In the crowded space that is subscription based trading advisory services and trading training courses, differentiating one's offering is increasingly challenging. The approach taken by the Early-Stage Playbook by Crowdability in drawing parallels between sport strategies and trading analysis is a novel differentiator. The novel approach to naming the offering aside, the Early-Stage Playbook by Crowdability is similar to many other subscription based training courses, trading analysis and trading advisory services.

The early-stage or angel investing space is becoming increasingly popular with private equity investors. The primary reasons for this rise in popularity are, the enabling legislation outlined in the HR 3606 / JOBS act and the highlighting of spectacular gains (as illustrated in their marketing material by the likes of Crowdability) earned by some private equity investors.

The Covid pandemic and all the manifestations of the fallout from lockdowns have had a devastating effect on economies around the world. Stimulus packages devised by governments around the world to provide relief for the citizenry have had the unintended consequences of destabilising and undermining the value of the major FIAT currencies , the current fluctuations displayed by the US dollar are but one of many examples. An additional side-effect has also been relatively poor performances of stock markets and the resulting uncertainty. Crowdability have not let the challenges faced by stock markets go unnoticed, in fact they have seized upon what they obviously perceive to be an opportune marketing tactic.

A key and possibly overstated feature of their Early-Stage Playbook sales pitch, is the avoidance of stock market trading. The opening sentence on the Genesis Investing System (the investment category targeted, analysed and facilitated by Crowdability with its Early-Stage Playbook) website reads as follows, “The Genesis Investing System is a trading system that involves investing private equity into start-up companies and will not put a single dollar of risk into the stock market.” A valid counter to this position adopted and promoted by Crowdability is the reality that although private equity investing in start-up companies has the potential for spectacularly lucrative returns, the caution that this investment vehicle is high risk can hardly be overstated.

The Early-Stage Playbook purports to be a comprehensive and authoritative training resource for the new private equity investor. The questions we need to pose are as to the credibility, accuracy and delivery of the Early-Stage Playbook subscription service. This review sets out to present an objective assessment of the Early-Stage Playbook by Crowdability.

The Teaser

Much ado appears to made of non stock market investments and the claim is that private equity investing is more lucrative and secure than the traditional stock market trading. There are numerous examples given of spectacularly successful private equity / early-stage investments. The often quoted examples of Facebook, Google and Microsoft speak truth to the claims of spectacular returns but there are numerous caveats that one would be careless to ignore. Examples like that of early Google investors who earned profits of 3000% after the IPO and the first Facebook investor who obtained a return of $20 million for every $1000 initially invested. These returns, sensational as they are, while occasionally possible are not typical. Highlighting these atypical and spectacular yields does little for the credibility of Early-Stage Playbook offering.

The emphasis placed on the calculated avoidance of investing in the stock market is a dubious strategy. The risks associated with private equity / pre-IPO investing are no less challenging than in investing on the publicly traded stock markets. It may actually be argued that most stock markets have more rigorous compliance standards and regulatory frameworks than private equity and crowdfunding initiatives, thus offering investors a more stable and regulated investment platform.

Table of Contents

What is the Early-Stage Playbook?

Who are Genesis Investing / Crowdability?

Is the Early-Stage Playbook Legit?

What is the track-record?

How the Early-Stage Playbook works.

What do you get?

The cost and refund policy

Performance

Pros vs Cons

Summary and conclusion

What is the Early-Stage Playbook?

A brief summation of the Early-Stage Playbook would outline the offering as a subscription based training course and trading advisory service focused on early-stage, private equity investing.

- Name: Early-Stage Playbook by Genesis Investing.

- Publisher: Crowdability

- Website: https://www.crowdability.com/

- Phone: (844) 562-7228

- Address: 205 Hudson Street, 7th floor, New York, NY 10013.

- Type: Private equity, early stage investment education and advisory service.

- Founders: Matt Milner and Wayne Mulligan.

- Target market: Early-stage and pre-IPO private equity investors.

Who are Genesis Investing / Crowdability?

Matt Milner and Wayne Mulligan are the founders of Crowdability, they state their backgrounds are in the sectors of banking, investing and entrepreneurial ventures, have granted them access to over 30 of the top early stage investors. Their access to these top early stage investors has apparently informed their research and the compilation of the training material for the Early-Stage Playbook.

Matthew Milner a descendant of Russian immigrants, holds a B.A. from Cornell University and a M.B.A. obtained from the Kellogg School of management. Matt's career started on wall street working for investment banks like Bear Stearns and Lehman Brothers. His time on Wall Street endowed him with the experience of investing and profiting from the financial markets. A serial entrepreneur, Matt Milner was not an immediate success, his first enterprise, started at the age of 30 floundered and depleted his financial resources. His second attempt at starting and running a business initially struggled but eventually succeeded to the extent that it was sold for a “small sum”, reputed to be several million dollars.

The profit from the sale of his second business provided the seed capital for Matt's third business, a social media company. This start-up was sold off to Hearst, a major player in the media sector, for a price that netted millions for Matt. He had found his niche and went on to mentor other start-up tech companies in addition to his work at Hearst. The implementation of the JOBS act in 2013 was welcomed by Milner who was already operating a venture capital fund. He then founded Crowdabality jointly with Wayne Mulligan. One of the stated aims at the founding of Crowdability was “to show ordinary citizens how to invest and profit from startups”.

Wayne Mulligan holds a B.A. from Columbia University, he got an early start to his tech career having worked as a programmer while still at high school. He started a tech firm that grew to the extent of employing 12 people. Wayne has a successful record as a financial media executive with Wall Street experience and proven start-up success. He started a platform called TickerHound, the primary purpose of which was to assist investors with information relating to finance and investing. TickerHound was the subject of an acquisition by The Institute for Individual Investors (IFII), a company specialising in financial education and publishing. Wayne rose through the ranks at IFII eventually becoming the CEO and facilitating the sale of IFII to Agora Inc.

Other members of the Crowdability team are:

- Brian Eller – associate publisher.

- Rob Parker – director of marketing.

- George Zhao – director of technology.

Is the Early-Stage Playbook Legit?

The existence of the concept of genesis / early-stage investing is rooted in the enactment of the H.R. 3606 / “Jumpstart Our Business Startups Act” the JOBS act, first signed into to law in by President Barak Obama in April 2012 and finally effected in October 2015. This legislation has opened up the realm of private equity investing to the general public with the creation of a legislative framework that facilitates pre-IPO investing and fund raising. The concept of crowdfunding has also been facilitated and formalised by the H.R. 3606.

The Early-Stage Playbook is pitched as an educational / training guide for aspirant early investors. Opinions on the efficacy and quality of the content vary considerably with some subscribers submitting glowing (but untested) reviews and others delivering scathing critique.

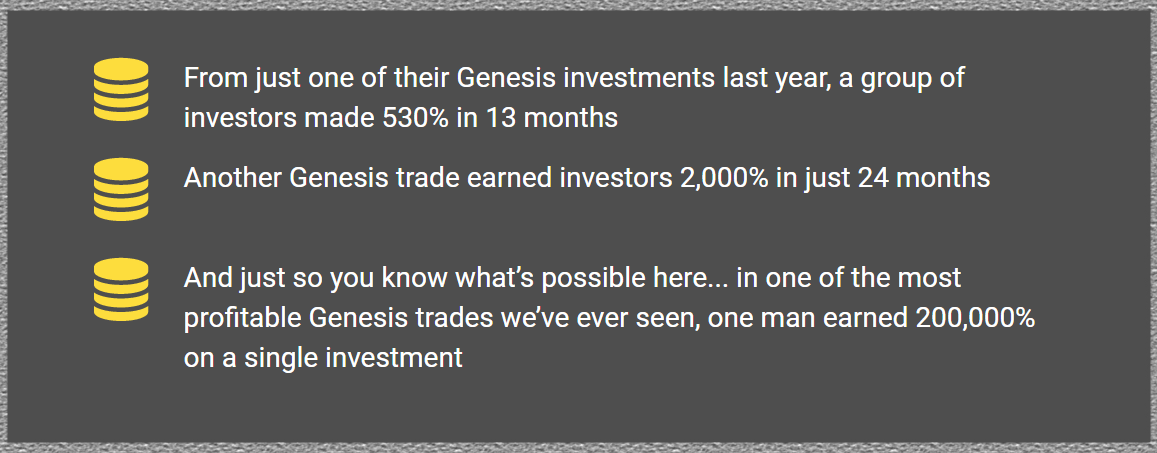

The promotional material makes claims of sensational returns on investments. Illustration below is an example of some of these claims.

While these claims may be true, they are not typical by any stretch of the imagination. Due diligence must be exercised by investors and thorough examination of the investment opportunity is crucial.

The Crowdability promotional material lists endorsements by Forbes and the Wall Street Journal, the reality is that both these authoritative sources go to considerable lengths to outline their reservations about the risks prevalent in the genesis investment category. Another feature of the references to the endorsements form Forbes and the Wall Street Journal is, that these are not a specific endorsement of Crowdability. The endorsements refer to the early-stage investment opportunities made accessible by the JOBS act, it is an endorsement of the investment category, and not an endorsement of a specific company or service.

Crowdability tops the list of competitors offering advice on crowdfunding opportunities with funding and revenue exceeding that of its rivals. The legal compliance of the service in terms of compliance with H.R.3606 and the credible backgrounds of both Matthew Milner and Wayne Mulligan leave no doubt as to the legitimacy of the Early-Stage Playbook.

What is the Track-record?

Just like many similar marketing efforts, the Early-Stage Playbook promotional literature makes several spectacular claims. “you'll be able to build your own early-stage portfolio in just 60 minutes a week.” This direct quote from the Crowdability promotional material is unfortunately but just one of several examples of hyperbole that exaggerate the ease of earning massive returns on early-stage investments. Thorough and extensive research are required before making investment selections, as is the case with most trading platforms. Examples are mentioned of private equity investors who obtained spectacular ROI but these examples lack details and no independent or credible verification is offered.

How the Early-Stage Playbook works

The Genesis Investing system as described and taught by the Early-Stage Playbook is not unlike Neil Patel's Private Deal Flow and a few other subscription based advisory services that propose angel or early stage private equity investing as an investment strategy that has the potential to spectacularly outperform traditional stock exchange based trading. The course material of the Early-Stage Playbook is intended to educate new or inexperienced private equity investors to the point where they are positioned to be able assess and profitably invest in early-stage investment opportunities.

Crowdability teach and apply what they term the “ASE process.” ASE in it's expanded form denotes,

- Allocate, this illustrates how to determine the amount of private equity to allocate to a given early investment opportunity.

- Screen, this is a guide to screening out the more risky early investments.

- Evaluate, this is a list of criteria to consider when doing an in depth evaluation of the merits of a particular investment.

This yardstick is the fundamental set of criteria that Crowdability recommend as applicable considerations when selecting potentially high profit early-stage private equity investments.

What do you get?

The Silver Level Early-Stage Playbook course is comprised of 12 lessons. The access to these lessons is staggered over time in a strategy that is supposed to ensure that the subscriber progresses gradually and thoroughly through the course material. A transcription of the first lesson illustrates a comprehensive explanation of the concepts of early-stage investing, private equity and difference with publicly traded shares. The JOBS act and the legislative facilitation of early-stage investing and crowdfunding are also covered in great detail.

The content of the additional lessons covers:

- How to assess the degree of risk in an investment.

- What are the identifying traits of a weak verses strong company.

- The venture capital indicator is explained and how it helps to identify profit earning opportunities at early-stage companies.

- How to build a portfolio of lucrative early-stage investments.

- How to realise 10% to 12% returns from the private equity market.

- The importance of a 506(c) account as an instrument for raising capitol.

In addition to the basic Early-Stage Playbook which teaches the fundamentals of the Genesis Investing system, there are two additional levels, the Gold Level and Platinum Level which give access to several bonuses. The bonuses purport to illustrate how subscribers can practically use the knowledge gained from the video lessons. The bonuses and additional information are:

- The first bonus is a report listing start-up companies that are at a fairly advanced stage of their pre-IPO evolution. The valuation of equity in a company often sees it's greatest increase in the period shortly before the IPO and post IPO. Companies that have reached the pre-IPO phase are often fairly well established in terms of their functionality and viability. In theory these companies present opportunities for optimal returns on investment with minimal risk.

- The second bonus offers insight into the Private Bond Market. Investors are given guidance as to accessing the 12% yield offered by the private bond market.

- The third bonus is essentially a checklist of criteria against which to evaluate prospective investment opportunities. Matthew Milner and his team have formulated a list against which to evaluate the viability of companies vying for private equity funding. The listed criteria emanate from what the Crowdability team assert is extensive experience in the realm of Genesis Investing.

- The fourth and fifth bonuses are a parody of the Shark Tank tv show. Two investment examples are chosen to illustrate the implementation of the methodology used by Matt Milner to evaluate and select investments. This is in effect a further lesson in the practical application of the lessons included in the 12 video course.

- CrowdabilityIQ, this is a “stock screener” that systematically sorts through companies offering possible early-stage private investment opportunities. Several filters can be used to sort through companies, searches can be based on the identity of existing investors, the education level of the founders, the valuation of the company and other relevant criteria.

- There is also a considerable volume of free resources in the form of informational videos and white papers available on the Crowdability website. The subject matter ranges from an explanation of the workings of the JOBS act to the detailed explanation of the concept of crowdfunding.

The Cost and Refund Policy

There are three levels of membership to the Early-Stage Playbook. The prices for the various membership levels listed below are the latest prices listed as of February 2021. There may be reduced priced specials offered on occasion as has been frequently the case in the past.

The Silver Level @ $249 gives the subscriber:

- Access to the Early-Stage Playbook online 12 lesson video course.

- There are also tutorials on how to use equity crowdfunding platforms

The Gold Level @ $379 in addition to the material available with the Silver Level, additionally includes:

- The 60 minute investor

- Double-Digit Returns in Private Income

- A Mutual Fund for Start-ups

- 20 Pre-IPO Investments with One Click

The Platinum Level @ $499 is the most costly offering from Crowdability, it includes the contents of the Silver and Gold levels and adds:

- Two In-depth Case Studies, these studies are intended to demonstrate in practice how Matt & Wayne execute an early-stage investment. The Early-Stage Playbook is the template for these two investments.

The refund policy takes the form of a “30 day risk-free trial.” There are, however, complaints about obtaining a refund.

Performance

Performance

The spectacular illustrations of massive ROI as used in the marketing and promotional material for the Early-Stage Playbook, are sensational to the extent that any savvy investor must view the Crowdability offering with due scepticism. There are real examples of early-stage / angel investments that have yielded phenomenal profits but these don't represent a balanced or objective view of the prevailing reality. In the material covered in lesson one the caveat is offered that the sensational returns of several thousand percent as quoted in the marketing material are not typical. A claimed average of 27% ROI is more realistic, but suggesting that this is typical is still overly optimistic to the point of compromising Crowdability's credibility.

Pros v Cons

Pros

The 12 lessons that comprise the basic offering covered by the Early-Stage Playbook are fairly comprehensive and provide an extensive insight into the private equity world of angel / early-stage investing. The Crowdability IQ software (a nine point checklist used to analyse crowdfunding opportunities) and some of the lists of evaluated investment prospects are useful guides in reducing risk when selecting investments. The bonuses featured in the Gold & Platinum levels of the offering illustrate practical methods of applying the lessons to a private equity investment strategy.

Cons

A recurring criticism of the Early-Stage Playbook is that the educational content is too simplistic and narrowly targeted at new entrants to the private equity early investing sector. The focus on educating new entrants and raising awareness of the opportunities made accessible to ‘ordinary' private investors by the implementation of the enabling framework of the JOBS act, is undoubtedly a aim of the training program. The complaints raised by subscribers with experience and advanced knowledge of pre-IPO investing and the associated specialities are valid. Much of the training content in the 12 video based lessons can be relatively easily and freely accessed by online research. The usefulness of the training material to experienced private equity investors is debateable and the marketing of the course would be more credible if this limitation was acknowledged.

In the words of Crowdability's Wayne Mulligan, “this is a high risk asset class.” It is speculated that most venture capitalists lose money on 60% to 70% of their early investments. This reality is best not ignored and is definitely a salient aspect of early investing.

Summary & Conclusion

The loftily stated goal of Crowdability is “We aim to protect individual investors. By educating and empowering them, we believe we can help them avoid making costly mistakes – and provide them the highest chances for success.” Whether Crowdability with their Early-Stage Playbook offering, which purports to educate private equity investors on the intricacies of Genesis Investing, provides an effective educational resource is the substance of this review.

A genuine effort appears to have been made by the team at Crowdability to provide a comprehensive and informative training course for those contemplating embarking on a private equity investing strategy. Having said that, the usefulness 0f the Early-Stage Playbook Content for the more experienced trader may be limited.

Prospective private equity investors need to avoid the trap of being bedazzled by the glow of the potentially spectacular ROI possible with this high risk asset class. Many companies active in the realm of training and advisory subscription services are little more than paid-for listings. The subscriber needs to conduct their own due diligence and thoroughly assess the offering before subscribing to and acting on the content of any service. The internet is an easily utilized resource for researching the bona fides and effectiveness of a service. There are several reviews that cut through the marketing hype of what is a regular feature of the efforts of Crowdability and similar offerings.

No one wants to lose money but early-stage investing is undeniably high risk, the long established advice that you shouldn't invest money that you aren't 100% prepared to lose is as pertinent as ever. The potential for high ROI offered by early stage private equity investing need not be avoided but quality research and an intelligently diversified trading portfolio are an absolute necessity.