Our review of the Motley Fool’s Share Advisor (Australia) will help you get to the bottom of the company’s claims. According to them:

“Every single Motley Fool service has delivered positive returns. Most are beating the market. A couple of them by a very large margin.”

Additionally, they say that their service is simple.

We are also refreshed by the fresh and somewhat comic marketing language Motley Fool uses. But are these enough to entice you to subscribe to them?

Overview

- Name: Share Advisor

- Lead Advisor: Scott Phillips

- Publisher: Motley Fool Australia

- Website: www.fool.com.au

- Service: Investment research service

- Cost: $399 (Australian dollar)

The newsletter service from the Land Down Under, which provides investment recommendations for Australians, promises huge rewards. But upon closer inspection, they have released little information on the newsletter itself. Could it be that they are already confident of the brand’s prominence and reputation? Do they feel that they do not need to inform their subscribers about what they will be getting into?Whatever the case, we at Green Bull Research are here to try to give you a complete picture. So do read until the end, as we have a lot to unpack.

Who is Scott Phillips?

With many appearances on TV shows, Scott Phillps is the most high-profile person in the company. One could say that he is Motley Fool Australia’s spokesperson of sorts.Phillips’ official role is Chief Investment Officer of the research firm. Aside from Share Advisor, he also is in charge of the Everlasting Income newsletter. Before assuming this role, he had other designations in the company. He used to be its General Manager and Director of Research.The investor holds a bachelor’s degree in Commerce and a graduate diploma in Accounting.As a way to reach more subscribers, the advisor also hosts two podcasts for the research company.

The Good Oil with Scott Phillips attempts to simplify the world of finance to regular people. Accordingly, the podcast “brings you the best of business, finance, technology, and economics”. To do this, the host talks to resource persons who are experts in their field. All these are done in the usual informal and fun vibe the company is known for.Meanwhile, Motley Fool Money aims to give listeners the latest developments on investing. Joined by Andrew Page, they also answer questions to help subscribers in their quest for financial freedom. A bonus in listening to the program is a stock that the Motley Fool recommends each week.

What is Motley Fool?

Motley Fool

Upon clicking the About page of their website, you will see these words:

At The Motley Fool, we take our purpose seriously, but that doesn’t mean we take ourselves too seriously.

It is quite a fresh take on the investment research industry. While others use uber-serious and doomsday marketing tactics, this company does not. They say that the Motley Fool’s mission is “to make the world smarter, happier, and richer.” Instead of focusing just on one of the three goals, they try to achieve all three. How would they do this? By giving “excellent business and financial tips” that have a bias towards the fun side of life.The company name is a tribute to a Shakespeare character in the comedy, As You Like It. It is only the court jester who is capable of speaking the truth to royalty without risking his life.Old-fashioned fools used to amuse and teach the court with their humor. Yet the “fool” never shied away from challenging established knowledge.Motley Fool believes that every dollar spent should be viewed as an investment in the future. Over the long run, they think that investing in outstanding companies will lead to riches. Because of this, they invest in their community's ability to gain knowledge. A plus in this direction is if investors can grow alongside each other.Further, the company believes in keeping track of its investments. Not only that, they pledge to be honest about results. They also fulfill their mission by supporting all their teammates and subscribers.Brothers Tom and David Gardner established Motley Fool in the United States in 1993. The company has then evolved to serve millions globally. Their subscribers come from Australia, the U.S., Germany, the United Kingdom, Canada, and Japan.In a piece called “If the jester's cap fits…”, The Guardian chronicles the rise of the research firm. Moreover, Harvard Business Review took special notice of its work culture in 2019. Researchers examined key factors why it counts as one of the “best companies to work for”.

Green Bull Research has written about past teasers of Motley Fool in the U.S. You may read our articles on their Triple Buy Alert and Next Amazon Stock.

These were promos for their Stock Advisor and Rule Breakers newsletters, respectively.Concerning Motley Fool Australia, the branch was launched in Queensland in 2011.

Bruce Jackson

They count on a man named Bruce Jackson as its General Manager. Jackson was also a co-founder of the company’s operations center in the U.K.In 1999, Motley Fool released The Motley Fool UK Investment Workbook with Jackson as one of the authors.He graduated with a Business Accounting degree with a Financial Services Diploma. Aside from running the division’s operations, Jackson writes the free Take Stock newsletter.

What is their “Fool-osophy”?

We admit that we have found scant data on this service of the company’s Australian counterpart. But we will not let this hinder us from delivering quality information to our readers. By looking at the worldview of Motley Fool, we believe you will be able to see patterns of their process.Phillips wrote an article detailing the approach the company takes as they invest. He gives six points as he makes his case. These are the key components of what he calls a “six-legged stool”.

- We’re standing on the shoulders of giants

They believe that investing is not a new concept. Though new conditions exist and we may learn from them, the fundamentals haven't altered much in a century.Further, they clarify that they do not offer get-rich-quick magic formulas for their subscribers. It is not in their nature to make lofty promises they cannot fulfill.Via careful stock selection and an emphasis on education, they instead attempt to take the best of what they’ve learned from others. They then use these to help their members become better investors.

- We expect volatility

They say that they are honest about their assessments and give readers all the brutal facts. In fact, they freely say the truth that “the stock market has a year of negative returns about one year in three”.

- We know the odds

In 2018, this is what they have seen:

We’re only delivering a positive return 64% of the time (just over 6 out of 10)We’re only beating the market 59% of the time (just under 6 out of 10)

These serve as proof, they claim, that they know what they are doing.

- We’re diversified — and you should be, too

Phillips says that diversification is “the only free lunch in investing”. Due to this, they recommend that you diversify.The more shares you own, the more likely it is that you will be able to get big winners from their recommendations. If it is possible, it would be great if you could get 15 to 20 holdings.

- We’re long-term investors

Not only do we embrace diversification, but we know that market-beating results will come over the long-term.

They favor this because they say that it takes time for the market to realize a company’s full value. For them, looking at it in the short term is not the smart way to approach investing.As a long-term investor, you'll also reap the benefits of compounding for a lengthy period. But you must be able to locate and buy solid companies early on.

- We work on our temperament

For them, part of Foolish investing means being disciplined.

Financial, mental, and emotional preparation will help investors in the long run. These are the necessary ingredients to survive and thrive during periods of unrest.

What is Motley Fool’s Share Advisor?

Motley Fool considers Share Advisor as its flagship investment service. They claim that this “has been beating the market since 2011.” The service gives “one ‘best of the best’ ASX investment recommendation each month, as well as one U.S. stock idea.”ASX refers to The Australian Securities Exchange, the country’s primary securities exchange. It is owned and operated by a company also called ASX Limited.When you subscribe, the brand's promise is that you will be as good as a broker or someone with a Finance degree. They say the investment newsletter service has more than “25,000 loyal members”. If the number is true, that is impressive.

This speaks not only of the credibility of the advice they give but also of the editor in charge of the service.Here are the other newsletters under the banner of Motley Fool Australia:

- Motley Fool Dividend Investor

- A collection of investment ideas that specializes in ASX dividend-paying stocks

- Focuses on selecting great businesses with regular, reliable, and rising dividend payments

- Motley Fool Extreme Opportunities

- Focuses on the higher-risk, higher-reward end of the ASX

- Seeks out the “ten-baggers of tomorrow”, but accepts that some recommendations could well go to zero

- Venture-capital style investing, but on the ASX

- Motley Fool Million Dollar Portfolio

- Designed to integrate with the three services listed above

- A real-money diversified portfolio comprised solely of ASX-only shares from Motley Fool Share Advisor, income stocks from Motley Fool Dividend Investor, and growth stocks from Motley Fool Extreme Opportunities

- Motley Fool Hidden Gems

- ASX-only, small-cap investment service

- For those looking for small-cap value and growth – and don’t mind a little volatility

- Only periodically open to new members, maintains a strict membership cap

- Announcements are made as and when the service opens to new members

- Motley Fool Pro

- ASX-only, real-money portfolio

- Teaches you how to construct and build a diverse portfolio

- Motley Fool Everlasting Income

- Designed to provide you with an income stream in or near retirement, without having to sell shares to fund your lifestyle

- Shows you how to construct a tax-effective, quality portfolio of Australian shares, and how you can use it to provide yourself with a regular income

How it works

There is very little information about how their system works. All that they say about it is that in their newsletter, they will deliver all that you need for that month. Their system and team of experts led by Phillips do all the hard work and deep research. Then they deliver two new picks for you each month.

- ASX investment recommendation

- U.S. stock idea

Due to the brevity of the information provided, they claim that it only takes minutes for you to see gains.

Track Record

What Motley Fool does is show you the image below. For them, these will tell you that the returns from their picks have been “phenomenal”.

According to them, they do not believe in “secret” strategies other stockbrokers advertise. It is just not their thing, they say.They also admit, though, that not all their picks have done well. But they are confident that their major successes will prove their credibility. As proof of concept, they point to ResMed, Kogan, and Netflix. They claim that these were initially suggested in Share Advisor.However, we found one reviewer on ProductReview.com.au that talked about his experience with the research firm. He wrote this review six years after his initial investment.

We talk more about the Australian website in the Reviews section below.

We are showing you their track record based on subscribers themselves to present both sides. This way, you get to see how their actual recommendations performed.

This subscriber, meanwhile, talks about his substantial losses. Read for yourself and you be the judge.

Motley Fool replied, describing investing risks as well as their push for diversification.

We also turned to one balanced comment we found on OzBargain. The website is a forum for Australian online shoppers.Although we do not include comments just from any website, the dearth of information on the service pushed us to be more creative.

The comment below is a good summation not just of Share Advisor. It also encapsulates a wise view of all advisory services.

What you get

Based on what we were able to gather, the advisory service will give you:

- A monthly newsletter containing research on one ASX investment recommendation and one U.S. stock idea

- A website exclusive to subscribers. Inside, you will have access to discussion forums as well as audio and video content

- Educational materials and special reports

Cost and Refund Policy

One year of subscription to the newsletter will cost you $399. All in all, this would mean a minimum of 24 stock picks for the whole 12 months.Take note also that like most subscription newsletters, they have an auto-renew function. If you are not keen on renewing for a second year, tell them before your last day.Although we have discussed this many times already, a lot of subscribers still fall for this. So to spare yourself from a headache in the future, cancel early. We do not want to see our readers experience the horror stories we often read on other review sites.As for refunds, they say they have a guaranteed money-back feature. Within the first 30 days, inform them that you no longer wish to proceed and they will return your payment.

Reviews

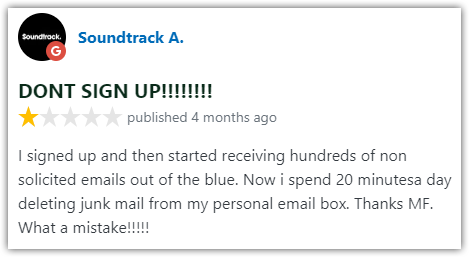

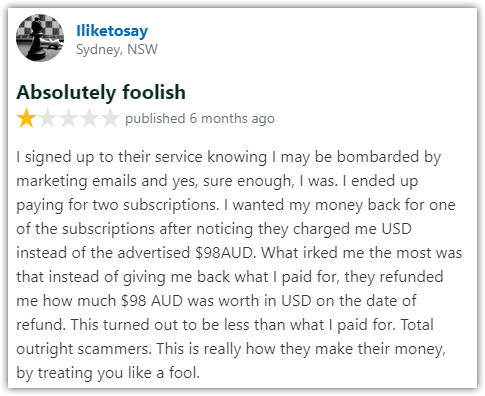

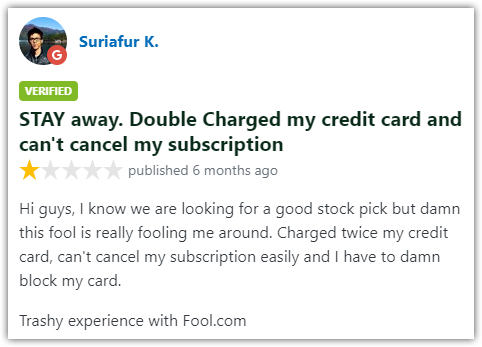

As we have already mentioned, it was quite challenging to see more in-depth information about the newsletter. But we have come across new sites that we believe give credible feedback on the service. One such source is ProductReview.com.au, which has been online since May 2003.

The company is “Australia's first and most comprehensive consumer opinion site”. They also emphasize that companies cannot remove or alter reviews.The Motley Fool in the country got a pretty low rating on their website. It was able to get an average grade of 1.8 out of 5 stars from 360 reviews as of this writing.

Here is the breakdown of the ratings:

As you can see, the majority of those who wanted to register their opinions gave 1 star.One comment named his profile “Fooled”. Based on experience, Motley Fool's recommendations have not been great for his portfolio.

Another subscriber went as far as calling the company a scam.The other comments elaborated on the lack of information and lots of upsells.

Again, we also saw some complaints about fraudulent or unauthorized credit card charges. These are distressing because we could imagine how frustrating these can be.In fairness to the investment research company, they do reply. We could see some effort to right some of the wrongs done to subscribers. But we wonder why these things still need to happen. We could just imagine some who do not have the time and energy to complain and follow up. That would mean tens, hundreds, and even thousands of dollars down the drain.

Of course, if there were disappointed subscribers, there were also satisfied subscribers. No matter how few these are, we also want to highlight positive experiences. We also want to be fair and show you what their comments are.

Moreover, it is more likely for disappointed customers to leave reviews. Those who loved their services would normally just continue subscribing.

We also want you to factor that in as you read all the comments.

Stock Gumshoe users gave Motley Fool’s Share Advisor 3.2 out of 5 stars as of the time we are writing this review. This is based on 15 votes.

Pros v Cons

Pros

- Amusing language and style

- Global research firm with agencies in various countries

Cons

- Complaints about their stock picks and spam mails

- Lack of information

Conclusion – Is it a G'day or G'bye to the newsletter?

It is interesting that a serious investment research company would include the word “fool” in its name. We have read about the reference and we get it.At the same time, we have to admit that we found something funny about some of the complaints. They played with the research firm’s name and called themselves foolish for subscribing. There were several permutations of the term and we found them entertaining. So, would you be a fool if you subscribe? Or would it be foolish to pass on this newsletter?

Tell us in the comments section below how our review of Motley Fool’s Share Advisor (Australia) has influenced your decision.