Overview

- Name: Neptune Global Holdings

- Website: neptuneglobal.com

- Type: Full-service precious metals company

- Founder: Christopher Blasi

What Is Neptune Global Holdings?

, aka Neptune Global Bullion Exchange or Neptune GBX,

full-service precious metals dealer for small retail investors as well as large institutional investors

started out in 2002 as your typical full-service precious metals dealer

have evolved over the years to provide more than just precious metal coins and bars – “bridged the best of two worlds – ease of trade like an ETF with actual physical bullion ownership

precious metals exchange, proprietary trading platform, and patented financial technology

not BBB accredited, but there are many legitimate and trustworthy companies that aren't, so this doesn't mean all that much.

3rd party non-bank depository – get certificate of ownership when storing precious metals with them

if your metals are in storage through Neptune Global Holdings you can login to the website and see the amounts in your portfolio – can sell at any time

fees are about the same as what you'd pay to the managers of GLD or SLV ETFs if you were to invest in them

research and trading firm

Wilmington, Delaware

Products/Services

Much of what Neptune has to offer is its exchange, so start off by going over this. I'll be breaking things down into buying and selling. First we'll go over what all is available for purchase…

Buying

PMC Ounce

The flagship product they offer is called the PMC Ounce, which is a patented physical precious metals asset (PMC = Precious Metals Composite) that was created in 2008 and later patented in 2013.

The PMC Ounce is a fixed fraction amount of gold, silver, platinum, palladium. This is fixed… as in it doesn't change.

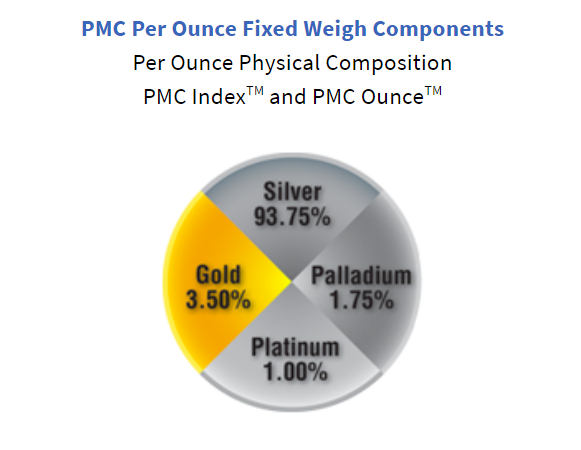

According to the website, the percentages of each precious metal by weight in a PMC Ounce are:

- 3.5% gold

- 93.75% silver

- 1.75% palladium

- 1% platinum

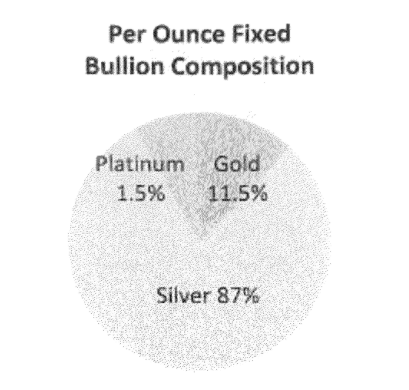

But this information is a bit confusing. I was able to find the patent for the PMC Ounce (US patent number US8583547B2) and this shows different numbers…

So it seems that they aren't even using the patent… which is strange.

At any rate, the PMC Ounce is a great way to diversify your precious metals portfolio. It helps mitigate volatility and has outperformed gold and silver over the long-run, as this chart shows…

If you are interested in this asset you can take a look at their PMC calculator tool, which you can use to make mock trades. You can enter the amount of PMC Ounces you wish to purchase and it will give you the overall price as well as a breakdown of the prices per precious metal based on the current market prices. This way you can see exactly how much money is going towards what.

Gold

You have several options to purchase gold. It can be purchased by the ounce and stored in a vault account through Neptune Global Holdings or you can purchase bullion coins and bars. These include coins like US Eagles, Maple Leafs, and Krugerrands, as well as 1 oz, 10 oz, and 1 kilo gold bars. Fractional-ounce coins are also available, but you'd need to call them to find out more.

Silver

With silver there are also a lot of options. You can purchase silver bullion and have it stored through the company in a secure vault, or you can choose to purchase coins and bars. These are much the same, including 1 oz coins such as the US Eagle and Maple Leaf, and bullion bars can be purchased at 10 oz, 100 oz, and even 1,000 oz.

Platinum

The options for buying platinum are limited. These include 1 oz and 10 oz bars and they are not available for vault account storage services. You'd have to have them shipped to you.

Palladium

The only option here is to purchase a 1 oz bar. As with platinum, palladium is also not able to be stored in a vault account, so you'd have to have it shipped to yourself and stored.

Precious Metals IRA

Neptune Global also offers IRA services. There is limited information provided on the website, but they do mention that you can start a new IRA or transfer funds from an existing IRA to them, and there is also the ability to transfer 401k funds to a precious metals IRA.

A precious metal IRA would be great if you are looking to save with tax-free growth or on a tax-deferred basis for retirement.

Selling

If you bought from Neptune and want to sell your precious metals back to them, this is another service they offer. However, they only buy back gold, silver, and PMC Ounces, so if you purchase platinum or palladium you are stuck with it.

Gold and silver can be sold back to them whether you have it stored in a vault account or if you've had it shipped to yourself and are personally holding onto it. And of course PMC Ounces are only available to be stored vault accounts – also available for selling back to Neptune.

But is it really even worth selling back to them? Well, let's look at what the going rates are.

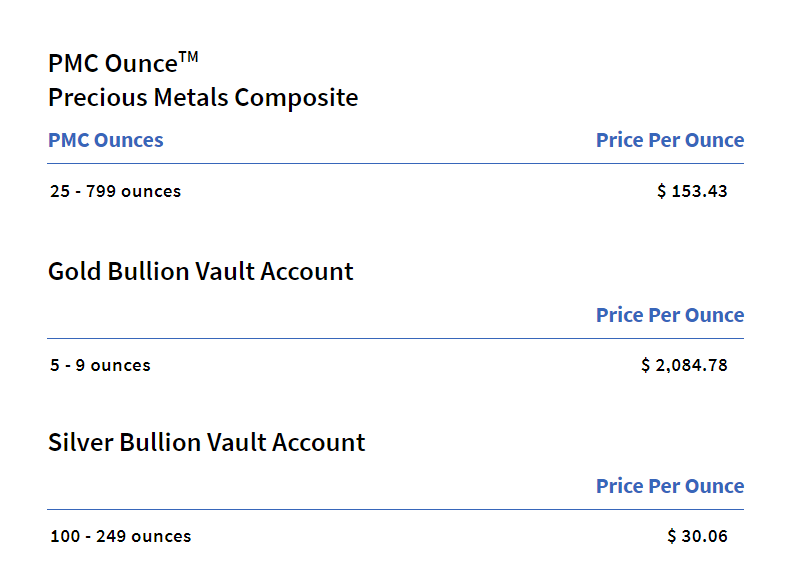

At the moment of me writing this gold bullion is available for purchase at $2,084…

And if I were to try to sell gold back to them I would be given $1,935 per ounce…

And if I were to try to sell gold back to them I would be given $1,935 per ounce…

That's about a 7% difference in prices… so their fees are about 7%.

However, this varies. If you were to purchase gold bullion to be shipped to you and then would sell it back the fees would be a bit higher, which makes sense since it would take more work on their part to make the transaction. And in this case you'd also have to consider the cost of shipping. You'd have to pay to have the gold shipped to you originally and then would have to ship it back for the sale (I'll talk more about the cost of shipping in a bit).

Pricing

I just went over some prices for buying bullion, but how competitive are these prices really?

Now of course the prices will change, but the differences in prices will likely remain close to the same no matter what the cost of gold is.

Right now, the price for purchasing 1 oz of gold bullion is currently set at $2,084, and at the moment the market price of gold per ounce, according to Monex, is $1,992.

That said, it takes some time for dealers' prices to catch up with the current market prices, and even if you go on large and trusted bullion dealer sites, like US Gold Bureau's, you'll still find prices a bit high.

All in all, Neptune's prices are very competitive. On the US Gold Bureau's website the current price for a 1 oz bullion is about $2,067, only $17 cheaper than at Neptune.

Also, gold bullion bars that are available to purchase and have shipped to you have the same pricing as gold bullion that you can buy and store with them. After all, gold bullion is gold bullion.

Storage Options

Neptune Global Holdings uses 3rd party depository services to keep their clients' bullion safely stored. Of course you have the option to either store bullion with them or have them ship it to your address, but if you do choose to store the bullion in a vault account you will receive documentation of ownership and will also be able to login to your account to view your assets.

As usual, on the website they don't provide all that much information on their storage options, just simply stating that they provide the “safest, most cost effective, and secure bullion storage in the precious metals industry”.

However, after looking more into things I was able to find an interview between Chris Blasi and Jay Kim (of the Jay Kim Show) where Chris Blasi, the founder, mentions International Depository Services (IDS) being their primary depository.

This is good news. IDS is a fully insured private company that provides depository services in the US and Canada (has depositories in Delaware, Texas, and Toronto). Additionally, IDS of Delaware's depository is COMEX/CME-approved for storage of gold, silver, platinum and palladium. I'm not entirely sure if you have the choice of where you want your precious metals to be stored if you do choose to keep them in a vault however.

Delivery & Pick-Up Services

When you make a purchase through Neptune's website you have the option to store the precious metals in vault storage, as just talked about, or to have them shipped to you or an existing storage account – you have control over your bullion.

They mention that “shipments are fully insured and are handled by leading transport and freight companies”, but there isn't any mention as to what companies they use.

That said, I can guarantee that shipping fully insured bullion certainly isn't going to be cheap. So this is something you have to keep in mind when you buy.

If you plan on holding onto your bullion for the long-term and would rather trust yourself to keeping it safe, then it might be worth shipping out. However, if you are looking to trade bullion, as in buy it and then later sell it for a profit, then this might not be quite as good of an option.

Contact & Support

There is only one phone number listed if you want to contact Neptune's support staff. To talk to a “Bullion Specialist” call 302-256-5080.

It doesn't matter if you are having technical problems with your account, want to ask a question about shipping options, or want to purchase a large quantity of bullion and are looking for the pricing… this is the only number to call.

If it's not an urgent situation then it might be better to just submit a support ticket through their webpage here.

Who Should Use Neptune Global Holdings?

Heading H2…

Enter your text here…