Is Paul Mampilly's 100X Club worth joining? Is this service legit and will you really be able to 100X your investments based on his recommendations?

In this review we'll be taking a look at what the service provides, how it works, Paul's track-record and more. By the end you'll have a better idea of what you're looking at here.

Let's first talk about the promotional material for this service. I came across what was called “The 100X Summit”, which has been promoted quite a lot online…

The 100X Summit

Basically this was an incredibly long (1 hour+) presentation where Paul Mampilly and Corinna Sullivan talked about the100X Club service that Mampilly is offering – it's all a sales pitch really, similar to his “Rebound Profit Summit”.

Paul talks about how this new opportunity provides investments in “untapped sectors” of the market that have the potential to return $100 for ever $1 you invest, which is a 100x return.

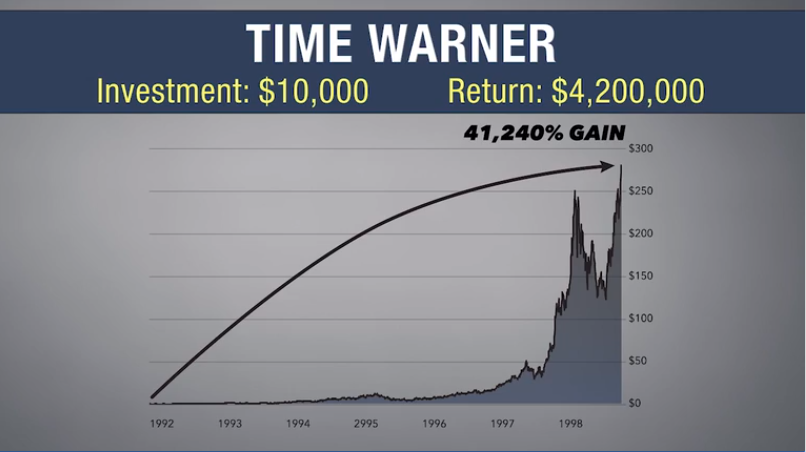

The presentation then goes over a bunch of examples of stocks that have provided 100X+ returns in the past, such as Biogen and Time Warner here…

But it's easy to look back at past examples – it's a totally different ballgame to actually predict them before they happen, and reap the rewards of investing early.

But anyways, Paul claims that he has 3 particular stock selections right now that have the potential to soar higher than any other stocks he's revealed to-date (which he seems to say about all of his recommendations) and that these stocks have the potential to rise up to 50,000%. We don't know much about these 3 stocks, but we do know that they are 1) 5G company, 2) an electronics company stock, and 3) a company in the medical industry

And of course the details on these 3 stocks are all provided in a “free dossier” titled Micro-Cap Fortunes: Three Stocks Positioned to Become the Market's Next 100 Baggers…

However, in order to get this “free dossier” you first have to become a member of his 100X Club, which is far from being cheap.

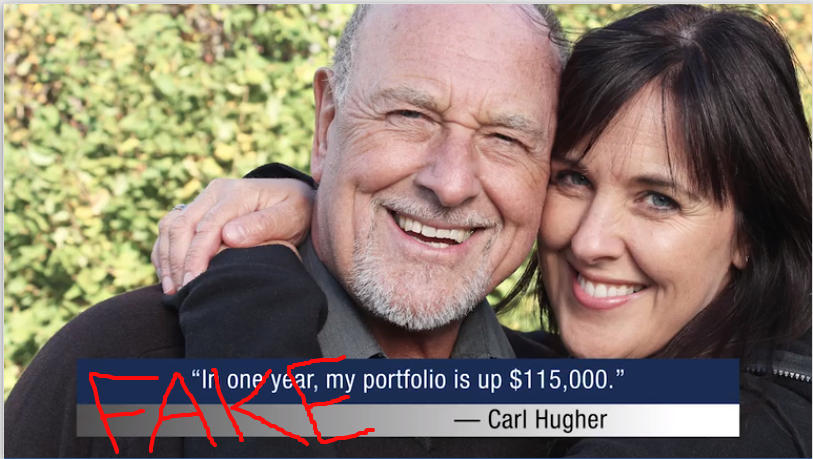

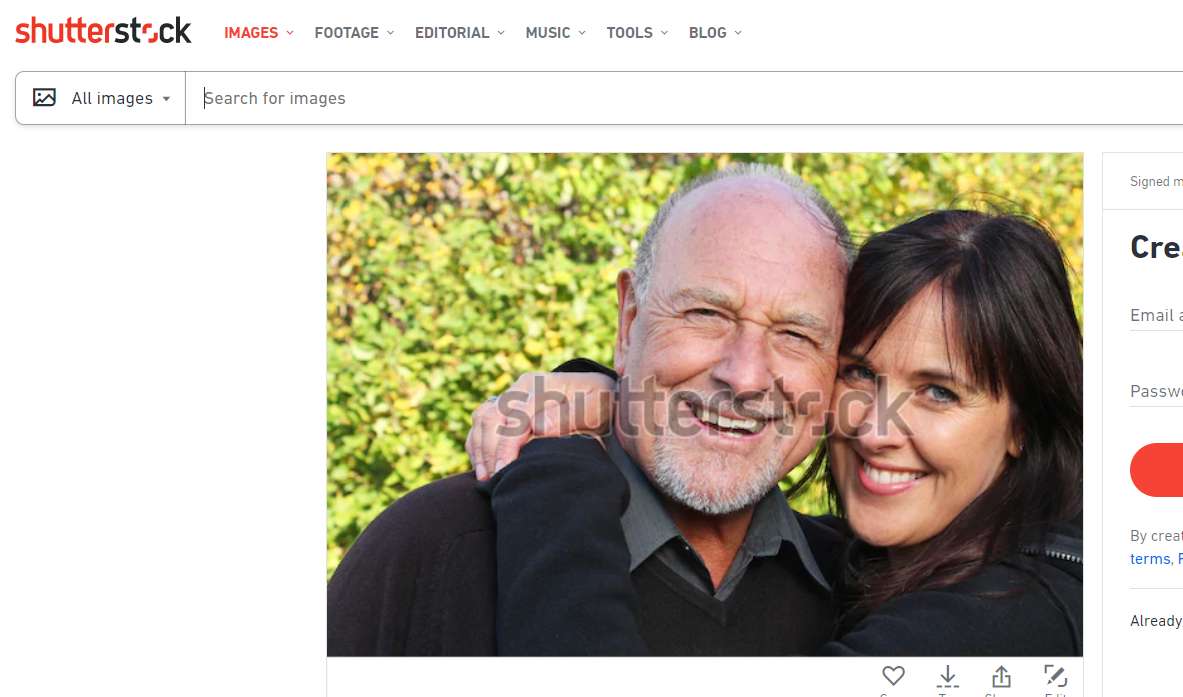

Not only is this sort of sales tactic a bit misleading, but what's also concerning is the fact that I found some of the testimonial photos used in the presentation to be fake.

Throughout the presentation we were shown people who have supposedly been earning substantial amounts of money from this service, such as “Carl Hugher” here who is said to have profited $115,000 in a year…

However, after doing a quick reverse Google image search I was able to find out that this is actually a stock photo on ShutterStock… meaning that it is a fake and not really “Carl Hugher”… if the guy even exists…

Not only that, but the testimonial stated that he has made $115k in the past year… but this particular 100X Club service hasn't even been around that long (at the time of me writing this), so then what does this actually mean?

Anyways… the marketing material is a bit misleading and over-the-top, as expected. The service is legit though, as you will see. Let's get to what you can actually expect from it…

Overview of the 100X Club

- Editor: Paul Mampilly

- Publisher: Banyan Hill

- Cost: $10k + maintenance fees

What Is The 100X Club?

The 100X Club is a membership investment advisory service edited by Paul Mampilly and published by the Banyan Hill Publishing company. This service provides members with specific micro-cap stock recommendations on a regular basis, and specifically looks for opportunities that have the potential to increase by as much as 100x in price.

Who Is Paul Mampilly?

Paul comes from a background of investing for large companies on Wall Street – over a decade of experience here. He started out as a junior analyst at Banker's Trust back in the early 1990's and worked his way up to some high-level positions, such as those managing money for the Royal Bank of Scotland, Deutsche Bank and others.

Because of his background and expertise, it's possible that you've seen him featured on media outlets such as Fox Business, CNBC, NBC, etc.

One of his most notable achievements took place back in 2008-2009 when he competed in an investment competition in which he was able to grow a $50 million starting investment into $88 million, which is more impressive considering that this was the time of the big recession.

Currently Mampilly no longer works on Wall Street. He is employed by the Banyan Hill company where he edits several investment newsletter services, which besides 100X Club includes Extreme Fortunes, True Momentum, Rapid Profit Trader, IPO Speculator and others.

*Note: You will find a lot of mixed reviews on Paul Mampilly. On sites like Dirty Scam you'll find a number of complaints. These are mostly due to the over-hyped marketing claims and somewhat misleading marketing material that he puts out there to lure in new subscribers to his services… which has become a commonplace sales tactic for investment services like those that he provides. On a much better note, the reviews on his Facebook page are much more positive overall.

Other FAQ's

Is 100X Club legit?

Yes, this is a legitimate service that provides legitimate investment recommendations, all of which are publicly traded on major exchanges.

It's understandable that some people think it could be a scam because of how the promotional material sounds too good to be true, but the service itself is legit.

Who is Banyan Hill?

Banyan Hill is the company behind it all. They are the publishing company that Paul Mampilly works for and provide a number of other investment advisory services.

Is this risky?

There is always risk involved when it comes to investing, and because this service is focused on small companies, there is even more risk present.

That said, I'll be going over the criteria Mampilly uses to pick stocks, which mitigates risk.

*Note: Don't invest more than you can afford to lose.

How much money do you need to get started?

I'll be providing a breakdown on this later. As for now, just know that it will cost quite a lot to really take advantage of this service.

How It Works

This is a follow-along service, so the basics of how it works are pretty simple – subscribers are told what to invest in and when to invest.

You really don't need to know much of anything to follow along, but I think it's important that you know exactly what you are getting yourself into… if you do actually decide to join.

The Strategy

Paul takes a scientific approach when it comes to identifying stocks that have the potential to increasing 100-fold.

In a nutshell, he is focused on finding micro-cap stocks that are fairly well established, under the radar of mainstream investors, have good management, are in small niche industries where there isn't much competition, and that have low share prices.

There are actually 20 criteria that Mampilly looks for before recommending a stock. These include:

- niche businesses – focused on one industry with limited competition

- low share price (under $10 per) – most he recommends will be $5 or less

- market cap must be low – looks for micro-cap stocks

- established companies no less than 5 years old

- have operating profit in at least one of the last 3 years

- have enough cash to operate for the next 12 months – even if revenue suddenly stopped

- gross margin of at least 20%

- liquidity of at least 10k shares per day

- have huge clients – ideally fortune 500 clients

- management is experienced

- are in a $50 million + sector

- have been listed on a major exchange for at least 3 years

- shares are near all-time low trading prices

- survived the 2008 crisis (if they've been around this long I guess)

- had large market capitalization at IPO

- proven history of raising equity funds

- product they make is commercially sold on a large scale

- are under the radar (from analysts)

- were once considered major players in their industry

- in industries that are expected to “surge 100% or more”

What Is a micro-cap stock?

A micro-cap stock is a stock from a public company that has a market cap of between $50 – $300 million, roughly.

Penny stocks are often also micro-cap stocks, but not always. These two terms are misused quite a bit. A penny stock is just a stock that trades for less than $5 per share.

So when you look for penny stocks you are just looking at the share price, but when you're looking at micro-cap stocks you are looking at the market capitalization that a stock has – two different things.

The types of micro-cap stocks that Paul looks for are those in untapped market sectors.

Isn't this risky?

Generally speaking, yes they are… more so than large-cap stocks anyhow.

As Mampilly mentions, what he recommends are highly speculative opportunities. These micro-cap recommendations he makes have much more potential to grow than large stocks, but this potential for increased growth of course comes with increased risk, because of how small the companies are and how they are much more vulnerable to negative events and bearish markets.

But, as we know, there is a strict criteria that these micro-stock recommendations must meet before they are recommended to subscribers.

What You Get as a Subscriber

To start off, as you already know, new members get the “free dossier” called Micro-Cap Fortunes in which Paul Mampilly provides his top three 100x stock picks. This is just to get started with though. The membership also provides ongoing recommendations. Here's a breakdown of what all you'll get if you do decide to buy into this:

- New 100X Recommendations – Each month a new investment recommendation will be made. Along with this subscribes will be told all the details on how to place the order, when to sell and how much to invest.

- Weekly Research Updates – Every week a new update will be sent out providing news and analysis on the market, new stock opportunities that Paul is looking at and of course how the current recommendations are performing. This is sent via a video podcast.

- Trade Alerts – When it's time to buy or sell, subscribers are sent trade alerts via email (also an option to receive alerts via text message). These will explain exactly what to do.

- Model Portfolio Access – Subscribers will be able to see all of Mampilly's current recommendations. This is updated every time a change is made.

- Members-Only Website Access – Here is where you can find an archive of all the past updates, recommendations, the model portfolio, etc.

- The 100X Club Rules of the Investing Game – This is best described as a manual for how this trading system works and how to get started.

Cost & Refund Policy

The cost is a lot… $10,000 for the initial payment and then a “small annual maintenance fee” of $995/yr for every year after that.

Paul does tell us that this is his most elite service to-date, and the numbers I'm seeing here reflect this.

As far as refunds go… they are not available. This is cut-and-dry, stating that “because of the elite nature of this opportunity, we cannot offer any refunds”.

That said, there is a “100x guarantee” that is offered. This is a guaranteed from Paul that subscribers will receive a minimum of 15 recommendations in the first year that have the potential to rise 100x in price…

However, this type of guarantee has no real value. After all, you could say that just about any stock has “the potential” to rise 100x in price… but this is far from saying that this will actually become a reality.

How much money should you have to get started?

It is recommended by Paul Mampilly that you invest between $1,000 – $10,000 in each of his investment recommendations.

So if you consider that he provides his top 3 recommendations in his Micro-Cap Fortunes report, then this means you'll want to have around $13,000 to start out ($10k for the membership price + $1k for each of his top 2 recommendations). Additionally you'll then want $1,000 to invest per month for his monthly recommendations.

So if you do the math here it equals $25k for the first year that you'll want to invest… but of course the idea is that investing this kind of money provided you with multiple-times gains.

Track-Record

So I'm sure you are wondering how much you can actually trust these recommendations Mampilly will be providing.

What's his track-record here?

Unfortunately, because this is a rather new advisory service that is different from any other service he has provided in the past, we don't really have a clear picture as to what you can expect.

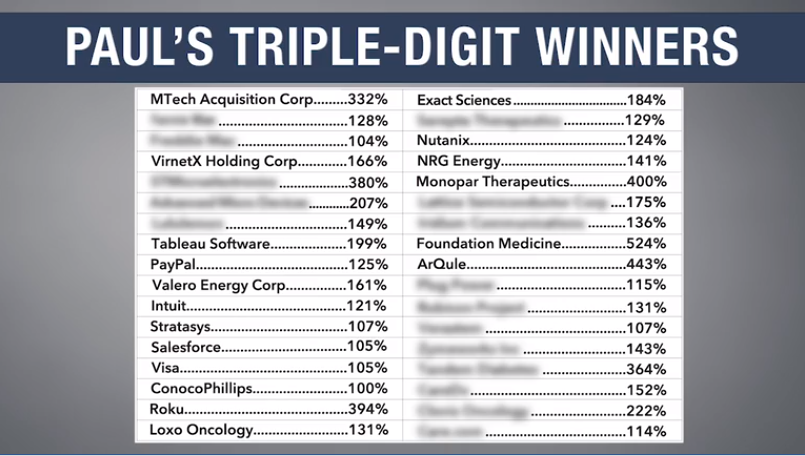

In some of the promotional material I found a number of recommendations that have produced triple-digit gains for subscribers (from his other advisory services), such as these…

… but these are still not even close to the 100x gains that he is promising with the 100X Club subscription.

Only time will tell has well this service really performs.

*Let us know how this service is performing in the comments below this post if you're a subscriber.

Who 100X Club Is Best Suited For

Because of the barrier of entry for a service like this and the risk involved with investing in small companies, this service is definitely better suited for people with a fair amount of extra month to spend… and of course those willing to take chances.

As mentioned, Paul recommends investing between $1,000 – $10,000 in each of his recommendations. Of course it doesn't really matter all that much. Even if you'd just invest $100 in each you could still do well, but these are the amounts he recommends… so you will need a large amount of money to get started here, considering it already costs $10k just to join.

It's also worth noting that the pricing of this service is much more attractive if you are going to be in it for the long-term. Remember, it's only $995/yr to remain a member after buying in. But of course whether or not you'd want to will depend on the performance, which is too early to make good predictions on.

Pros v Cons

Pros

- Easy to follow – everything is well laid-out

- No experience or knowledge needed – specific investment recommendations are given

- Knowledgeable advisor – Paul Mampilly has quite an impressive background and definitely knows what he's talking about

Cons

- No refunds

- Could be risky – as is the nature of micro-cap investing (although Paul Mampilly's criteria mitigates this risk)

- Expensive to get started – Costs $10k + $995/yr + the cost of actually investing in the recommendations, which he recommends at least $1,000 in each

Conclusion – Worth Joining?

This decision ultimately falls on you. And unfortunately at this time it's hard to make a quality decision because of how new this service actually is. That said, Mampilly does have a good track-record with some of his other services and he has an equally impressive record in his past life investing on Wall Street. So if this is any indication as to how well this 100X Club will perform, then this should have some good potential.

But again, just make sure you have the extra money to spend and to now spend any more than you can afford to lose. Mampilly knows his stuff, but he has also recommended his fair-share of losing stocks as well.

And be sure not to expect 100x returns – I know we are all led to believe these will happen, but who knows how long that could take to actually be realized, and there is certainly no guarantee it will happen.