Our review of Empire Financial Research will examine what Whitney Tilson's firm is all about.

As you know, the former hedge fund manager is a fixture in financial circles, as the head of the now-closed Kase Capital. So it would be good to know how his relatively new venture is doing.

In a sleek, well-produced video released in 2019, Tilson discussed why he decided to enter the world of finance research.

Of course, he started his pitch with his claim to fame: growing a $1 million fund to over $200 million. As a result, he says he became “one of the best-known investors out there.”

Obviously, Tilson is not bashful about his accomplishments. But you would also know that modesty is a rare trait among financial research editors. So that's nothing new.

What's different with Tilson is that he also does not shy away from talking about his failures. In this department, he has made a few substantial ones. But more about this later.

Now, let's go back to the video. As he pensively looks outside tall buildings and walks the streets of New York, the investor says he now wants to give back.

According to Tilson, since he learned a lot from others, he now wants to teach others. Before, he used his best stock ideas to invest and earn. Now, he wants to share his knowledge of investment fundamentals with his subscribers.

According to him, his ultimate goal now is to help people make more money.

All of these sound good and even selfless at first glance.

But a logical person would also ask some questions about this.

Isn't managing a fund also a way of helping others make money? Since he had issues with the last fund he managed, wouldn't it be best if he redeemed himself there first?

Even if we were to grant him the premise that he learned a lot of lessons in the past, would his word be enough for subscribers to trust him now?

Obviously, there are a lot of issues we need to talk about.

Aside from examining Tilson's career, we will also dive deep into the services his firm offers. If you are on the verge of subscribing to his newsletters or just curious, we have what you need.

So stick around and read until the end as we will be honest, thorough, and fair in this review.

Overview

- Name: Empire Financial Research

- Founders: Whitney Tilson

- Website: www.empirefinancialresearch.com

- Service: Investment Research

Whitney Tilson, a former hedge fund manager, set up Empire Financial Research with the aim of helping regular investors.

According to him, the firm's goal is to provide research, guidance, and commentary that ordinary Americans can use.

Since he is a prominent fixture on the financial scene, much of the marketing hinges on his persona. Almost every corner of the website prominently displays the name “Whitney Tilson.”

This is to be expected since he is quite a popular figure and a charismatic speaker.

But he is not the only one providing investment research. He has a team of experts that deliver regular investing recommendations to subscribers. Each service also has a specific focus, which we will discuss later in our article.

We also want to mention early on that Empire Financial Research is a joint venture of sorts between Tilson and Stansberry Research. Apparently, Tilson and Porter Stansberry go way back, so they founded this firm.

However, the latter is not significantly mentioned on Empire's website. Meanwhile, Stansberry lists Empire on its Friends of Stansberry page.

Consequently, this means Tilson's company is under the vast wing of The Agora. If you want to know more about its extensive network, including its share of controversies, read our detailed review of The Agora.

Through that well-researched article, we help subscribers see the big picture about the umbrella company. We believe giving you more information will help you decide better.

In fact, reading about its founder will also give you a deeper insight into the financial research industry. You may read about him in our past article: “Is Bill Bonner A Scam Artist or An Investing Expert?”.

As you find out more about the system Empire Research is under, you will get to know more about how it operates as well.

What is Empire Financial Research?

The investment research company opened in 2019 as a vehicle for investor Whitney Tilson to “give back”, he says. According to him, many financial experts have helped him achieve success in life.

So he feels that 20 years of experience gives him the license to teach regular investors. The former hedge fund head believes that more Americans will be able to achieve financial success with proper guidance.

As a firm, Empire Financial Research admits that those at its helm are contrarians. They are not afraid to go against the grain if they believe in their positioning.

Also, Tilson and his team say they dare to pick investment opportunities Wall Street just ignores. They are not afraid to make bold calls and predictions since they know more than the typical investor.

Such bravado is not without basis, they claim.

According to its website, its team of analysts and researchers are industry experts. They have deep knowledge in “value and growth investing, short-selling, macroeconomic analysis, and more”.

Of course, such self-praise is par for the course when you examine every “About” page. As potential subscribers, it's always best to maintain a healthy skepticism towards anything an advisory firm claims.

So throughout this review, we will tell you what we think about them. Also, we will give you feedback from other sources, including their subscribers.

Aside from Tilson, the company has five others in its leadership team. These are Enrique Abeyta, Berna Barshey, Herb Greenberg, Gabe Marshank, and Alex Griese.

Based on a quick scan of their profiles, they come from a typical financial background. It seems like all of them are achievers in this field. But we will discuss their details below.

Together with Empire's founder, they provide two free newsletters and seven paid subscriptions.

Coronavirus Section

There is also a tab on Coronavirus updates, which is interesting.

We checked out the two latest articles inside it by the time we publish this review. Initially, we assumed the section would discuss how the pandemic affects the market.

But it looks like Tilson is really devoting significant space to addressing people's concerns about Coronavirus.

Our first impression of this move: it's laudable. It sends a signal to potential subscribers that not everything is about profit.

As of this writing, the latest post is Tilson's response to a reader who asked him about COVID-19. Although, on the surface, the discussion seems purely science-based, it's obvious there are political undertones.

The letter sender asked about the investor's perspectives on natural immunity, the use of Ivermectin, and vaccine hypocrisy.

While we do not want to be political in this space, we know you are also aware of how the debate can be highly charged. Tilson is clearly for vaccine mandates and against the use of Ivermectin.

We also observed that he uses rather strong language against people with whom he disagrees. This may be the reason why he receives complaints about his “progressive Marxist ideologies”.

We discussed this issue in our previous article about the former hedge fund manager. In it, we talked a great deal about Tilson and his career, so it would be a great accompanying piece to this review.

The other article on the Coronavirus tab on Empire's website is about Tanzania. Tilson actually just copy-pasted a Wall Street Journal article about the country's COVID-19 coverup.

To reiterate the point we made earlier, we think this is a commendable feature. Since we are all concerned about this deadly disease, we need as much information as possible from all credible sources.

However, his abrasive language waters down his valid concern for others' health:

The miraculous Trump vaccines (yes, I’m going to keep calling them that, since it’s his supporters who are disproportionately refusing to get vaxxed) have been widely available, for free, to every American, yet roughly 25% of eligible folks still aren’t vaxxed, allowing the virus to kill another American EVERY MINUTE.

As a result, it could be interpreted (rightly or wrongly) as more of political advocacy rather than a science-based assessment of issues.

This is complicated since the discussion also includes individual freedom, personal decisions, and basic human rights.

In any case, Tilson believes this will help his existing and potential subscribers, so take what you can from this move.

Who is Whitney Tilson?

Among the earlier prominent collaborations of Tilson is with the famed Michael Porter. The former was a student at Harvard Business School, where the latter was a professor. They founded the Initiative for a Competitive Inner City.

Tilson served as its executive director from 1994 to 1998.

A year after, he focused on the hedge fund, Kase Capital, and managed it until 2017. It shut down because it has been underperforming since 2010.

Tilson explains in a Forbes article what happened. Expectedly, before telling us why the fund failed, he started with his usual script.

Before its closure, Kase Capital was doing great. He claims that he beat the market almost every year for nearly a dozen years.

In plain speak, “nearly a dozen” just means 11 years, mind you. But because he is the “Whitney Tilson”, he'll say what sounds better. It is what it is.

In fact, he also reiterates that he tripled his “investors' money in a flat market”.

However, at that time, he believed that “the market was ahead of the fundamentals” as the economy picked up. As a result, he employed a defensive fund strategy.

He held on to a lot of cash and carried a “meaningful short book, waiting for the next big downturn”. Obviously, it did not come.

The extended bull market was not kind to such a conservative positioning. This resulted in his fund “significantly underperforming” for seven long years.

This disappointed his investors to the point that the fund's assets shrunk to only $50 million. These developments also had a tremendous impact on Tilson:

More importantly, I was miserable: month after month, year after year, I felt like I was letting my investors down, so I finally decided to pull the plug last fall.

This is what we were referring to earlier in the review. Objectively speaking, Kase Capital failed in managing its three hedge funds and two mutual funds.

So naturally, such a record would raise doubts among subscribers. How could they trust the man behind an investment research firm if his last venture was a failure?

We believe that judgment and trust are two critical elements in investment research.

Can you trust the instincts and judgment of the person at the helm of the firm? Yes, it is admirable that he openly talks about such a career setback. But can people trust his investment recommendations now?

We have a simple analogy here.

If you were looking to hire a manager for your business, you would naturally look at their track record. If you see that the last venture an applicant has managed went bankrupt, would you likely hire that person?

So it is tricky, knowing what we know about Tilson. Yes, managing a hedge fund is different from helping you with your investments. But it comes down to a person's judgment call.

Maybe some would still consider the applicant because of their honesty. After all, being candid and accountable for past actions is refreshing.

But is that enough ground for you to entrust your financial future to their recommendations?

Or consider this. If you were to choose between two equally honest and accomplished applicants, would you choose someone whose last business was unsuccessful?

Certainly, headlines like His Hedge Fund Shut, Whitney Tilson Says Now He'll Try Research is not helping his case. This February 2019 article from Bloomberg News talks about his career shift.

The framing puts him in a bad light.

We are not advocating for a particular answer or position here, just to be clear.

Our job at Green Bull Research is to help you separate the wheat from the chaff. We ask tough but fair questions so you can arrive at the best decision in the end.

It is also worth noting that Tilson acknowledges this and gives a positive spin to it. In his introduction video to Empire Financial Research, he says this:

I think I've learned all the right lessons and now I am well-positioned to be a much better investor moving forward.

Though he did not address his Kase Capital stint directly, we can assume he was indirectly alluding to it. In this regard, he makes a lot of sense.

Author Samuel Smiles has an apt quote for this:

“We learn wisdom from failure much more than from success. We often discover what will do, by finding out what will not do; and probably he who never made a mistake never made a discovery.”

So it is a matter of taste if you would still opt to trust Tilson.

For his new business, what would help us directly is how subscribers feel about Empire. But let's not get ahead of ourselves as we will discuss that shortly.

For now, let's go back to a few more relevant issues about its founder.

He is credited with having written four books. His latest one is The Art of Playing Defense: How to Get Ahead by Not Falling Behind.

The two others, The Art of Value Investing: How the World's Best Investors Beat the Market and More Mortgage Meltdown: 6 Ways to Profit in These Bad Times, credit him as a co-writer.

In addition, his website says that he is a contributor to Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger.

In terms of academic credentials, Tilson is a powerhouse. He graduated magna cum laude with a bachelor's degree in government. He also finished his MBA at the Harvard Business School with High Distinction.

Obviously, the guy is an intellectual force. If you listen to him speak, and he has been around, he is a sensible investor. He has spoken at Google, on CNBC, Bloomberg, Fox News, and even 60 Minutes.

So maybe his shift into research would make better use of his intellect? Well, read further to find out what subscribers think about his firm and its services.

Who are the Experts in Empire Financial Research?

As we have mentioned, five other people join Tilson in Empire Financial's leadership team. His colleagues seem to carry most of the load, though, of seven paid services and two free newsletters.

In fact, Tilson is in charge of only two paid services and one free newsletter.

Enrique Abeyta

He is the editor of Empire Elite Trader, Empire Elite Growth, Empire SPAC Investor, and Empire Elite Options.

Based on his load, it would be safe to say that he is Tilson's second-in-command. He seems to have the credentials to back it up.

Like Tilson, he also has over twenty years of experience on Wall Street. During these years, he also claims to have raised more than $2 billion in assets.

In addition, his profile advertises that he has outperformed the S&P 500 for ten years. Empire's website also says he generated “positive returns during the bear markets that followed the dot-com bubble and global financial crisis”.

Also, he graduated cum laude from Wharton.

Berna Barshey

Barshey, meanwhile, is a cum laude graduate of Princeton, with an MBA from Harvard Business School.

Like both Tilson and Abeyta, she also spent two decades on Wall Street. She started her career with Goldman Sachs and Sanford Bernstein.

Barshey is the editor of Empire Market Insider and the free Empire Financial Daily newsletter.

Herb Greenberg

Empire Financial Research's Senior Editor, Greenberg, has four decades of experience in financial journalism. CNBC, Chicago Tribune, San Francisco Chronicle, Fortune, and KRON-TV are some of the outfits he worked for.

Gabe Marshank

Meanwhile, the other Senior Editor at the company is a cum laude political science graduate from Yale.

But immediately after graduating, Marshank did enter the investing world. As a professional investor, he has achieved a lot for more than twenty years, at least according to his profile.

It said that “he has been responsible for managing billions of dollars in capital and generating more than $1 billion of profits for his firms' investors”.

Alex Griese

The youngest member of the leadership team is a Chartered Financial Analyst who graduated from Carleton College in 2017.

Aside from being a resident analyst, Griese also writes for Empire Stock Investor, Empire Market Insider, and Empire Investment Report.

The Team

Looking at the profiles of this group, they seem to have the perfect background for financial research. All of them have been involved in the industry in various capacities.Though all are in the same field, they have a good mix of past specializations. If we are to judge their credentials at face value, this looks like a dream team.However, excellent credentials alone cannot make you money. Although there are brief descriptions of their past performances, these do not guarantee future success.Especially because investment research is a different animal. Now, they have to convince potential subscribers to trust them.Whenever they make recommendations, these so-called experts must consider how to communicate their calls in a language subscribers would understand.

Readers must know what they need to do and why they need to make such investing decisions.

So more than the polished career history, what will help subscribers the most would be the quality of their services.

Services

Free Newsletters

Empire Financial Daily

- Editors: Berna Barshay and Herb Greenberg

-

Offers a different take on current events from the usual talking heads on CNBC and Yahoo! Finance

-

Delivers investing opportunities, interesting articles, and expert commentary

Whitney Tilson's Daily

- Editor: Whitney Tilson

-

Gives Tilson's take on current events and issues, whether related to investing or not

Paid Services

Empire Elite Growth

- Editor: Enrique Abeyta

- Fee: $3,000 per year

- Frequency: Monthly (every fourth Wednesday)

- Needed capital: At least $10,000 available to invest

- Holding period: A few years to a decade

- Long-term, buy-and-hold service focusing primarily on publicly traded, small- to mid-cap U.S. stocks

Empire Elite Options

- Editor: Enrique Abeyta

- Fee: $3,000 per year

- Frequency: Bimonthly (every first and third Friday)

- Needed capital: At least $10,000 available to invest

- Holding period: A few weeks to a few months

- Short-term options-trading service that draws from the Empire Financial Research universe of small- to large-cap U.S.-listed stocks

Empire Elite Trader

- Editor: Enrique Abeyta

- Fee: $69 per month

- Frequency: Weekly (every Wednesday)

- Needed capital: A portfolio large enough to put at least $1,000 into each recommendation

- Holding period: A few days to a few months

- Short-term trading service that draws from a universe of around 100 mid- to large-cap stocks

Empire Investment Report

- Editor: Whitney Tilson

- Fee: $3,000 per year

- Frequency: Monthly (every third Wednesday)

- Needed capital: A portfolio large enough to put at least $1,000 into each recommendation

- Holding period: Two to three years

- Focuses on recommending and building a model portfolio of small- or mid-cap stocks

Empire Market Insider

- Editor: Berna Barshay

- Fee: $3,000 per year

- Frequency: Monthly (every second Friday)

- Needed capital: A portfolio large enough to put at least $1,000 into each recommendation

- Holding period: One to two years

- Recommends the best stock idea for making money in the market (mid- or large-cap U.S.-listed stocks)

- Ranges from a long-only traditional asset manager to an ultra-high-net-worth family office to a global reinsurer and several large hedge funds

Empire SPAC Investor

- Editor: Enrique Abeyta

- Fee: $3,000 per year

- Frequency: Monthly (every second Wednesday)

- Needed capital: A portfolio large enough to put at least $1,000 into each recommendation

- Holding period: A few years to a decade

- One of the first-of-its-kind newsletters on special purpose acquisition companies (“SPACs”)

- Identifies and vets the highest-upside SPAC opportunities

Empire Stock Investor

- Editors: Whitney Tilson, Enrique Abeyta, Berna Barshay, Alex Griese

- Fee: $49 per year / $799 lifetime subscription

- Frequency: Monthly (every first Wednesday)

- Needed capital: At least $10,000 available to invest

- Holding period: Three to five years

- Recommends a world-class investment opportunity to help readers safely grow their wealth through large-cap, U.S.-listed stocks

In one glance, you have here an outline of all their services. This would save you time clicking through all the links just to get essential information.

Overall, the general pattern of Empire Financial Research's services is designed for the long term. Sure, it has Empire Elite Options and Empire Elite Trader, but these are exceptions.

Also, a common style this firm commonly uses is the slashed price technique. It's often indicated that the original price is a certain amount. But because of the company's generosity, it's giving you a discount.

We may not really know how serious such claims are, but we have an idea that it could also just be a marketing ploy. Does it work? Maybe for some.

But for those in the know, the tactic cheapens the offer, to tell you the truth. Now that we are digital, potential subscribers would appreciate honesty and candidness better.

Instead of drawing us into the service, it makes us all the more skeptical. If an editor or publisher believes in the quality of its work, why resort to age-old tactics?

In addition, the minimum investments required are pretty steep. You need to have deep pockets to be able to see substantial gains and returns.

So you need to factor that in. You may afford the subscription fees or trust Tilson and his team. But do you have enough resources to maximize profit if they are indeed effective?

So even if you do have dollars to spare, it still is a question of how competent they are. What have others said so far? Let's find out.

Track Record and Reviews

There's not much to see yet on the Better Business Bureau website regarding this research firm. As of this writing, only one person gave it a rating, which was a one star out of five.

The three comments that we saw were all about how difficult it is to get refunds. So this is not good, definitely.

One even said that they received an unauthorized credit card charge. Now we are not sure if the commenter really did not click on anything. However, since a person has a complaint, the company must answer at the very least.

But by the time we publish this article, there has not been a single response from Empire Financial.

Meanwhile, there are subscriber pages for two of its services on Stock Gumshoe.

Empire Elite Growth from Abeyta has gotten four out of five stars from around 30 votes. This is a respectable rating, to be fair.

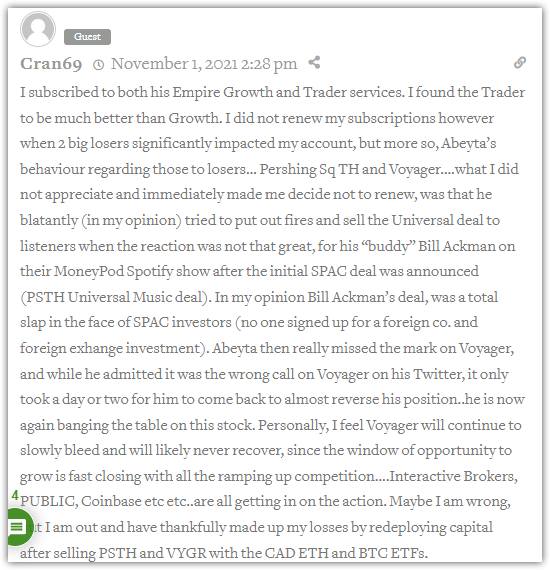

However, we saw a negative comment that we think you should see.

If these accusations are true, again, they will not reflect well on the company.

Another comment, meanwhile, focused on the editor.

Meanwhile, Empire Stock Investor was able to get a 3/5 rating from around 40 votes on Stock Gumshoe.

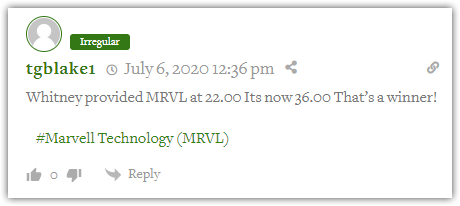

There was also a comment about a specific stock which speaks well of the newsletter's performance.

Before we end this section, we would once again like to reiterate one point. Online reviews are not 100% predictive of how advisory services may perform for you.

Comments and reviews will give you a glimpse of others' experiences. But they may not necessarily happen to you, whether positive or negative.

So, in the end, you must weigh what the marketing says, what the editors' credentials are, and subscribers' feedback.

Pros v Cons

Pros

- Strong credentials of the Empire Financial Research team

- Lots of advisory services to choose from

Cons

- Whitney Tilson's record with Kase Capital Management

- Not advisable for active and hands-on investors

- Requires substantial investments

Conclusion – Should You Trust Tilson's New Company?

Whitney Tilson is, without a doubt, a controversial financial figure. Our past article about him contains extensive research about his career and personal life. We believe these would help you determine his trustworthiness.

At first glance, his rationale for setting up this research firm seems admirable. Indeed, Kase Capital did not end the way he or his investors expected.

But it is also reasonable to believe that he has learned from this chapter in his career. It is also refreshing to see an investor and financial editor be transparent about a past failure.

Often, we merely see exaggerated and made-up credentials. So Tilson's honesty is to be commended.

But will this trait be enough for you to entrust your financial future based on his firm's recommendations? Well, that's ultimately your decision to make.

What we did here in this Empire Financial Research review is to give you all the information you need. And we know that knowledge is power. So do exercise this power to make an informed decision. Do not just be easily swayed by marketing gimmicks or even negative feedback.