Will Neil Patel's Angels + Entrepreneurs Network really help you find investment opportunities with 1,000%+ profit potential? Do you really only need $50 to invest in order to get started?

There are a lot of questions being asked about their investment advisory services and whether or not this company is legit, which is the reason for this review. Here we'll be taking a look at Neil Patel and others behind the services, what exactly their investment services provide, the cost and refund policy, how risky the recommended investments are, and more.

Overview

- Name: Angels + Entrepreneurs Network

- Website: angelsandentrepreneurs.com

- Social Media: Facebook page

- Founder: Neil Patel

- Products/services: Pre-IPO investment advisories

What Is Angels + Entrepreneurs Network?

Angels + Entrepreneurs Network, which I'll be referring to as A&E Network at times (not the TV station), is and investment newsletter publishing company that was launched by Neil Patel in June of 2019. Its focus is specifically on investing in tiny startup companies in the pre-IPO stage, which is what Matt Milner has been calling "Genesis Investments".

Neil Patel is new to the business of providing investment advisory services, but has found personal success investing in small startups as an "angel investor" himself. Not only that, but when the company was first launched Robert Herjavec, one of the guys from the hit ABC show Shark Tank, was a big endorser of it. Additionally, Neil isn't the only one behind it all. There are other experts on-board as well, and the team looks through hundreds of opportunities a month while only recommending a few.

The address the company is listed at is as follows...

1125 N Charles Street

Baltimore, MD, 21201 USA

Why am I even bringing this up?

Well, because this place is located at same address as Stansberry Research, Money Map Press, and other investment newsletter publishing companies. More specifically, it's located at the same address as many "Agora" companies, which is the big company behind most of the investment newsletter publishers out there, such as Omnia Research and Brownstone Research... and is a company that doesn't exactly have a very good reputation (there are many companies under "The Agora" umbrella and not all are bad).

Is it an Agora company?

I haven't been able to find the specifics, but there are definitely ties to The Agora as will become more evident throughout this review.

Who Is Neil Patel?

Neil Patel is, as he puts it on his own website, an author, entrepreneur, marketer and blogger. He is well known for his expertise in the online world of SEO (search engine optimization), where he helps large and small businesses increase their online presense through Google, Yahoo, Bing, etc. search results. His main focus has been helping websites gain more traffic and he is one of the most well-known experts you will find in this field.

Besides this, Neil is also an investor, New York Times best-selling author, a top influencer on the web according to The Wall Street Journal, and has received recognition for being a top entrepreneur by President Obama and the United Nations.

In the more recent years he seems to have been getting more and more into investing and putting his money to work for him. According to what's been said, he has made good money investing in startups and this is the whole reason for launching this Angels + Entrepreneurs Network to help others follow along.

So, in short, he's rather new to the world of investing. He doesn't come from a spectacular Wall Street background. And this is his first time getting into the world of investment advisory services... but he claims to have developed a very extensive network of high-level contacts and it is this private network that has led to him being so successful investing in startup companies.

Other FAQs

Is Angels + Entrepreneurs Network legit?

Yes, the company and the services they offer are legitimate - no scams here.

That said, the promotions you may find online can be a bit misleading and investors must understand that there is definitely risk involved investing in startup companies like they recommend through their services.

Are refunds available?

Yes and no. It depends on what subscription you are buying into.

I'll be providing more details on this later in the review so just hold your horses.

It's All About Investing Pre-IPO

Getting in on companies before they have IPOed is where the big money is at, and this is what the A&E Network is all about.

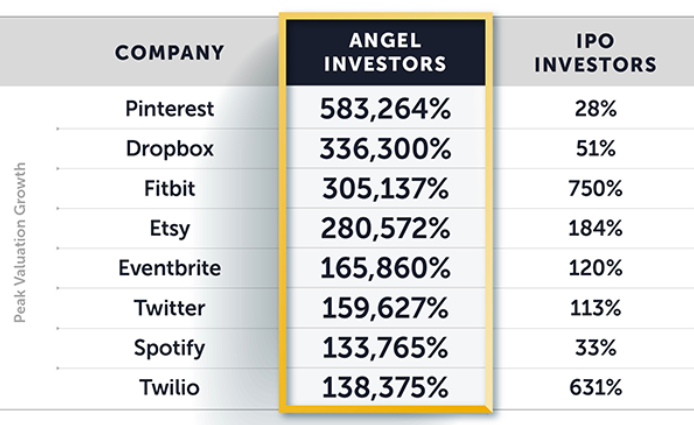

In some of the promotional material for A&E Network they talk about how you could have the opportunity to get in on the next Facebook, Google, or Amazon at the ground-floor, and also go on to show the chart shown here that shows the amount angel investors made versus those who invested in these companies during their IPO...

There's a big difference here. However, this is a bit misleading and getting into companies like this pre-IPO would be an incredibly rare, an unlikely occurence.

To explain why this is, let's talk about what makes all of this pre-IPO investing even possible.

It all has to do with Title 3 of the JOBS Act

IPO stands for Initial Public Offering, and this is when a company "goes public", allowing the public to invest in their stock.

Before IPOing they are still private companies and normally only accredited investors and qualified clients have access to invest in them, which exludes 99% of the general public. Unless you have at least $1 million in net assets (not counting your house) or have made at least $200k for the past two years, OR are married with a $300k combined income per year... then you don't qualify to become an angel investor, at least not in the traditional sense.

This is a bummer, because getting in early is what everyone wants. And this is exactly what Title 3 of the JOBS Act allows for, as explained in this informative 1-minute video...

What is the JOBS Act?

The JOBS Act, or Jumpstart Our Business Startups Act, was signed into law by President Obama in 2012 as a way to help stimulate the economy and help out small businesses during this time of economic struggle.

Basically what it does is makes it easier for small businesses to get investments from the public.

Title 3 of the act is also known as the CROWDFUND Act... and at this point you probably get what's going on here.

Title 3 alows for startups to issue securities via crowdfuding. As long as you are over the age of 18, you can invest in pre-IPO companies through crowdfunding websites like Kickfurther, SeedInvest, and WeFunder for example.

It sounds amazing and all, but there are some downsides and concerns with this. I'll go over two that I think everyone should be aware of.

#1 - Don't expect to invest in the next Amazon or Facebook like you are led to believe you'll be able to

This law brings a great amount of new opportunity to the public, but one thing you should know is that the companies you usually find on these crowdfunding websites are those that have failed to secure investments from venture capitalists and whatnot.

There still are hidden gems out there, but if the venture capitalists pass on an investment opportunity, then there is a good reason.

Not only that, but there is a $1 million cap set on the amount of money companies can raise through crowdfunding (Reg CF) sites, meaning that many of these companies are complete saplings just starting to grow... many of which you will find don't even have business plans set in place.

#2 - A good opportunity for scammers

One concern that has sparked some controversy is how this law also increases the opportunity for scammers to scam the general public.

Making it easier for the public to invest in startups and making it easier for startups to get funding... this all makes it easier for scamming to occur.

Now of course the various crowdfunding platforms out there have safeguards in place to help mitigate the chances of such occurences, and of course the A&E Network will be doing a lot of research into any opportunities recommended, but it's still something worth noting.

Experts on the Team

Neil Patel is the main guy behind it all as we already know, but I won't spend any more time talking about him. Let's go over some of the other people on the Angels + Entrepreneurs Network team.

- Don Yocham

Don Yocham is an expert on the A&E Network. He is the Director of Deal Analysis for the company and his job consists of traveling around and talking with founders and CEOs of startup companies to find the best opportunities for subscribers.

And he certainly isn't another Joe Schmo. Don started out on the bond floor of the Chicago Board of Trade and went on to spend over 25 years in the investment management industry, managing up to $16 billion in assets at one point. And currently, besides being part of the team here, he is also the Executive Director of the National Institute for Cannabis Investors (NICI), which is an investment advisory firm that provides subscribers with investment recommendations in the cannabis industry.

- Mike Ward

Mike Ward is also on the team. You may have heard his name before because he's been in the investment newsletter business for quite some time. He's actually the founder of Money Map Press, another investment newsletter publisher, as well as being the founder of Money Morning, a popular investment news website. And he's also the founder of NICI, which I just mentioned Don Yochman is a part of, AND before all of this he was the editorial director at The Oxford Club... another investment newsletter publisher. He is the founder of the Private Deal Flow service they offer, which I'll go over next, but besides that I'm not sure of his position.

It seems that he's more of a publisher than some expert invester however. His background is impressive, but not in the area of investing. He comes from the area of magazine and book publishing before getting heavily involved in the investment newsletter publishing business.

*Note: This further shows that Angels + Entrepreneurs Network is tied to The Agora. NICI is an Agora company as well as the Money Mapp Press company that Mike Ward is the founder of.

Products/Services

Right now the product/service lineup that the company offers is few, but what they provide here is a lot. Neil and the team really seem to overprovide with what you get here.

Angels & Entrepreneurs Network ($599/yr)

This is the main membership service offered here, and the focus is on startup companies that have the potential to bring investors gains of 1,000x or higher. There's a lot included with this subscription so I'll break it all down for you:

- Investment Recommendations - The core of what subscribers get here is 2 recommended investments each month. Upon joining you'll be provided with the latest recommendations, and access to the member's website where you can find over 20 deals that they still recommend.

- Due Diligence Packages - Each startup recommendation that is made comes along with a detailed report on why the recommended companies are good opportunities, including a look at their business plans, projects, revenue projections, etc.

- Deep Dive Videos - These are informative videos that Neil Patel puts together where he eplains more about the recommended investments, what he likes, future predictions, etc.

- Angel Investor Action Plans - This consists of a step-by-step action plan if you want to invest in the recommendations.

- Hot Seat Sessions - These are interesting... subscribers will be able to ask questions and hear entrepreneurs pitch their companies and why you should invest. It's like a Shark Tank type thing.

And there's still a lot more. Investor Updates are provided for new developments that subscribers should be aware of. The Momentum Report is a monthly report sent out about exciting announcements from recommended startups. Boardroom Meetings are live webinar sessions where the team answers questions and provides any additional information they've gathered or heard from insider contacts. The State of Angel Investing Report is a briefing where the team goes over upcoming trends for the next quarter. The Founder's Corner is a private forum that subscribers get access to where one can connect with others subscribers and share ideas. And as if this isn't enough, they also provide cheetsheets investors should use when looking at investments in this area, master class training sessions and pre-recorded training sessions on being a successful angel investor of this kind, and even access to an annual retreat.

As was listed above, the retail price for a membership here is $599/yr. However, this is often discounted through special promotions, although with all that they are providing I don't think $599 is too high of a price.

Private Deal Flow ($5,000/yr)

Private Deal Flow is a VIP service offered by A&E Network, as you can tell by the high cost of this service.

This is all about, as the name suggests, private "deal flow".

Neil Patel has worked with high-end clients like Google, Facebook General Motors, NBC, etc. over the years... and has developed connections with leaders in various industries. This is important because it is this private network that he finds out about deals from. In a nutshell, because he has access to high-level individuals, opportunties to invest in startups run by these people or by people they know often come across his desk... and when joining his Private Deal Flow service this is what you are getting access to.

As is stated on the website, "you'll be able to invest in the next 8-figure payday opportunity that comes across our deak and makes the cut". The goal here is pretty ambitious, which is to get in so early that venture capital firms haven't even gotten in yet.

Here's the basic process of how it works...

- First it starts when a founder of a startup in Neil's private network brings him details on their new company.

- The deal is looked at and analyzed by Neil, being rejected if it doesn't look good.

- The team at A&E Network vets the angel deal further.

- Research and analysis is sent out to subscribers along with the Due Diligence Package for the company.

- Instructions are provided on how to go about investing.

For each investment recommendation there are the Due Diligence Packages provided that I already mentioned, and subscribers also are provided with Deep Dive Videos where Neil provides his thoughts on the companies and why he thinks they're so great, Hot Seat Sessions with the recommended companys' founders where questions can be asked and answers are provided, Urgent Deal Updates when there is something going on that should be known, and more. The layout of the content is very similar to that of the regular membership.

Members to this VIP service will also get access to a private VIP forum, which I imagine is separate from the forum normal members get access too, but this I'm not 100% sure of.

And once again, the $5,000 price tag is the retail price, but there are often discounts provided through current promotions.

Costs & Refunds

As you just saw above, the costs of these services range from $599/yr to $5,000/yr, but are often heavily discounted through different promotions.

*Note: These memberships are set to autorenew. So don't be surprised when you join and get charged in a year from now.

As far as refunds go, it depends on what subscription you buy into.

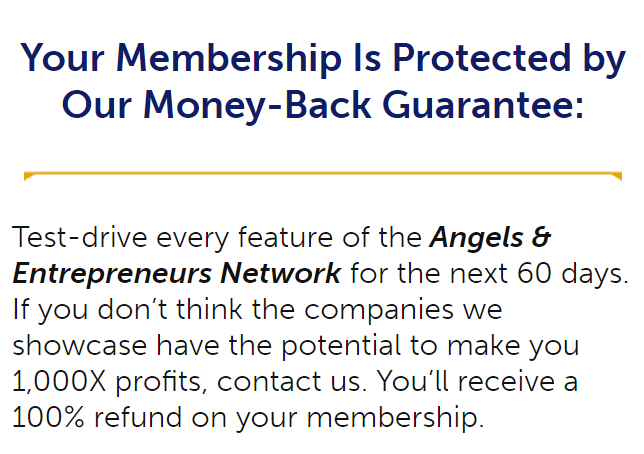

The regular membership does have a 60-day money-back guarantee, in which you can request a full refund if you don't think the companies recommended have the potential to make 1,000x profits. It's a bit of a strange refund policy, because I guess anyone can say they don't think the recommendations will go up 1,000x, but this is what it states...

If you do want to request a refund then you can contact customer service through this form or call, text, or email them as follows:

- 1-866-310-1498 to call

- 443-564-4624 to text

- support@angelsandentrepreneurs.com to email

Their hours are 8 - 5 Monday through Friday.

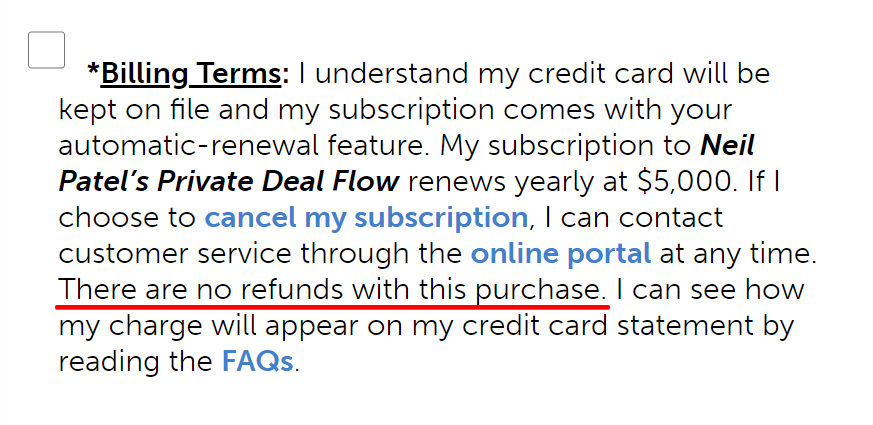

For Private Deal Flow the policy is cut and dry. NO REFUNDS...

And that's a $5,000 charge. So make sure it's something you really want to buy into before you actually do.

Track-Record

At this time there is no track-record as to how well the investment recommendations provided through their services have performed over time. This is disappointing, but perfectly understandable considering how new the service still is. When investing in startups this early, you have to be patient. Fast gains are possible, but shouldn't be expected.

Pros v Cons

Pros

- Low Barrier of Entry - The crowdfunding investment opportunity requires little money to be invested. According to A&E Network's website, it could be worthwhile to start out with just $50 (but honestly I certainly wouldn't pay for the subscription just to have $50 to invest).

- Recommendations Are Heavily Vetted - Neil and the team both look deep into any company they recommend and provid detailed reports on this. Equity crowdfunding can be risky, but their selection process helps mitigate this risk.

- High Profit Potential - We're all here to make a profit, and getting in on the ground-floor of a company before it goes big is where everyone wants to be.

- Trusted Team - From what I know, and have known, about Neil Patel, he seems like a trustworthy guy... more so than most you'll find in the investment newsletter publishing business. Not only that, but Robert Herjavec backed the launch of this network.

Cons

- It's Risky - Some stats show that 90% of startups fail. Not only that, but 75% of startups that manage to secure venture capitalist funding fail. Lots of failure and lots of risk here, although of course Neil and the team help to mitigate this as I mentioned.

- No Refunds - For the Private Deal Flow service there are no refunds.

- No Track-Record - This isn't their fault, but it's still a con and makes the decision of whether or not to join a bit more challenging.

Who It's Best For

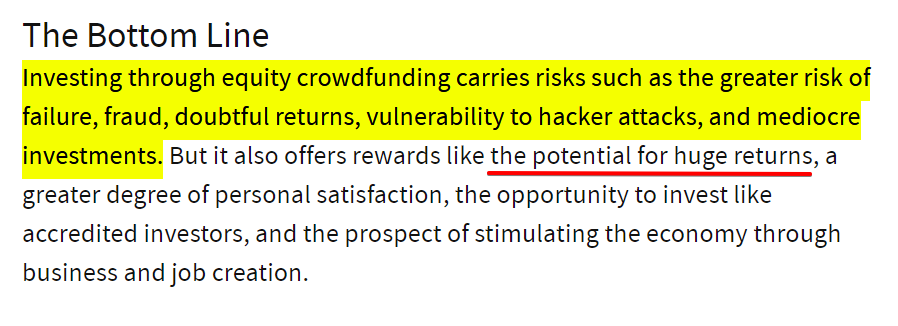

Investing through equity crowdfunding can be a risky game. As Investopedia puts it, it "carries risks such as the greater risk of failure, fraud, doubtful returns, vulnerability to hacker attacks, and mediocre investments"...

But, at the same time, there is the potential of huge returns, and this is what everyone is looking for.

So with that said, the service provided by Angels + Entrepreneurs Network are best for those looking for explosive gains but don't mind the risk. Investing in startup companies like this is far from investing in established bluechip stocks. Many investments will likely fail, but the idea is that you can lose a lot and just have one winner to make huge gains. It's asymmentric risk when you consider how little money needs to be invested in order to reap big returns.

And obviously these services, because of the rather high subscription prices, only make sense to buy if you have a good bit of money to spend. Yes, you could potentially invest only $50 and make good money as was mentioned in some of the promotions, but I would not suggest joining if this is all you have at your disposal to invest.

Conclusion - Worth Joining?

Although we generally aren't too big of fans of The Agora companies here at Green Bull Research (because a lot of them are a bit scammy), overall I like what I see here with Neil Patel's Angels + Entrepreneurs Network. The promotions out there for the subscriptions that this company offers can be a bit over-hyped and misleading at times, but the service provided is solid and there is a lot of value given.

The prices are pretty steep and there is no long-standing track-record, but we certainly aren't going to tell readers not to join. As always, due your own due diligence and decide whether or not it's right for you.

Hopefully this review will help you make that decision.

Take care and be sure to leave any comments/questions below!

I am a member of the private deal flow and got in on less than half of what you listed, as well as became a lifetime member, so I don't have the recurring charges every year. Some of the opportunities have some great potential, so I am looking forward to seeing some of those returns. Yes, these are definitely long term investments, but hopefully with the due diligence done, the risk is mitigated. One thing also to note is that they strongly advise you to do your own due diligence also and not just rely on them. Their classes are helpful in how to go about that. Just thought I would throw that out there.

Great review even as it’s my first on this company. I like the honesty stated in the overall review and the pros and cons. Key statement, the review says they wouldn’t tell anyone NOT to subscribe

Hi Bob. Just curious, were you lucky enough to get involved after Daymond John became one of the founders? His video made everything with A & E network seem new but I see now that it was also endorsed by other SHARKS.

Thank you for the feedback, very informative, you are correct, that if you do not have a good amount of money in your pocket to invest other than the $50 as a promotion, it is best to wait. Thanks once again for the review!

Hi

I learned about the A&E membership opportunity through the Daymond John Facebook post. He was the key note speaker and presented himself as one of the main investors of this opportunity…just curious to know why he wasn’t mentioned in your review? Looking for clarity on who’s who in this investment space…

Thanks much!

Wandy