Wondering what Motley Fool's “Mini-Berkshire” stock is? Then you're in the right place.

The Motley Fool has been teasing this “Mini-Berkshire” company for quite some time now. People have been asking what the heck it is and today I'm going to answer exactly this… for free.

Above is a screenshot I took from one of their ads. They are hinting that buying this company they're teasing could be like buying Berkshire back in 1992.

Really now?

That's about a 50x gain in case you didn't know.

This company is also being recommended under a “triple buy alert”.

This is when The Motley Fool recommends a company not twice, but three times, and it is said to be “a sign of extra confidence in a company we already know well.”

So let's talk about what they mean by a “mini” Berkshire and then expose this company once and for all.

What Do They Mean By a “Mini-Berkshire”?

TMF is pretty creative with their marketing lingo, as you'd already know if you read our reviews of their “Cable TV's Ticking Time Bomb” and “Next Amazon” stock teasers.

As for this teaser in question, well, what they are talking about here is that this company is very similar to Berkshire Hathaway and that they think its stock could grow tremendously, as Berkshire's has since its early days.

According to The Motley Fool: “If this company continues to imitate Berkshire Hathaway in performance as well as style, its future gains could potentially be astonishing.”

If you had invested in Berkshire Hathaway when Buffet took over the struggling company in 1964, you'd be looking at around 3.5 million % gains (3,500,000%) gains right now.

The chart below is only from 1990 – 2021 and is impressive enough…

Remember, The Motley Fool is teasing this opportunity as being like investing in Berkshire back in 1992… which I mentioned is still around a 50x gain.

We all know Berkshire Hathaway is an amazing company where fortunes were made.

Berkshire is Buffet's investment vehicle. It's a holding company of many businesses, a multinational conglomerate.

According to Wikipedia:

“The company wholly owns GEICO, Duracell, Dairy Queen, BNSF, Lubrizol, Fruit of the Loom, Helzberg Diamonds, Long & Foster, FlightSafety International, Pampered Chef, Forest River, and NetJets, and also owns 38.6% of Pilot Flying J; and significant minority holdings in public companies Kraft Heinz Company (26.7%), American Express (18.8%), The Coca-Cola Company (9.32%), Bank of America (11.9%), and Apple (6.3%).”

And the claim is that this “mini Berkshire” also “uses Buffett's disciplined, common-sense approach of leveraging the insurance business to buy other stocks, bonds, and entire companies”.

As we're about to see, the company does take a very similar approach.

Exposing This “Mini-Berkshire”

Let's take a look at some of the earliest clues we could uncover on this stock…

- “It's only 1/30th Berkshire's size”, when talking about market cap

- “Since the business started over 30 years ago, his company's stock has risen nearly 10,000%” – “his” referring to this mini-Berkshire's CEO

- It “uses Buffett's disciplined, common-sense approach of leveraging the insurance business to buy other stocks, bonds, and entire companies”

And that's really all that is needed. I already know the company without having to dig too deep.

- Well, the hint about the company only being 1/30th the size of Berkshire is outdated. This is a hint they were stating back in 2018 and as you can imagine, the numbers have changed. But not how you might expect. Berkshire Hathaway is actually even larger in comparison at the time of me writing this. It's actually over 35x larger rather than just 30x.

- The claim that its stock rose nearly 10,000% (in 2018) is also in the ballpark.

- And yes, the company does take the “approach of leveraging the insurance business to buy other stocks, bonds, and entire companies”. As a specialty insurer, they offer coverage in a number of niche markets, such as workers comp, classic cars, environmental liability, and more. And, they aquire other companies to strengthen and diversify their portfolio.

What company am I talking about?

It's none other than Markel (MKL) that's being teased here.

Some other confirmations that Markel is indeed the stock being teased here include that the Motley Fool has referred to the company in similar language in the past, as you can see from this article…

And that this investment teaser has been around for so long that this pick is well confirmed with subscribers to The Motley Fool's Stock Advisor service.

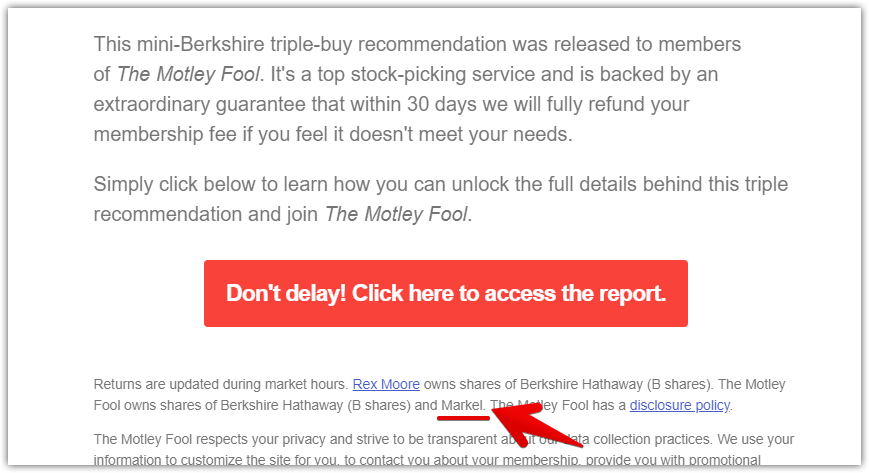

Not only that, but I think they might have even given away their pick in the email I received teased it…

Take a look at that!

I think it was likely a mistake on their part. And don't think that they accidently give away their picks like this normally. I checked with other email teasers and they did not.

Markel (MKL) was first recommended as a triple buy alert on March 15, 2018. So if this was the third time they recommended the stock, the first time was likely significantly earlier – came across some information suggesting The Motley Fool recommeded it as far back as 2007/2008.

Should You Buy This Mini-Berkshire?

Well, this depends a lot on your investment strategy and how you look at things. At the moment, Markel is a “strong buy” on Zacks.

It has also shown good growth over recent years, continues to increase revenue, has surpased many recent earnings estimates, and is considered undervalued by many, largely due to its 2020 price drop which didn't reflect the good year it actually had.

From 2010 to 2020 the stock provided an annualized return of 10.6%, and it continues to do well today.

In my opinion, it's at least worth a look.

Conclusion & Recap

- The Motley Fool has been teasing the opportunity to invest in a company they call a “Mini-Berkshire”

- In order to find out the name of this company, you'd normally have to buy a subscription to their Stock Advisor service

- The company they're referring to here is undoubtedly Markel (MKL)

- Markel is rated as a strong buy by Zacks and has great financials, but you decide whether or not it's a buy

And that's all I have for you. You're welcome! I hope this post provided some value to you.

As always, let us know what you think of this stock pick in the comment section below.