A CNBC survey found that 1 in 10 invest in crypto. But where would you turn to for more information? Our review of Weiss Crypto Ratings will discuss if you can trust the newsletter for advice.Even if it is a new form of investment, it ranks fourth after real estate, stocks, mutual funds, and bonds. According to crypto investors, the main reason why they invest is the ease with which they can trade.But does easy mean safe or profitable? Clearly, we need to study more.

Of course, you should exercise caution in whom to believe. There is still a lot we do not know, which means a huge risk should you invest your hard-earned money.

Overview

- Name: Weiss Cryptocurrency Ratings / Weiss Crypto Ratings

- Founder: Martin D. Weiss

- Editor: Juan M. Villaverde

- Publisher: Banyan Hill

- Website: www.issues.weissratings.com

- Service: Weekly cryptocurrency research advisory

- Cost: $468 per year

Do not be confused. The rating agency is called Weiss Ratings.The rating system that the agency uses to grade institutions and investments is also called Weiss Ratings. Yes, just like the name of the company. One of the agency’s newsletters is Weiss Cryptocurrency Ratings or Weiss Crypto Ratings. Also, the rating system the agency uses to grade cryptocurrencies is called Weiss Cryptocurrency Ratings. Yes, just like the name of the newsletter.The name of the founder is Martin D. Weiss. So when we say Weiss Ratings, it could mean a lot of different things. But you do not need to worry because they are all related anyway. So again, do not be confused. But feel free to be annoyed.

What is Weiss Ratings?

Weiss Ratings is an independent financial rating agency founded in 1971. It claims to be the only one that has the broadest coverage and strictest independence.

They also promise complete objectivity, high ethics, and a commitment to safety.In assessing various financial institutions, Weiss assigns letter grades to each of them. Totaling about 55,000, they cover a lot. These include banks, insurance agencies, stocks, credit unions, mutual funds, and ETFs.In 2018, the agency also started to rank cryptocurrencies. It even claimed that it is the only agency in the world that does this. According to Weiss, they are comprehensive. They can evaluate each cryptocurrency’s features. Blockchain technology, adoption, security, other factors, and risk-reward potential are all crucial.The financial rating service ranks cryptocurrencies on a scale of A (excellent) to E (very weak).

As per the company, they can do this correctly because of their process. It involves a careful study of thousands of data points. Weiss also boasts of an unparalleled digital model. As a result, they help their readers get profits and reduce their risks.Moreover, users can rely on their ratings because the crypto agencies do not pay them a single cent. This sets them apart from Moody’s, Standard & Poor’s, Fitch, and A.M. Best. Independence and impartiality are among the hallmarks of their services. They also say they are fearless in naming cryptocurrencies you need to avoid because of this.Further, they have a track record of about 50 years. They also claim that The Wall Street Journal and The New York Times endorse them. Even the U.S. Government Accountability Office vouches for their accuracy.This is why they did not join the mad chorus for Bitcoin in 2017. They know better, they say, and are looking at “more than 1,000 cryptocurrencies” that are a lot better.Weiss Ratings was even in the headlines during the start of 2018. It was when the agency ranked Bitcoin for the first time. This widely traded crypto only got a grade of C+. What was the justification for the grade? Bitcoin does get positive feedback for its security and widespread adoption. But their network has bottleneck problems.

As a result, the delays and transaction costs cause investors headaches.Apparently, not everyone was pleased with the agency. CNBC even reported that according to the company, they received service attacks online. In fact, hackers were allegedly able to enter their website.Further, a notable juncture in the company happened in January of 2018. Martin Weiss announced that he will be joining forces with Banyan Hill.

We also discussed this connection between Weiss and the publishing house in our review of Money and Markets.

Who are the key people behind Weiss Cryptocurrency Ratings?

Since the founder is Dr. Martin Weiss, he is still the prominent figurehead of this newsletter. For this reason, he will still figure prominently in our review.To start his career in 1971, Weiss founded his research firm called Weiss Research. The firm conducts economic research and assesses the safety of financial institutions. As a Fulbright Scholar, Dr. Weiss spent time in Japan before returning to the United States in 1980. By then, he started reviewing banks and savings organizations. In 1989, his company gave the country’s first independent insurance ratings. Weiss Research followed that up with the nation's first HMO ratings in 1994. Then they gave the first stock safety ratings in the U.S. in 2001.The man, called “Mr. Independence” by Forbes, is also a philanthropist. His advocacy for quality education is also well-documented.A widely recognized expert, Weiss has also been a frequent resource speaker. He has appeared in Congress, educational institutions, and major media agencies.He graduated from New York University with a B.A. in political science. He then went to Columbia University for a Ph.D. in cultural anthropology.

Meanwhile, his main editor for the newsletter is a man called Juan M. Villaverde. He is an econometrician and mathematician. The man leads the team of the analysts and programmers who created Weiss Crypto Ratings. Among the reasons why the founder trusts Villaverde is because of his “encyclopedic knowledge of cryptocurrencies and the cryptocurrency ecosystem”.

As proof, he was the one who built the Technology and Adoption models of the agency.The mathematician from Uruguay is the editor of Weiss Cryptocurrency Ratings, Weiss Cryptocurrency Portfolio, and Weiss Crypto Alert. He also helps co-edit Weiss Crypto Investor.

What is Weiss Cryptocurrency Ratings?

Weiss Cryptocurrency Ratings is the research investment newsletter that provides information about crypto. Once you subscribe, you will receive their recommendations weekly.Read further below to see the inclusions in your subscription.One other newsletter under the agency is Weiss Crypto Investor. Read about our commentary on its “super crypto” picks that can make your investment grow 29 times in a few months.

How it Works

Weiss Cryptocurrency Ratings are an industry first. The agency analyzes thousands of data points on each coin’s trading patterns, technology, adoption, and security, among others.This is what they use, lifted from their offer page:

- The Cryptocurrency Risk Index measures:

- relative and absolute price fluctuations over multiple time frames

- declines from peak to trough in terms of frequency and magnitude

- market bias, whether up or down, and other factors

- The Cryptocurrency Reward Index evaluates:

- returns compared to moving averages

- absolute returns compared to a benchmark

- smoothed returns, and other factors

- The Cryptocurrency Technology Index evaluates:

- the level of anonymity

- governance capabilities

- the ability to upgrade

- energy efficiency

- scaling solutions

- interoperability with other blockchains

- other technological strengths or weaknesses

- The Cryptocurrency Adoption Index (formerly called the “Fundamental Index”) measures:

- transaction speed and scalability

- market penetration

- network security

- decentralization of block production

- network capacity

- developer participation

- public acceptance, plus other key factors

The company has an independent team of analysts and software engineers. They are in charge of powerful, sophisticated computer models. This results in a high degree of performance accuracy.If you want to know the grade of a crypto, check their ratings system.

- A = excellent

- B = good

- C = fair

- D = weak

- E = very weak

- F = fail or subject to credible allegations of fraud

Like their C+ rating for Bitcoin for the first time in 2018, “a plus or minus sign indicates the upper third or lower third of a grade range, respectively.”But the agency also recognizes that no grading system is complete. There are just too many factors involved for an emerging technology like crypto. So to further help investors, they also have devised “a series of the proxy metrics.”The Weiss Crypto Ratings model is built with five basic layers:

- Layer 1

- Current data on each currency’s technology, adoption, risk, and momentum.

- Layer 2

- Proprietary formulas that convert the data into comparable ratios

- Layer 3

- Proprietary sub-models that aggregate the ratios to measure key factors and features considered critical to the potential success or failure of investments in each cryptocurrency

- Layer 4

- Two grades:

- the Tech/Adoption Grade which evaluates the long-term potential of each cryptocurrency

- a shorter-term Market Performance Grade based on market price patterns

- Two grades:

- Layer 5

- The overall Weiss Crypto Rating

- Uses a complex algorithm to combine the Tech/Adoption Grade and Market Performance Grade

What you get

When you subscribe, the advisory service promises abundant alerts. You would be needing this due to the active nature of crypto.Here are the things you will get:

- Access to all our cryptocurrency ratings

- You will get immediate access to their entire list of over 100 coins.

- First access to newer coins

- As they expand beyond the 74 that they currently rate, they will make sure you get the information first. Weiss Ratings anticipates more coverage for their crypto ratings. As a result, this will give you data on what to stay away from and what to choose.

- Weekly updates

- They promise regular updates every week. This is their strategy to make sure you can keep up with the unique speed by which crypto markets change. With this, you will know how to maximize your potential for more earning and how to reduce your risks. Expect to receive their updates on Thursdays at 4:00 PM Eastern Time.

- Weekly commentary

- You can also expect a deeper analysis of crucial movements in the markets.This includes upgrades, downgrades, and trends.

- On-demand flash alerts

- Who does not want on-time updates? Weiss Ratings promises alerts on new ratings and news about the world of crypto.

- Weiss Crypto Alert

- For those wanting more info on crypto, you will enjoy their thrice a week e-letter. Every Monday, Wednesday, and Friday, you will receive commentary and analysis of the latest and biggest crypto topics.

All these will come from their reliable network of experts.

Cost and Refund Policy

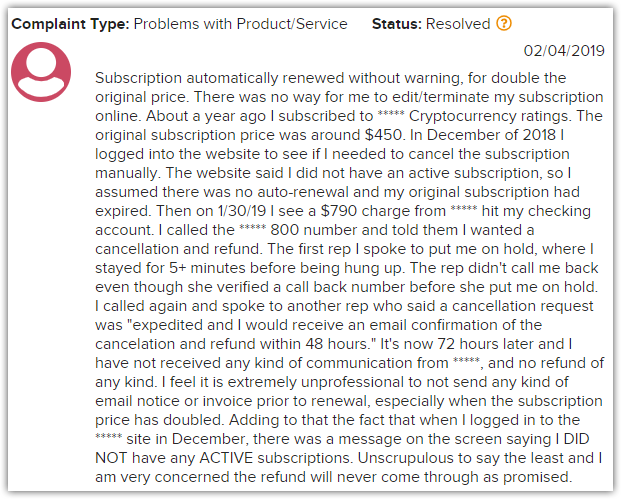

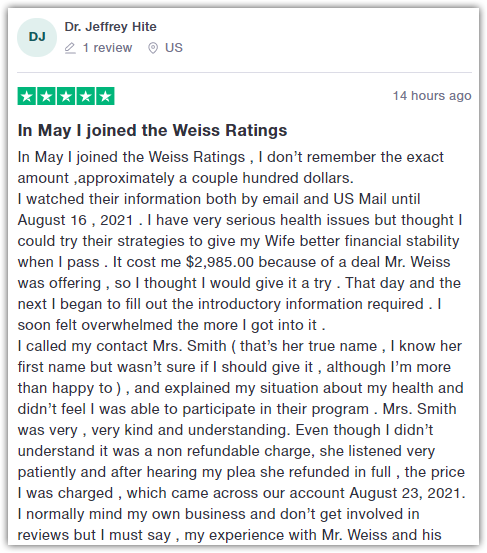

The company claims that the regular price of a one-year subscription is $936. But they are willing to give their newsletter service for a discounted price of $468.Further, there are no clear policy records on their refund policy. What we found are comments saying you have to call them to discuss this.

You may read a subscriber comment in the Reviews section about an experience in this area.

Track Record

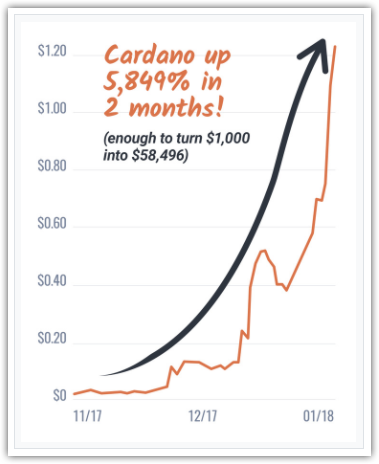

Weiss in its promo claims that it outperforms Bitcoin. “Investors buying only Weiss Ratings’ top-rated coins in 2017 could have seen significantly greater gains than investors buying Bitcoin alone.”Weiss Ratings relied on their scientific formula. They refused to bow to so-called experts and the mainstream media. As a result, their readers were spared from losing their money, unlike most investors.They cite 2017 as proof. Their recommended top-rated crypto rose 6% while Bitcoin declined by up to 68%.In 2018, meanwhile, they have already seen the potential of Cardano. It was new then but boasted of advanced technology. There were even knowledgeable people who served as backers.Cardano could have made you huge gains from November and December of 2017 to January of 2018. $1,000, in the beginning, would have ballooned to $58,496 by January.

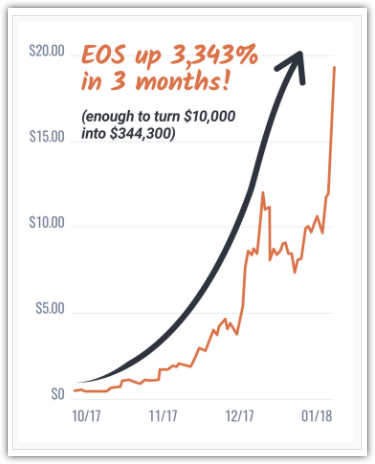

They also boast about another example.Bitcoin, by 2018, was already a “technical dinosaur”. EOS, another little-known cryptocurrency, was created to fix its flaws.EOS is a highly advanced cryptocurrency with outstanding crypto engineers at its core. This makes it a great investment. Just three months after it was released, from $0.53, it sold for $18.25. This is a gain of 3,343%.A $10,000 investment in EOS might have yielded $344,300, which is a great result in three months.

An opinion piece on Nasdaq’s website belies the agency’s claims of accuracy.When Weiss ratings released their assessment of Bitcoin, it shook the crypto world. According to the article, the Technology Index of the agency does not make sense. Bitcoin, contrary to its rating, “actually has the strongest governance out of any crypto asset network in existence.” The article mentioned that Bitcoin “is the only one that has reached a level of adoption that makes it less vulnerable to a single entity having too much control over the system.”Two comparisons prove Weiss Ratings is faulty. Zcash and SmartCash, for example, had the same ratings. But, SmartCash looks to be a copy of Dash, with less than $1 million worth of trade activity in the previous 24 hours. Meanwhile, Zcash offered zero-knowledge proofs that improved anonymity on a crypto network for the first time.The opinion piece also cited another absurd rating where Monero got a C and Electroneum got a C-.On the darknet, Monero is considered to be one of the most promising altcoins when it comes to anonymity. Electroneum is merely its knockoff. In fact, there are even some plagiarized parts in the Electroneum whitepaper. So it is a mystery as to why their ratings are so close. We also looked at how Weiss as a whole is perceived on the Better Business Bureau website.We found two reviews that had issues with how their investments fared. One said that though it seemed legit, he found the content to be of low quality after a while.

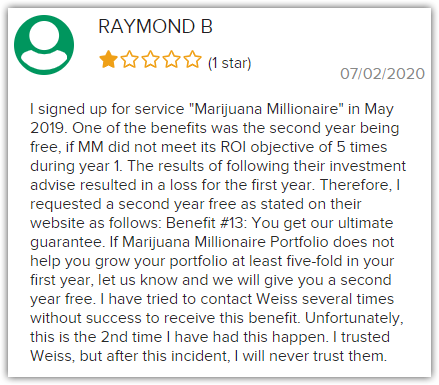

Moreover, one subscriber was enticed by what seemed like a guaranteed ROI. The lure was a second-year free offer.

The reader did not see the expected results and decided to take them up on their promise. Read about what happened in the comment below.

Reviews

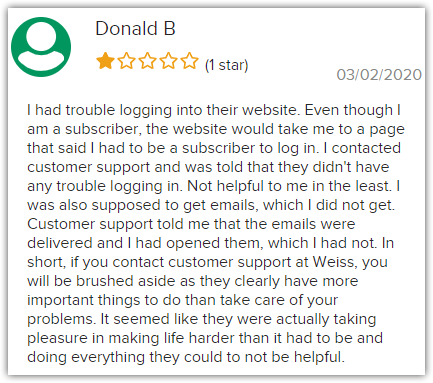

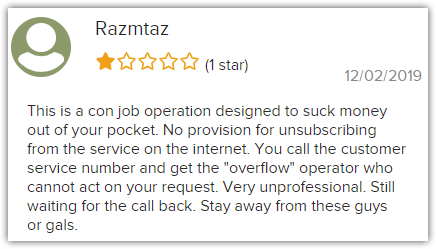

Disappointed subscribers turned to the Better Business Bureau to register their complaints. According to them, the company does not treat its readers well. Read about details of their encounters below.

The complaints were mostly about the other services of the company. But we found one that specifically mentioned the newsletter in our review.

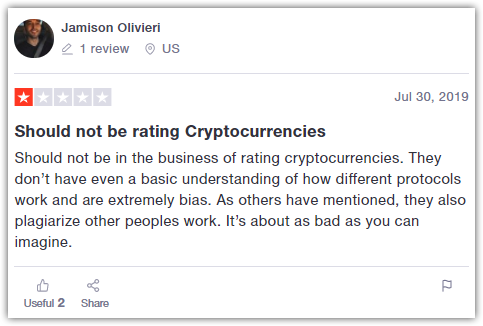

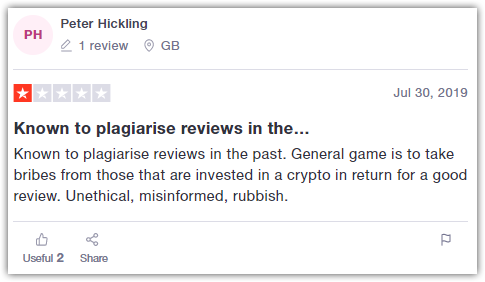

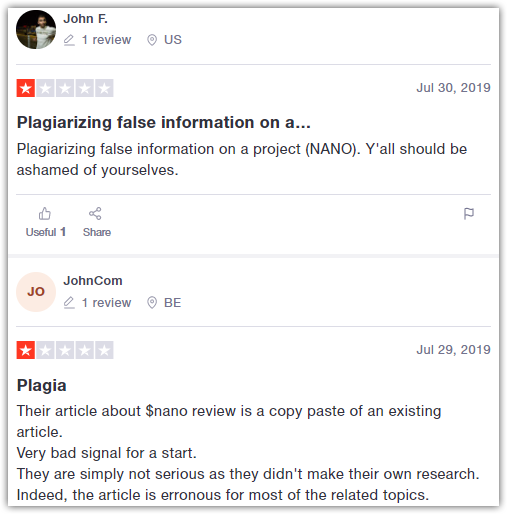

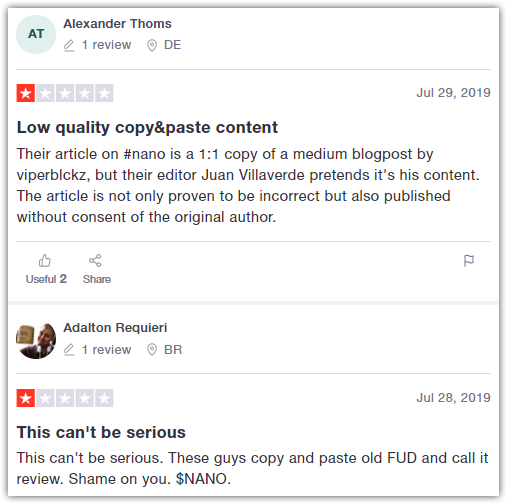

As of this writing, Weiss received 1 out of 5 stars and 81 complaints.Again, there was no mention of this specific newsletter, but the agency has gotten a beating at Trustpilot. Among about 70 reviewers, Weiss got 1.5 stars out of 5. This time, the majority were not just talking about deceitful credit card schemes. Commenters were talking about the company’s actual recommendations.The words “scam”, “fake”, and “plagiarism” pepper almost all the comments. All these are serious charges. But being accused of plagiarizing articles is something else.If proven to be true, this is downright evil for a company claiming to educate others. As it is, the subject alone is already confusing. But to add to people’s disorientation on crypto is unacceptable.To reiterate, we are not saying the allegations are true. As regular readers, you would know we always put a caveat when we discuss user reviews. These do not represent the whole universe of subscribers.We are including the comments here so you can judge them on your own. You should decide for yourself.That said, here are a few comments that discuss how Weiss supposedly plagiarized content.

There was one positive review on the rating company and we also want to show the comment here.

We invite you to look at the comments on trusted websites. If you are interested in subscribing to Weiss Cryptocurrency Ratings, the reactions. You need to be aware of the other side of the agency’s sweet words in their marketing promotions.Knowledge is power. As you get to see both sides, you can make a better decision.

Pros v Cons

Pros

- The company and its founder have a long record of ratings in other markets

- There is a huge potential for cryptocurrency

Cons

- Negative reviews

- Accusations of plagiarism

- The volatile and risky crypto market

Conclusion – Is Subscribing a Wise Move?

Crypto is gaining popularity as an asset that can be part of a well-balanced portfolio. But it is still unlike any other.Here, if you make a mistake, you may lose everything. This is because crypto allows you to be your own bank. Unlike traditional means of banking and trading, there are not enough fail-safe options in place.When you invest here, prepare to know the nitty-gritty of the coin you will buy. In addition, you have to study which crypto wallet to use. Are you equipped to protect your password and other sensitive data? You are on your own.The need for more information to demystify crypto is where Weiss Ratings comes in. They claim to be the best and have the necessary ratings system and model.Yes, they may have a proven record in traditional markets. But it does not automatically mean they can translate that ability to cryptocurrencies. Weiss' high rating does not ensure that a cryptocurrency will perform well. Because crypto-assets are relatively new and volatile, evaluating them is also more difficult.In the end, it is your money. That is why we tried to provide you with the most comprehensive review of Weiss Crypto Ratings. We even talked about both the newsletter and the agency. Now, are you inclined to subscribe?