Wall Street hasn't looked this ugly in over 50 years as investors are fleeing stocks at record levels.

But Adam O'Dell says he is smiling from ear to ear, because as an experienced investor, he knows we've been in the exact same place 12 times in the last 100 years, and there's one “Fear to Fortune” stock that could hand us huge gains if we're bold enough to invest.

The Teaser

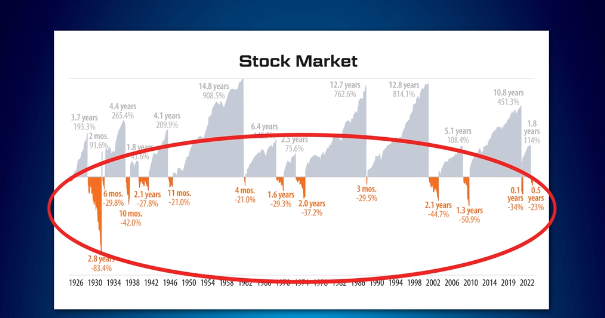

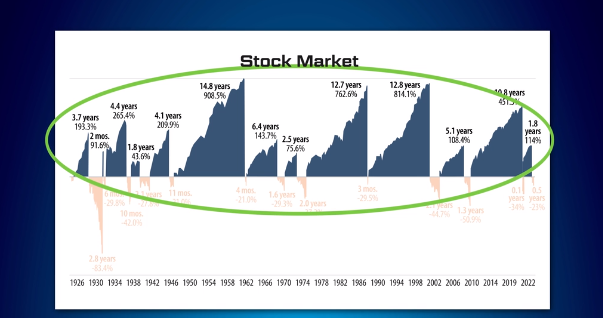

If we really pay attention to the market, we begin to see a clear pattern emerge. The median bear market over the past 100 years has lasted about 1.5 years, before reaching a bottom.

Adam O'Dell is Money & Market's Chief Investment Strategist and the architect of Green Zone Fortunes. We previously did an in-depth review of his Green Zone trading service and also reviewed several of his top stock picks, like his “Infinite Energy” Software Pick.

Getting back to our presentation, these bear markets are always followed by raging bull markets that usually last more than 6 years.

Anyone that knows about this pattern and isn't afraid to invest is able to turn bear market fear into bull market fortune.

Fear is Everywhere

The VIX fear index is now at a four-month high and market inflows have come to a halt, as investors flee to perceived “risk-free assets.”

If history is any indication, this means the market will only go in one direction from here on out – up.

I wouldn't be so quick to call for a market bottom just yet, with the Wilshire 5000 market index still at over 150% of GDP. This figure got to as low as 57% in the 2008 housing crash, but Adam believes this is the bottom.

To be fair, the median P/E ratio of the S&P 500 has come down quite a bit since December of last year and some bargains do abound. Adam says the best pocket of value right now is in something he likes to call “Fear to Fortune” stocks.

These are stocks that have historically achieved triple and quadruple-digit gains in just five years' time and some billionaires are already loading up on them as I write this.

The Pitch

A complete breakdown and the ticker symbol of Adam's No. 1 “Fear to Fortune” stock is in an un-originally named special report called: My No. 1 Fear to Fortune Stock.

This is all the info we need to buy the stock and it's ours if we subscribe to Adam's Green Zone Fortunes investment research service. The service typically costs $199, but for a limited time, it can be ours for just $49. A bunch of extras are also thrown in, like two bonus “Fear to Fortune” Stocks, regular weekly portfolio updates, and a 12-month 100% satisfaction guarantee.

The Fear to Fortune Blueprint

For over a decade, Adam attempted to discover how billionaire investors were able to seemingly buy into stocks near the bottom and get out near the top.

He says that he “cracked the code” and was able to create a blueprint for finding the best stocks, at the worst of times.

This blueprint contains three simple steps:

- Investing at the bottom of a bear market (easier said than done)

- Identify a promising specific industry set to soar

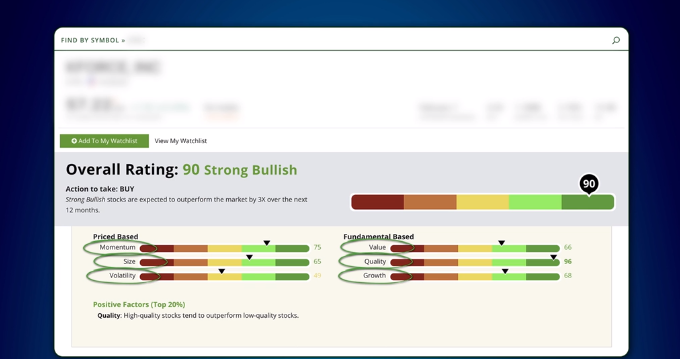

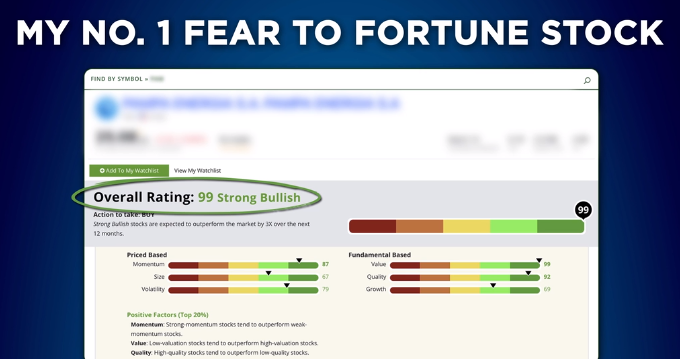

- Invest in stocks rated 90 or higher using his proprietary “Green Zone Rating System”

What is the Green Zone Rating System?

Its a combination of six price and fundamental-based attributes that give a stock an overall rating. This is a screenshot of the system in action:

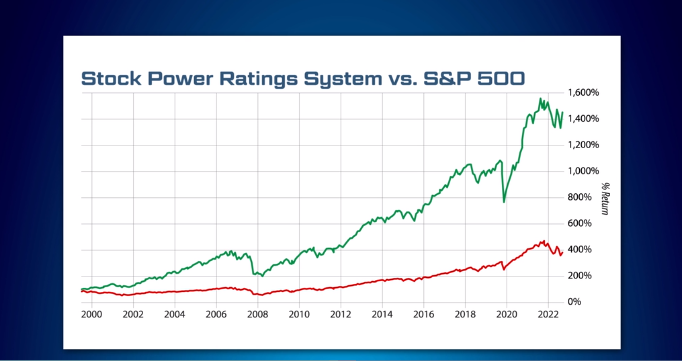

The system was designed using decades of historical data, with stocks scoring high in all six attributes beating the market by a factor of 3:1 since 2000.

Not a bad backtest result by any means.

However, the real test may be to first accurately define the bottom of a bear market and also what makes up a promising industry before buying just based on the Green Zone Rating itself, but we may be here a while if we did that.

In this respect, Adam tells us that his No. 1 Fear to Fortune stock is in the energy sector. A sector whose 3-year annualized return is 45%, based on the S&P 500 Energy Index. So perhaps an annual return of over 10-15% is the definition of a “promising” industry.

We don't get a bear market bottom definition, but we are told that Adam's top pick has a near perfect Green Zone Rating for what it matters.

So what is this highly rated, energy sector stock?

Revealing Adam O'Dell's No. 1 Fear to Fortune Stock

Quite a few clues are provided about what this company is and what it does:

- For starters, we know it operates eight thermal power plants, three hydroelectric power plants, and three major wind farms.

- It also has the world’s fourth-largest reserves of shale oil and the second-largest reserves of shale natural gas.

- The company is 28x smaller than ExxonMobil.

- Among the shareholders of this stock are, Ken Griffin, who holds over 130,000 shares, and Larry Fink, who owns more than 10,000 shares.

Based on this info, the company is Pampa Energia S.A. (NYSE: PAM). Here is how the clues line up.

- As per its company website, Pampa operates eight thermal power plants, three hydroelectric power plants, five wind farms, and a cogeneration plant.

- It also has substantial oil and gas operations, which includes a greater than 8% interest in the Vaca Muerta shale gas acerage – the world's second-largest shale gas deposit.

- Ken Griffin owns 144,000 thousand shares of Pampa, which he first started acquiring back in 2018.

Legit Opportunity to Make 2,000%?

At a current valuation of less than six times earnings with a return on equity of 22%, Pampa stock looks attractive.

The company also has a current ratio of 2, meaning it is not over-leveraged with debt and in danger of going under if rates keep rising.

A dividend would have been icing on an already tasty cake, but management has shown that it is shareholder friendly by having an irregular share buyback program. The last taking place last summer with $30 million worth of shares being repurchased.

Given Pampa's low absolute valuation, coupled with increasing long-term energy demand. Accumulating a small stake should pay off and may even return 2,000% over a long enough timeframe.

Quick Recap & Conclusion

- Amid the market chaos, Adam O'Dell is teasing a “Fear to Fortune” Stock that could make us as much as 2,000% over the next five years.

- It turns out, there's an entire Fear to Fortune blueprint that has a pretty good track record of identifying promising stocks. Beating the market by a factor of 3:1 since the year 2000.

- This system has identified a No. 1 “Fear to Fortune” stock and we can find out its name in a special report called: My No. 1 Fear to Fortune Stock. We can get it if we pay $49 for Adam's Green Zone Fortunes investment research service.

- I say keep your money, because we were able to identify Adam's No. 1 pick for free as Pampa Energia S.A. (NYSE: PAM).

- Pampa Energia is a rare, quality stock pick. The business has a low absolute valuation and it is cash flow positive, which it re-invests back into more growth.

Do you think Pampa's potential is 2,000% over the next five years? Let us know your thoughts in the comment section below.

I don’t know about 2000%, but my research certainly finds it attractive. I’m buying a bit.

I’ve been tracking something I just came across an AI stock KSCP. you may want to look into it.

I bought some. I like the idea and think it will eventually catch on with communities, but it may be a longish wait.

There are several pitches just now coming from the best of the real advisors. One from Empire’s Whitney Tilson on SWaB with what to buy from the Elon Musk project. I doped this project out last summer as Musk’s real project above & beyond the car, the batteries, etc. Whitney proposes to tell you where to put one’s money – in a tiny, secret, company that will become a behemoth (what else is new?) the price is cheap, but I’m offended that I subscribe to his daily, but every time he gets a new number that sounds fascinating there’s another charge for it:

https://secure.empirefinancialresearch.com/?cid=MKT655401&eid=MKT685444&step=start&plcid=PLC173994&SNAID=SAC0030611228&encryptedSnaid=b0dKKejE%20WAu31BZFErgwt58rPr7X0HAhcj10NsdrAE%3D&emailjobid=5318537&emailname=20230322-181811-EFD-Issue&assetId=AST257582&page=2

Then there’s a fascinating one from Stansberry’s founder, the very respectable Dr. Effrig. He calls it the Great Reversal. His presentation is absolutely intriguing. He’s as experienced and honest as anyone in that business. He says the big names are beginning to flood into a tiny sector that no one normal follows and there’s a fortune to be made if one gets in now. He also really dumps on a goup of super rich who are lying about their real activities:

https://orders.stansberryresearch.com/?cid=MKT721515&eid=MKT724886&step=start&plcid=PLC174112&SNAID=SAC0030611228&encryptedSnaid=b0dKKejE%20WAu31BZFErgwt58rPr7X0HAhcj10NsdrAE%3D&emailjobid=5318610&emailname=20230322-210937-DIG-Digest&assetId=AST289141&page=2

I’m a subscriber, but I don’t touch facebook.

Adam is “smiling from ear to ear” because he’s made a small fortune hustling stocks to suckers like me. I’m up on PAM, but way down on NINE that’s sucked up a bunchof profits. I put him on Spam a bit ago after several other downers. I put him in the same category as Luke Lango: not experienced stock picker.