After decades of being on the back burner, a $10 trillion super bull market in energy is now underway.

Adam O'Dell's research shows that oil will shoot oil up to $500 a barrel and his “$1 Oil Stock” I set to soar 100% in the next 100 days.

The Teaser

Crude, black gold, texas tea, whatever name you call oil, one thing that can't be disputed is that it's the lifeblood of our global economy.

Adam O'Dell is the Chief Investment Strategist of Money & Markets and he's been publishing his trade recommendations online since 2012. We have reviewed quite a few of these here at Green Bull, including his “Infinite Energy” Software Pick and “x.AI” Stock.

Once upon a time, the richest people in the world were primarily energy entrepreneurs. John D. Rockefeller, John Paul Getty, and others regularly topped rich lists and Adam believes history is about to repeat itself.

We already have some confirmation of this, because oil is up BIG over the last year. Exxon Mobil has shot up 78%, hitting an all-time high in the process.

Marathon Oil stock has risen 93%

And some smaller explorers are up even more.

These gains are great on an absolute basis and they far outperform the broader S&P’s negative 20% return in 2022.

But What About Inflation

In a short video clip from a private team meeting, Adam stated the North Dakota-based oil stock he has his eye on, is not some dubious IPO. It’s not a complicated option trade. And we don’t need to use any kind of risky leverage either. It is an ordinary oil stock that we can take advantage of right away.

This is all well and good, but what about inflation? Will this new bull market in oil continue even with, heaven forbid, higher inflation?

Wells Fargo recently did a study where they looked at 15 major asset classes and studied how each one did during high inflationary periods. The study goes all the way back to the year 2000.

What they surprisingly discovered is, crude oil outperformed all other asset classes, jumping as much as 40% during high inflationary periods.

Bottom line: Oil still has plenty of room to run and one stock, in particular, will outperform the rest during this boom.

The Pitch

Adam has put everything we need to know about this oil stock in a new report called Energy Fortunes Uncovered.

To access it, we'll need a subscription to Adam's new stock-picking research service, 10X Stocks. Besides the special report, the $995 cost to join gets us access to a private members portal where we can review the model portfolio at any time, real-time trade alerts, and more.

The Case for Crude

The chart below shows the combined market cap of energy’s biggest stocks…compared to Apple

Not only this, but even after 2022’s gigantic run-up, oil is STILL showing the most attractive prices in decades.

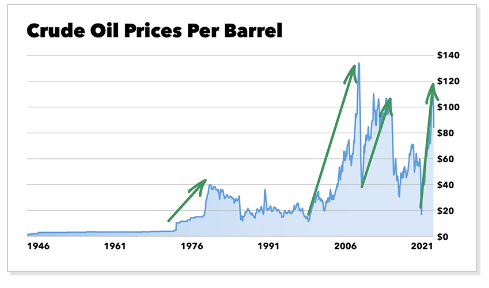

As we can see, oil went up after the bear market and high inflationary period of the early 1970s. Then oil went up again following the dot-com bubble in 1999, and it also went up in 2008, following the Global Financial Crisis. Now, here we are, following the worst bear market in 50 years and once again oil is up.

From this, we can derive two things:

- First, that every previous oil price increase saw a boom over a massive, multiyear rally.

- Second, that oil has gone through a decade and a half of no new highs.

So, we may be long overdue for a massive bull run in oil.

Some big banks are on board with the idea of an oil boom as well. For example, Bank of America says oil could hit $200 and JPMorgan is projecting oil at $380. Goldman Sachs is also calling for a 10-year bull market that will send oil prices to the moon.

A 10x Increase?

Adam and his team think we could see at least, another 10X increase from 2020’s lows. Just like what happened in the most recent boom from 1998 to 2008 and in the oil boom of the 1970s.

Under such a scenario, oil would shoot up to $500 a barrel. How likely is this to happen?

Given the confluence of factors at play:

- The embargo on Russian oil

- OPEC's production cuts

- And the Biden administration's shrinking of our strategic oil reserve to the lowest level since the ‘80s

There's a solid case to be made for a bull market in oil BIGGER than any other oil boom before it.

Some “smart money” is also loading up on energy stocks. Warren Buffett’s holdings in the oil and gas sector now surpass $45 billion. Then there's Carl Icahn, who bought 5.8 million shares in Southwest Gas. An amount totaling more than $440 million. And asset manager Steven Cohen has spent $104 million on shares of First Energy Corp.

So, what is the small, U.S.-based oil stock that is primed to shoot up 100% in the next 100 days?

Revealing Adam O'Dell's #1 Oil Stock

Here is what we know about Adam's top energy stock pick:

- The stock is trading for around $20 today

- It just announced a nearly $200 million sale of its foreign mining assets to focus on domestic production in North Dakota.

- The company's CEO is homegrown from within the company and has proven himself by putting shareholder value first.

Based solely on the info we have on hand, Northern Oil and Gas, Inc. (NYSE: NOG) appears to be the pick. This is why:

- Since last January NOG's stock has been fluctuating around $20 per share, before ascending in the last half of the year.

- I wasn't able to dig up anything on a $200 million foreign asset sale, but the vast majority (64%) of NOG's producing properties are located in or around North Dakota.

- The company's current CEO previously served as its Chief Financial Officer and he also held the title of President from September 2019 until his promotion to CEO.

Opportunity to Make 100% in 100 Days?

Northern is the largest publicly traded non-operated exploration and production company.

What this means is that it acquires minority positions in high-quality acreage that is about to be drilled by other operators. This model enables it to earn high internal rates of return on capital.

Combine it with financial liquidity and asset diversification, and NOG is on to something. The long-term strategy in the producer's own words is “to capture and participate in only the highest-return opportunities across premier US oil and gas basins”, which sounds lucrative.

The safest play in oil and gas is royalty trusts, where all you have to do is sit back and collect a dividend check every month during the productive life of an asset. The second safest is owning a non-operator that owns working interests in producing wells and properties. NOG fits the latter profile and it is currently available at an absurdly low Price/Earnings multiple of less than 4x.

Don't really see the short-term catalyst for the stock to skyrocket as Adam says, but the mid/long-term prospects for appreciation are good.

Quick Recap & Conclusion

- Adam O'Dell is uber bullish on oil, saying it will shoot oil up to $500 a barrel and that his “#1 Oil Stock” is set to soar 100% in the next 100 days.

- A number of factors are contributing to a new oil age and we could see another 10X increase from 2020’s lows. Just like what happened in the most recent boom from 1998 to 2008 and in the oil boom of the 1970s.

- Adam has put everything we need to know about this and his oil stock in a new report called Energy Fortunes Uncovered. To access it, a subscription to the stock-picking research service, 10X Stocks is required at a cost of $995.

- Based on the clues that were dropped throughout the teaser, Northern Oil and Gas, Inc. (NYSE: NOG) looks to be the pick here.

- Northern is the largest publicly traded non-operated exploration and production company and a good value play in the oil and gas sector.

Do you think oil will reach $500 a barrel? Tell us why or why not in the comment section below.