It makes no difference whether you lean right, left, or somewhere in between. Personally, I don’t trust any politician.

This is about what Dan Ferris is calling the most important economic story in America today, “Obama's 2024 Surprise” which may be bigger than inflation, interest rates, and AI.

The Teaser

This is because we won't get a second chance at recovering the money we stand to lose if he’s back in power.

Stanberry Research editor Dan Ferris is the presenter here. Dan joined Stansberry back in 2000, where he focuses on the safest and most profitable stocks in the market: great businesses trading at steep discounts. My kind of guy. We have previously reviewed his “Best Oil Business on Earth” and “Best Gold Business on Earth” teasers at Greenbull.

Many will dismiss any notion of Barack Obama ever becoming the US President again because of the 22nd Amendment, which clearly states:

“No person shall be elected to the office of the President more than twice.”

Pretty cut and dry right? Not so fast.

The word “elected” is critical here. Because there’s a way to become a sitting President without being elected to the office…

That is if you’re the Vice President.

The Technicality & The Precedent

See, the 22nd Amendment doesn’t say you can’t hold the office of President more than twice. Only that you can’t be elected to the office of President more than twice.

Others might point to the 12th Amendment, which says:

“No person constitutionally ineligible to the office of President shall be eligible to that of Vice President.”

However, according to a professor of constitutional law at Cornell University, this only applies to the standard qualifications:

- At least 35 years old

- A natural-born citizen

- Have lived in the United States for at least 14 years

In other words, the 12th Amendment doesn’t disqualify a Vice President from being on the ticket simply because they’ve served as President, even though this hasn’t happened before.

These are the technicalities.

The closest thing we have to a precedent is Lyndon Johnson, who could have run for President again in 1968, although it would have been his third term because he would have only been elected to two of those.

All of this makes Dan say he wouldn't be surprised to see a Biden-Obama ticket emerge in the coming weeks.

Then, once the election is won, Dan is certain they’ll remove Biden by invoking the 25th Amendment, which gives Congress the authority to remove any President clearly “unfit” for office.

The economic consequences of such a “surprise” coming to fruition could plunge America into the deepest, darkest financial crisis in its history.

The Pitch

Dan says the best first step we can take today is to read Stansberry Research's new book, The End of the American Empire, which includes the name of the one financial asset we must own to survive the coming crisis.

A digital copy of the book is free if we sign up for a 30-day risk-free trial to Dan's monthly research service, The Ferris Report. The report normally costs $199 per year, but there's a special on right now of $49 for the first year.

Included in the offer are instant access to a brand-new End of the American Empire model portfolio, four other investments “we'll be impressed by“, and an entire archive of hundreds of back issues and special reports.

The Economic Consequences of A Third-Term

Hypothetically speaking, if a third Obama term were to happen, and if it would be anything like his first two terms, then we're talking about more stimulus, handouts, and expensive debacles like Obamacare.

All of these things could end up destroying the value of our savings, with more taxes and even higher inflation than we’ve recently experienced.

How The Darkest Financial Crisis in History Would Play Out

Assuming a continuation of the same old, same old, Dan predicts the following:

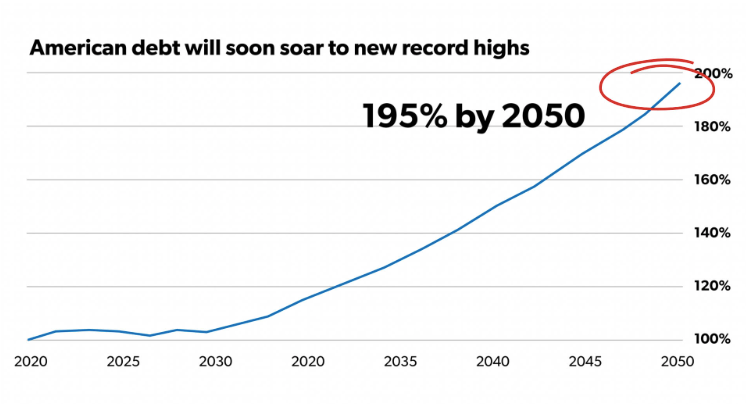

- The $138 billion in student loans Biden has forgiven will grow more than 10 times bigger

- Tens of trillions in benefits will be promised, making the $1 trillion in stimulus checks the government sent out during Covid look small in comparison

- Soaring national debt, much higher and quicker than ever before

Now that the good news has been delivered, what's the bad news?

Well, the fallout could mean stocks crash by 50% or more, destroying most 401(k)s and IRAs.

There's also a good chance the price of food, gas, and everything soars so high, that few of us will ever be able to return to our “normal” way of life again.

Oh, and as far as Social Security is concerned, that would become a relic of the past too.

There are already signs of economic strain all around.

Credit card delinquencies shot up 50% last year, more Americans are behind on their car payments than at any other point in the past 30 years, and the average household has less than $500 saved.

A major economic downturn against this backdrop would mean carnage.

So what's the solution and is there one?

The answer to both is yes, as every market shakeup creates not only big losses, but huge opportunities, and there’s a simple solution we can implement right away to help us get through the coming chaos of the next few years.

Revealing Dan Feriss' Answer to Obama's 2024 Surprise

The clues left behind by Dan are more scarce than a snow leopard.

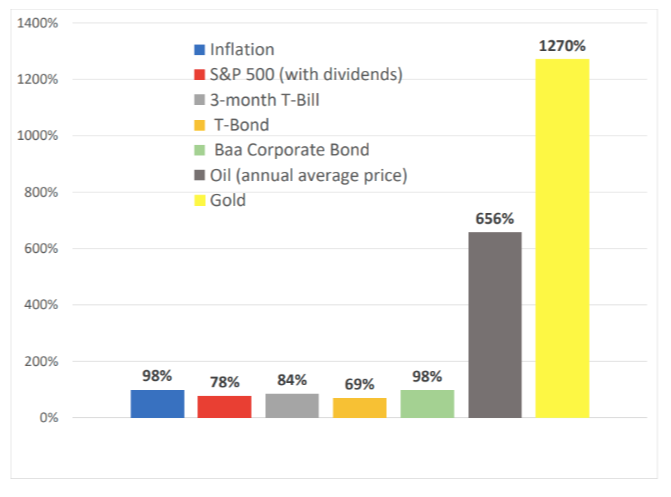

All he says is that “During the 1970s, gold went up more than 1,400%, while another investment went up more than 1,800%.”

Gold was by far the best-performing asset of the 1970s

But what Dan seems to be hinting at here is large-cap gold stocks, which tend to rally even more than the price of gold during up cycles in the “barbarous relic.”

No hints are dropped about any specific names, just that the second part of his recommendation “Is to buy a small group of stocks with as much of your investment portfolio as you’re comfortable with.”

Dan continues “These are the world’s least risky, most financially stable companies, and they produce extraordinary returns.”

Based on this understanding, we're talking about names like Barrick Gold (NYSE: GOLD) and Newmont Mining (NYSE: NEM).

Are they good enough no matter what happens this November?

The Best Plays for The End of The American Empire

One disclaimer in Dan's presentation stood out to me.

These are some of Dan’s best recommendations across his services; not all companies will perform as well. His average gain for The Ferris Report since its inception in 2022 is 7.9%.

Credit to him for including it, I wish all newsletter writers did the same.

If we look at a Gold Miner ETF like the VanEck Gold Miners ETF (NYSE: GDX), whose top two holdings are Newmont Mining and Barrick Gold respectively, we can see that it is up about 50% over the past five years or 10% per year.

Not bad at all, but if we go back even further to the last major downturn in the US – The Great Recession, GDX dropped by more than 50% from June to October 2008.

Meanwhile, physical gold also fell from June to November 2008, albeit by a much smaller 10%, before rallying for the next four years straight.

The bottom line is, that physical gold has some obvious downsides like no dividends, possible storage fees, etc. But there's no denying that it remains one of the only asset classes that has preserved our wealth during times of major economic upheaval over the last 100 years.

Quick Recap & Conclusion

- Dan Ferris says the most important economic story in America today is “Obama's 2024 Surprise” which may be bigger than inflation, interest rates, and AI.

- Based on a series of legal technicalities, Dan says he wouldn't be surprised to see a Biden-Obama ticket emerge in the coming weeks, which could spell economic peril for everyday Americans.

- The best first step we can take to nip this in the bud is to read Stansberry Research's new book, The End of the American Empire, which includes the name of the one financial asset we must own to survive the coming crisis.

- Clues about this one financial asset were more scarce than an endangered animal, but in the end, Dan talks about owning large-cap gold mining stocks.

- This isn't a bad suggestion, but physical gold during a major economic downturn is likely to perform better if 2008 is any indication.

Are you holding large-cap gold stocks, physical gold, or both? Let us know in the comments.