Is Hard Assets Alliance legit? Can you trust this place to buy gold, silver and other precious metals or is it a scam you should avoid?

Precious metals are all the rage nowadays. Government-backed fiat money isn't as trusted as it once was and some economists are predicting a doomsday of sorts when it comes to the world's currencies. So one logical safety measure is to invest in precious metals, such as gold that seems to be crises-resistant and that some are predicting will reach as much as $10k/oz in the near future.

Hard Assets Alliance is promoted quite a bit by investment advisory services, and so here at Green Bull we've been getting quite a few questions about its legitimacy. Luckily for you, in this review I'll be going over some background on the company, the products and services offered, whether or not it's safe to invest through them, prices, complaints and more.

Let's begin with an overview of the company...

Overview

- Name: Hard Assets Alliance

- Website: hardassetsalliance.com

- Service: Precious metals exchange (buy, hold, sell)

- Owner: Unknown

What Is Hard Assets Alliance?

Hard Assets Alliance, or HAA, is an alliance of economic and investment research firms that have come together to provide a precious metals brokerage service, which they call their SmartMetals platform, to make it easy for retail investors to buy and sell precious metals. Providing precious metals at competitive prices is also a primary focus and it is interesting how their online marketplace works, which I'll go over in more detail.

They are a full-service precious metals company with international storage and delivery options.

Anyone can open one of their many account optioons, such as an IRA, and purchase, store, and sell physical precious metals.

- Additional Company Details:

The details on this company are still a bit confusing to me. I've found information on how this alliance is made up of more than 60 members, including Casey Research, Sovereign Society, Peak Prosperity, Agora Financial, Mauldin Economics, Rich Dad, Eagle Publishing, Daily Reckoning, Oxford Club, StreetWise Reports, Sovereignman.com, Cambridge House, and Street Authority and more... however I was not able to find any information on who actually started the company. All that is stated is that it "was started by long-time investing professionals".

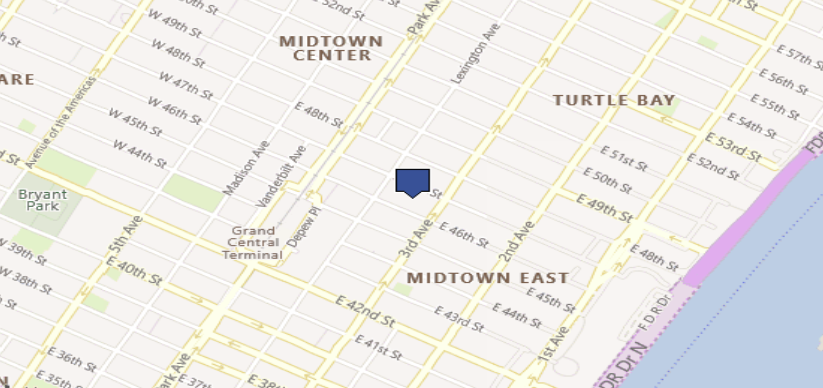

Furthermore, HAA is listed at...

750 3rd Ave, Suite 702, New York, NY 10017, US

This makes sense because I also found that the website is "powered by GBI"...

GBI, or Gold Bullion International, is a company that provides a platform for buying and selling precious metals that can be integrated with existing accounts and trading systems.

As mentioned, I'm a bit confused with how everything fits together and it would be nice if they were a little more clear on the website with what's going on, it seems to me that HAA is simply tapping in to the precious metals exchange that GBI provides... and this is a good thing because GBI is a legitimate company that has a good reputation.

FAQs

Is Hard Assets Alliance a scam?

Hard Assets Alliance is not a scam. That said, there are some legitimate complaints against the company that are worth knowing and it's not the cheapest place to buy precious metals. I'll go over more on this in a bit.

What are the benefits of joining Hard Assets Alliance?

The main benefit here is the simplicity that HAA offers to buy, hold, and sell precious metals. The process is painless. Prices are competitive and decent, but you can find cheaper elsewhere.

Products

The precious metals available for purchase here include gold, silver, platinum, and palladium... with the most options being for gold and silver.

- Gold

- This includes gold bars going from 1 oz to 1 kg and 1 oz coins such as golden American Buffalo nickels, Great Britain Britannia, South African Krugerrand, Canadian Maple Leaf, Austrian Philharmonic and American Eagles.

- Silver

- Here you can find silver bars from 100 oz to 1,000 oz along with 1 oz coins such as Buffalo Nickels, Great Britain Britannia, American Eagle, Austrian Philharmonics and a 500 oz "Monster Box" of American Eagle coins.

- Platinum

- The only option here is a 1 oz bar.

- Palladium

- And the only option here is also a 1 oz bar.

Prices

HAA is not a dealer. Instead, they simply provide a marketplace where they bring dealers, refiners, and banks together. Every time an order is placed they bid against each other to win the business, thus keeping prices competitive.

How competitive are the prices?

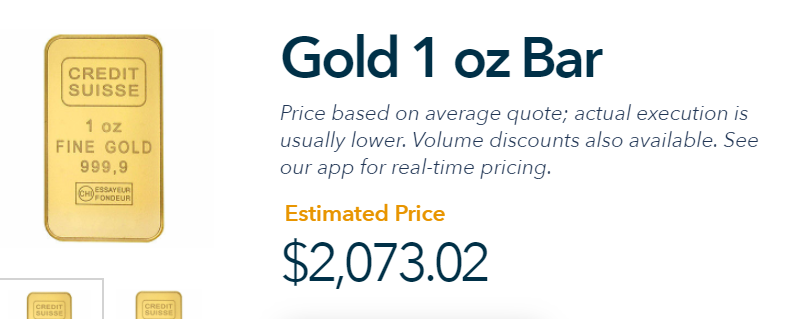

Well, let's take a look at an example. As I'm writing this, the cost of a Credit Suisse 1oz gold bar on HAA is listed at $2,073...

This pricing is competitive, but I was able to find cheaper alternatives. For example, on the US Gold Bureau's website I was able to find multiple 1oz bars for around $2,030.

According to trustablegold.com, the estimated markup price is:

- 1 oz: 3.16%

- 10 oz: 2.58%

- 1 kg: 2.47%

- 400 oz: 2.14%

Their prices are competitive and better than some places, but you can find cheaper sources that are trusted. That said, HAA does make the process of buying, storing, and selling easy, and because of this it might be worth using.

Accounts

It doesn't take long to join and verify who you are, and then you can go ahead and fund your SmartMetals account (this is what they call their accounts) to make your first purchase. Since HAA is a US company they are required to verify everyone's identity. You can open up an account from anywhere in the world, but this requirement always remains in place.

The different types of accounts you can create include:

- Individual Account

- Joint Account

- Retirement (IRA) Account

- Trust Account

- Corporate Account

- Uniform Transfer to Minors (UTMA)

It's nice to see all these options, but most people are probably going to be interested in opening up a Personal Account, or an IRA Account if they are looking invest for their retirement and save money on taxes in the process.

In addition to this, you can also set-up what they call a MetalSTREAM account.

MetalSTREAM

This is their automated monthly investment feature. If you sign up for MetalSTREAM you have to pay $25/mo and you'll be able to connect your bank account so that each month a specified amount is invested into precious metals of your choice. Money will be held until enough has accumulated for a full coin/bar.

This is an excellent hands-free way to invest over the long-run without thinking about it, but I don't see much of a reason for them to be charging $25/mo for it. Since you are setting up an automated payment gateway you would think it would be free at least... similar to how phone services give discounts when you set up automated payments.

Storage Options & Shipping

Hard Assets Alliance has vaults in various locations around the world. I'm not entirely sure of all the locations, but I do know they have storage options in New York, Salt Lake City, Zurich, London, and Singapore.

| There isn't much information provided on their storage, but we are told that your precious metals will be "stored in the world’s most secure non-bank vaults", and on the website they also mention Loomis, Malca-Amit, Brinks... which I suppose play a part in the safe storage. |

The cost of storage is set at:

|

These are the starting prices, but they do mention that the cost could be lower for high-valued accounts. The cost for gold storage can be as low as 0.5%/yr if you have more then $1 million invested.

There is also a $5/mo minimum fee per account if you use their storage options, but this can be waived if you have a MetalStream account opened, which is the automated investment account I talked about earlier.

HAA provides true ownership and digital access. Owners can sell their precious metals at any point from HAA's vault storage option or they can choose to have things shipped to them anywhere in the world. But do keep in mind that you will have pay the shipping costs.

If you are looking to hold onto gold or other precious metals long-term then it might be wise to store gold yourself, but if you want more liquidity and/or don't have a safe place to store it yourself then using their storage might be the better option.

Complaints

There really aren't too many complaints about this company, but this seems to be largely due to the fact that they aren't all that well known, because the complaints I have been able to find are a bit concerning.

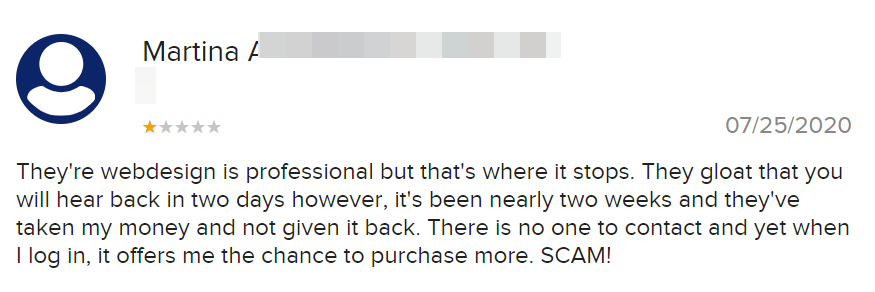

*Most of these complaints come from Trustpilot.

Lack of Transparency

As was mentioned in the beginning, there is no information provided on who the owner of this company is. I understand that it is an alliance of different companies, but there has to be someone in charge running the whole thing.

There have been others complaining about this as well, as is shown in the complaint below that reads "it should be more transparent... to inspire more trust"...

I don't think the company is a scam by any means, but if you are going to be investing large amounts of money in precious metals as a way to secure your financial future, it is pretty reasonable to want to know who you are giving your money to.

Lots of Moving Parts

This goes along with the lack of transparency just mentioned. There is a lot going on with HAA. We know that it is powered by GBI and that there are a bunch of companies involved in the "alliance", but all of this is pretty confusing and there is no clear-cut explanation offered on any of it.

It seems that the company really doesn't do all that much themselves but instead contracts 3rd parties to handle everything. For example, GBI runs the exchange platform, their storage options are through 3rd parties, and their IRAs are handled by the Millennium Trust Company, which is something I didn't mention and it's worth noting that this company has a fair number of complaints against them about hidden fees.

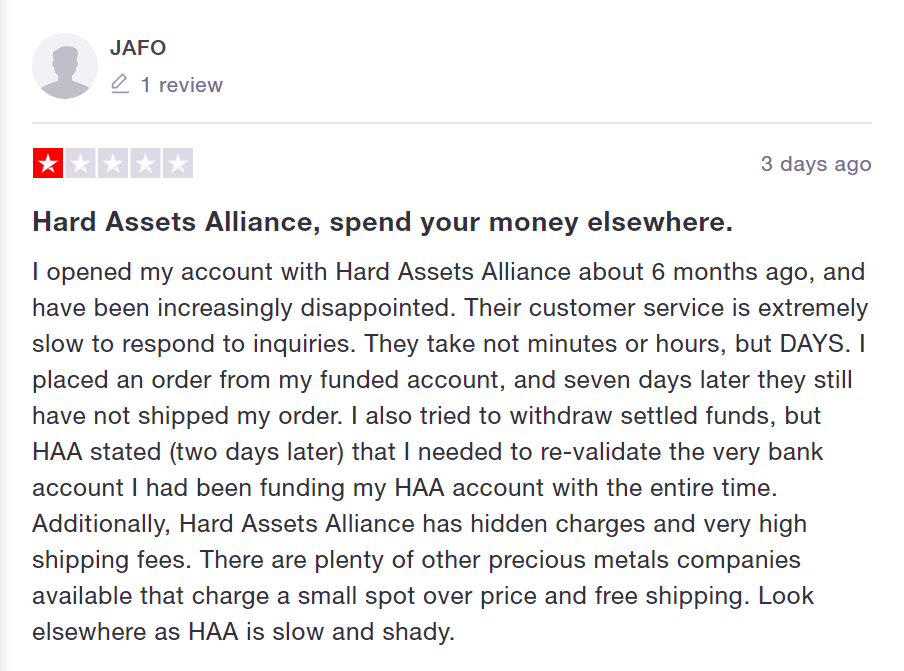

Horrible Customer Service

This is one of the more common complaints I've come across. Apparently the customer service leaves a lot to be desired. The complaint below reads that "they take not minutes or hours, but days [to respond]"...

Now a few days to receive support isn't great, but it's not absolutely horribly bad either... unless you really have an urgent situation that you need help with. However, I also found a complaint with the BBB from someone who claims "it's been nearly two weeks" and they still haven't received any support...

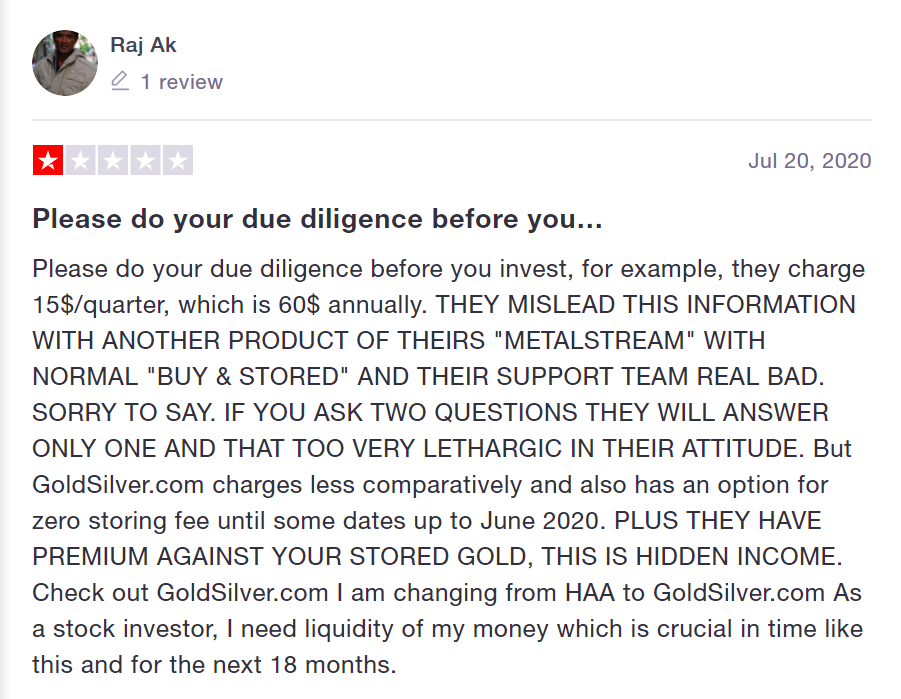

"Hidden Fees"

Lastly, let's talk about "hidden fees". Some people have been complaining about them, such as this complaint that claims they "mislead" customers and charge more than you are led to believe...

One of the other complaints I showed above also mentions hidden fees, mainly with the overpriced cost of shipping (something I don't know too much about).

Is Hard Assets Alliance Safe?

Although there is a lack of transparency and hardly any information provided on where the heck they are storing your precious metals if you choose to let them do so, there is no good reason to think that this place isn't safe. That said, there is definitely no good reason to think your precious metals are safe and sound either, because of the lack of information provided. For all we know the unknown owner of this company could be storing everyone's gold in a cardboard box in his mom's basement (although I highly doubt this of course).

So is this place safe? Well, I'll let you draw your own conclusion on this.

Pros v Cons

Pros

- Good number of precious metal options

- Remote storage available with the ability to ship directly to you

- Can easily buy, hold, and sell through the company

- HAA runs on the GBI platform, which is trusted

Cons

- Lack of transparency and trust

- A bit overpriced

- Customer support doesn't seem to be that great

- Not much information on the storage facilities they use

- Shipping supposedly costs a heck of a lot (understandable though, since these are precious metals)

Conclusion - Worth Using?

The big question... should you use Hard Assets Alliance or take a pass and buy or sell through another company? Well, this will depend on what exactly you are looking for, but due to the lack of transparency this company provides we (Green Bull Research) will not be promoting their services. They do make the process of investing in precious metals very easy and this is appealing especially for beginners just getting started, but we only recommend services that we know are trustworthy... and besides, their prices are a bit high anyhow.

Invest if you want to, but be sure to do your own due-diligence first.

Hopefully this review will help you make a more informed decision on this matter. And as always, leave any comments/questions down below. Here at Green Bull we like to hear back from our readers. You're important to us!

This is an excellent review. Thank you for the pro and cons of a research professional and personal investor.

I was thinking about investing in gold/silver in Hard Assets but now I’m reconsidering. I had a bad experience with another broker, Regal Assets, who never purchased the gold/ silver I thought I’d purchased and had stored for over a 1 1/2 years. I was lucky to get my money back so I am looking at other investments. Still looking.

who do you recommend for buying storing selling gold?

Excellent review. I was going to open an account as it was recommended to me by one of the “experts” in your list. But, as you said, they are vague, not transparent. I couldn’t find what the storage fees would be, for instance. I will look into the website you mentioned. Thanks for this. Very helpful.

The website says storage is .7% annually for gold an .8% annually for silver

I talked to a representative who had called me. When I asked if I could only purchase documented asseyed gold they had no idea what I was asking and had to ask a co-worker. This happened twice. Not a confidence builder.

They do not charge $25/mo for metalstream. That is the minimum monthly investment using the service

Thank you. HAA was recommended to me but what you have uncovered makes me leery of them.

Thank you very much for the review of HAA. I’ll be looking elsewhere. You saved me a lot of time.

After reading your review, I’m hesitant to work with HHA. What companies do you recommend? Thanks, JP