With his special insights and strategy, he boasts that he can make you retire very, very wealthy. In this complete Jeff Clark Trader review, we will learn if there is truth behind his claims.We discuss his background, strategy, and how his service will translate into big gains for his subscribers. Further, we look into his nearly 4 decades of experience in options trading. As per Clark, everything he learned during those years can help turn even an investment of $1,000 into as high as $55,000.Of course, expect that we will also tell you both the good and the bad aspects of this newsletter advisory.

Overview

- Name: Jeff Clark Trader

- Editor-in-chief: Jeff Clark

- Publisher: Omnia Research

- Website: www.jeffclarktrader.com

- Service: Monthly option trading advisory

- Price: $19 or $199

Jeff Clark’s goal for this service is to reach out to people who are beginners in this field. He offers guidance through his experiences. The trader wants investors to be more comfortable with options trading. He also targets long-term investors interested in the trade.

Who is Jeff Clark?

Clark was previously the president and chief executive officer of a brokerage house and a private money management firm. He then retired at the young age of 42.After that, he began his career in writing newsletters for Stansberry Research (formerly Stansberry & Associates Investment Research). In the group, he was the editor of The Short Report and Pro Trader for over 15 years.Clark started in options trading when he was in his 20s. Throughout these years, he says that he was able to develop his skills until he became an expert.In one profile, he also describes himself as a “$200 million Silicon Valley money manager who’s predicted more market moves than anyone else we know of”.These are some of the other claims of the trader:

- Predicted the two biggest market crashes of the past 15 years

- Made a trade just 8 days before the dot-com meltdown that earned him more money than he’d ever seen on a single trade

- Called the 2008 crisis as early as January 13th of that year

- Made 10X just before 1987’s Black Monday

- Called the gold crash of the early teens and the recent gold boom

- Predicted the bottom of the market in 2020 and the historic rally that followed

To be honest, there is not a lot of information about Jeff Clark out there. Sure, he has a profile that is being repeated in various other promotions, blogs, and interviews. But apart from the repetitive list, we had a hard time looking for more of his background information.For example, in his profile, Clark mentions that he was instrumental in developing the curricula of an international Masters in Business Administration (MBA) program. Now that would be a convincing argument for his expertise.To boost his credentials, he also mentions that he founded an investor education firm. As always, we are curious to know what the MBA program and the investor education firm are. These are experiences worth boasting about. So it is surprising that as of this writing, we have not found information about what these are.

We are not saying these are not true. We could tell you though that it is very hard to find them. So if you know what these are, do tell us in the comments section.Why are we making a big fuss over these details? Well, to us, these are not inconsequential data. Every day, we see overblown profiles from so-called experts. Furthermore, it is getting more and more difficult to look for third-party sources that will verify their claims.Since we are entrusting our money to them, we need to know how they performed before writing these types of newsletters. And this is not a big ask.When we invest in companies, we also tend to look at who is in charge. Heck, even the investors who sell us their research tell us that. They say that one criterion for their recommendations is the leaders’ track record. So we deserve to know. Obviously, we want to find out how their companies performed when they were still working for them. How was the firm doing when they left? What is their reputation in their previous affiliations? Why did they leave?Sadly, due to the barrage of sponsored posts and curated profiles, the answers to such questions are hard to find. This is true for almost all editors and founders of investment advisories.We do not just want to mindlessly echo what they say in their profiles. We are not an extension of their research firms. We serve you, our readers, and we owe you the truth.

What is the Jeff Clark Trader?

The basic premise of this advisory is that anyone can understand and apply their learning on options trading. Further, it is a simple process you can practice immediately.This is where Jeff Clark Trader comes in. The service it provides will make anyone a trader if they follow his advice.In fact, it is so easy to do that Clark teaches you how to trade only three stocks. Three stocks. He encourages his readers to do this every month and they will get a large retirement fund at the end.Like many others who provide such research advisory, the company gives reports, portfolios, and trade alerts. Clark also adds educational training videos so you can understand the process better.It is worth noting that the newsletter is published by a company called Omnia Research. We examined this particular firm in a past review on this website. Further, we mentioned that it is connected to other well-known financial research publications. These are Bonner & Partners, Stansberry Research, and Legacy Research Group among others.

As with most promotions hype, you should be careful with any marketing gimmick that oversells. If somebody tells you that something is a no-brainer, it should all the more make you think twice. First, anything that involves your money involves a great amount of risk. Others find it easy to let go of statements that tell you to blindly do what they say. Well, they are not necessarily risking their money. Or they may do so, but they are not responsible for what happens to you when you lose your retirement fund. Your money is your responsibility.Second, options trading as a strategy requires careful analysis and study. Some find it easy, while others would rather not touch it. Sure, many people have already earned from them. But it would be healthy as well to learn from others who had negative experiences with them.The bottom line is, make your judgment after looking at its potential, risks, and factors for success.Here at Green Bull Research, we have already reviewed a past teaser from Clark about a trading strategy that can give you gains of up to 582%. In our article, we mentioned that he gave no substantial and specific details that would back up his claims.The trader’s website also lists the other services he offers:

- Jeff Clark Alliance $9,199

- A protégé program for those who want to learn more

- Delta Report $5,000

- Contains advanced options service

- The Breakout Alert $4,000

- Has tips on explosive upside moves in the small-cap stock market

- Market Minute

- A free e-letter on general ideas on trade options and investing

Read our review of Market Minute and find out why we think the free newsletter is somewhat unsatisfactory.

How it Works

As mentioned, this service focuses on those who have very limited knowledge of options trading. Because of this, the language Clark uses is simplistic and basic.But it has lofty promises. When you subscribe, you will be ready to trade in a matter of weeks. Further, you will not only be trading. You will already see profits from your investments.Before we go further, let us briefly discuss first what an option is.It is a contract that has an end date. Once you have such options, you will have the right to either buy or sell specific assets at a pre-set price. Of course, you must do so before the contract expires.Many people regard options as a risky form of investment. But the author of the well-regarded Amazon best-selling book, The Rookie's Guide to Options, has something else to say.Mark Wolfinger, the writer of the beginner handbook, asserts this:

“Options were designed to be risk-reducing tools. They are used to hedge risk, so the myth that options are too risky is not true. Options are risky if you don’t understand how to use them. By themselves, options are not risky, although some strategies are risky. The real risk is with the options trader.”

To help more investors understand the concept, Forbes also lists Five Things To Know About Options Before You Start Trading Them.

These are:

- Writing covered calls is not always a path to success.

- Buying out-of-the-money options is unlikely to work.

- Multileg spreads can increase returns and limit risks versus trading stocks.

- Be on the right side of time decay.

- Understanding implied volatility is crucial.

Having a better understanding of the mechanics for options trading will help you cut your risks. A Fox Business article discusses this. It also adds that a supportive community will increase your chances of success. Specifically, it seems that Clark is more conservative than others. He focuses on short and mid-term trades. He also integrates speculative strategies in his process.The editor also strives to be as safe as possible. Because of this, he only trades with three (fast money) stocks per month. The trader also provides timely reports on hold/sell prices. Further, he recommends options from large-cap stocks.Clark also says that the methods he employs work in both bull and bear markets.

Track record

A positive aspect of this newsletter is that he shows you how his recommendations have performed. On his website, there is a link showing the performance of these companies.This is a great way to show transparency. You will see both the gains and losses.His recommendations also come from diverse sectors like technology, gold, and even from companies like Exxon Mobil, Macy’s, and Tupperware.

What you get

We hate to sound like a broken record, but Jeff Clark Trader also has a confusing offer scheme. If you go to his website, you will get a package with a higher price.

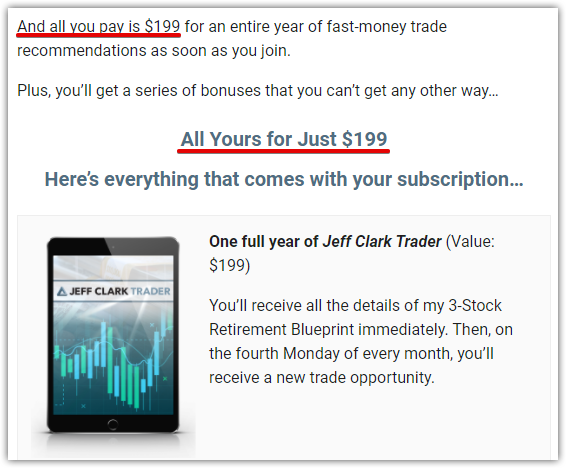

But if you had clicked a link from one of the sales pages we found, it would have led you to The 3-Stock Retirement Blueprint offer site.

We gave our opinion on this teaser in a review that cautions you not to easily fall for such simplistic claims. You need to be diligent in your research.

On this site, he offers everything for just $19 for the first year and $99 for the second year upon automatic renewal. The price is only $99 because he adds in a lifetime half-off from the subscription of those who subscribe from this page.

How would you feel if you go through the website and pay $199, only to learn later on that there is such an affordable option? Obviously, you would cancel immediately and would want the better deal.But here is another thing. The website offer does not even give cash refunds, whereas The 3-Stock Retirement Blueprint offer site has a 60-day money-back guarantee.Confusing, right? By now, though, you would know that this is a standard practice in the majority of newsletter services.That said, upon subscribing, you get the standard inclusions in a research service.

- One full year of Jeff Clark Trader (Value: $199)

- On the fourth Monday of every month, you’ll receive a new trade opportunity

- Frequent Updates

- You will get updates on all trades, including when to sell

- Available on their app

- Special Report: The 3-Stock Retirement Blueprint (Value: $99)

- Clark’s ultimate strategy guide

- Includes reasons for the stocks he chooses and how to trade them

- Money Multiplier Masterclass Training Series (Value: $599)

- Video training exclusively for his subscribers

The values of the materials and reports Clark presents are from their website, so these can be very tricky. We cannot know their actual value, so it will be up to you if you want to believe them or not.

Cost and Refund Policy

Website offer

Cost

When you enroll through the website, a one-year subscription costs $199.

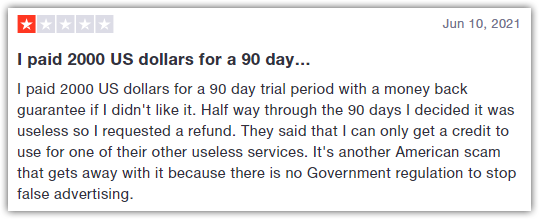

RefundHere, Jeff Clark Trader gives an unfortunate deal on his refund policy. Yes, you may cancel within 90 days. But instead of returning your money if you are not satisfied with his service, he will only give you credits.Of course, he says that you may use this for his other services. But these cost anywhere from $4,000 to $1,199. So this is not a fair deal at all.He also states that you may use the credits to his other affiliate newsletter services. But that defeats the purpose of canceling. What if you do not trust him anymore so you do not want anything to do with him or his colleagues?

The 3-Stock Retirement Blueprint sales page offer

CostIf you subscribe to the newsletter via this page, you will get an offer of $19 on your first year and $99 upon automatic renewal.

RefundIn contrast to the official website that offers no cash refunds, this offer page gives you the privilege of getting a full money refund. You just need to get in touch with their team within 60 days.Again, this discrepancy is an unnecessary distraction. Those who have subscribed through the website will feel cheated if they know a better offer exists.

Reviews

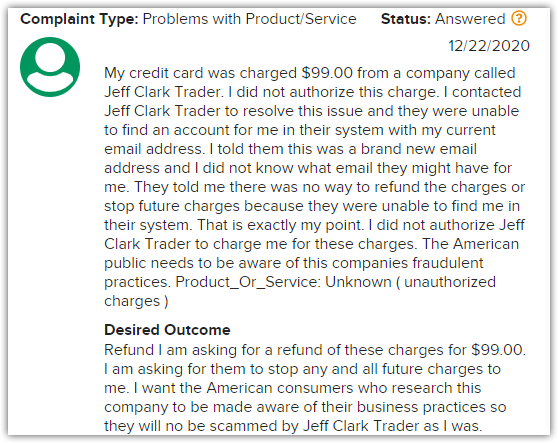

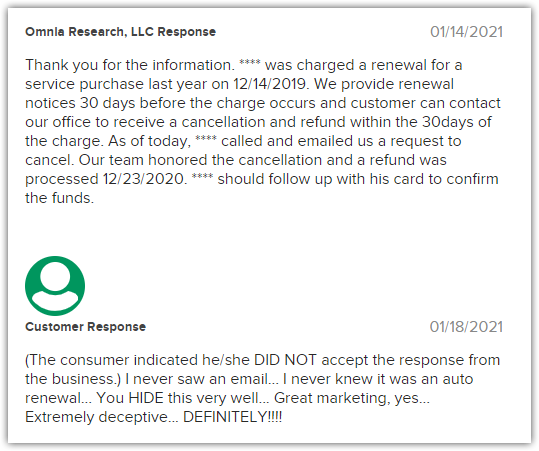

Before we take a look at the reviews, we want to be fair. The reviews we see online do not reflect all the sentiments of their subscribers. Naturally, a huge majority of those who go online are irate readers who want to register their displeasure at the publishers.But the reviews and ratings also serve as useful guides. They give us a glimpse of both the meat of the products they offer and how their customer service works. You are parting with your hard-earned money, so we want to provide you with useful information. Although some of the offers can get cheap, the renewal fees can get much higher. So this is not just about, say $19, but much much more in the long run.There was no specific page for Jeff Clark Trader on the Better Business Bureau website. But we looked at the complaints under its publisher, Omnia Research. As of this writing, there was one complaint lodged against this newsletter under Omnia. Take a look at the screenshot below from a subscriber who was charged $99. The publisher also replied.

Still, how do you feel about an incident like this?

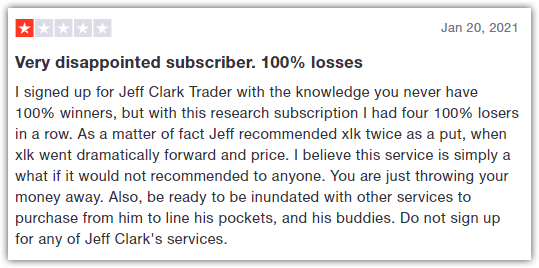

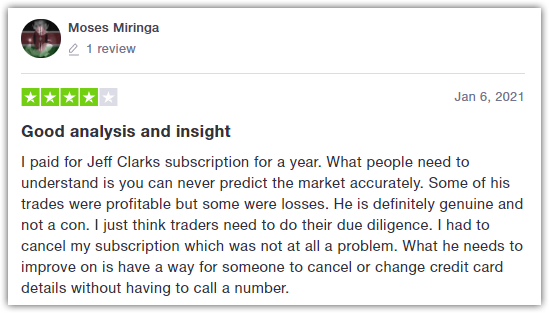

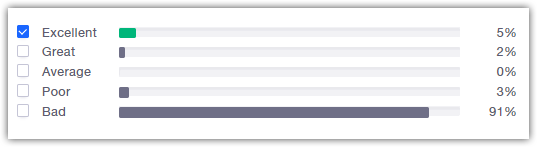

To get a fuller picture, we turned to Trustpilot.com. Of the more than 60 reviews, the options trading newsletter got a 1.5 out of 5 rating.An overwhelming majority gave it a poor and bad rating.Read some of their comments below. Here is review that pertains to his expertise.

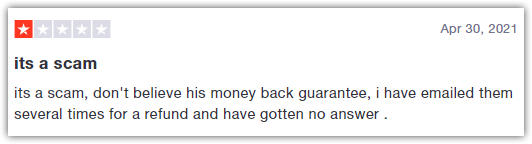

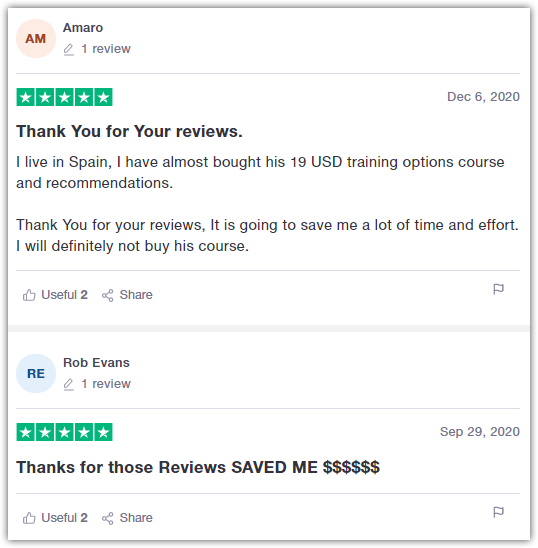

These are the comments that shed light on issues about credit card transactions.

We did find a comment that defended Jeff Clark.

Looking at the ratings chart, we also checked those who gave it a score of 5. We want to be fair and show you positive experiences as well.

But when we looked at the comments, alas, they were reviews of the negative comments and not of the newsletter. How ironic.

Our goal at Green Bull Research is to prevent incidents like those experienced by the subscribers above. We could just imagine how frustrating the incident has been for the subscriber. Often, talking to such companies for refunds is an intense process.Although publishers always promise a smooth transaction flow for refunds, this is not the case most of the time. Complainants go through hoops to contact customer representatives. Then, some are bombarded with technical terms of service no one understands.This is the result of confusing and probably purposely misleading fine print. The fine print tends to be exactly that. Very, very fine to the point that you will not be able to read and understand them.Again, this is such a disservice to customers.

Pros v Cons

Pros

- Inclusion of video materials for those who prefer watching

- There are only three positions to track

Cons

- The Masterclass Training Series videos can be too salesy, as per customer feedback

- There are techniques in options trading that might take time to understand

- Negative reviews

Conclusion – Is This Legit?

The trader wants you to trust his almost 40 years of experience and subscribe to his newsletter. According to him, he can make you understand options trading. Further, he can make you earn enough profits from it that you will retire as a wealthy person.According to him, part of his mission is to make options trading easy to understand. As a result, he has made his newsletter affordable. Now, it will be up to you which offer you will take, the affordable $99 or the affordable $19.We commend his transparency in showing you the track record of his recommendations. This way, you get to see if you like what you are seeing. But we must also mention the experiences of those who commented on the websites we mentioned. We hope that they will help you decide if you want to subscribe to the investor’s newsletter.In the end, it is still your decision to make. Our Jeff Clark Trader review merely presented you with the track record of the trader and his newsletter service.