Market veteran Jim Woods believes he's built the “Perfect Portfolio.”

It is made up of only three stocks and it has outperformed the S&P 500 by more than 1,461% over the past two decades.

The Teaser

The old adage goes that “lower-risk stocks can help protect us from market crashes, but they can’t deliver life-altering gains.” Jim says he used to believe this too, until he discovered a strange market anomaly.

Before getting into the investment newsletter racket, Jim Woods was a stockbroker and hedge fund trader for decades. We have previously covered some of his work here, including his Biden Rupture Stocks and “Fail-Safe” System teasers.

So what is the strange market anomaly Jim is alluding to?

Harvard Business School researchers went so far as to call it “the greatest anomaly in finance” and Institutional Investor says it “defies the laws of traditional finance theory.”

Those who are fans of Modern Portfolio Theory (MPT) may want to look away, as the so-called “Perfect Portfolio” anomaly is delivering higher returns while taking on lower risk, over the long term.

High Volatility vs. Low Volatility

I won't bore you with the super-exciting details of Modern Portfolio Theory, but what the mathematical framework basically boils down to is – higher risk = higher returns.

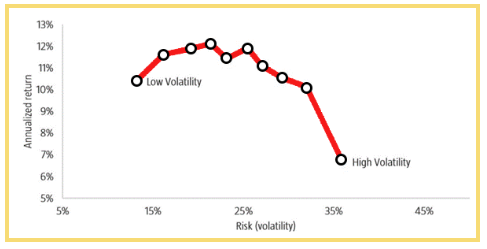

This next chart, which dates all the way back to 1929, completely blows up this notion:

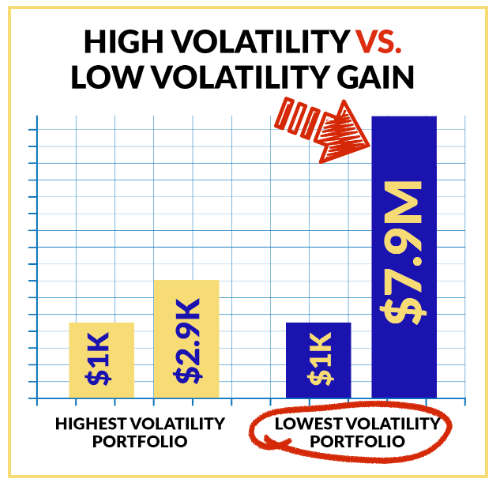

It shows that over the past 90 years, the lowest-volatility portfolio outperformed the highest-volatility portfolio by nearly 4% per year.

This may not seem like much, but over a long enough timeframe, it means an extra $7.6 million produced by the low-volatility portfolio.

Less risk, more reward, is sacrilege in finance.

But it's true due to one fatal flaw in the theory that underscores it – that markets are efficient.

Even one of the greatest investors of all time, Warren Buffett, agrees that markets are most certainly not efficient.

With this in mind, it becomes easier to understand why the strategy behind The Perfect Portfolio has delivered market-beating returns.

Jim says the large-cap, blue-chip, household-name companies in The Perfect Portfolio give us the best chance to protect ourselves in today’s hyper-volatile market.

The Pitch

The names of all three stocks are revealed in a brand-new special report called: The Perfect Portfolio: Discover a Simple Strategy to Outperform the S&P 500 by 1,461% (Even If Stocks Crash!)

It's complimentary…if we sign up for Jim's newsletter the Intelligence Report. The retail price for the Intelligence Report is $249 for a 12-month subscription, but for a limited time, we can get the first year for only $49.95.

Included is a 30-day money-back guarantee, access to all the back issues of the newsletter, not one, but two model portfolios, quarterly virtual calls with Jim's market insights, and more.

The Formula Behind The Perfect Portfolio

Unlike some other presentations promoting sexy-sounding “secret” formulas, the things that make The Perfect Portfolio work are all pretty simple and straightforward.

Win By Not Losing

When it comes to investing, the first rule is “Don't lose money.” The second rule is “Don't forget the first rule.”

This is what low-volatility portfolios do – win by not losing.

You may not hit a grand slam, but you won't lose your shirt either and truth be told, if you can avoid devastating losses during market crashes, you’re already way ahead of most investors.

Low Volatility + Strong Profitability = Perfect Performance

The second thing is, that investing in low-volatility stocks of strong, profitable companies allows you to participate in long bull market runs.

Just by relying on this simple formula:

Low Volatility + Strong Profitability = Perfect Performance

Jim found most market crashes can be avoided.

For example, when the dotcom crash sent the S&P 500 plunging -41% in 2000, The Perfect Portfolio actually gained 36%. The same thing happened again when the financial crisis of 2008 sent the S&P into a -54% tailspin. The Perfect Portfolio came out unscathed with a 2% gain.

Overall, the strategy has outperformed the S&P 500 ETF by a massive 1,461% over the past two decades, so it's time-tested.

Avoid Trying To Time The Market

You have probably heard the term “buy the dip” before.

Although markets have gone up over the long term in nominal terms, if your timing happens to be bad (like yours truly), the time horizon can be years or even decades before you claw all your money back.

As an example, if you had money invested in the stock market during the crash in September 1929, it would’ve taken you until 1954 to get your money back. That would be like making an investment today and not breaking even until 2048!

It's a crapshoot that can be avoided by buying just three stocks.

Revealing Jim Woods’ “Perfect Portfolio” Stocks

Jim rightly says no investment is 100% foolproof, but The Perfect Portfolio offers us the highest returns possible, while at the same time drastically reducing our risk.

Unfortunately, he doesn't provide a single clue on any of his three picks that might have helped us reveal them. Well played Jim, well played.

To give you an idea about the kind of stocks Jim is talking about here, I found some data on the five best-performing stocks of the past 30 years through this past July and these are the names:

- Monster Beverage Corp.

- Amazon.com Inc.

- Apple Inc.

- Biogen Inc.

- Nvidia Corp.

The top-performing name on this list generated a staggering 191,852% return. Enough to turn a $10,000 investment into $19.2 million.

However, looking at these stocks, some of them can be quite volatile due to heavy trading volume. So I also looked at some of the best-performing low-volatility stocks over the same timeframe as well. This list is much different:

- Berkshire Hathaway

- Altria

- Kansas City Southern

- Dollar General

- Aflac

Far less sexy names, but all outperformers nonetheless, with Berkshire alone returning nearly 20% annually.

On the whole, Jim's strategy of a small, concentrated portfolio of good to great businesses is sound and carries better-than-average odds of beating the indexes over the long term, which is no small feat.

Quick Recap & Conclusion

- Jim Woods believes he's built the “Perfect Portfolio.” It is made up of only three stocks that have outperformed the S&P 500 by 1,461% over the past two decades.

- The key to the “Perfect Portfolio” is investing in low-volatility stocks of strong, profitable companies, and holding them over the long term.

- The names of all three stocks are revealed in a brand-new special report called: The Perfect Portfolio: Discover a Simple Strategy to Outperform the S&P 500 by 1,461% (Even If Stocks Crash!). It is only available to subscribers of Jim's newsletter the Intelligence Report, which costs $49.95 for the first year.

- Jim knew even one clue would be enough for the Green Bull to out his trio of stocks, so he played it safe and provided none.

- While we weren't able to reveal Jim's picks this time around, we can honestly say that his overall strategy of owning a small, concentrated portfolio of good to great businesses is a sound one and likely to produce above-average returns over the long term.

Do you practice a highly concentrated or a diversified stock portfolio strategy? Let us know what your experience has been with each in the comments.