockchain technology. However, King clarifies that this is not limited to currencies and payments.

According to King, this is the “decentralization of our future”.

He said that one unfortunate effect of recent developments on the Internet is the issue of monopoly. Companies used their “first-mover advantage” to take control of our private data.

Unfortunately, we allow them to do that because if we don't, we would not be able to use their platforms. He cited Facebook, Gmail, and Airbnb as examples.

We agree with him on this point. There have even been objections to the fact that for these platforms, our data are not even as secure as we might expect.

People have also correctly pointed out why the default settings in the past always allow you to disclose personal information. If you want your data to be protected, you still need to click on a lot of links first.

If we go by the logic of consumer protection, every company's default mode should always be to give you privacy. This should be the case unless you explicitly say you are fine with them using your information for other purposes.

Objections and concerns to these led to some reforms. Although some were a bit late, we still appreciate key amendments to data privacy.

According to King, with blockchain technology, Internet users will even have more control of their data. In fact, you can easily choose what to share and with whom.

He also cited the transformation of YouTube and Spotify, since artists will soon be able to share their music directly with their fans.

Naturally, his article on Web 3.0 ended with a pitch for his Next Wave Crypto Fortunes newsletter.

On Bitcoin's Rise to $100,000

King uses an amusing analogy as he discusses his thoughts about Bitcoin reaching all-time highs.

He recounts a conversation between him and his wife about the science of “parenting without saying no”.

They found out that instead of the words “no”, “don't”, or “stop”, it is more advisable for parents to redirect their toddlers. Another way is to be a more proactive parent so you wouldn't have to say “no”.

He then went on to say that when we frequently verbalize that we disallow things, the more toddlers want to do them. The same is also true even for adults, he adds.

This is why as more so-called experts warn people about cryptocurrencies, more people are going to buy them. And this, according to him, would result in Bitcoin going to $100,000.

Based on his calculations, this is happening soon. He does not listen to current controversies but he did look at the trajectory of bitcoin since 2012. This is the best way to look at volatile investments like crypto, he says, that's why he is confident he is right.

So, do you share his views on either blockchain or bitcoin? Or do you tend to agree with both?

Your answer can pretty much determine if you can trust him and his choices. If you do not trust his instincts and judgment, it would be best to pass on this one.

But if you find his arguments compelling and you are excited about what he will invest in next, you may try his service. According to him, it is completely risk-free, anyway. But let's discuss that further below.

What is Strategic Fortunes?

So what is it? Well, apparently it is the newest name to what has been previously called Automatic Fortunes.

Unfortunately, it seems the publisher is handling so many subscriptions that it could not even be bothered to proofread the website.

In a nutshell, the service is an advisory focused on mid-cap stocks. King's goal is to help you invest in emerging tech companies that are poised for dramatic growth.

Imagine spotting Apple or Amazon even before major investor took notice.

According to King, he is able to show these stocks through a system he devised. To help guide you better, he will update you regularly through different channels.

However, the meat of his recommendations are in his portfolio and newsletters.

How it Works

This part here is a bit tricky for us. In his marketing page, King talks about a “four-step system” that allows him to see big tech winners before they explode.

So we were wondering if he has an updated version of a similar system he talks about. However, that includes five steps.

In our review of New Era Fortunes, we discussed these steps. These are:

- Identify tipping-point trends that are on the verge of a big breakthrough

- Invest in small-cap tech stocks that will be the next giant superstars like Waze, Twitter, and Uber.

- Look for companies that have the “X-factor”. These are the ones underpriced by investors.

- Identify companies that have momentum. Their sales must be increasing by 20% every year.

- Know when the right timing is.

As you can see, there are five, not four steps. We looked at his typically overly lengthy pitch so we could check. However, there was no discussion about it.

All the clues we found were on the first marketing page: “tipping-point trends”, “X factor”, “track record of profitability”.

So it looks like it is just a variation of his five-step program. It seems steps 1, 3, and 4 are covered. Still, there were only three clues, so we assume it's step 5 since he targets mid-cap companies in this service, not small companies.

As would-be subscribers, it would be best if he would have given us a clearer picture of his process. A lot of the information in his pitch is not even his ideas, sadly.

We understand the need to show evidence and proof of a trend he is trying to establish. But to go on and on, repeating a lot of information, without even telling us how you will be able to help us, is unfortunate.

To be frank, we highly doubt that people need screenshots of what seems like every TV appearance he had. We even had to zoom out to 25% just to capture all his photos.

This is a pitch for his newsletter which bears his stock recommendations. It is not a scrapbook of keepsakes made by his parents.

To be fair, in the end, he was able to make a compelling case for blockchain. But our point here is that even if he reduced his text by 30% or even up to 60%, that would have been enough.

But this seems to be the typical playbook for most, if not all, investment research editors (and/or their copywriters).

What You Get

We repeat, Automatic Fortunes and Strategic Fortunes are the same. We know you clearly see the inconsistency (which can easily be remedied by editing software), but you know what they mean anyway.

So what will you get when you subscribe to the newsletter?

Well, it depends on your subscription, but here are the basic inclusions:

- Model Portfolio

- Shows stocks on King's “Buy Now” list

- Monthly Dispatch

- Eight pages of a “tipping point trend” analysis usually tied to a stock recommendation

- Weekly Webinar

- Thursday sessions on portfolio updates and analysis in current market issues

- Trade Alerts

- Contains explicit instructions on urgent trades: buy, sell, for how much

- Daily Briefings

- Free subscription to Smart Profits Daily

- Customer Care Team

- Dedicated group assigned to assist subscribers

If you subscribe to their Standard option, you will receive all the items listed above, for $47 a year. This is a digital-only service with two exclusive reports:

- How To Make a Fintech Fortune

- Making $1 Million: How to Buy Your First Bitcoin

The Deluxe Subscription offers digital and print copies of the newsletters for $129. You will also get the same free reports.

But if you subscribe to Platinum, you will not pay the regular annual fee of $199. King says he is offering this for only $79. This will entitle you to both digital and print subscriptions.

Aside from the two reports we mentioned, he also adds three more bonus modules.

- The Company Leading the $12 Trillion 5G Revolution

- 5 Toxic Stocks to Dump NOW

- Buy This Millennial App Now

We also want to point out that these special reports change over time. What editors and publishers usually do is update them depending on current market and/or even political events.

Cost and Refund Policy

Cost

- Standard: $47

- Deluxe: $129

- Platinum: $79 from $199

Refund Policy

You may ask for a refund within a year of subscription. As per their policy, you just need to call them.

Track Record and Reviews

It's crucial for us to know how King's previous recommendations have fared. We want to know what regular investors think and what analysts have to say about him and his recommendations.

Feedback like these, though, as you would know, do not represent the whole newsletter experience. So as much as they are useful to use as a guide, you must also not solely rely on them.

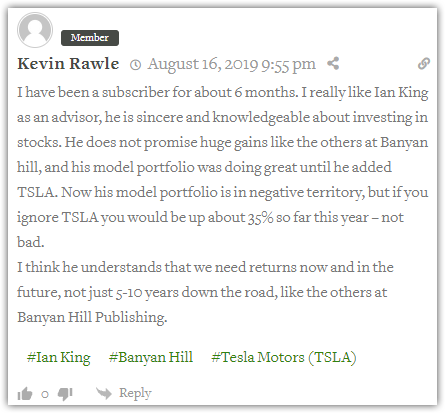

In Stock Gumshoe, the newsletter has a decent 3.7 rating out of 5 as of this writing. There were two comments about fraudulent credit card charges, so those are red flags.

However, some comments also spoke well about King and his service. The frequent updates alone, one commented, are already worth the subscription fee.

We have also noticed and mentioned above, as King has daily, weekly, and monthly updates.

Another subscriber also talked about King's model portfolio. However, user Kevin Rawle has only been a subscriber for less than a year when he wrote the comments. So it remains to be seen what his impression is after a longer period.

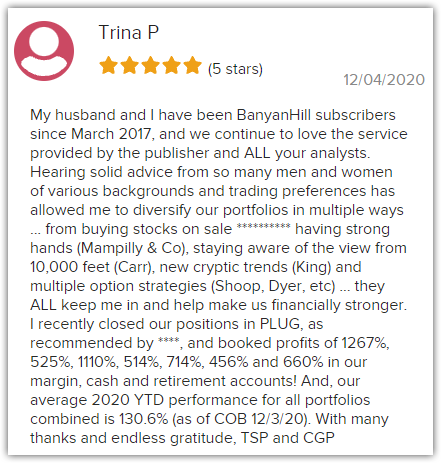

In the Better Business Bureau, Banyan Hill was able to get an impressive 4.72/5 rating. Upon closer inspection, of the almost 150 comments, a great majority were about Paul Mampilly. He seems to be a rock star among subscribers.

We were able to spot one comment which mentioned King, but it was for his crypto service.

We think the rating is still significant, though. It somehow reflects on this newsletter in some ways since they belong to the same publisher. It also confirms the rating in Stock Gumshoe.

For our part, we noted how King's claims can be overly optimistic or somehow exaggerated, depending on how you view them.

You can find valuable information, clues, and insights regarding his previews teasers on our website. Check out past articles about his Digitarium: Next Google and Mobility as a Service (MaaS) stocks and 20-minute Retirement Solution.

Pros v Cons

Pros

- Affordable service

- Frequent updates and alerts

Cons

- Lacks a deep discussion on how it works

- Complaints about credit card charges

Conclusion – Is Subscribing a Strategic Move?

We hope you found all the details you were looking for in our review. As always, we try to be balanced, fair, and informative.

In our review, we walked through the editor's background and views, as well as the process, track record, and claims of the newsletter.

Given all the points we have covered, are you inclined to subscribe to Ian King’s Strategic Fortunes? Why or why not? Do tell us below.