Everyone is talking about the biggest change to our financial system in 52 years.

It's the end of the U.S. Dollar as we know it and former investment banker Teeka Tiwari has a “#1 Stock for the Coming Digital Dollar.”

The Teaser

The U.S. Dollar by all outward appearances is on its last leg and the U.S. government will soon announce a radical plan to stop its free fall.

Teeka Tiwari knows a thing or two about crisis', he admittedly made a small fortune going short during the Asian crisis in the 90s before proceeding to lose it all in a three-week span because he hung on too long. We have extensively reviewed Teeka's track record here at Green Bull and also revealed more than a few of his stock picks.

Getting back to our teaser, what dastardly plan is the government about to announce?

Teeka says a mandatory national recall of the U.S. dollar is in store and it could come as soon as July 26.

Digital Dollar Trojan Horse

Much of this is about the forthcoming FedNow instant payment system.

On its face, FedNow is an innocent instant money transfer service like Cash App and Revolut. But something far more sinister could be hiding beneath the surface.

It could be a precursor or a trojan horse if you will, for a digital dollar. Here's how:

By launching an instant payment service with “early adopter organizations” like JP Morgan Chase, Citigroup, and Wells Fargo (the usual suspects). The ease and convenience will incentivize average Americans to move their accounts over to one of the “early adopter” partner banks, thereby in-directly enrolling more and more people in FedNow.

Once this has been accomplished and the government has direct access to your bank account, in one fell swoop, the doors of the trojan horse will swing open, and the launch of a central bank digital currency (CBDC) would be announced.

Under such a scenario, most Americans not reading this today would be caught completely off guard and if a dollar recall happens in conjunction with a CBDC rollout, they could end up holding a bunch of worthless U.S. paper dollars.

This is also where the opportunity comes in.

If we know which companies are working on these CBDC projects and which assets will directly benefit from a digital dollar, we could come out of the U.S. dollar recall wealthier than ever before.

The Pitch

Teeka believes that once they officially announce the U.S. dollar recall, shares of one company will skyrocket. He's put all the details inside a special report called My #1 Stock for the Coming Digital Dollar.

The report and plenty of other extras are ours when we sign up to The Palm Beach Letter for only $49 for a limited time. What are the extras?

They include a model portfolio that has averaged an incredible 131% a year, a trio of bonus reports, weekly updates, and urgent alerts among other things.

De-Dollarization & A Digital Dollar

As of today, most countries use U.S. dollars to transact in global trade.

It has been this way ever since the Bretton Woods Agreement of 1944 made the dollar the world's de-facto reserve currency.

But this privilege may now be coming to a slow, painful end.

Just this past year, the volume of international trades using currencies other than the U.S. dollar has increased eighty-fold. Why is this happening? A few reasons come to mind.

Trillions in Debt

Since Nixon took the U.S. dollar off the gold standard, America has racked up a hefty credit card bill.

$31 trillion dollars worth and counting…

As fiscally irresponsible as this is, it's not what may ultimately break the greenback.

Freezing Russian Dollar Reserves

In February 2022, the Biden administration took the unprecedented step of freezing all the dollar reserves of Russia's central bank.

Geopolitics aside, the rest of the world watched this play out before their very eyes and collectively thought “If the U.S. can do that to Russia, a nuclear superpower, they can do it to anyone.”

This is why an increasing number of nations from Asia, Europe, and Latin America have recently announced plans to de-dollarize.

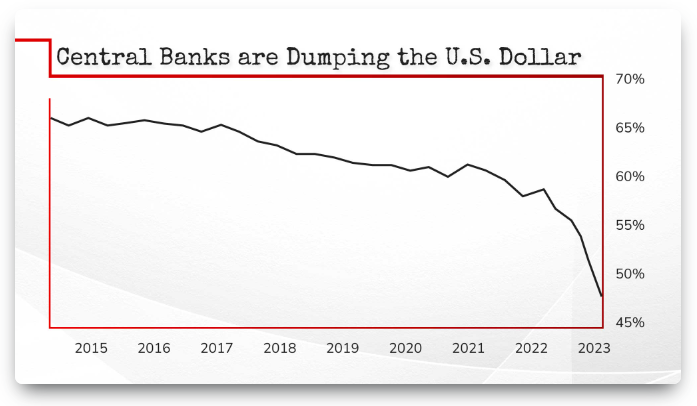

The U.S. dollar share of world reserve currencies has collapsed from 73% in 2001 to the lowest level ever at 47% this year.

Many Americans don’t realize this is a HUGE deal.

As has historically been the case, the government never lets a crisis go to waste and they’re going to use this dollar crisis to implement what they’ve been planning for a long time now – a U.S. CBDC that could potentially also help maintain the dollar’s international standing.

Unfortunately for all of us, you and me included, this would give the federal government complete control over our money.

But there's hope yet, as Teeka says there's a way to opt out and he's also found a company that’s working directly with the Fed to develop the digital dollar so we can profit from what's being implemented. Let's find out what it is.

Revealing Teeka Tiwari's #1 Stock for the Coming Digital Dollar

These are the clues we have to work with:

- This company has already helped the Fed develop its real-time payments network called FedNow.

- They already signed a deal to do the same for five central banks from other countries.

- BlackRock and Vanguard have collectively invested more than $6 billion in this stock.

Teeka's #1 digital dollar stock pick is Fidelity National Information Services (NYSE: FIS). How can I be so sure?

Besides being an early FedNow adopter and working with foreign central banks to help them deploy digital payment solutions, users of another credible forum have also confirmed the pick as FIS.

The question is, does it give us a chance to earn a huge six-figure payout like Teeka says?

A Truly Historic Opportunity?

Like most newsletter hypemen today, Teeka contradicts himself in his pitch.

First, he says “Central banks will likely end up hosting at least part of their new currency systems with major cloud providers like Microsoft, Google, and Amazon.” But it's unlikely we’ll make huge gains with these stocks because they are already too big. I agree with this premise.

However, the stock pick he gives us – FIS, already has a market cap of $35 billion dollars itself.

FIS provides payment processing and other back-office solutions for financial institutions. Presumably, under a centralized digital dollar system, the banking sector would contract and only a few primary dealer mega-banks (if any) would be left.

This would leave businesses like FIS with only a few customers (central banks), with whom they are already working. Sure, the scope and nature of these contracts would expand, but I don't see the stock growing much or doubling solely on the back of this.

I think it safe to say, there are better ways to make money off the digital dollar rollout.

Quick Recap & Conclusion

- Ex-investment banker Teeka Tiwari is teasing the end of the U.S. Dollar as we know it and he has a “#1 Stock for the Coming Digital Dollar.”

- Teeka believes a physical dollar recall will happen in conjunction with a CBDC rollout. If and when this happens, he reasons that the companies working on these CBDC projects stand to benefit the most.

- The shares of one company in particular could skyrocket and he's put all the details on it inside a special report called My #1 Stock for the Coming Digital Dollar. The report is ours when we sign up to The Palm Beach Letter for only $49 for a limited time.

- Fortunately, you can skip this step as we were able to reveal Teeka's #1 digital dollar stock pick for free as Fidelity National Information Services (NYSE: FIS).

- I'm not big a big fan of Teeka's investment thesis here, as FIS' business would actually shrink if there are fewer financial institutions to serve. Sure it would survive the fallout, as it is already working with central banks, but its future growth would be kneecapped.

What do you plan to do when the digital dollar becomes a reality? Let us know in the comment section.