Between stagnant wages, above-average inflation, and a volatile stock market, most of us could use some more income right about now.

Enter Marc Lichtenfeld with an “Ultimate Dividend Package” which promises to give us a few stocks to supercharge our investment income.

The Teaser

Marc's presentation begins with a startling statistic: Dividends and the income they provide are responsible for 90% of U.S. equity returns over the last century.

Marc Lichtenfeld is the author of Get Rich with Dividends and the Chief Income Strategist at The Oxford Club. He's also someone we're familiar with here at Greenbull, having previously reviewed and revealed his “Ultimate Passive Income Play” and Commodities Supercycle Summit Stocks.

Even more enticingly, Marc says investing in the right dividend stocks means we could end up collecting rising income for the rest of our lives.

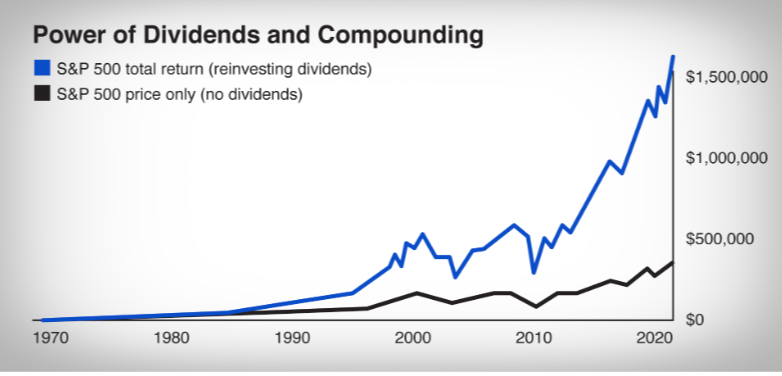

This chart puts the power of reinvesting dividends on display:

In his 20 years as an investment professional, Marc admits he's “never seen an income opportunity like what we’re seeing right now.”

What exactly is he seeing?

Dividend stocks are at their most oversold level relative to non-dividend payers in 10 years.

However, this info is a bit outdated as it's from a 2020 Ned Davis Research brief.

The present reality is that dividend stocks trading at attractive valuations are a lot harder to come by. Nevertheless, locking in an ultra-safe 8% dividend yield, for example, is still well worth the effort.

A ‘Right' Dividend Stock

One example is the seemingly innocuous stock MarketAxess Holdings (Nasdaq: MKTX) which operates an electronic trading platform for institutional credit markets.

MKTX first started paying out a dividend in November 2009 and every $1,000 invested that day would now be worth $47,648. $5,000 invested would be worth $238,000!

Similar opportunities still abound and Marc is going to drop some clues about a few in this presentation.

He goes a step further, by telling us, that if we follow the step-by-step instructions in his Ultimate Dividend Package, we could start collecting passive income from safe, but growing companies, for life.

The Pitch

We will get Marc's “Safest High-Yield Dividend in the World” and a few others as part of the Ultimate Dividend Package.

The Package is ours if we take a risk-free trial of The Oxford Income Letter. Normally, 12 months of The Oxford Income Letter costs $249, but a subscription is currently going for only $49.

This includes 12 months of the Oxford Income Letter newsletter, personal emails with breakdowns of the very best dividend growth companies as well as the ones we should avoid at all costs, access to several model portfolios, and finally the Ultimate Dividend Package itself, which contains five dividend stock picks.

Why Are Dividend Stocks So Great?

Marc thinks owning dividend-paying stocks is the single greatest way to get rich in the stock market.

And he's come up with some stats to back up his claim.

One in particular that caught my attention is that “dividend stocks have outperformed the broad market by 222% over the past 60 years.”

I wasn't able to source this finding, but what I did find was that consistent dividend payers, as defined by the S&P 500 High Quality Dividend Index returned about 6.5% annually over the past decade.

Meanwhile, the average yearly return of the S&P 500 is 12.6% over the last 10 years, as of the end of February 2024.

However, From 1940 to the end of 2023, dividend income's contribution to the total return of the S&P 500 Index averaged 34%. If we remove this 34% from the S&P 500's 12.6% annual return figure, we end up with 8.3%, which is only 2% more than the High Quality Dividend Index.

Do Dividends Drive Stock Prices?

Investing luminary Peter Lynch has also stated “The big reason that stock prices go up is that companies continue to raise their dividends.”

It's certainly a reason they go up.

There's no perfect correlation, but generally speaking, if a company announces that it will be paying a dividend on a certain date, that announcement can cause the stock to appreciate in the days leading up to the payment date. Conversely, a stock's price may also drop immediately after a dividend payment has been made.

As you can see, dividend stocks aren't the be-all and end-all.

But by investing in consistent dividend payers and paying a fair or better yet, low price for them. Our chances of achieving above-average returns go up exponentially and that's about as much as we can ask for in the stock market.

On this note, let's find out what dividend payers Marc recommends.

Revealing Marc Lichtenfeld's Ultimate Dividend Stocks

There are more than 3,000 publicly traded dividend stocks.

Precious few of these pay very high yields and only a handful pay safe high yields.

Marc has uncovered one.

The Safest High-Yield Dividend in the World

- This company has $36 billion in annual revenues and it just raised its dividend to a whopping 8% yield.

- It has also raised this dividend every year since 1998.

- The company's business model sees it acting like a toll collector for name-brand S&P 500 companies, allowing them to transport their products.

This sounds like Enterprise Products Partners L.P. (NYSE: EPD).

- The business generates $49 billion in annual revenue, so not an exact match, but it yields about 8% annually.

- EPD has increased its dividend each year since 1998.

- It processes and distributes natural gas and other refined products.

Marc's #1 Dividend Stock

- It owns the bestselling drug in the world, which brought in $19.9 billion in revenue last year.

- Over the past 12 months, it paid shareholders $6 billion in dividends.

- The company has raised its dividend every year since it began paying one, nearly 50 years ago.

Marc's favorite pick is Merck & Co. Inc. (NYSE: MRK).

- Merck's immuno-oncology drug Keytruda was the best-selling drug by annual revenue in 2023.

- In 2022 the company spent over $7 billion on dividends and executive compensation.

- I wasn't able to corroborate this fact, as Merck's history of annual dividend increases seems only to go back to 2010.

Also teased are three “Extreme Dividend” companies, but no clues are left behind about any of these. The only thing we know is that “they are volatile, small plays, so there is above-average risk involved.”

The Best Way to Collect Massive Dividend Income?

Both of Marc's picks are well-established large-caps that are likely to continue paying dividends for some time to come.

But are they the ultimate dividend stocks?

In terms of value and yield, Enterprise Products Partners fits the description with a price/earnings of only 11x and an annual yield of nearly 8%.

Merck on the other hand, most definitely does not. Its trailing P/E is a staggering 142x and its dividend yield is only 2.4%

For me, I would consult the list of “Dividend Kings“ with 50+ years of dividend growth and look to see which ones have the lowest valuation multiples, coupled with the highest yield. These would be the ultimate dividend stocks and the best way to collect dividend income for life.

Quick Recap & Conclusion

- Marc Lichtenfeld is teasing an “Ultimate Dividend Package” which promises to give us a few stocks to supercharge our investment income.

- Dividends are responsible for 34% of the S&P 500's total return over the past century and they are the best way to compound our capital in the market over the long term.

- The Ultimate Dividend Package includes one company Marc says has “The Safest High-Yield Dividend in the World” and another he calls his “#1 Dividend Stock.” The names of both are only revealed to subscribers of The Oxford Income Letter for only $49.

- But you can go ahead and put your credit card away because we were able to reveal both right here for free as Enterprise Products Partners L.P. (NYSE: EPD) and Merck & Co. Inc. (NYSE: MRK).

- EPD is a solid dividend pick with a low P/E and a relatively high yield of nearly 8%. Merck is the opposite, carrying a high P/E and a low absolute yield of 2.4%.

What is your favorite dividend stock? Share it in the comments below.

Would you research Alexander Green’s next magnificent seven

Would you research Alexander Green’s next magnificent seven

How about Warren Buffett’s ‘small’ stake in Oxy-this has tripled in 2 1/2 yrs from $17 to $65 and he vows to buy all of it outright plus a 10 to1 increase split for shares owned…I sold a lot of it (needed)+ didn’t buy more!! I should have kept SHIPS at $1

Appreciate you guys so much