Is Jim Rickards credible? This article looks at various aspects of his career to serve as a guide for those interested in his investment newsletters.

This is not the first time we have written about Rickards.

Our Strategic Intelligence review asked you, our readers, if you believe scare tactics work. We mentioned this because of the impression that the lawyer-investor is a doomsayer.

The content and marketing pitches for his books and newsletters always paint a gloomy future.

In fact, in The Great Biden Swindle, he says that he has “shocking pieces of evidence” to prove that it is still a long way to recovery.

Whatever it is that we are seeing now is just a mirage. We have not yet recovered and we will still experience a five-year Great Depression.

Politicians and media commentators who say otherwise are either outright liars or deeply uninformed.

According to him, it will take three long decades before we experience 2019 levels of growth.

How does he know all this? Well, he claims that he is among a handful in the world who has mastered the “complexity theory”. This is an advanced predictive tool like no other.

Since he is an expert in this (here is the sales part), you must engage with him. A wise and forward-looking investor, of course, will buy his books and subscribe to his newsletters.

That is the deal.

But are his pronouncements credible? Do they have factual and scientific bases? Does he have the track record of success for us to believe him?

Hopefully, we can help you make an informed judgment on this.

In this article, we will take a look at his background and record. In addition, we will discuss the existing literature that he published. Reviews and comments from experts and subscribers are also in this article.

Background

Jim Rickards holds a lot of titles. This, of course, is not shocking in the financial education industry. Upon observing closely, every editor is an expert on this and the number one at that.I guess as investors, even if we know at the back of our minds that we are being taken for a ride, we still choose to believe.Hey, at least the driver is well-known, right? Oh for sure, no one will put falsehoods on their resume. If it's online, it's legit, right?When it comes to our finances, we try to do what we can to protect our assets. So it is natural for us to entrust our fiscal health to the experts.But at the same time, we cannot easily refuse promises of instant and easy returns of investment. So in a way, we try to justify even sketchy people and propositions because of the dollar $ign$. As a result, we lose even more money because we fell for something too good to be true.We are not saying that Rickards is an example of this.

But as we discuss his background, no matter how impressive it is, we just want to remind you of such tendencies.

Expertise

Now, back to the topic. James “Jim” Rickards is a lawyer, investor, banker, speaker, financial pundit, commentator, and author. For 35 years, his name was associated with Wall Street.

Early on, he was already building a foundation for a long career in the global financial industry. His education proves this.

He attended Lower Cape May Regional High School in New Jersey. After that, he went to Johns Hopkins University where he graduated with a Bachelor of Arts degree with honors.

The investor then pursued further studies. Rickards got an M.A. in international economics from the Paul H. Nitze School of Advanced International Studies.

Not satisfied yet with his academic training, he worked towards getting a legal education. It was from the University of Pennsylvania Law School where he got his Juris Doctor.

After this, his interest in taxation made him obtain a Master of Laws from the New York University of Law.

Due to his impressive educational background, he landed senior roles in companies of global repute. Among them are Citibank, Caxton Associates, and Long-term Capital Management (LTCM).

After an event-filled stint there, he moved to a merchant bank in New York. Specifically, he was Tangent Capital Partners LLC's Senior Managing Director.

Then, Rickards took on a new role with Omnis, Inc. in Virginia. The consulting firm appointed him as its Senior Managing Director for market intelligence.

LTCM

In LTCM, this is how Wikipedia describes his role:

As general counsel for the hedge fund Long-Term Capital Management (LTCM), he successfully negotiated the US$3.6 billion rescue of the firm via the US Federal Reserve in 1998.

So, what happened there?

A detailed explainer from Business Insider provides us with key details.

As a background, LTCM is a hedge fund set up by John Meriwether. He used to be with Salomon Brothers as its vice-chair and head of bond trading.

The company was a huge deal back then. Among its key leaders were finance experts with doctorate degrees, professors, and Nobel Prize recipients.

Meriwether launched the firm in 1994 with a capital of $1.25 billion.

LTCM was a uniquely demanding firm from the beginning. Apart from its huge capital, it also demanded an asking fee of 25% of profits. In addition, they wanted an annual two percent charge on assets.

Further, those who wanted to invest must keep their capital for three years, minimum.

Due to their aggressive stance, it grew to a firm with $140 billion assets in just two years.

But the honeymoon stage soon ended. In 1997 and 1998, the world saw Asia and Russia experience devastating crises.

By 1998, LTCM's losses reached almost $3 billion on swaps and volatility trades.

Due to the exposure of different companies in the firm, if LTCM went bankrupt, the whole of Wall Street will go down with it.

It was during this time when the Federal Reserve finally stepped in to arrange a bailout.

So what is Rickards' involvement in all this?

Pretty significant. He was the chief negotiator and lawyer for LTCM.

Together with the Federal Reserve Bank of New York, they were able to arrange for a $3.635 billion bailout.

Although Bear Stearns and Crédit Agricole refused to take part in the deal, these contributed to the arrangement:

- Paribas and Lehman Brothers: $100 million

- Société Générale: $125 million

- Bankers Trust, Barclays, Chase, Credit Suisse First Boston, Deutsche Bank, Goldman Sachs, Merrill Lynch, J.P.Morgan, Morgan Stanley, Salomon Smith Barney, UBS: $300 million

Soon after, the firm stabilized.

We believe this is worth mentioning as this is historic not just for the financial sector, but for world affairs. A leading role in the ordeal means that he has the gravitas and know-how to negotiate the complex bailout.

His expertise in international affairs, economics, and law proved handy in this case.

As an investor, this is a positive signal. Imagine following the financial advice of someone of his caliber. Certainly, his experience in the LTCM alone puts him above other newsletter editors.

This is a common comment on this space. Unfortunately, several of so-called experts do not have a depth of experience. Despite this, they dish out investment commentary with much chutzpah.

So in fairness to Rickards, this is a major boost to his credibility.

In an article on Forbes by Addison Wiggin, one of The Agora's leaders, Rickards recounts his experiences.

A crucial lesson he learned in the ordeal was that the model used by Wall Street banks and the Federal Reserve to assess risks is all wrong.

This led to his current views on investing.

Key Involvements

One such view is his opinion that the US dollar is at risk. According to him, the currency is facing imminent hyperinflation. Thus, foreign entities may easily attack the financial system of the country.

He even presented this perspective at Johns Hopkins University in 2009.

That same year, he spoke before the U.S. House Science Subcommittee. Congressional representatives called on him due to his expertise on various financial risks vis-à-vis the 2008 crisis.

To this day, he continues to spread his brand of financial ideas. The pages of The Financial Times, Evening Standard, New York Times, and Washington Post are home to his opinion pieces.

According to his publicly available profiles, he was also an adviser to the Central Intelligence Agency's Financial Risk Assessment Unit.

In addition, he was also an adviser to the U.S. Department of Defense and several other hedge funds.

The Pentagon also tapped on him to facilitate its first-ever financial war games, based on his claims.

Apart from these, he is also well-connected in the academe. The Kellogg School at Northwestern University and the School of Advanced International Studies at Johns Hopkins University often get him as a guest lecturer.

Books

Although not the perfect measure, well-received publications are also a good indicator of a track record.

If your books are critically acclaimed, that could mean that your views and how you defend them pass the believability test. Critics and observers view your work as valid.

Further, if people buy them, that means the author has hired great publicists!

Kidding aside, it could also mean that there is an audience for the writer's points of view. People believe the author enough that they are willing to buy their books.

If only for these two, Rickards seems to fit the image of a credible thought-leader. As you will see below, his books have sold well and have received various praise.

Note also what we just said.

These only seem to boost his credentials only as an opinion-maker. On that specific area alone, we can vouch for him, or at least the details on Amazon can.

We need to add this caveat as we are evaluating the man on his investment research newsletters.

So what about his books? All in all, he has written seven thought-provoking books. As to his general theme, some classify his writing as financial doom-and-gloom literature.

We will list them below to give you a better perspective on his worldview.

Since you, our readers, are his target market, you need a good idea about his body of work. This way, you can assess for yourself if you find him and his POV worth your time.

We will also provide space for relevant reviews and comments. Just note that such opinions do not reflect a representative sampling of all his readers.

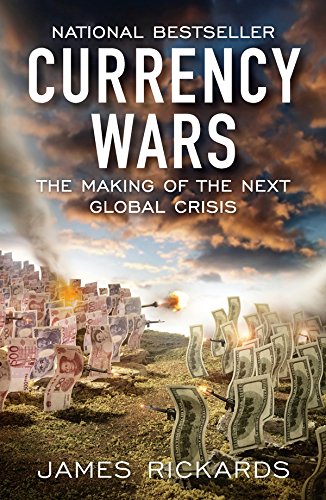

1. Currency Wars: The Making of the Next Global Crisis, 2011

- New York Times bestseller

-

Untangles the web of failed paradigms, wishful thinking, and arrogance driving current public policy

-

Points the way toward a more informed and effective course of action

-

Mike Allen, Politico: “One of the most urgent books of the fall.”

-

Bloomberg Businessweek: “Rickards has written one of the scariest books I’ve read this year. Though I was tempted at first to dismiss him as alarmist, his intelligent reasoning soon convinced me that we have more to fear than fear itself.”

-

Amazon 5-star rating commenter: This book was fascinating. It was totally outside my area of understanding, but after reading the book, I learned a lot about the process and influence of a currency in this world. The book gives you a brief history of the role of currency and goes into how people wage war by using the ups and downs of the valuation of a certain currency of a country.