Tom Gentile's Weekly Cash Clock dangles a full bunch of ‘get rich quick' carrots in a manner that could hardly be less subtle. The assertion is made that Tom Gentile is America's #1 Pattern Trader and that the Weekly Cash Clock is a unique service, the veracity of which, is the subject of this review.

The sensational marketing of this service begs several questions. Can the Weekly Cash Clock deliver on what are some pretty extravagant claims? Is the Weekly Cash Clock a Scam? What follows is an objective review of Tom Gentile's offering.

The Teaser

Tom Gentile is no shrinking violet, bold and extravagant claims dominate his Weekly Cash Clock promotional material. The headline teaser is “10 X your money”, by way of elaboration, Tom Gentile claims that by following his options trading recommendations, a subscriber to his advisory service can increase their initial stake invested by a multiple of ten within a period of four months. This claim is backed up by Tom's promise to provide his advisory service free of charge for an additional year to any subscriber who fails to realise the “10 X your money” claim. One could argue that given the initial high price of the subscription service, the offer of an additional free year as compensation for under delivery does not represent a major financial commitment on the part of Tom Gentile.

The other equally sensational teaser in the promotional material is the statement that all that is required from a subscriber is to spend five minutes reading and acting on the advisory received at noon on a Monday. This very limited subscriber activity is apparently all that is needed to successfully employ Tom Gentile's trading recommendations. The claim that a subscriber can increase their initial investment tenfold within a four month period while doing five minutes work once a week, is outlandish to say the least. This and other similar, increasingly made claims cannot be good for the general credibility of the subscription based trading advisory sector.

Overview of the Weekly Cash Clock

- Name: Weekly Cash Clock

- Type: Subscription based weekly trader advisory service, focused on options trading.

- Editor: Tom Gentile

- Publisher: Money Map Press

The Weekly Cash Clock is published by Money Map press a Baltimore, Maryland based leading publisher of subscription based financial / trading research and advisory services. The company is headed by Mike Ward a doyen of the financial publishing world and associate of Neil Patel, the high profile Angel Investor and celebrated digital marketer.

The Weekly Cash Clock provides subscribers with a weekly analysis of the trading activity of a select list of stocks compiled by Tom Gentile and makes recommendations relating to the trading of these stocks. These recommendations take the form of suggested Weekly Distribution Contracts which are a type of options trading instrument. The subscribers are notified at midday on a Monday and any gains made are deposited into the subscribers account on the following Friday.

What is Tom Gentile's Weekly Cash Clock?

The Weekly Cash Clock from Tom Gentile is but one of several subscription based trading advisory services that claims to have at its core, a propriety developed trading platform utilizing cutting edge technology. The trades are selected from a list of 200 of the world's top-rated stocks as compiled by Tom Gentile. The weekly options trade recommendations are issued on a Monday at 12h00 E.T. The recommended ‘Weekly Options Distribution Contracts' are valid for a maximum of eight days and expire every Friday. The payment of any accrued profit on a Friday, is lawfully compelled by the expiration of the weekly option term.

This potential weekly profit pay out is punted as a differentiating or unique feature of the Weekly Cash Clock and a key contributing factor to the “10 X your money” in four months promise. The claim is also made that even in the event that a traded stock only makes a .5% gain, the real gains due to the subscriber will be closer to 50%. This later claim is supposedly a benefit of Weekly Distribution Contracts.

The trading platform is programmed to search the trading patterns of the safest stocks as listed by Tom Gentile and his team of analysts. The trading patterns have to conform his required template of:

- Momentum

- Strength

- Confirmation

It is emphasized that the trading patterns have to stringently comply with the above three stipulated criteria in order to meet the requirements to be recommended as options trades. The system reportedly “crunches millions of data points of stocks activity”. This continual use of what are essentially largely unsupported or undemonstrated claims of unique technical features and attributes is becoming increasingly typical of this and many other subscription based trading advisory services. The mere mention of algorithmic formulations as the mechanism for the predictive patterns of an advisory service should never be accepted as a basis for the effectiveness of these services. There really is no substitute for a verified record of the claimed performance.

Who is Tom Gentile?

Unlike many other ‘celebrity traders', Tom Gentile does not parade a vast array of academic credentials and achievements. This may be in line with a deliberate attempt to craft a seemingly non-elitist strategy and to portray himself as someone who prioritises the interests of new and ‘ordinary' participants in the area of stocks trading. Cynical though this view may be, it does point towards the targeting of an alternative and largely unexploited client base, the harvesting of (to use or misuse the phrase) low hanging fruit, so to speak.

Touting humble beginnings, Tom Gentile recounts working an unrewarding clerical job for 60 hours per week at Home Depot, 30 years ago. Motivated to do something different, using his parent's basement as his operations centre, he began to study the workings of options trading on a nightly basis. His story is yet another variation on the overworked ‘blue collar to riches narrative'.

The genesis of his trading career was in 1986. He spent several years building a large financial tech company, the focus of which was teaching people how to trade options. This company was Optionetics, an apparent leader in the niche of options education. Gentile apparently sold Optionetics to a large discount broker firm for several million in 2009.

Since selling Optionetics, Tom Gentile has actively maintained a role in teaching his options trading techniques to a claimed over 300 000 traders. Aside from The MoneyShow he has presented at seminars and workshops and is the author of several specialist books and training material. The titles include, The Options Course, The Volatility Course, The Index Course, and The Stock Market Course. These publications all include a practice workbook. He is also a regular contributor to Stocks and Commodities Magazine and an experienced radio personality.

Another of Tom Gentiles offerings promoted by Money Map Press is the Fast Fortune Club. This is another subscription based service that purportedly shows the subscriber how to buy stocks at negotiated “low ball prices”. This service requires the subscriber to work at it for an arduous (by Gentile's standards) 10 minutes a day. The common thread of promoting their advisory services as facilitating high gain returns for minimal subscriber effort, would appear to be a consistent feature in the marketing of Tom Gentile's offerings.

Other FAQ's

Is the Weekly Cash Clock Legit?

On the face of it the Weekly Cash Clock meets the requirements of legitimacy. A product is supplied by Money Map Press, a reputable publisher, for the price charged. The claims made for the performance of the advisory service, are as stated earlier, rather sensational and similar to other advisory services punting rates of return that are seldom if ever delivered. One is compelled to pose the often asked question; if the propriety system is so accurate and effective, why do the likes of Tom Gentile not devote all their time and resources to trading the recommendations that emanate from their much vaunted systems?

An analysis of the income streams of these purveyors of subscription based advisory services would no doubt provide some interesting insights. The begged question is, how much of their earnings are derived from applying their own systems to trading activity, verses the proceeds earned from selling training and advisory services? The plain fact that so much effort is put into the hard-sell of these subscription services, would suggest that it is a very lucrative enterprise.

It is clear that the people who are targeted as subscribers to services like the Weekly Cash Clock, need to apply their minds to critically researching the claims made by these trading ‘gurus'.

Are Tom Gentile's recommendations credible?

The “remarkable and fast gains” claimed by Tom's Weekly Cash Clock, include:

- A 170% gain on Pandora Media (P) in less than three days.

- A 148% profit on Allergan (AGN) in a week.

- A 379% gain on Seagate (STX) in four days.

- A double on Netflix (NFLX) in 24 hours

A basic online search with the objective of testing the veracity of Tom Gentile's spectacular trading recommendation claims, reveals widely contrasting testimonials and opinions. There are numerous supposedly unsolicited accounts from subscribers who confirm having made sensational gains from following the Weekly Cash Clock options trading recommendations. These tales of huge gains are not verified and the names of some these grateful subscribers are suspiciously unconventional. The credibility of the various streams of testimonial content raises doubts when viewed in isolation and the combined effect of a complete absence of independent testing of these testimonials has to beg a serious question. Why are these claims of sensational gains not submitted to the review of a website like the reputable Trustpilot or similar websites? Even a single credible review would go a long way towards the enhancing the credibility of both the product and its marketing.

Unlike the lack of tested positive reviews there are more than a few strident offerings from subscribers who were less than happy with the service. Independent website sources like Pissed consumer, have a considerable amount of content which is substantive in the number of negative comments relating to the Weekly Cash Clock and the broader list of Tom Gentile's offerings.

A general caution is that the mere mention of algorithmic formulations as the basis for the predictive patterns of an advisory service, should never be accepted as a basis for the effectiveness these services.

Cost and refund policy

The full price of the Weekly Cash Clock annual subscription is a hefty $4995, it has however, been discounted to $1950 for an annual subscription on occasion. It would seem that shorter term payment options can also be negotiated. The stated policy is that there are no refunds available but several subscribers have reported exercising a cancellation option that they had to exercise within a two month cut-off period.

How the Weekly Cash Clock works

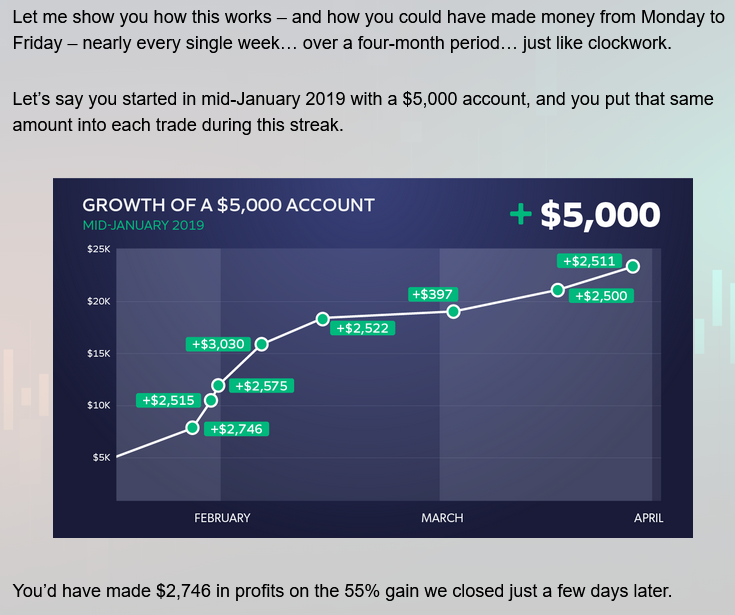

The above diagram illustrates the compounded gains that the Weekly Cash Clock is supposedly capable of realising over a period of four months. Each profit point on the graph is a Friday paid out gain on the preceding Monday's options trade. This graphic illustration is yet another example of the aggressive marketing that uses illustrative examples that are not proven as typical or consistent.

Trading Strategy

The trading strategy is based on the analysis of 200 of the markets most liquid stocks as selected by Tom Gentile. These stocks are analysed using a proprietary system developed by Tom and this data together with input from his fellow analysts is used to select the trade recommendations which are presented to Subscribers on a Monday at Midday. The options trades are made as “Weekly Distribution Contracts” which are obliged to pay out any gains by no later than Friday. In a nutshell, the subscriber receives a notification from the advisory service on Monday at noon Eastern Time. The subscriber can act on the recommended options trade and any gains made are automatically paid out on the following Friday. The minimum sum is a reasonable $150.

What you get

- Weekly Cash Clock alerts and alert videos, the alerts are delivered at midday on a Monday. The assertion is made that the subscriber need spend no more than five minutes on actioning the options trades recommended in the alerts. Should anything happen during the week that has a material effect on the recommended trade for that week, an urgent e-mail will be sent out with updated information and an advised response to this update.

- Weekly Cash Clock quick-start guide. This guide outlines the workings of the Weekly Cash Clock and guides the subscriber through the setup of the required trading account.

- “The Essentials of Profitable Options Trading” video course. This video course is a fairly comprehensive training course on options trading in general. Tom Gentile's ‘trade secrets' are supposedly also revealed to the subscriber in this video course.

- Access to the Weekly Cash Clock online members-only portal. This facilitates access to the website where all past analysis and options trade recommendations are archived. A library of past webinars is also available here.

- Weekly Cash Clock special reports. These reports cover all the special reports and pitches that are provided to members.

- Weekly Cash Clock coaching webinars. These webinars supposedly provide you with coaching from Tom on aspects of your own money management. Subjects like account setup with a view to minimising commissions paid are covered.

Performance

Despite claims of regular returns in the triple-digits by Tom Gentile, the reality appears to be much less spectacular. An examination of a six month period from the latter 2018 t0 early 2019 reveals average gains of less than 50%. The credibility of the many positive testimonials must also be called into question. There are very few advisory services that make any attempt to demonstrate independently verified gains achieved by following their recommended trades. When one considers the relatively easy verification avenues open to these services and their apparent reluctance to provide positive proof their marketing claims, it is difficult not to be sceptical.

Even if one adopts the generous view that the Weekly Cash Clock delivers as marketed, the standard caution that one should only invest what one can afford to lose, must still apply.

Pros v Cons

Pros

- The recommendations are confined to a list of the top 200 capitalised stocks.

- You apparently only need to spend 5 minutes on a Monday reading and implementing the recommended options trade.

- The relatively short open position period of 4 days avoids long-term risk. This is a debatable benefit.

- There is a relatively low minimum trade amount of $150.

- No time consuming day trading which would involve hours spent at one's computer, tablet or smartphone.

Cons

- There is no attempt to present independent verification of the spectacular claimed trading gains.

- There is no clearly stated refund policy.

- The full subscription price of $4995 is exceedingly high.

- The are a significant number of negative subscriber reports on several credible review websites.

Summary and Conclusion

The claim that the Weekly Cash Clock is unique is quite easily dispelled. There are many other subscription based advisory services targeting options based trading for similarly claimed quick and high rates of return. These offerings, almost without exception, require considerable due diligence on the part of prospective subscribers. There is little doubt that a compilation of analysis and data from a carefully selected range of advisory services could be useful in compiling a viable trading strategy. The high price and dubious veracity of the Weekly Cash Clock service make it a poor value proposition when compared to many other competing services.

That Tom Gentile is a trader and specifically a pattern trader with an earned high profile is beyond dispute. His marketing of the Weekly Cash Clock as a means of delivering high and quick gain trades “week after week”, with virtually no proof of his sensational claims is not good for his credibility. Any potential subscriber would do well to exercise due circumspection when considering this high priced service.

I invite you to share your impressions of Tom Gentile's Weekly Cash Clock. Please feel free to submit your opinion in the comments section below.