There are already too many financial research advisory service providers out there. Read our WealthPress review so you can discover key aspects of this specific company. As always, we would like to encourage our readers to take extra care with their money. There have already been too many reports of scams, fraud, and losses. One way to protect your investments is to trust only those who have a proven track record. Before subscribing to any service, read and research first.

Overview

- Name: WealthPress

- Publisher: Conor Lynch

- Head Trader: Roger Scott

- Website: www.wealthpress.com

- Service: Investment research advisory

- Cost: Not easily accessible, you need to email them for the price of their services

We have a lot to unpack in this article. However, our goal is not to give you all the answers.

If we will be able to convince you to ask more questions, we have done our job. If you will start to have more doubts about some claims out there, we’ll be happy with that.

What is WealthPress?

The company is a publishing house that has several investment research advisory services. Upon opening their sleek website, these are the first words you will see:

“Trading and investing tactics to grow, preserve, and protect your wealth”“Navigate the markets with integrity, intelligence, and pure winning trades”

WealthPress also advertises that they provide “actionable intel”. Further, their experts have “150+ years of combined market experience”.Consequently, if you would like to learn from them, you can choose from their 22 premium services and 7 free newsletters. They boast of 10 industry leaders that make up their core investment team.Occasionally, we do review an entire research company here on this website. A previous article we have is on Brownstone Research. We have also written about Southbank Investment Research.

Who are the people behind WealthPress?

We will start with the most ubiquitous member of the team.

In fact, comments from all over are that you could see him everywhere. His face is plastered on various websites and even on some of the emails.

Roger Scott, Head Trader

His profile tells us that he has “over 25 years of experience trading everything from corn futures to stock options and ETFs”. He adds that his interest in trading started in college, later at law school, and well after that.Scott even says that he has collaborated in his first fund with established economists from Ivy League schools.He is an expert, he says, who’s been featured on CNBC, CNN, Forbes, Bloomberg, and Fox Business. Scott also claims to be knowledgeable on “advanced technical analysis, risk control, and money management and systematic trading.”The commodity broker also says that he counts as a valued client one of the richest families in the world.We know all these sound so impressive. The guy seems to have everything you would want in a financial and investment advisor.Of course, we want to take his words at face value. But you know us and the kind of service we want to provide here at Green Bull Research.So we had to dig deeper.Initially, we were already curious as to why there seem to be no third-party sources for Roger Scott. We read the same profiles over and over again from different websites and reviews.To us, they all seem to come from the same script. Then we came across this, shall we say “controversial”, article. The reviewer went to great lengths to provide a no-nonsense commentary on WealthPress and Scott.

In the article, there was a list of titles supposedly carried by the founder of the company.

The hedge fund trader claims that he:

- Is a lawyer

- Started with $5k and realized profits of $720,000,000

- Worked in the White House as a “key economic advisor”

- Is a hedge fund manager

- Is a licensed commodity broker

This is where it gets interesting.

The reviewer exercised due diligence in trying to find out if all these are true. Here is what they found:

- On being an attorney:

This information was forwarded to our legal team at TradingSchools.Org — they could find NO MATCH for ‘Roger Scott’ on any State Bar registries with these addresses.

- On working in the White House as a “key economic advisor”, a hedge fund manager, and a licensed commodity broker:

However, according to Finra.Org, this Roger Scott person simply has no valid registrations or company registrations connecting his claims.Next, I reached out to the National Futures Association. It is the regulator that manages Commodity Trading Advisors, Futures Hedge Funds, and Futures brokers. According to their databases, this ‘Roger Scott’ person simply does not exist.Additionally, we can find no ‘Roger Scott’ that ever worked in any White House as an economic advisor.

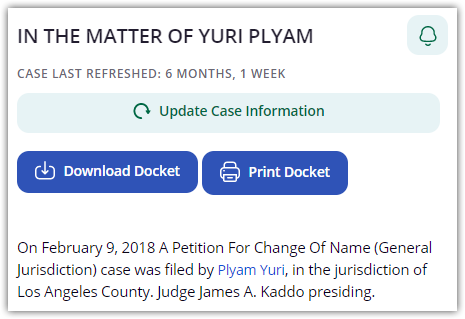

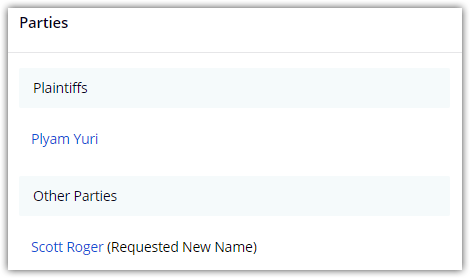

According to the review, their team also tried to reach out directly to Scott but received no response.To investigate further, the reviewer even called the company’s boiler room. The person who answered the phone reportedly had no deep knowledge about investments.When asked about Scott’s being a lawyer, there was an admission that he was not one but took some law classes.Of course, an article would not be complete without a review of the company’s trading record. Upon request, the person at the other end of the line sent a bunch of cards the reviewer found ridiculous. In addition to what trading TradingSchools.Org found, we also did our own digging. We found a few comments alleging that Scott’s previous name is Yuri Plyam. The plot gets thicker.So we pushed forward.We were able to find a document showing that there was a court petition for a change of name. Want to guess the names involved in this?

So is this good news for Scott that he had a previous name if it is indeed him? This explains why there were no results on his current name.

Maybe if the reviewer we just mentioned searched for Plyam, all his credentials would appear.Of course, we had to know more. Who is this Yuri Plyam?A quick search on Google gave us this December 2015 article from the Niagara Falls Reporter.

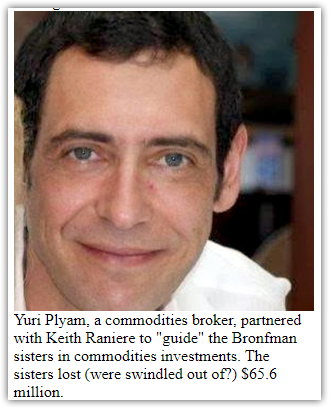

Seems like a weird association but we proceeded to read the article. Attached is this familiar photo of Yuri Plyam.

Here is the photo of Yuri Plyam side by side with available pictures of Roger Scott.

Why is this relevant?

In looking for investment advice, you should only take them from the most credible people. You are investing your hard-earned money and there are a lot of scammers out there.How many reviews have we already written about subpar investment advice? These result in thousands of dollars lost because of bad recommendations. Add to this the fraudulent issues with credit cards? These victimize people from all walks of life. But the alarming number of elderly people complaining about this disheartens us.Grifters specifically target them through the deceptive fine print and vague conditions.Further research about Plyam reveals serious issues about his credibility.The article we mentioned earlier connected Plyam with failed investment schemes with Keith Raniere.

“Raniere employed a commodities broker named Yuri Plyam who operated his own brokerage firm, Castle Trading, in Los Angeles.”“Yuri Plyam, a commodities broker, partnered with Keith Raniere to “guide” the Bronfman sisters in commodities investments. The sisters lost (were swindled out of?) $65.6 million.”

Rainere is the founder of NXIVM, a company alleged to be a sex cult.

In 2019, Rainere was found guilty of “racketeering, racketeering conspiracy, wire fraud conspiracy, forced labor conspiracy, sex trafficking, sex trafficking conspiracy and attempted sex trafficking.”Vanity Fair also mentions Plyam and his wife Natasha in a 2010 article about the same issue.

“According to the lawsuit, filed in Los Angeles Superior Court, the Plyams had diverted for their personal use part of the $26 million the Bronfmans had given them to develop real estate in Los Angeles.”

Now, what do you think about this information? How has it affected your perception of the research advisory service? Tell us in the comments section.

Conor Lynch, Founder and Publisher

He is credited as the owner and publisher of WealthPress. Other companies where he credits himself as the owner, founder, and CEO are PunchCast Inc., FetchMe, and Conor Lynch Inc.On the website, Lynch has a rather obscure introduction. While other advisors in the financial business brag about credentials, it’s not the case here.His profile highlights how he grew up with a family who talked about investing at the breakfast table. In addition, he tells the story about how he “traded oil and currency futures with a Russian mathematician”. Turns out, this Russian eventually “helped design the cockpit for the MIG fighter jet”.Further, he claimed that he started his first online business at 13 years old. When the entrepreneur built and launched his first venture-funded startup at 21, he raised $1 million.These are all the information we could find about Lynch, after how many pages of Google search. For sure, there are a lot more, but that is quite strange for someone in such a position.

We just want to make the point that more information about him is very inaccessible.

Francisco Bermea, Editorial Director

Bermea manages the company’s editorial staff and publications. Trading specialists work with him to ensure they deliver high-quality research.

Further, his background is in economics and business.

Sharita Jennings, Compliance Attorney

The lawyer has a degree in political science from Hampton University in Virginia. After that, she was able to complete her law studies at American University Washington College of Law in Washington, DC.

Jennings helps WealthPress remain on top of the rules and regulations around finance.

Tom Busby, Editor

As a securities trader and broker, Busby has been in business since the late 1970s. After working for Merrill Lynch for a few years, Tom was promoted to Vice President of Smith Barney in 1984.

Founded in 1996, the Diversified Trading Institute (DTI) was Tom's brainchild.

Lance Ippolito, Editor

In his former career, Lance was a hedge fund trader who excelled in making huge sums in a short period. For spotting market trends, he created his software program.

To maximize his profits, he only looks for opportunities that may at least double his money.

Jeff Zananiri, Editor

After two decades on Wall Street, Jeff learned from the top traders how to make huge gains. It was at Pan Capital that he honed his trading skills, turning $5.1 million in initial money into more than $700 million in profits.

Adam Sarhan, Editor

Sarhan has been in market trading for over 20 years. He also founded 50 Park Investments. Serving also as the CEO of the firm, he guides the company in its investments in private businesses/equity and capital markets.

Chuck Hughes, Editor

Known as The Trophy Trader, Hughes has won 10 trading championships. Hughes is also Trading Champion's all-time top award winner.

Matt Warder, Editor

A globally known energy, metals, and mining expert, Warder has more than two decades of experience in the business. Wood Mackenzie hired him as a principal analyst for coal, iron ore, and steel costs.

Further, Warder co-founded and served as director of Energy Capital Research Group after almost a decade there. It was at Seawolf Research where he established himself as the company's founder and CEO.

Services

Paid

Six of the core team members of WealthPress have premium advisory services. These are Roger Scott, Lance Ippolito, Jeff Zananiri, Adam Sarhan, Chuck Hughes, and Matt Warder.You can choose the kind of service you want as they have an array of services, 22 in total. In each service, they indicate the following to serve as your guide:

- Holding period

- Portfolio size

- Alerts per month

- No. of positions

- Trading

Roger Scott has eight offers:

- Alpha Rotation

- Overdrive Profits

- First Strike Porffolio

- Nasdaq Titan+

- VIP Trade Rooms

- Precision Profits Elite

- Roger's 12 Week Bootcamp

- Microburst Profit Alerts

Here are Lance Ippolito’s services:

- Blockbuster Breakout Calendar

- 3D Profit Surge Alerts

- 2 Click Profits

- Sweet Spot Stocks

If you want to subscribe to Jeff Zananiri, you may avail:

- Monthly Money Flows

- Monthly Money Flows Elite

- Money Link

- Burn Notice

Adam Sarhan, meanwhile, offers these:

- Alpha Trade Alerts

- Kingmaker Alerts

- Infinity Profit Plays

Chuck Hughes has two advisory services:

- Trophy Trade Alerts

- Profit Generator Club

Matt Warder has one newsletter:

- Disruptor Digest

Most of the prices are not indicated and require you to send them an email first.

Free

If you are interested in receiving free information, the firm allows you to get these:

- WealthPress Hub

- Roger Scott

- Joy of the Trade from Jeff Zananiri

- Early Bird Trades from Tom Busby

- Future of Wealth from Lance Ippolito

- Alpha Intel from Adam Sarhan

- Fortune Research from Matt Warder

We have to admit, this is among one of the most comprehensive publishers we have seen. They seem to have everything for any type of investor.But on the question of delivering their promised results, that is a different story.

Track Record and Reviews

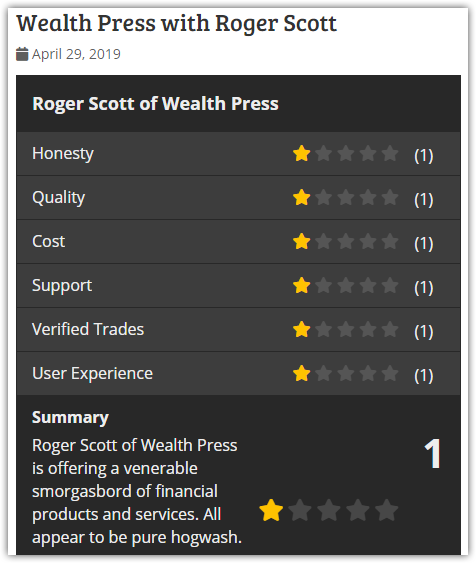

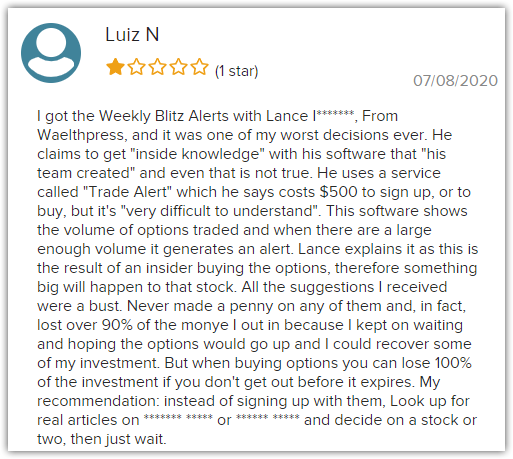

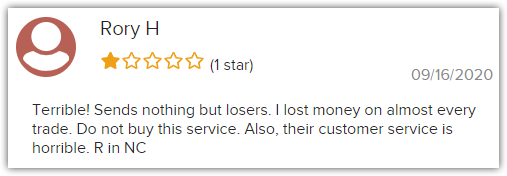

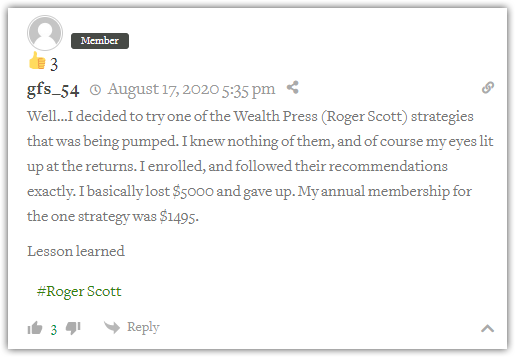

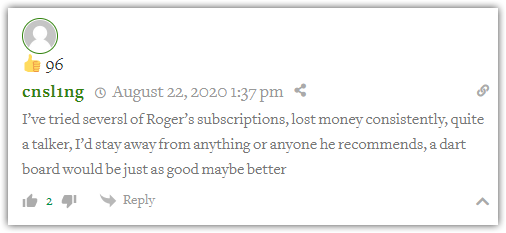

So, of course, you want to know subscribers rate the company and its services, so we will get to that right away.From about 30 reviews, WealthPress was able to get 2 out of 5 stars from the Better Business Bureau.

First, we want to show you the positive reviews, because there are. We know that is surprising, given its dismal rating. We found six comments that mentioned how accommodating their customer support is. They were appreciative that the company has responsive and helpful agents.

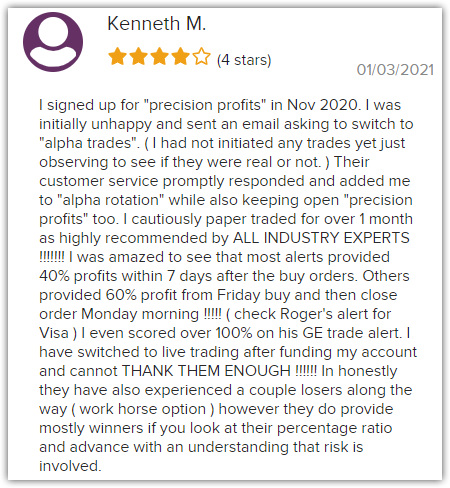

In addition, you will also be able to see comments who attest to the effectiveness of their services. It is interesting that one commenter even apologized for an earlier negative review. The reviewer gave an updated comment.

We think it is great that such companies can help people. After all, that is the essence of their service. As experts, they give their recommendations, for a fee, so regular investors can earn more.So, these reviews are helpful.We also think negative reviews are extremely helpful.

They can provide you with a sober reality check, just when you are about to believe the sales pitch.

So there you have it. We have two sides of the story from the BBB website. All is good, right?Well, not so fast. Allow us to share an observation. It may mean something, or it may just be a product of our wild conspiratorial imagination.Although if you are aware of the various marketing ploys of investment companies, you will agree with us that we might be on to something here.Again, this is just an observation.

The first review in the BBB website is on March 21, 2019. There were several others after that during the year. Only one of them rated the company with three stars. The rest gave WealthPress one star.

Then the first response from “WealthPress Holding LLC” came on October 8, 2020. There was a long 19-month gap.During that period, the company mostly got bad reviews. People gave one-star reviews. Interestingly, it was when WealthPress was already active on the website that they then received positive reviews. It is quite a shift. Of course, there were still one-star reviews after. But it is mysterious how they suddenly got great comments.We can think of a few explanations. Maybe they did improve their service during that time, so it was reflected in the feedback. Or you know. They did “something” to get better reviews.

In addition to what we have learned so far from the Better Business Bureau, we also turned to Stock Gumshoe. Although there was no direct review and rating page for the company, there were comments.

And we went over them.

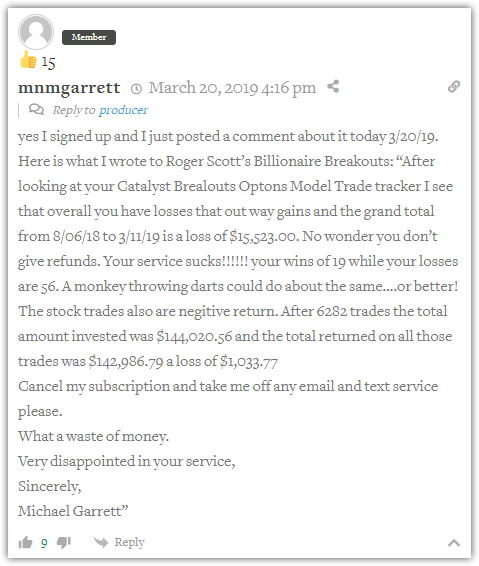

One guy even gave specific numbers to back up his complaint.

We have found several comments like the one above. Some even went to the extent of calling him a “fraudster” and a scam artist.This is unfortunate. These are real people losing real money because of what they call “fake advice”.Again, our disclaimer here is that the reviews only show a partial picture of the whole truth. But we want to show them to you anyway so you can factor them into your decision.

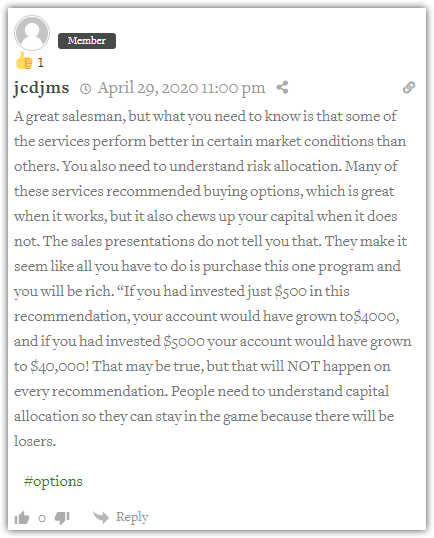

This comment below has an objective take on the man and his service.

Cost and Refund Policy

For premium products. WealthPress allows a dissatisfied customer to cancel. But they can only do so 14 days after the purchase. Within this period, they claim that they will return your money in full, as long as your subscription is $250 and above. But then, they will deduct the cost of physical items sent to the subscriber.Beyond 14 days, all that they can do is transfer your subscription to their other newsletters. If you have purchased products for $249 and below, you may get a full refund at any time. All that you need to do is get in touch with their customer service agents.

Pros v Cons

Pros

- Comprehensive services

- Sleek and easy to navigate website

Cons

- Negative reviews

- Lack of information on their services and personnel

- Accusations of fraud

Conclusion – Can You Trust Them?

Several investment research firms are already in the market. A lot of them have outrageous claims, some spew promises that seem too good to be true.Can you lump the company we reviewed with them?Well, what do you think? Given everything we revealed in our WealthPress review, will you subscribe to them?