Our review of The Oxford Income Letter examines if this is a true “full wealth-building system”, as Marc Lichtenfeld claims. Read about the sober truth behind the marketing tactics of The Oxford Club. They say that they have the best research. The club also asserts that they can give you the highest income from their dividend-paying picks.

Is this legit? If you are knowledgeable about the goings-on in the investment world, chances are you know about The Oxford Club and Lichtenfeld. As a result, you may already have opinions about them. But continue reading so we can discuss in the comments section what your thoughts are.

Overview

- Name: The Oxford Income Letter

- Senior Editor: Marc Lichtenfeld

- Publisher: The Oxford Club

- Website: www.oxfordclub.com and www.oxfordincomeletter.com

- Service: Investment newsletter service

- Cost: $49, $79, $129, $2,995

Many people love the idea of getting regular income from stocks that give them dividends. It is this very crowd that Lichtenfeld is targeting.Through his many media appearances, the investor was able to build a reputation as a man worth listening to. Now, let us examine if his insights make sense and if his newsletter will deliver its promises.

Who is Marc Lichtenfeld?

The Senior Editor of The Oxford Income Letter is a man named Marc Lichtenfeld. On a sales page for the newsletter, he calls himself the country’s “#1 retirement income expert”.

Also, another profile describes him as one of the world’s leading income experts. Such titles and claims are not unusual in this kind of industry. You will observe that there is no shortage of self-promotion and PR exaggerations. Almost every newsletter writer and editor are the best “this” and the top “that” in their bio notes. But these will only be acceptable if they are true and if they can deliver. So let us examine Lichtenfield’s background to know what makes him the “best” in this area.Aside from his role at The Oxford Income Letter, he is also the Chief Income Strategist of The Oxford Club. Because this group is prominent (some say notorious) in the investment world, we will talk about them further below.Going back to Lichtenfeld, the expert is also credited as the Editor of four other publications at the club. These are Technical Pattern Profits, Lightning Trend Trader, Oxford Bond Advantage, and Predictive Profits. According to his profile, almost 500,000 people read all his publications weekly.This is a huge number. It can mean that investors see value in his opinions that they continue to subscribe to him.But, another interpretation is that their marketing promotions are at work. So let’s continue.The former Wall Street analyst started his career in trading at Carlin Equities. All in all, he has spent over 22 years studying and analyzing the markets. Part of his background is being a business journalist. He was a senior columnist at Jim Cramer’s TheStreet and a senior analyst at Avalon Research Group.

This is why his media involvements are front and center in his profiles. The Wall Street Journal, Marketwatch, CNBC, Fox Business, Bloomberg Radio, Yahoo Finance, National Public Radio are among those who have turned to him for his expert analyses.In these appearances, the topics he likes to talk about are macroeconomics, stocks, and financial literacy.Also worth noting is that the former trader is a published author. The Institute for Financial Literacy named Get Rich with Dividends: A Proven System for Earning Double-Digit Returns as Book of the Year in 2016.His bestselling book talks about how investors can get double-digit returns even with the use of a conservative strategy. The dividend-investing book was also translated into many languages.Lichtenfeld’s second book, You Don't Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, won again in 2019.

It became the Investment and Retirement Planning Book of the Year of The Institute for Financial Literacy. In addition, though this is not related to investing, here is an interesting trivia about him. The editor is also a ring announcer in boxing and mixed martial arts for ESPN, HBO, and Showtime.According to the strategist, his mission in life is “to help regular folks generate consistent retirement income they can count on.”We have also previously written about his Infinite Energy presentation here at Green Bull Research.

What is The Oxford Club?

Their website states that it is “a private, international network of trustworthy and knowledgeable investors and entrepreneurs.” Because of this expertise, The Oxford Club publishes financial research and news from its top leaders.Among the experts in the club are Chief Investment Strategist Alexander Green, Chief Trends Strategist Matthew Carr, Engineering Strategist David Fessler, Quantitative Strategist Nicholas Cardy, and of course, Lichtenfeld.

The group currently has three newsletters:

- The Oxford Communique

- The Oxford Income Letter

- Strategic Investor

As of writing, they also offer 12 VIP trading services:

- Dynamic Fortunes

- Extreme Disruptions Trader

- The Insider Alert

- Lightning Trend Trader

- The Momentum Alert

- Oxford Microcap Trader

- Oxford Swing Trader

- Oxford Bond Advantage

- Predictive Profits

- Technical Pattern Profits

- Trailblazer Pro

- The VIPER Alert

We also want to mention that The Oxford Club is part of The Agora. In our review of the publications written by Alexander Green, we have extensively discussed why we think this is a red flag. This is not to say that the group is not a legitimate organization. Truth is, it does offer real advice to its readers.

What we have an issue with the most is the kind of marketing tactics they use to draw in subscribers. Misleading claims and exaggerated promises do not help the subscribers they want to serve.In another article here at Green Bull Research, we also specifically zeroed in on one of the club’s teasers, Alexander Green’s 3 Dollar Stock. Read our review to know what we really think about his claims.

What is The Oxford Income Letter?

The specific newsletter in our discussion here is The Oxford Income Letter. It is a monthly research advisory from Marc Lichtenfeld that focuses on dividend-paying stocks.According to him, he will show you “how to harness the power of dividends and other income-producing strategies.” In order to achieve this, he employs his proprietary 10-11-12 System.Through the service, the income investor will help his subscribers “create passive income that pays them forever.” He adds that his goal is “to ramp up people’s retirement savings.”

How it Works

In the sales pages for the newsletter, we wanted to see the details on how Lichtenfeld will be able to deliver on his promises. As a potential subscriber, you would want to see his process of making your money grow, right? But all that we found was a quick mention of his “proprietary 10-11-12 system”.To deliver to you the information you need, we checked more resources. We found details of this system in discussions in his book, Get Rich with Dividends.

What the system means is that “in 10 years, the investor will be generating 11% yields, and will have averaged a 12% annual return on the portfolio.”According to the strategy, you need to consider three things when picking dividend stocks. These are yield, dividend growth, and payout ratio.Also, when you set up your portfolio, you must follow these guidelines:

- The payout ratio should be 75% or lower

- Starting yield of 4.7% or higher

- Dividend growth of 10% or higher

So there. At least now you get a better appreciation of his science, should you choose to subscribe.Obviously, Lichtenfeld advocates for owning dividend stocks. According to the investor, he has five reasons for such a perspective.Dividend stocks:

- Have outperformed the broad market by 222% over the past 60 years

- Have less risk and a higher return than non-dividend stocks

- Can increase over time. Each year, you could get paid more without putting in more money

- Often have higher earnings growth

- Pay you no matter what the stock is doing

In fact, he continues to tell people to invest even during times of crises like the COVID-19 pandemic. Lichtenfeld also maintains that the economy always rebounds. Those who made calculated risks profit from their foresight.This has happened in the past. Many people could have earned more in stocks, but they were traumatized. He cited the CNN Business article which said that 10 years after the 2008 crisis, many were still not investing.The strategist says that it is happening again. Investors are still nervous about the stock market despite record highs in July 2021.As the editor of an income newsletter, his goal is to teach as many people as he can to take educated risks. When they succeed, they will gain financial independence on their retirement.Another peek into how Lichtenfeld’s mind works is by studying his views on real estate investment trusts or REITs.In one sales pitch, he goes into a long discussion on why he thinks REITs will be great for your portfolio. The bestselling author even cites the Forbes article, Data Proves REITs Are Better Than Buying Real Estate.

In choosing the best options, he uses these criteria. The REIT must:

- be trading at a big discount to previous highs so you can get as many shares as possible.

- have a long history of increasing its payments as it acquires more properties and collects more rent.

- operate in a booming sector. This will make it more likely that your shares themselves multiply in value.

- be lesser-known, so you can get in at a good price before everyone else discovers it.

In the end, the editor says that it will still be your decision. But he will give you the best options so you can make the wisest decisions.You may choose from stocks from his range of portfolios.

- Instant Income Portfolio

- This appeals to those who want and need cash immediately. It contains companies that pay great dividends.

- Compound Income Portfolio

- For investors who can still wait a while, this portfolio features stocks that increase their dividends annually. The idea is to reinvest the dividends you receive so you can have way more when you retire.

- Retirement Catch-Up Portfolio

- This option is ideal for those who invested late in the game. Lichtenfeld will show you high-yield dividend stocks for your portfolio.

- Fixed Income Portfolio

- If your main concern at the moment is the safety of your wealth, he recommends this route. This contains fixed income options like corporate bonds.

Through these processes we have mentioned, you get to see his approach to stocks. Now it will be up to you if you trust his financial worldview.

Track record

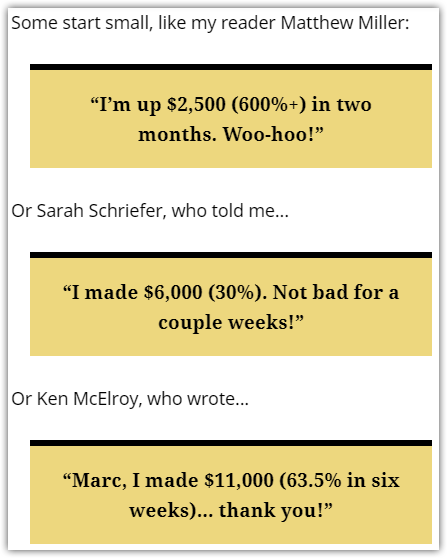

You know how such promotions work. They always feature random people or random names but we rarely get real insights.Take for example these statements from the names he mentions.

As a reviewer earnest to provide our readers with the best information possible, we would have loved to see more. After all, research advisory services always tout that they hold the secret ingredient to success.Every single one also has quotes from satisfied customers. They say they were able to grow their money. Some also attribute their wealth to the editor and newsletter. As a result, many of them recommend that you subscribe immediately.But we need actual information that proves that the “#1 retirement income expert” has delivered results.Instead, what we get are examples of stocks that have performed well. This is inadequate. The former fund manager says that his recommendations have outperformed the S&P 500 and the S&P Healthcare Index by a wide margin.We are not saying we are not convinced. What we want to convey is that we will be swayed more if we see the actual performance of The Oxford Income Letter.

What you get

With your subscription, the former trader also gives you special reports about the most relevant breakthroughs in the investment world. We list down all the bonus features that they offer at the time of this review.

Both are $49 but have different add-ons.

Option 1

- Oxford Income Letter

- 12 pages of analysis each month

- Access to four different Model Portfolios

- Instant Income Portfolio

- Compound Income Portfolio

- Retirement Catch-Up Portfolio

- Fixed Income Portfolio

- Weekly portfolio updates

- Access to a Members-only website, where all special resources are archived

- Access to Pillar One Advisors, including experts in collectibles, real estate, tax law, insurance, and more

- A direct line to the Member Services Team

- Special reports

- The Great 2021 Real Estate Redo: Three REITs for MASSIVE Income

- Multiply Your Money With THIS Moonshot REIT

- The Ultimate COVID-19 Market Recovery Blueprint

- Bonus reports:

- How to Claim Up to an Extra $130,000 in Social Security

- 3 Safe but High-Yielding Dividends

- 101 Ways to Grow and Protect Your Retirement Savings

Option 2

In this particular sales pitch, he says that he wants to give you free reports. Out of the goodness of his heart.

The Free Ultimate Dividend Package:

- The Safest High-Yield Dividend in the World

- My #1 Dividend Stock

- Three Extreme Dividend Stocks

- Dividend Riches: Marc Lichtenfeld’s Income Investing Video Series

As you continue to rejoice in the free resources you are about to get, he says the magic words. But wait there’s more.Well, he does not say those exact words. But he does tell you that you can get more if you subscribe to a risk-free trial of The Oxford Income Letter.You will also get these:

- 12 Months of The Oxford Income Letter

- Weekly model portfolio

- SafetyNet Pro

- Password-protected access to the subscribers-only website

- Access to our Pillar One Advisors

- Weekly Mailbag

- Oxford Income Blasts

- Access to All of Our Special Model Portfolios

- Extra Bonus: Free Hardcover Copy of Get Rich with Dividends

- Access to SafetyNet Pro Reports:

- Start Collecting Weekly Payouts With the Retirement Cash Calendar

- Retire Rich With Five Small-Cap Dividend Stocks

One recurring comment that we have is on how they market these packages. Newsletter reviews often reveal that many subscribers are elderly people, and they always comment that these offers are very confusing.

We hope that research advisory companies can come up with streamlined versions of these. After all, digitalization has made this process easy.

Cost and Refund Policy

Cost

- Standard: $49

- Includes digital-only subscription to The Oxford Income Letter

- Deluxe: $129

- Includes digital (via email and website) and print subscriptions

- Premium: $49 (Down from $249)

- Includes digital and print subscriptions

- With special reports and bonus features

- Lifetime: $2,995

Refund policy

We have to be honest. They do have a generous policy on refunds.

You may cancel your subscription within one year and you will get your money back. They will also let you keep all the reports and the book that’s included in their packages.So you get to test their products first to see if it is worth investing in. It is a commendable gesture as it communicates how confident they are in the product.

This also means they trust that their subscribers will give them their loyalty in return for their graciousness.

Reviews

As of the time this review is published, the newsletter service has a 4.6 rating from 3869 votes on the Stock Gumshoe website. It is among the highest ranked among newsletters.

At the moment, majority of the 216 comments gave favorable reviews. Many even gave detailed assessments like the one below.

It was a curious sight to see overwhelming positive reviews. A number of them were also addressed directly to “Marc”.

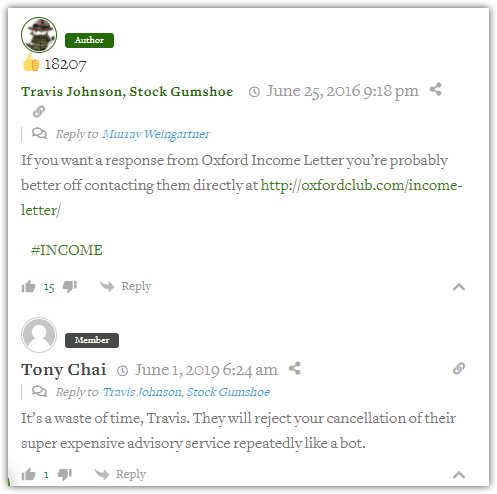

As we read all the replies, we came across a commenter who shared our observation. Stock Gumshoe replied.

It's great that subscribers see great value in the offer, especially considering the price.

But it could also be a marketing ploy as a gateway to The Oxford Club's more expensive products.

Here are two examples of negative comments.

Pros v Cons

Pros

- They have a great 365-day money-back guarantee

- Marc Lichtenfeld has a great reputation in financial circles

- If you are into dividends, you will find value in the recommendations

- The advisory focuses on high-yield stocks

- Affordable compared to other subscription services

Cons

- Lack of information on the performance of their previous recommendations

- Association with Agora Financial

- Confusing packages

Conclusion – Will This Build Your Wealth?

As mentioned before, the focus of this newsletter is on stocks that will give you dividends. In this regard, the editor has a proven track record of success.In fact, people still regard his book, Get Rich with Dividends, as an authoritative source of information on the subject. People also listen to Lichtenfeld as he gives his opinions on various shows and publications. The reviews for the newsletter have also been overwhelmingly positive from the website we covered. If these are genuine feedback from actual subscribers, this could potentially be the real deal.The price point is also great value for money and is among the cheapest among the services of its kind. So we assume that investors like you would find this a huge selling factor.Also, we want to highlight their customer-friendly refund policy. You can enjoy their services for almost one year and cancel on the 364th day. They will return your money and you get to keep all the reports and freebies.That is confidence in their product and their subscribers.In our review of The Oxford Income Letter, you have seen that we have been fair. We presented to you the positive aspects of the service and the organizations behind it. But, we also showed you potential red flags. Now you get to decide.