Newsflash: you are not seeing the real numbers of companies in their reports. So the “stock cop” and his research advisory promise to help you see the truth.This review of Joel Litman's Hidden Alpha will walk you through the claims, the man, and the service. There is so much hype surrounding them and it can get confusing.

Don't worry. This comprehensive walk-through will answer all your questions, so let's begin.

Overview

- Name: Hidden Alpha

- Editor: Joel Litman

- Publisher: Altimetry Research

- Website: www.altimetry.com

- Service: Investment research service with monthly reports

- Cost: Annual subscription: $49 (Note that the subscription automatically renews. They will charge your card $199 plus taxes upon renewal.) One-time payment for lifetime access: $599 (You will still pay an annual fee of $24 as a maintenance fee.)

The newsletter service promises to expose what Wall Street and the mainstream media have been hiding. According to him, he has the perfect system. He created this is as a response to his view that our current sources of financial information are inaccurate.

He further teases that as an accounting expert, he can show you the real numbers. Continue reading our review to find out what he means.

Who is Joel Litman?

Buying into Hidden Alpha means buying into Joel Litman. And this man has quite a reputation in the investment world.

You may have already seen him on CNBC or read about him in Barron’s and Institutional Investor. Harvard Business Review has also published his articles. Litman is also the co-author of the book, DRIVEN: Business Strategy, Human Actions, and the Creation of Wealth.

His profile on Forbes as a contributor reveals his areas of expertise. He says that his focus is on “strategic analysis, corporate performance and forensics, and business valuations.”

Litman's research in these areas has led him to a sobering conclusion. According to him, the usual metrics we look at in business and investing are wrong.In fact, his March 2021 article in Forbes pounces on this idea. In it, he talks about the unnecessary fear-mongering in Wall Street. His conclusion? The Goldman index is wrong and we should not trust Wall Street.

According to him, the index is inaccurate and does not reflect “real valuation levels of the firms or the market as a whole.”This sentiment is also the thesis of Hidden Alpha, but we will discuss more about that later. For now, we go back to learning more about Litman.

He is also the CEO and President of a corporate performance and investment research and analytics firm called Valens Research. The firm “provides equity, credit, and macro analysis daily to 200 of the largest 300 institutional investors as well as tens of thousands of individuals.”

Valens Research has a financial analysis platform, Altimetry, where he serves as Chief Investment Strategist. This platform publishes Hidden Alpha.

Litman also works with a brokerage firm in Asia, the COL Financial Group. He serves as a member of its Board of Directors.

This guy is really serious about his advocacy for “a single, consistent, global standard for corporate financial statement analysis.” That is why he also heads the UAFRS Advisory Council for Uniform Accounting as its Chairman.

Meanwhile, to his students at Hult International Business School, he is Professor Litman.

Other institutions he taught or guest-lectured at include Harvard Business School, U Chicago Booth, Wharton, LBS, and SAIF Jiao Tong, among others.

He has other notable academic involvements. His profile mentions that he helped build Credit Suisse’s HOLT University and the Center for S.E.V. and MBA Concentration at the Driehaus College of Commerce at DePaul University.

This litany of his involvements is already a condensed version. However, we at Green Bull Research want you to know where he is coming from, so his profile is necessary.

As a Certified Public Accountant, his expertise is really on the numbers. That is why there is merit when he says that he and his team can uncover for you the “hidden numbers”.

Based on his years of experience, he says he knows for sure that Wall Street and the media are not showing you the true numbers.

According to him, his research advisory service knows what these are and he can tell you about them.

What is Hidden Alpha?

Joel Litman and his team claim that their forensic accounting system is top-notch. They say that their system is so accurate, you will never rely on Bloomberg or Yahoo Finance again.

He claims that the financial statements these outfits rely on are inaccurate. However, the companies and their CEOs and CFOs are not to blame.The problem is with the inconsistent application of the rules. The issue is with GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).So all the available information you are basing your financial decisions on is wrong. And he has figured this out and created a new system to give you better guidance.

In fact, Litman says that he can show you hidden companies that are about to grow massively.

This is essentially what the service is. Hidden Alpha is the research advisory subscription that will reveal these stocks.

The goal is to grow your investments. Once you subscribe, you will get an unparalleled forensic analysis of the market. You will receive stock recommendations, predictions, and warnings.

Your fee will grant you access to inside information so you can take advantage of market situations.

Vigilance in investing

No matter what you think about Joel Litman and his bold claims, he is on to something big here. Here at Green Bull Research, we continue to provide you with detailed information so you can make better financial decisions. Our recent reviews on Cash Machine and Casey Research’s W Codes encourage you to be vigilant and smart with your investments.So this is a welcome proposition. Litman tells you that you are not to accept all claims as they are presented. Since investing involves your hard-earned money, it always pays to be extra critical. Wall Street is a tough place and everyone wants to make money, even at your expense.So we appreciate not only the service that Litman provides. In addition, we welcome the discipline you can gain from having his point of view. It is always better to examine for yourself the small details. If there are things you do not understand, research and study more. A healthy skepticism on financial issues will benefit you. Sadly, not everyone is as critical. This is the reason why many still become victims of get-rich-quick schemes and investment scams.In the same breath, we can also say that we can apply Litman’s perspective on the very services he offers. This is our advocacy here at Green Bull Research.You can ask yourself some key questions:

- Is he saying something new or just renaming an existing idea?

- Are his claims too good to be true?

- What is the feedback from other subscribers?

Litman further claims that other global financial leaders also use the same data they have. Multibillion-dollar hedge funds, government-run sovereign funds, billionaires, top investment firms, and money managers all benefit from them.

For such data, these investors pay tens of thousands of dollars. So the fee for Hidden Alpha is peanuts compared to the quality of research you'll get. This is his pitch.

In this review, we also want to point out that much of the pitch for Altimetry's other newsletter services are the same. Litman also offers High Alpha and Microcap Confidential.

The difference? Hidden Alpha looks for large-cap safe stocks. High Alpha, meanwhile, aims for “small- and mid-cap stocks that can deliver big upside but tend to have more risk.”

In Microcap Confidential, the goal is to find “the tiniest stocks with the biggest upside potential yet.”

How it Works

So how can Litman see what others are not able to? What is the secret sauce of Hidden Alpha?

Much of his process revolves around what he calls the “L.O.C.K. System”. You may read more about it in our review. Basically, what this system does is reveal what he calls “hidden gems” in the market.

It does not ride the prevailing popular sentiment. According to the accountant-investor, they look at the long-term value of companies. They change the algorithm so you will see the truth.

The system locates stocks with discrepancies. It then checks the operations of such companies and analyzes conference calls. According to Litman, the voice patterns of the CEO reveal a lot of information.

With these, you can then decide whether you want to kick or keep these stocks.

Litman goes to such lengths because he says that as-reported financial statements are problematic. Income in GAAP does not reflect reality.

The issue, he says, is due to the rules and their inconsistent application in as-reported financial statements.

Even Warren Buffet has the same sentiments. He elaborates on this in his opening statement at the 2018 Berkshire-Hathaway shareholder meeting.

We suggest that you check out the page as it does discuss what Buffett thinks about the issue. In addition, you will learn a ton from the top investor.

According to Litman, other financial experts doubt the reliability of GAAP. These are Charlie Munger, Seth Klarman, Shelby Davis, Ben Graham, and Marty Whitman.

What does Hidden Alpha use, then?

Well, to see the accurate picture, they disassemble the financial statements of publicly traded companies. They then reassemble all these using “globally consistent standards that repair” existing problems.

This process, he adds, requires more than 90 accountants and analysts. This team makes more than 130 adjustments just to reflect a company's true numbers.

From analyzing over 32,000 stocks, they can narrow it down to 200 companies. Further analysis will then leave them with only 30 stocks with the most potential for huge earnings.

Every month, their team does this so they can deliver to their subscribers only the real alpha stocks.

Track Record

In our previous discussion on Litman's L.O.C.K. System here, we already mentioned some examples of stocks.

One is BMW. In 2016, everyone in the financial world looked at the stocks of the German luxury carmaker as untouchable.

But Litman told people to sell their BMW stocks, contrary to popular opinion and predictions. After a while, the stocks did fall, which proved L.O.C.K. System right.

Litman also states an example when they were correct.

The system also went against predictions when it spotted Square, Inc. From 2016-2018, the stock made 816% gains.

There are some more examples. However, these two will give you a picture of what his system was able to do.

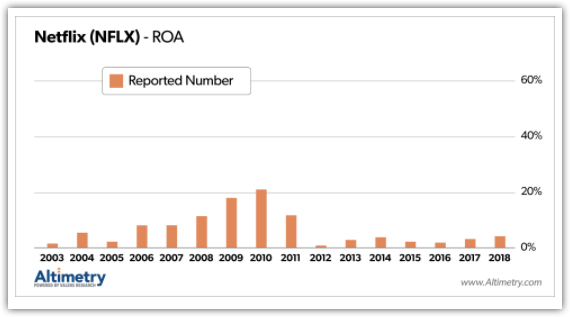

Further, on the Investing Philosophy page of Altimetry, they feature Netflix.Consider the bar graph below. The orange bars are the Return on Assets figures based on publicly available data.

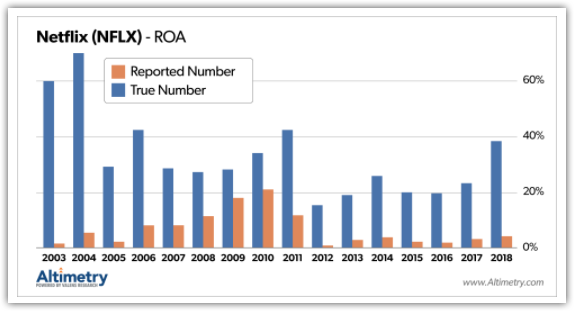

Now compare this with the blue bars in the figure below.

These blue bars are the figures reflected in Altimetry’s system. As you can see, there is a huge difference between the orange and blue bars.

Obviously, this is because there is a discrepancy between public information and Hidden Alpha data.

If you are looking to invest in Netflix, the low numbers may discourage you. But if you are aware of the real numbers, your money can grow.

Again, this is the promise of Hidden Alpha and the L.O.C.K. System.

What You Get

In the pitch, Litman uses his Professor card.

“Each month, on the first Monday of the month, I, Prof. Joel Litman will brief you…”

As an investor, he wants to make you feel that he knows what he is talking about. Imagine getting a report from a practitioner and a professor right in your inbox.

- Newsletter

- Every month, you will receive newsletters that contain his 30 stock picks. They will also give you step-by-step instructions for your account so you can make more money.

- Within the month, his team will give you important updates that need your urgent action.

- Access to archived research reports and recommendations

- You may examine for yourself the performance of his past projections through this access.

Bonus features

Litman adds four research reports to his service at the time of me reviewing this.

One will teach you his methods to make you a mini stock cop of sorts. The other three focus on stocks affected by the COVID-19 pandemic.

- Stock X-Ray Machine Quick-Start Guide (In other promotional pages, this is called The Investment Truth Detector: How to Analyze Any Stock for Hidden Gains of 100% to 500%)

- He will teach you how to apply the L.O.C.K. System for your investments in this guide.

- The Giants of Online Shopping

- In this report, he teases about an in-demand remote payment and a cloud computing that can give you massive profits.

- The 3 Pillars of the Internet

- Litman promises to reveal the new tech giants of the post-COVID world in this research.

- The 14 Fad Stocks to Sell Before You Get the Vaccine

- According to him, most stay-at-home stocks will not survive in the long term. You will know which stocks to let go of in this advisory.

- 3 High-Flying Home Entertainment Stocks to Buy Now

- In this report, he will reveal your best options in the entertainment field.

Cost and Refund Policy

Cost

A one-year subscription costs $49, discounted from the original price of $199. For $599, you can also upgrade to a lifetime membership.

Again, we want to remind you that renewal after your first year costs $199 plus taxes.

The lifetime membership will also charge $24 as a maintenance fee every year.

Refund policy

As always, we are glad that they offer a full refund if you choose to unsubscribe within 30 days. You may get in touch with their customer service team at 1-800-701-9346 or info@altimetry.com

With the numerous claims of financial newsletters, it is always better if you can opt-out if you feel unsatisfied.

Complaints

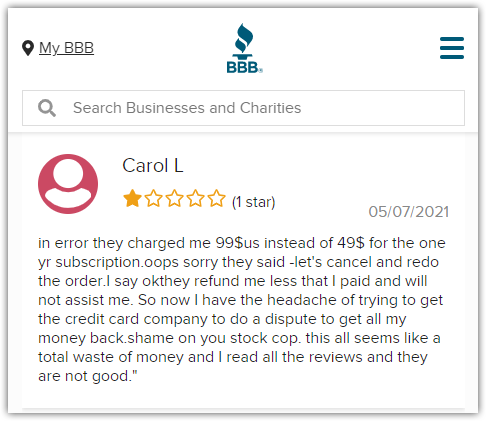

For all the promise and prestige of Litman and Hidden Alpha, the service seems to be affordable. Imagine getting the chance to hear investment advice from a global financial thought-leader. However, it is incumbent upon us here to also mention the reviews on Hidden Alpha when it comes to billing.Some subscribers say that Altimetry, its publisher, has a problematic billing system. They complain that their credit cards have been overcharged. Others say that it also seems impossible to cancel their subscription.Read some reviews from Trustpilot and Better Business Bureau below and tell us what you think about them.

Do you have similar experiences with the services of Altimetry? We would also welcome positive reviews in the comments section.

This is a cause of concern for us. So our advice is to read the fine print and check legitimate sources.

You must think long and hard before subscribing to any newsletter service. Before entering your credit card details, make sure you know your options.

Pros v Cons

Pros

- Joel Litman has a global reputation as a no-nonsense finance expert

- Exposes inaccuracies in Wall Street and mainstream media financial reportage

- Teaches you a new system of analyzing stocks through financial and earnings reports

Cons

- Promises too much

- Altimetry, the publisher of Hidden Alpha, has very low subscriber ratings due to poor customer service (false charging, overcharging)

Conclusion – Subscribe or Keep it Hidden?

Reading about Prof. Joel Litman will reveal that he has a solid reputation not just in the U.S., but all over the world. He is a resource speaker on TV, in schools, and in publications.His thesis on Wall Street and the mainstream media is also convincing. In this area, he is among the leading voices against the inconsistent application of the rules on financial statements.In addition, he has created his own system that claims to reveal companies’ true numbers. His background as an accountant further boosts his claims and credibility.As “America’s stock cop”, Litman claims that he and his team can reconfigure as-reported financial statements. The reports they come up with reflect the companies you should be investing in.Further, he encourages a healthy skepticism of popular thought and perceptions. Often, they are wrong. And when you base your decisions on them, you miss out on the best investment options. In fact, a wrong analysis will make you lose money.So he favors stocks with earnings and fundamentals that are genuinely stable and solid. If you are a patient investor who looks at long-term gains, you can benefit from Litman’s analyses. So should you subscribe?The truth is, only you can answer this question, it is your money you are risking, after all. However, we did provide you with a detailed explanation of the service. We even examined the background of Joel Litman so you can decide if you can trust him.We admit that the user reviews concern us. After all, even if the guidance and advice are sound, it is a red flag if you can’t trust them with charging your credit card.This review of Joel Litman’s Hidden Alpha has given you both the good and the not-so-good information on the service. Now, you can decide how to proceed. Tell us your thoughts in the comments section.